Swissquote Bank: Sovereign Bond Market Analysis And Outlook

Table of Contents

Current State of the Sovereign Bond Market

The sovereign bond market is experiencing a period of significant change. Interest rates are on the rise in many major economies, impacting bond yields across the board. This is largely a response to persistent inflation, forcing central banks to implement monetary tightening policies, such as interest rate hikes and the unwinding of quantitative easing (QE). These actions, while aimed at curbing inflation, have created a challenging environment for bond investors accustomed to low-rate environments. Geopolitical events, including the ongoing war in Ukraine and rising global tensions, add another layer of complexity, further impacting investor sentiment and bond prices.

-

Analysis of yields for major economies: US Treasury yields, typically considered a benchmark, have risen significantly, impacting the yields of other sovereign bonds globally. German Bund yields, historically low, have also increased, reflecting the broader shift in the global interest rate environment. Similar trends are observed in UK Gilts and other sovereign debt instruments.

-

Impact of rising inflation on bond values: Inflation erodes the purchasing power of future interest payments, leading to a decline in bond prices, especially for bonds with longer maturities. Investors are demanding higher yields to compensate for the erosion of their principal value due to inflation.

-

Potential central bank actions and implications: The actions of central banks remain a critical factor. Further interest rate increases could put downward pressure on bond prices, while a potential pause or reversal in tightening could provide a boost to the bond market. The timing and magnitude of these actions remain highly uncertain.

-

Assessment of risks associated with specific sovereign bonds: The risk profile varies significantly across sovereign bonds. Emerging market sovereign bonds, while offering potentially higher yields, carry greater default risk compared to bonds issued by developed economies with strong credit ratings.

Key Factors Influencing Future Bond Market Performance

Several key factors will shape the future performance of the sovereign bond market. Economic growth projections play a crucial role: a robust global economy generally supports higher interest rates and can lead to reduced demand for safer sovereign bonds. Conversely, a recessionary environment may drive investors towards the perceived safety of sovereign debt, increasing prices.

-

Forecasts for economic growth in key regions and their implications for bond markets: Forecasts from leading economic institutions will be closely watched, as they provide insights into potential shifts in interest rate policies and investor sentiment.

-

Analysis of the creditworthiness of various sovereign issuers: Credit ratings agencies continually assess the creditworthiness of sovereign issuers. Changes in these ratings directly impact the perceived risk and attractiveness of sovereign bonds, influencing their yields.

-

Potential risks associated with emerging market sovereign bonds: Emerging market sovereign bonds offer the potential for higher returns but expose investors to higher levels of currency risk, political risk, and default risk compared to developed market bonds.

-

Exploration of the role of ESG factors in sovereign bond investing: Environment, Social, and Governance (ESG) factors are increasingly important for many investors. Investors are beginning to assess the environmental and social policies of issuing governments, influencing their investment choices.

Swissquote Bank's Perspective and Investment Strategies

Swissquote Bank possesses extensive expertise in fixed income and sovereign bond analysis, providing clients with comprehensive market insights and sophisticated trading tools. Swissquote Bank's current outlook on the sovereign bond market is cautiously optimistic, acknowledging the persistent challenges of inflation and geopolitical instability but also recognizing potential opportunities for selective investment.

-

Summary of Swissquote Bank's forecasts for key sovereign bond markets: Swissquote Bank regularly publishes market analyses and forecasts for various sovereign bond markets, providing investors with valuable guidance on potential investment opportunities.

-

Recommended allocation strategies for different investor risk profiles: Swissquote Bank offers customized investment strategies tailored to individual risk tolerance and investment goals. This may include diversification across different sovereign bond issuers and maturities.

-

Discussion of potential opportunities and risks within the sovereign bond market: Swissquote Bank's experts identify specific opportunities and risks within the sovereign bond market, helping investors navigate the complex landscape and make informed decisions.

-

Highlight Swissquote Bank’s trading platforms and tools for accessing the bond market: Swissquote Bank offers state-of-the-art trading platforms with advanced tools for analyzing market data and executing trades efficiently.

Conclusion: Investing in Sovereign Bonds with Swissquote Bank

The sovereign bond market remains a dynamic and potentially lucrative asset class, but navigating its complexities requires careful consideration of current market conditions, future projections, and a robust understanding of risk management. Swissquote Bank’s expertise in fixed income analysis, coupled with its advanced trading platforms and tailored investment strategies, provides a valuable resource for investors seeking to maximize returns while managing risk effectively. Gain a deeper understanding of the sovereign bond market and explore Swissquote Bank's comprehensive resources and trading tools to develop your investment strategy today. Visit [link to Swissquote Bank's website].

Featured Posts

-

Ufc Vegas 106 Experts Weigh In On Morales Headliner Performance

May 19, 2025

Ufc Vegas 106 Experts Weigh In On Morales Headliner Performance

May 19, 2025 -

Nyt Mini Crossword Today Hints And Answer For March 6 2025

May 19, 2025

Nyt Mini Crossword Today Hints And Answer For March 6 2025

May 19, 2025 -

Why Interdisciplinary And Transdisciplinary Approaches Matter

May 19, 2025

Why Interdisciplinary And Transdisciplinary Approaches Matter

May 19, 2025 -

Funding Your Smes Sustainability Journey

May 19, 2025

Funding Your Smes Sustainability Journey

May 19, 2025 -

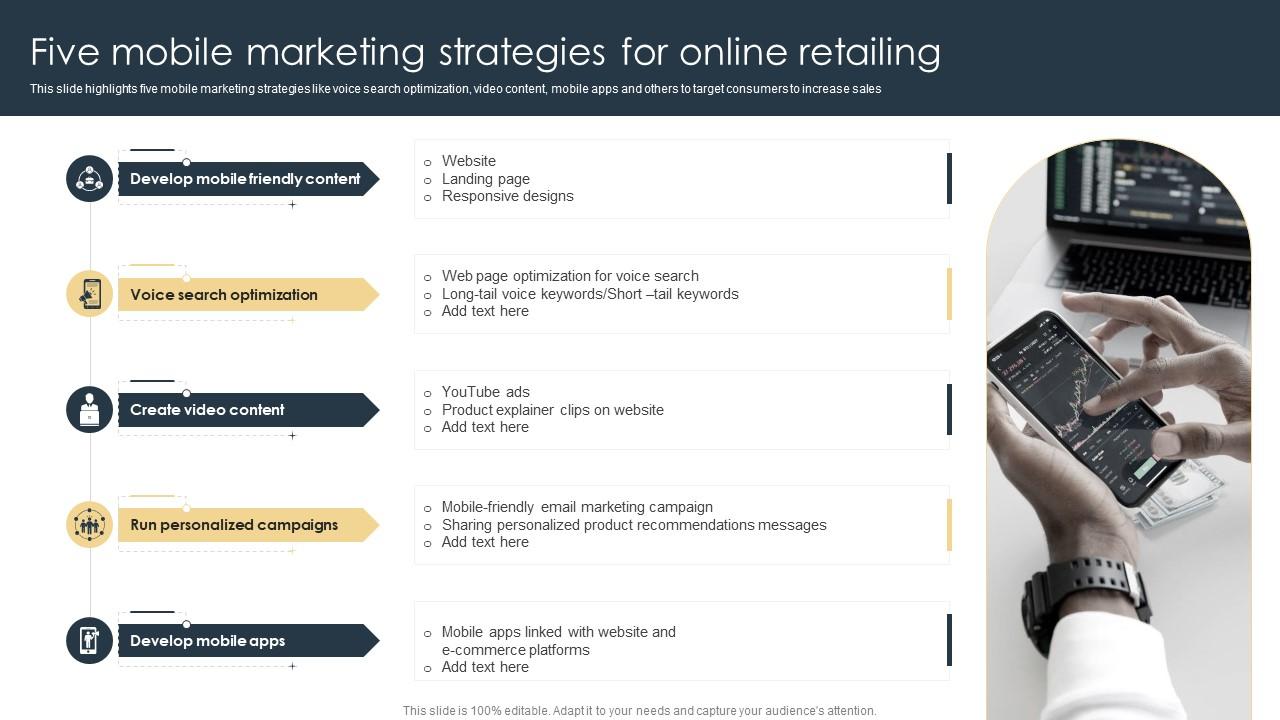

Mobile Marketing Strategies For E Commerce Success

May 19, 2025

Mobile Marketing Strategies For E Commerce Success

May 19, 2025

Latest Posts

-

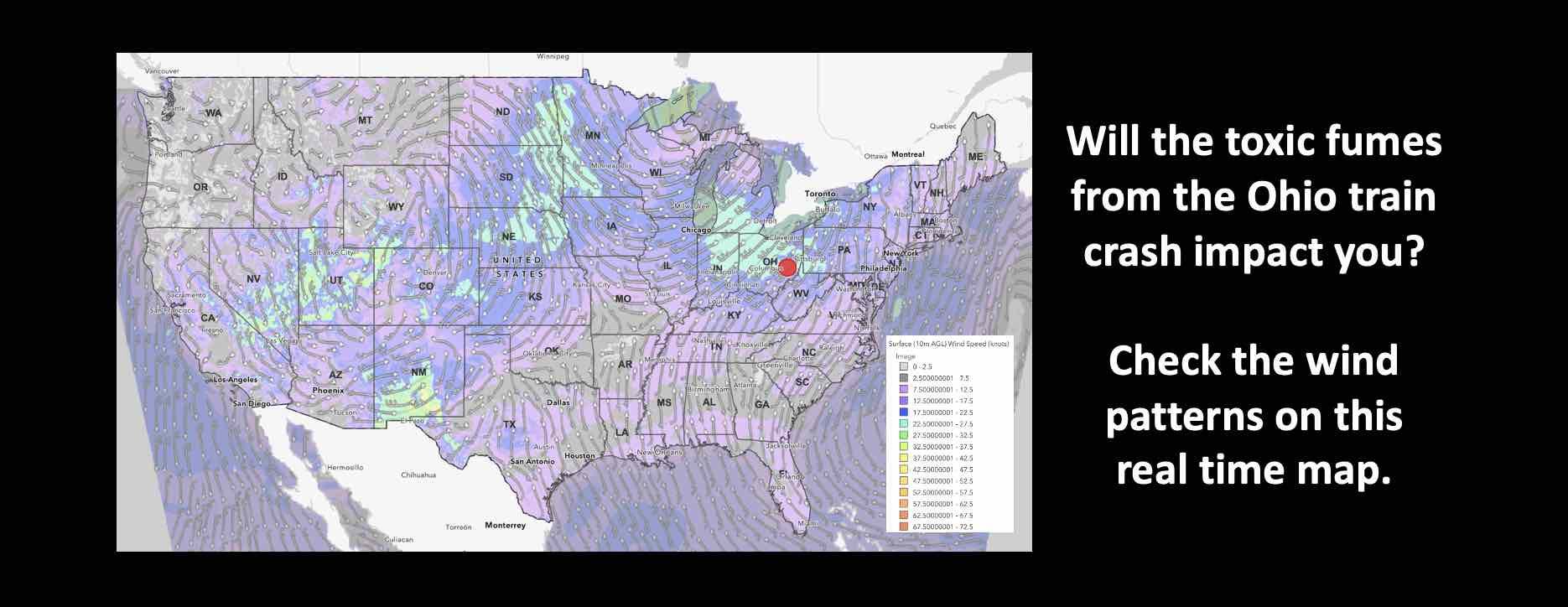

Ohio Train Disaster Persistent Toxic Chemicals Found In Buildings

May 19, 2025

Ohio Train Disaster Persistent Toxic Chemicals Found In Buildings

May 19, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Contamination

May 19, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Contamination

May 19, 2025 -

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025 -

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025 -

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025