Ripple's XRP: A Long-Term Investment Perspective

Table of Contents

Understanding Ripple and XRP's Functionality

Ripple, the company behind XRP, has developed a groundbreaking blockchain technology aimed at revolutionizing cross-border payments. XRP acts as a bridge currency within the RippleNet network, facilitating near-instantaneous and cost-effective transactions between different currencies. Unlike traditional payment systems that often involve multiple intermediaries and lengthy processing times, RippleNet leverages XRP to streamline the process.

This technology offers several key advantages:

- Faster transaction speeds: XRP transactions are significantly faster than those on Bitcoin and Ethereum networks.

- Lower transaction fees: The cost of sending XRP is substantially lower compared to traditional banking fees and other cryptocurrencies.

- Global reach through RippleNet: RippleNet connects numerous financial institutions worldwide, enabling seamless cross-border payments.

- Scalability: The Ripple network is designed for high scalability, handling a large volume of transactions efficiently.

These features make XRP an attractive alternative for businesses and financial institutions seeking efficient and cost-effective cross-border payment solutions. The use of blockchain technology ensures transparency and security, further bolstering its appeal.

XRP's Market Position and Adoption

XRP consistently holds a prominent position in the cryptocurrency market capitalization rankings, solidifying its status as a major digital asset. Its adoption rate by financial institutions and businesses continues to grow, although at a pace influenced by regulatory uncertainties.

Key factors to consider include:

- Market Cap and Ranking: XRP maintains a significant market capitalization, placing it among the top cryptocurrencies globally. Its precise ranking fluctuates but consistently remains within the top ten.

- Partnerships and Integrations: A growing number of financial institutions have partnered with Ripple, leveraging XRP and RippleNet for their payment solutions. These partnerships underscore the growing acceptance and practical application of the technology.

- Real-World Applications: Beyond financial institutions, XRP is finding applications in various sectors, showcasing its versatility and potential for wider adoption. These real-world uses provide tangible evidence of XRP's value and utility.

- Growth Potential: The ongoing growth in institutional adoption and the expansion of RippleNet point towards significant future growth potential for XRP.

The increasing adoption of XRP by both businesses and financial institutions strongly suggests a positive outlook for its future growth and market position.

Regulatory Landscape and Legal Challenges

The regulatory landscape surrounding cryptocurrencies remains complex and evolving. Ripple Labs has faced significant legal challenges, most notably the ongoing lawsuit filed by the Securities and Exchange Commission (SEC). This lawsuit alleges that XRP is an unregistered security, creating considerable uncertainty for investors.

Understanding the potential impact of this lawsuit is crucial:

- SEC Lawsuit: The SEC lawsuit against Ripple is a significant legal battle that could redefine the regulatory framework for cryptocurrencies.

- Potential Outcomes: The outcome of the lawsuit could significantly impact the price and future of XRP, with various potential scenarios ranging from a complete ban to a revised regulatory framework.

- Jurisdictional Variations: The regulatory landscape for cryptocurrencies varies significantly across different jurisdictions, adding another layer of complexity for investors.

- Regulatory Risks: Regulatory uncertainty presents substantial risks for XRP investors. Changes in regulations could negatively affect the price and usability of XRP.

Investors must carefully consider these regulatory uncertainties and the potential impact on their investment decisions.

Potential Risks and Rewards of Long-Term XRP Investment

Investing in cryptocurrencies inherently carries a high degree of risk, and XRP is no exception. The price of XRP is highly volatile, subject to market fluctuations and external factors.

However, the potential rewards are equally substantial:

- Volatility: XRP's price is subject to significant volatility, meaning substantial price swings can occur in short periods.

- Market Manipulation: Like other cryptocurrencies, XRP is susceptible to market manipulation, impacting its price.

- Technological Disruption: The cryptocurrency landscape is constantly evolving, with the potential for new technologies to disrupt existing systems, including Ripple's technology.

- High Returns: If Ripple's technology achieves wider adoption, the long-term rewards for XRP investors could be substantial.

- Diversification: Diversifying investments is crucial to mitigate risk. XRP should be considered one part of a broader investment strategy.

A well-informed investment strategy requires a careful assessment of these risks and rewards.

Conclusion

Investing in Ripple's XRP presents a compelling proposition for long-term growth, fueled by its potential to disrupt the global payments landscape through innovative blockchain technology. However, the legal and regulatory uncertainties, coupled with inherent cryptocurrency volatility, underscore significant risks. Thorough due diligence, including understanding the ongoing SEC lawsuit and the complexities of the cryptocurrency market, is paramount before investing in XRP. Diversification within your investment portfolio remains a crucial risk-mitigation strategy.

While Ripple's XRP offers exciting potential for long-term growth, careful consideration of the risks and rewards is essential. Conduct your own research and consult with a financial advisor before making any investment decisions regarding Ripple's XRP or any other cryptocurrency. Remember to carefully assess the risks and potential rewards before investing in this volatile market. Learn more about Ripple's XRP and its potential through further independent research.

Featured Posts

-

Going From March Madness To Trademarks Madness Protecting Your Brand During The Tournament

May 07, 2025

Going From March Madness To Trademarks Madness Protecting Your Brand During The Tournament

May 07, 2025 -

Jenna Ortegas Verdict On Reprising Her Small Marvel Role

May 07, 2025

Jenna Ortegas Verdict On Reprising Her Small Marvel Role

May 07, 2025 -

Selling Sunset Star Calls Out La Landlords For Price Gouging Amid Fires

May 07, 2025

Selling Sunset Star Calls Out La Landlords For Price Gouging Amid Fires

May 07, 2025 -

Hardens 39 Point Explosion Leads Clippers Past Warriors To Playoffs

May 07, 2025

Hardens 39 Point Explosion Leads Clippers Past Warriors To Playoffs

May 07, 2025 -

71 Godini Dzheki Chan Pozdravleniya Za Aktora I Maystora Na Boynite Izkustva

May 07, 2025

71 Godini Dzheki Chan Pozdravleniya Za Aktora I Maystora Na Boynite Izkustva

May 07, 2025

Latest Posts

-

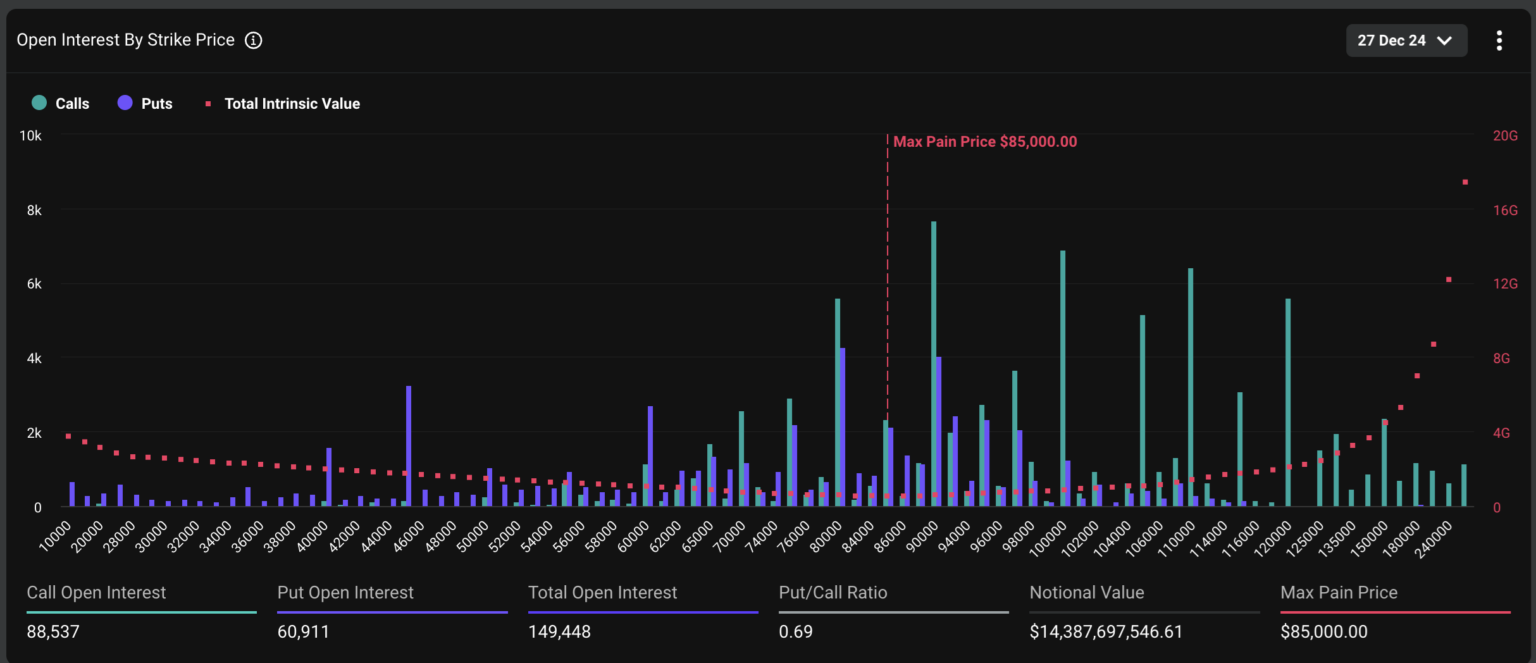

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025 -

Bitcoin And Ethereum Options Expiration Billions At Stake Volatility Ahead

May 08, 2025

Bitcoin And Ethereum Options Expiration Billions At Stake Volatility Ahead

May 08, 2025 -

Ethereums Future Will The Price Fall Below 1 500 Support Level Analysis

May 08, 2025

Ethereums Future Will The Price Fall Below 1 500 Support Level Analysis

May 08, 2025 -

Saving Private Ryan Nathan Fillions Powerful 3 Minute Performance

May 08, 2025

Saving Private Ryan Nathan Fillions Powerful 3 Minute Performance

May 08, 2025