Should You Buy Palantir Stock In 2024? A Prudent Investor's Guide

Table of Contents

Palantir's Business Model and Growth Potential

Palantir's success hinges on its innovative data analytics platform, used by governments and commercial clients to unlock insights from complex datasets. Understanding its business model is crucial to assessing its future potential.

Government Contracts and Revenue Streams

Palantir's initial growth was largely fueled by substantial government contracts, particularly within the US intelligence and defense sectors. However, the company has been actively diversifying its revenue streams into the commercial sector, targeting enterprises across various industries.

- Revenue Breakdown: While government contracts still contribute significantly to Palantir's revenue, the commercial segment is showing impressive growth and promises to become an increasingly important part of the overall picture. Specific figures will vary depending on the latest financial reports.

- Growth Projections: Analysts offer differing projections for both sectors, but the overall expectation is for continued growth, albeit potentially at varying paces for government versus commercial contracts. These projections are influenced by factors such as geopolitical stability and the adoption rate of Palantir's platform in the commercial market.

- Key Government Contracts: Significant contracts with various government agencies contribute substantially to Palantir's stability. The impact of these contracts on future revenue should be carefully considered. The renewal or expansion of these contracts is a critical factor in Palantir's short to medium term future.

Technological Innovation and Competitive Advantage

Palantir's core strength lies in its proprietary technology, most notably its Foundry platform. Foundry offers a unique approach to data integration and analysis, setting it apart from competitors.

- Key Technological Advancements: Palantir continuously invests in R&D, improving Foundry's capabilities and expanding its application across various sectors. Recent advancements include enhanced AI/ML capabilities, improved user experience, and more robust security measures.

- Comparison with Competitors: While the data analytics market is competitive, Palantir's unique approach to data integration and its focus on complex data sets differentiates it from many competitors, giving it a niche competitive advantage. Key competitors include established players like AWS and Microsoft, alongside numerous niche players.

- Potential Disruptions and Threats: The rapid pace of technological innovation presents both opportunities and threats. The emergence of new technologies or shifts in market demand could potentially impact Palantir's market share. Staying ahead of the curve in innovation is crucial to maintain its competitive edge.

Financial Performance and Valuation

A thorough assessment of Palantir's financial health is essential before considering an investment.

Analyzing Palantir's Financials

Analyzing Palantir’s financials requires looking at several key indicators.

- Key Financial Ratios: Investors should examine metrics such as the Price-to-Earnings (P/E) ratio, revenue growth rate, profit margins (gross and operating), and debt-to-equity ratio to understand the company's financial health and valuation.

- Profitability Margins: While Palantir's revenue is growing, profitability is an important factor to monitor. Improving margins would be a positive sign for investors.

- Debt Levels: Understanding Palantir’s debt levels and how it manages its debt load is crucial for a complete financial assessment. High debt levels can indicate risk, while careful management can signal financial strength.

- Cash Flow Analysis: A strong cash flow is essential for a company's long-term viability. Analysis of Palantir’s cash flow from operations will give a better picture of its operational efficiency.

Assessing Palantir Stock Price and Future Predictions

Predicting future stock prices is inherently speculative.

- Historical Stock Price Trends: Reviewing Palantir's historical stock price performance offers insight into its volatility and past growth patterns. However, past performance is not indicative of future results.

- Analyst Ratings and Price Targets: Many analysts provide ratings and price targets for Palantir stock. It’s important to note that these are opinions and should be considered alongside your own research.

- Potential Catalysts: Events such as new contract wins, technological advancements, or changes in the macroeconomic environment can significantly impact Palantir's stock price.

Risks and Considerations for Investors

Investing in Palantir stock comes with inherent risks.

Geopolitical Risks and Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to geopolitical risks.

- Examples of Geopolitical Risks: Changes in government priorities, international conflicts, or shifts in defense spending can all potentially affect Palantir’s revenue streams.

- Potential Impact on Revenue Streams: A reduction in government spending or a loss of key contracts could significantly impact Palantir's financial performance.

- Diversification Strategies: Palantir's efforts to expand into the commercial sector are a crucial strategy to mitigate its reliance on government contracts.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive.

- Key Competitors: Palantir faces competition from established tech giants and emerging startups. Understanding the competitive landscape is vital.

- Potential for New Entrants: The relatively low barrier to entry in certain segments of the data analytics market could lead to increased competition and market saturation.

- Strategies to Maintain Competitive Advantage: Palantir needs to continuously innovate and differentiate its offerings to maintain its competitive edge.

Conclusion

Should you buy Palantir stock in 2024? The decision hinges on your risk tolerance, investment timeline, and a thorough understanding of the company's business model, financial performance, growth potential, and inherent risks. While Palantir offers exciting growth prospects, particularly in the expanding commercial sector and through its technological innovation (Palantir Foundry being a key example), the inherent risks associated with its reliance on government contracts and the competitive data analytics market must not be overlooked. Palantir stock price predictions vary widely among analysts, highlighting the volatility of the market.

Remember, this is not financial advice. Before making any investment decisions regarding Palantir stock, conduct your own thorough research and consult with a qualified financial advisor. Consider your individual risk tolerance and financial goals before buying Palantir stock, and remember to diversify your portfolio to mitigate risk. For further research on Palantir stock and investment strategies, consider resources like [link to reputable financial news source]. Remember to carefully consider all aspects of Palantir stock investment before making a decision.

Featured Posts

-

The China Factor Why Luxury Car Brands Face Headwinds In The Asian Market

May 10, 2025

The China Factor Why Luxury Car Brands Face Headwinds In The Asian Market

May 10, 2025 -

Wall Streets Resurgence Defying Bear Market Predictions

May 10, 2025

Wall Streets Resurgence Defying Bear Market Predictions

May 10, 2025 -

Hertls Injury Will He Play For The Golden Knights

May 10, 2025

Hertls Injury Will He Play For The Golden Knights

May 10, 2025 -

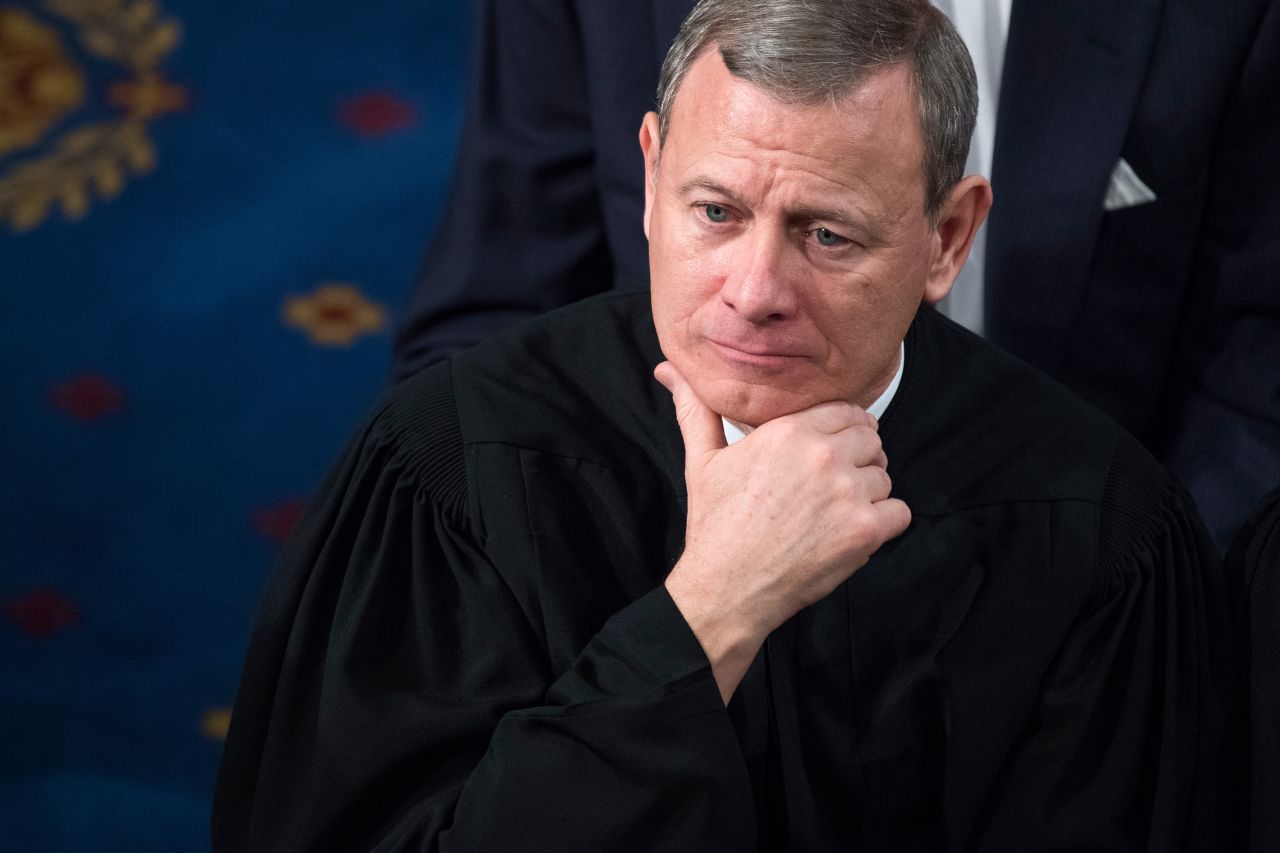

Cnn Politics Chief Justice Roberts On Mistaken Identity With Former Gop House Leader

May 10, 2025

Cnn Politics Chief Justice Roberts On Mistaken Identity With Former Gop House Leader

May 10, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles And Tariff Impacts

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Teslas Troubles And Tariff Impacts

May 10, 2025