Stock Market Valuations: Why BofA Believes Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Overblown

BofA's valuation analysis presents a nuanced view of the current market. Their assessment goes beyond simple price-to-earnings (P/E) ratios and other headline metrics to examine underlying fundamentals. This comprehensive approach considers several crucial factors:

-

Robust Earnings Growth Projections: BofA's analysis suggests that current valuations, while elevated compared to historical averages, are supported by strong projections for future earnings growth. This expectation of corporate profitability is a key pillar of their argument. They've factored in various economic indicators and industry-specific outlooks to reach these projections.

-

Impact of Falling Inflation and Lower Interest Rates: The anticipated decline in inflation and the potential for lower interest rates significantly impact their valuation models. Lower interest rates reduce the cost of borrowing for companies, boosting profitability and supporting higher stock valuations. This positive influence is a crucial component of BofA's overall assessment.

-

Discounted Cash Flow (DCF) Analysis: BofA incorporates sophisticated discounted cash flow analysis into their valuation methodology. DCF models project future cash flows and discount them back to their present value, providing a more comprehensive picture of a company's intrinsic worth than simple P/E ratios alone. This rigorous approach adds weight to their conclusions.

-

Sectoral Strength Despite Market Uncertainty: While acknowledging the broader market uncertainty, BofA highlights the continued strength of specific sectors. Identifying and investing in these resilient sectors can offer a buffer against overall market volatility, providing a more balanced approach to investment.

-

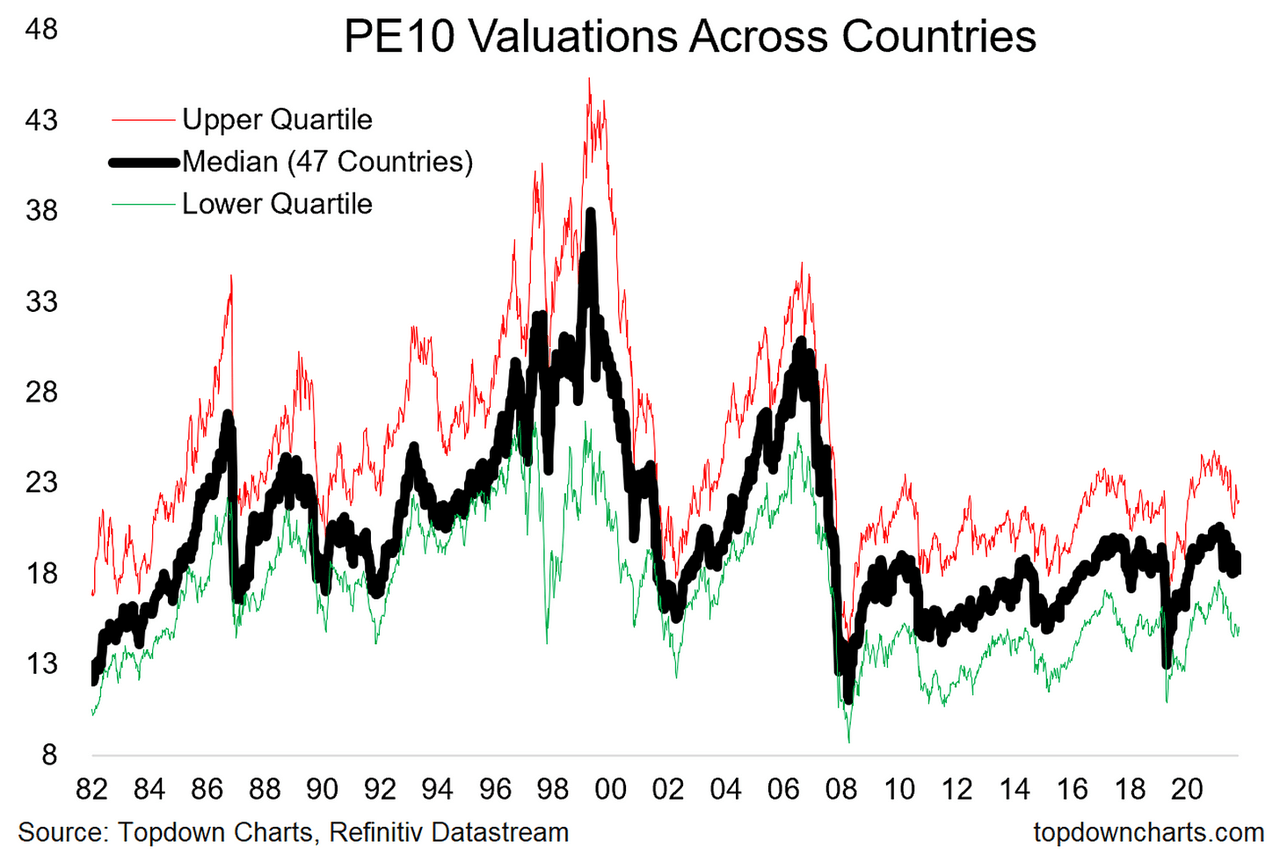

Headline Valuations vs. Underlying Fundamentals: BofA emphasizes a critical distinction between headline valuations—often the numbers that grab media attention—and the underlying economic fundamentals. They argue that a focus solely on headline numbers can be misleading and that a deeper dive into company performance and future prospects is necessary for a more accurate valuation.

Addressing Key Investor Concerns about High Stock Market Valuations

Many investors are understandably concerned about high stock market valuations, particularly in the face of recent volatility. BofA directly addresses these concerns:

-

Fear of Market Correction or Bear Market: The fear of a significant market correction or even a bear market is a valid concern. BofA acknowledges this risk but argues that their analysis suggests the current valuations aren't solely driven by speculation, but also by solid underlying growth projections.

-

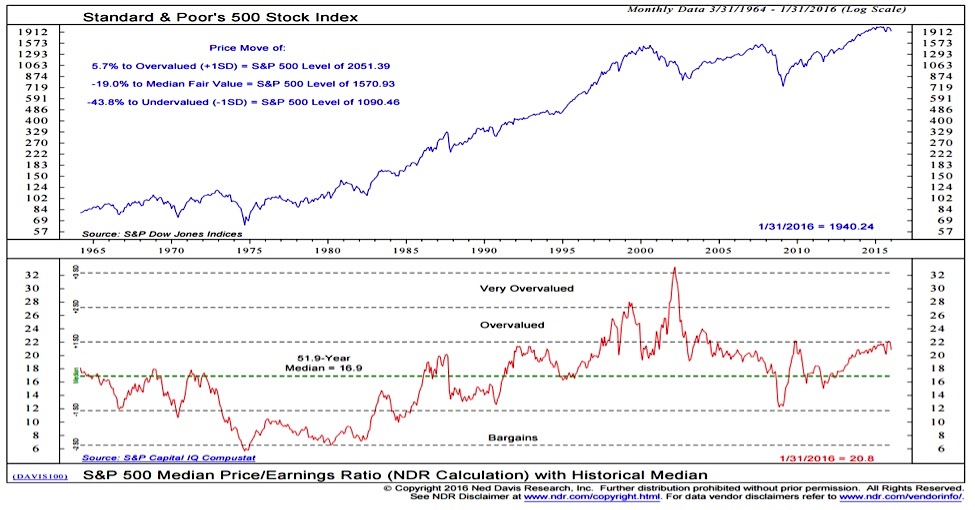

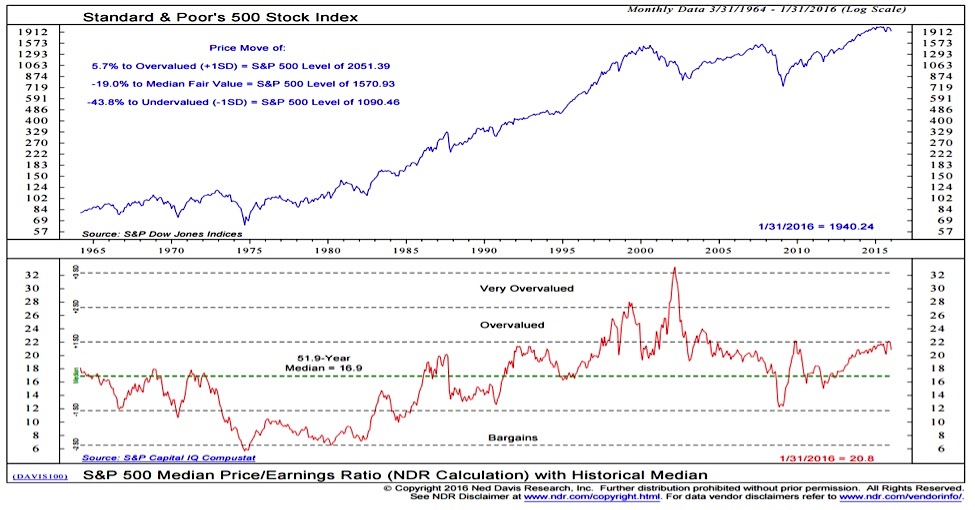

High Price-to-Earnings (P/E) Ratios: High P/E ratios are a common cause of investor anxiety. BofA counters this by highlighting the importance of considering the future earnings growth potential. A high P/E ratio can be justified if a company is expected to experience substantial earnings growth in the coming years.

-

Risk Management within a Portfolio: BofA emphasizes the importance of proper risk management. This includes diversification across different sectors and asset classes, as well as aligning investment strategies with individual risk tolerance levels. Their advice isn’t to ignore the risks but to manage them effectively.

-

Long-Term Investment Strategy: BofA stresses the crucial role of a long-term investment strategy. Short-term market fluctuations are normal and should not dictate long-term investment decisions. Focusing on a long-term perspective allows investors to weather short-term market storms.

-

Benefits of Portfolio Diversification: Diversification remains a cornerstone of sound investment strategy. By spreading investments across different asset classes and sectors, investors can mitigate risk and reduce the impact of any single investment performing poorly.

BofA's Recommended Investment Strategies in the Current Market

Based on their analysis, BofA offers specific recommendations for investors:

-

Strategic Stock Selection: BofA advocates for a meticulous approach to stock selection, focusing on companies with strong fundamentals, sustainable growth potential, and robust balance sheets. This requires in-depth research and analysis.

-

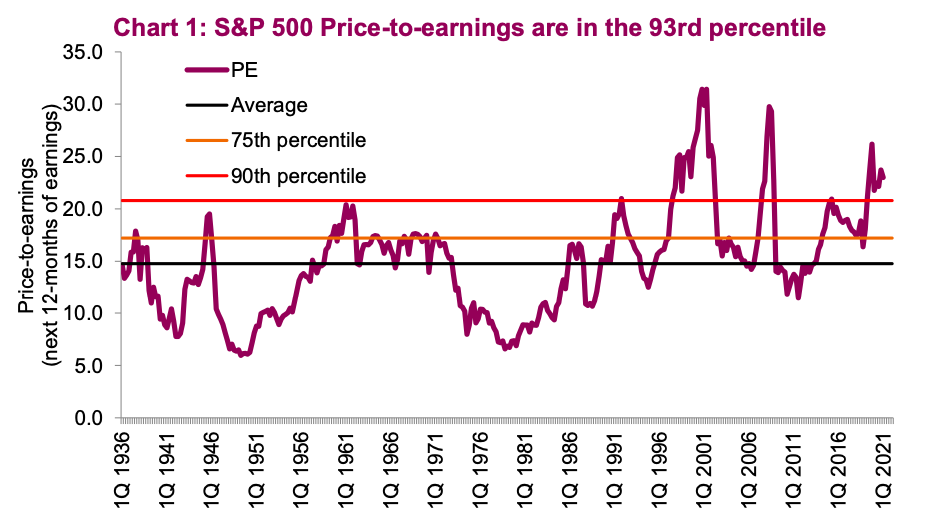

Sector Allocation: Careful sector allocation is crucial to mitigating risk. BofA suggests focusing on sectors expected to perform well even in a potentially challenging market environment. This requires a thorough understanding of macroeconomic trends and industry-specific outlooks.

-

Risk Tolerance: Investing should always align with an individual's risk tolerance. BofA emphasizes the importance of self-assessment and choosing investment strategies that fit one's comfort level with market volatility.

-

Portfolio Optimization: Regular portfolio optimization is crucial to maintaining a well-balanced and efficient portfolio. This involves periodically reviewing and adjusting asset allocation to align with evolving market conditions and personal goals.

-

Asset Allocation Strategies: BofA provides insights into appropriate asset allocation strategies based on different investor profiles and risk tolerances. Their recommendations cater to the unique needs of various investors.

Conclusion

Bank of America's analysis suggests that while stock market valuations may appear high, a closer look at underlying fundamentals and growth projections reveals a less alarming picture. By considering factors like future earnings growth, interest rate movements, and adopting a long-term investment perspective, investors can navigate current market conditions with greater confidence. BofA's recommended investment strategies offer a framework for managing risk and maximizing potential returns. Don't let concerns about stock market valuations deter you. Understand BofA's perspective and develop a well-informed investment strategy tailored to your risk tolerance. Learn more about navigating stock market valuations and making sound investment decisions.

Featured Posts

-

A Refugee Familys Escape From War And The Helping Hand Of Pope Francis

Apr 25, 2025

A Refugee Familys Escape From War And The Helping Hand Of Pope Francis

Apr 25, 2025 -

The Spider Man 4 Title And The Sadie Sink Casting Theory A Conclusive Look

Apr 25, 2025

The Spider Man 4 Title And The Sadie Sink Casting Theory A Conclusive Look

Apr 25, 2025 -

Eurovision 2025 Who Are The Frontrunners

Apr 25, 2025

Eurovision 2025 Who Are The Frontrunners

Apr 25, 2025 -

Jelly Roll And Guy Fieris Unexpected Collaboration What We Know

Apr 25, 2025

Jelly Roll And Guy Fieris Unexpected Collaboration What We Know

Apr 25, 2025 -

Brian Tyree Henry And Wagner Moura Steal The Show In Dope Thief Trailer

Apr 25, 2025

Brian Tyree Henry And Wagner Moura Steal The Show In Dope Thief Trailer

Apr 25, 2025

Latest Posts

-

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025