Stock Market Winners: Rockwell Automation, Angi, And More

Table of Contents

Rockwell Automation: A Deep Dive into Industrial Automation's Success

Rockwell Automation stands as a leader in industrial automation, consistently demonstrating strong performance and growth potential. Understanding its position and prospects is crucial for any investor considering adding it to their portfolio.

Strong Fundamentals Driving Rockwell's Growth:

Rockwell Automation dominates the industrial automation market, providing a wide range of solutions for manufacturing, processing, and other industrial sectors. Their success is driven by several key factors:

-

Technological Innovation: Rockwell continuously invests in research and development, creating cutting-edge automation technologies that improve efficiency and productivity for its clients. This commitment to innovation ensures they stay ahead of the competition.

-

Strong Financial Performance: The company consistently delivers impressive financial results. Revenue growth has been robust, driven by increased demand for automation solutions globally. Earnings per share (EPS) have also shown a steady upward trend, reflecting profitability and strong operational efficiency.

-

Strategic Acquisitions: Rockwell's strategic acquisitions of smaller companies have expanded its product portfolio and market reach, fueling further growth.

-

Key Financial Metrics (Illustrative):

- Average Annual Revenue Growth (Past 5 years): [Insert Data - Source needed]

- Earnings Per Share (EPS) Growth (Past 5 years): [Insert Data - Source needed]

- Profit Margin: [Insert Data - Source needed]

Investment Opportunities and Risks in Rockwell Automation:

The industrial automation sector is poised for significant growth in the coming years, fueled by the increasing adoption of Industry 4.0 technologies and the need for greater efficiency across various industries. This presents a compelling investment opportunity.

However, investors should also be aware of potential risks:

-

Competition: Rockwell faces competition from other established players in the industrial automation market. Maintaining its competitive edge will be critical for sustained success.

-

Economic Downturns: During economic recessions, businesses may postpone capital expenditures, including investments in automation. This could negatively impact Rockwell's performance.

-

Investment Considerations:

- Potential Benefits: High growth potential, strong financial performance, leading market position.

- Potential Drawbacks: Exposure to economic cycles, intense competition.

Angi: Navigating the Home Services Market with Success

Angi, formerly known as Angie's List, has successfully transformed its business model to become a dominant player in the online home services market. Its platform connects homeowners with a wide range of service professionals, creating a convenient and efficient marketplace.

Angi's Strategic Positioning in the Home Improvement Sector:

Angi's success stems from its strategic positioning:

-

Comprehensive Service Offering: Angi offers a wide array of home services, covering everything from plumbing and electrical work to landscaping and home repair. This comprehensive approach caters to a broad customer base.

-

Strong Network of Professionals: The platform boasts a large and diverse network of vetted professionals, ensuring homeowners have access to qualified service providers.

-

Digital Platform Advantage: Its user-friendly online platform and mobile app provide a seamless experience for both homeowners and service professionals.

-

Key Services and Market Penetration:

- Home repair and maintenance

- Home improvement projects

- Landscaping and outdoor services

- [Insert Market Share Data – Source needed]

Assessing the Risks and Rewards of Investing in Angi:

The home services market is large and consistently growing, driven by factors like an aging housing stock and increasing demand for home improvements. This presents strong growth potential for Angi.

However, investors should consider:

-

Competition: The online home services market is competitive, with other players vying for market share.

-

Economic Sensitivity: Home improvement projects are often discretionary, making them vulnerable to economic downturns.

-

Investment Considerations:

- Potential Returns: Growth in the home services market, expanding service offerings, technological innovation.

- Associated Risks: Intense competition, economic sensitivity, reliance on a digital platform.

Identifying Other Promising Stock Market Winners

Beyond Rockwell Automation and Angi, several other companies are demonstrating strong performance and offer compelling investment opportunities.

Beyond Rockwell and Angi: Exploring Emerging Market Leaders:

-

Company X: [Brief description and reason for success – include link to relevant information]

-

Company Y: [Brief description and reason for success – include link to relevant information]

-

Company Z: [Brief description and reason for success – include link to relevant information]

-

Key Strengths (Example for Company X):

- Disruptive technology

- First-mover advantage

- Strong management team

Diversification and Risk Management in Stock Investments:

It's crucial to diversify your investments to mitigate risk. Don't put all your eggs in one basket. Use a combination of fundamental and technical analysis to make informed decisions. Employ risk management strategies such as stop-loss orders to protect your capital.

- Best Practices:

- Diversify across different sectors and asset classes

- Conduct thorough due diligence before investing

- Use stop-loss orders to limit potential losses

- Regularly review and rebalance your portfolio

Conclusion: Capitalizing on Stock Market Winners – Your Next Steps

Rockwell Automation and Angi represent compelling investment opportunities, showcasing strong fundamentals and growth potential. However, remember to conduct thorough due diligence on any company before investing. Diversification is key to mitigating risk and maximizing returns in the dynamic stock market. Discover more stock market winners by continuing your research into the companies mentioned and exploring other promising sectors. Find your next winning stock by proactively seeking out undervalued companies with strong future prospects. Remember that all investments carry inherent risk, and past performance does not guarantee future results.

Featured Posts

-

Deepfake Vulnerability Exposed Cybersecurity Experts Cnn Business Demonstration

May 17, 2025

Deepfake Vulnerability Exposed Cybersecurity Experts Cnn Business Demonstration

May 17, 2025 -

Nba Referees Acknowledge Missed Foul Call In Knicks Victory Over Pistons

May 17, 2025

Nba Referees Acknowledge Missed Foul Call In Knicks Victory Over Pistons

May 17, 2025 -

Rockwell Automation Beats Expectations Leading Market Rally

May 17, 2025

Rockwell Automation Beats Expectations Leading Market Rally

May 17, 2025 -

Tom Cruises 1 Debt To Tom Hanks An Unpaid Role And A Lasting Joke

May 17, 2025

Tom Cruises 1 Debt To Tom Hanks An Unpaid Role And A Lasting Joke

May 17, 2025 -

Navigating The Chinese Market Challenges And Opportunities For Automakers Including Bmw And Porsche

May 17, 2025

Navigating The Chinese Market Challenges And Opportunities For Automakers Including Bmw And Porsche

May 17, 2025

Latest Posts

-

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025 -

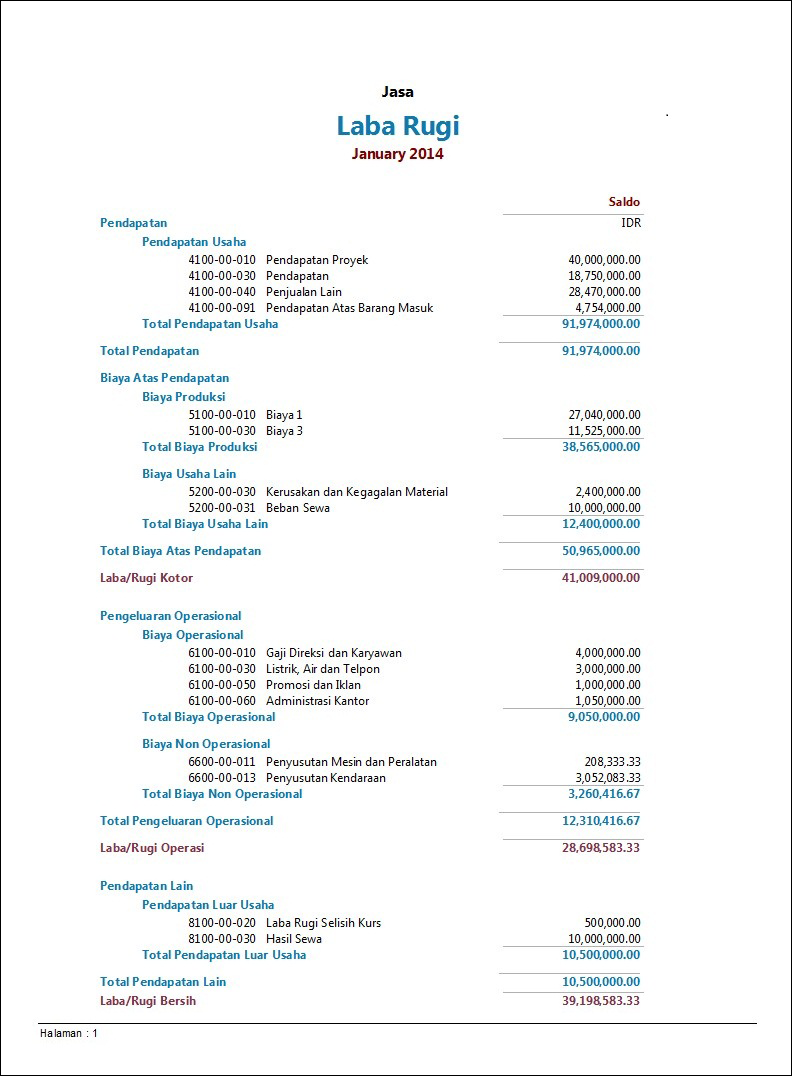

Jenis Jenis Laporan Keuangan And Pentingnya Bagi Kesuksesan Bisnis

May 17, 2025

Jenis Jenis Laporan Keuangan And Pentingnya Bagi Kesuksesan Bisnis

May 17, 2025 -

Principal Financial Group Nasdaq Pfg What 13 Analysts Predict

May 17, 2025

Principal Financial Group Nasdaq Pfg What 13 Analysts Predict

May 17, 2025 -

Laporan Keuangan Jenis Pentingnya Dan Penerapan Untuk Bisnis Anda

May 17, 2025

Laporan Keuangan Jenis Pentingnya Dan Penerapan Untuk Bisnis Anda

May 17, 2025 -

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights

May 17, 2025

13 Analyst Assessments Of Principal Financial Group Pfg Key Insights

May 17, 2025