South African Coalition Government Defeats Proposed Tax Increase

Table of Contents

The Proposed Tax Increase: Details and Rationale

The proposed tax increase aimed to bolster South Africa's strained fiscal position. The plan included a broad range of measures, focusing primarily on increases to Value Added Tax (VAT), corporate income tax, and fuel levies. The proposed VAT increase was a significant 2%, while corporate income tax was slated to rise by 5%, impacting various sectors of the economy. The rationale behind these proposed tax reforms, as stated by the government, was multifaceted:

- Funding Social Programs: A substantial portion of the increased revenue was earmarked for expanding social welfare programs, including healthcare and education initiatives. The government cited the need to alleviate poverty and inequality as a key driver.

- Infrastructure Development: Significant investment in infrastructure development, including upgrades to transportation networks and energy grids, was also a stated priority. The government argued that such investments were crucial for stimulating long-term economic growth.

- Deficit Reduction: Addressing the country's growing budget deficit was another primary justification for the proposed tax increase. The government highlighted the need for fiscal responsibility and sustainable economic management.

The full proposal, including detailed budget allocation plans, can be found on the [link to relevant government website, if available]. This document provides further insight into the government's intended approach to tax reform and fiscal policy.

The Coalition's Opposition: Key Players and Arguments

The proposed tax increase faced significant opposition within the South African Coalition Government itself. Key players included [Name of Party 1] and [Name of Party 2], who voiced strong concerns regarding the potential negative consequences. Their arguments centered on several key points:

- Economic Impact on Citizens: Opponents argued that the tax increases would disproportionately burden lower and middle-income households, exacerbating existing inequalities and hindering consumer spending.

- Potential for Increased Inequality: The proposed tax structure, they claimed, failed to adequately address issues of wealth distribution, potentially widening the gap between the rich and the poor.

- Alternative Fiscal Solutions: The opposition parties proposed alternative fiscal solutions, focusing on measures to improve tax collection efficiency, reduce government expenditure, and attract foreign investment to boost economic growth.

"[Quote from a key political figure opposing the tax increase]," stated [Name of Political Figure], highlighting the concerns of many within the coalition. The parliamentary debate surrounding this issue was robust and demonstrated the complexities of coalition politics.

The Vote and its Immediate Aftermath

The vote on the proposed tax increase took place on [Date of Vote] in the South African Parliament. The proposal was ultimately defeated by a vote of [Number] against [Number], with [Number] abstentions. This unexpected outcome sent shockwaves through the political and economic landscape.

The immediate aftermath saw a range of reactions:

- Government: The government expressed disappointment but acknowledged the democratic process. They indicated a need to review their fiscal strategy.

- Opposition: Opposition parties celebrated the victory, emphasizing their commitment to protecting citizens from undue economic hardship.

- Business Sector: Business leaders expressed mixed reactions, with some welcoming the outcome while others voicing concerns about the potential impact on investor confidence.

- Civil Society: Civil society organizations offered varied responses, reflecting the diverse perspectives within the broader community.

The short-term economic consequences remain to be seen, but there is speculation of potential market volatility in the immediate aftermath of the vote. The parliamentary vote's political fallout continues to be analyzed.

Long-Term Implications and Future Outlook

The defeat of the proposed tax increase has significant long-term implications for South Africa's economic trajectory. The government will now need to explore alternative strategies to address the fiscal challenges.

- Spending Cuts: The government may need to implement significant cuts to public spending, potentially impacting essential services.

- Tax Reform Alternatives: A renewed focus on alternative tax reform measures, potentially targeting specific sectors or wealth brackets, is likely.

- International Investment: The government may intensify efforts to attract foreign direct investment to stimulate economic growth and ease fiscal pressures.

The long-term effects on fiscal sustainability and economic growth remain uncertain. The defeated tax increase highlights the challenges faced by the South African Coalition Government in balancing fiscal responsibility with social needs. The outcome will undoubtedly shape future tax policy debates and the overall political landscape.

Conclusion

The defeat of the proposed tax increase by the South African Coalition Government represents a significant turning point in South African fiscal policy. This article has outlined the specifics of the proposal, the coalition's opposition, the parliamentary vote's outcome, and the potential long-term implications for the nation's economy. The South African Coalition Government’s decision underscores the complexities of governing a diverse nation with competing interests.

Stay updated on the future decisions of the South African Coalition Government, and follow the ongoing debate on tax reform in South Africa. Learn more about the South African government's fiscal policy by exploring resources from reputable sources such as [link to relevant resource 1] and [link to relevant resource 2].

Featured Posts

-

Walton Goggins From White Lotus To Fashion Icon In Bold Swimwear

Apr 25, 2025

Walton Goggins From White Lotus To Fashion Icon In Bold Swimwear

Apr 25, 2025 -

Aussie Veterans Warning Anzac Day Ignored National Identity At Risk

Apr 25, 2025

Aussie Veterans Warning Anzac Day Ignored National Identity At Risk

Apr 25, 2025 -

Vote Now County Durhams Best Hairdresser 2025 Northern Echo

Apr 25, 2025

Vote Now County Durhams Best Hairdresser 2025 Northern Echo

Apr 25, 2025 -

Bota De Oro 2024 25 Tabla De Goleadores Sin Messi Ni Ronaldo

Apr 25, 2025

Bota De Oro 2024 25 Tabla De Goleadores Sin Messi Ni Ronaldo

Apr 25, 2025 -

The Ultimate Guide To Europes Top 10 Shops

Apr 25, 2025

The Ultimate Guide To Europes Top 10 Shops

Apr 25, 2025

Latest Posts

-

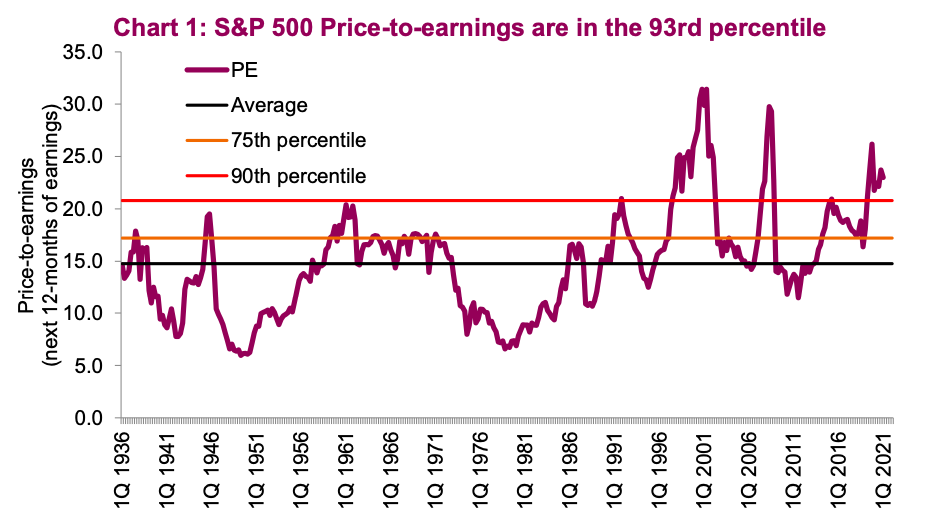

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025