The Bank Of Canada And Interest Rates: Analyzing The Retail Sales Data

Table of Contents

<p>The Bank of Canada's interest rate decisions significantly impact the Canadian economy, and understanding these decisions requires careful analysis of key economic indicators. One crucial indicator is retail sales data, which provides valuable insights into consumer spending and overall economic health. This article delves into how the Bank of Canada uses retail sales data to inform its interest rate decisions, examining the relationship between consumer spending and monetary policy. Understanding this relationship is key to navigating the complexities of Bank of Canada interest rates and their effect on your finances.</p>

<h2>Retail Sales Data as a Leading Indicator</h2>

<h3>Understanding the Retail Sales Report</h3>

<p>The monthly Retail Sales report, published by Statistics Canada, is a comprehensive overview of consumer spending in Canada. It details the total value and volume of sales across various retail sectors. Understanding this report is vital for interpreting its implications for Bank of Canada interest rates.</p>

<ul> <li><b>Data Collection and Reporting:</b> Statistics Canada collects data from a sample of businesses across the country, using surveys and administrative data. The data is then seasonally adjusted to account for fluctuations related to time of year.</li> <li><b>Nominal vs. Real Retail Sales Growth:</b> Nominal growth reflects changes in sales value, while real growth adjusts for inflation, providing a clearer picture of actual spending changes.</li> <li><b>Access to Data:</b> The official Statistics Canada data source can be found at [Insert Link to Statistics Canada Retail Sales Data].</li> </ul>

<h3>Correlation with Consumer Confidence</h3>

<p>Consumer confidence plays a significant role in influencing retail sales. Positive consumer sentiment, often reflected in consumer confidence indices, tends to lead to increased spending, while negative sentiment leads to decreased spending. This direct correlation makes consumer confidence a key factor in predicting retail sales trends, impacting Bank of Canada Interest Rates.</p>

<ul> <li><b>Positive Sentiment:</b> High confidence often translates to increased purchases of durable goods (e.g., cars, appliances) and non-essential items.</li> <li><b>Negative Sentiment:</b> Low confidence can result in consumers delaying purchases, focusing on essential goods, and increasing savings.</li> <li><b>Influencing Factors:</b> Employment rates, inflation levels, and overall economic stability significantly influence consumer confidence and, consequently, retail sales.</li> </ul>

<h3>Predicting Future Economic Trends</h3>

<p>Robust retail sales figures generally indicate a healthy and expanding economy. Conversely, weak sales can be a harbinger of economic slowdown or even recession. The Bank of Canada closely monitors these trends to anticipate future economic activity and adjust its monetary policy accordingly.</p>

<ul> <li><b>Strong Sales:</b> Suggest strong consumer demand and overall economic health, potentially leading to interest rate hikes to manage inflation.</li> <li><b>Weak Sales:</b> Indicate weakening consumer demand and potential economic trouble, potentially prompting interest rate cuts to stimulate the economy.</li> </ul>

<h2>The Bank of Canada's Reaction to Retail Sales Data</h2>

<h3>Interest Rate Adjustments Based on Sales Figures</h3>

<p>The Bank of Canada uses retail sales data, among other indicators, to inform its interest rate decisions. Strong retail sales, particularly when coupled with rising inflation, might prompt the Bank to increase interest rates to cool down the economy. Conversely, weak sales might lead to interest rate cuts to stimulate economic growth.</p>

<ul> <li><b>Interest Rate Hikes:</b> Implemented to combat inflation by reducing consumer spending and investment.</li> <li><b>Interest Rate Cuts:</b> Aimed at stimulating the economy by encouraging borrowing and spending.</li> </ul>

<h3>Other Economic Factors Considered</h3>

<p>It is crucial to understand that retail sales data is just one piece of the puzzle. The Bank of Canada considers a wide range of economic factors when making interest rate decisions. These factors influence the overall impact and interpretation of retail sales data on Bank of Canada Interest Rates.</p>

<ul> <li><b>Inflation:</b> A key indicator of price stability, influencing the Bank's decision on whether to increase or decrease interest rates.</li> <li><b>Employment Rate:</b> High employment levels generally suggest economic strength, while high unemployment suggests weakness.</li> <li><b>Housing Market:</b> The housing market’s performance is another vital factor in the Bank’s overall economic assessment.</li> </ul>

<h3>The Lag Effect</h3>

<p>There's often a time lag between changes in retail sales and the Bank of Canada's response. This lag occurs because the Bank needs time to assess the data, consider other economic factors, and analyze the overall economic picture before making interest rate adjustments. This lag impacts the effectiveness and timing of monetary policy responses.</p>

<ul> <li><b>Data Analysis:</b> Requires time for thorough examination and interpretation of the data.</li> <li><b>Economic Forecasting:</b> Involves projecting future economic trends based on current data.</li> <li><b>Policy Implementation:</b> The decision-making process within the Bank of Canada takes time.</li> </ul>

<h2>Analyzing Recent Retail Sales Data and its Impact on Interest Rates</h2>

<h3>Recent Trends in Canadian Retail Sales</h3>

<p>[Insert recent statistics and analysis on Canadian retail sales from Statistics Canada, including specific data points and links to sources. Discuss significant trends like growth in online retail, the impact of inflation on spending habits, etc.]</p>

<h3>Predicted Impact on Bank of Canada Interest Rates</h3>

<p>[Offer predictions, with clear caveats, on the likely direction of future interest rate changes based on current retail sales data. Clearly state any assumptions made, potential limitations of the predictions, and include links to relevant economic forecasts. For example, "Based on the current trends in retail sales, coupled with [mention other relevant economic indicators], a cautious prediction would be a [increase/decrease/hold] in interest rates in the coming months. However, this prediction is subject to change depending on future economic developments." ]</p>

<h2>Conclusion</h2>

<p>The Bank of Canada's interest rate decisions are multifaceted, influenced by various economic factors. Analyzing retail sales data provides crucial insights into consumer spending habits and helps predict future economic trends. While not the sole determinant, retail sales figures provide valuable information that informs the Bank of Canada’s monetary policy decisions. Understanding the relationship between retail sales data and the Bank of Canada's interest rate strategy is crucial for businesses and individuals alike to make informed financial decisions. To stay up-to-date on the latest developments concerning Bank of Canada Interest Rates and their impact on the economy, regularly review the official Bank of Canada reports and economic data from Statistics Canada. Continue learning about how the Bank of Canada uses retail sales data to make informed choices regarding your financial planning.</p>

Featured Posts

-

Masa Israels Record Breaking English Yom Ha Zikaron Ceremony

May 26, 2025

Masa Israels Record Breaking English Yom Ha Zikaron Ceremony

May 26, 2025 -

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 26, 2025

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 26, 2025 -

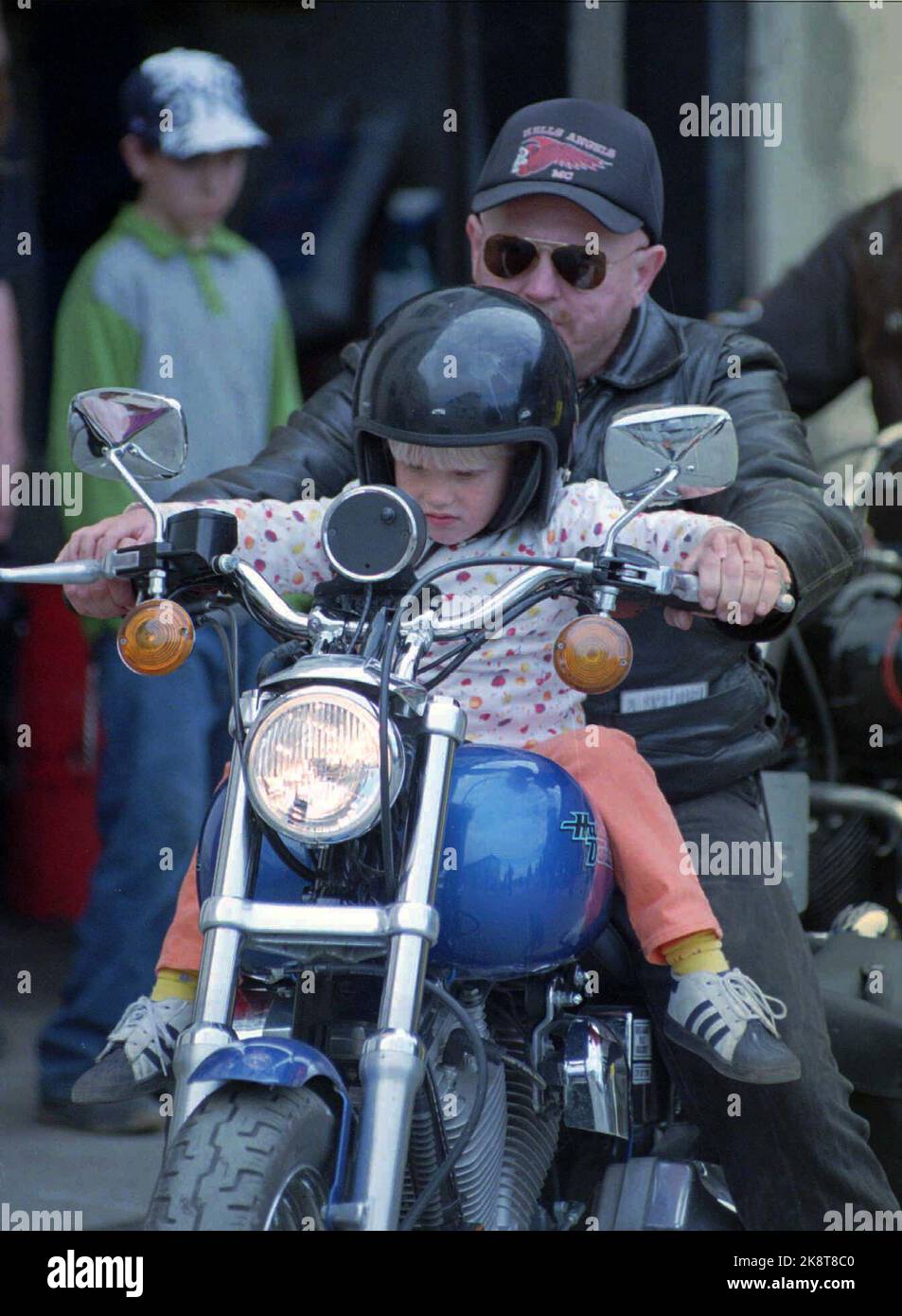

The Hells Angels An In Depth Analysis

May 26, 2025

The Hells Angels An In Depth Analysis

May 26, 2025 -

Atletico Madrid In Espanyol Uezerindeki Zorlu Zaferi Hakem Kararlarinin Etkisi

May 26, 2025

Atletico Madrid In Espanyol Uezerindeki Zorlu Zaferi Hakem Kararlarinin Etkisi

May 26, 2025 -

Double Milan San Remo Victory For Van Der Poel A Stunning Performance

May 26, 2025

Double Milan San Remo Victory For Van Der Poel A Stunning Performance

May 26, 2025

Latest Posts

-

I Online Payday Loans Best Tribal Loans For Bad Credit With Guaranteed Approval

May 28, 2025

I Online Payday Loans Best Tribal Loans For Bad Credit With Guaranteed Approval

May 28, 2025 -

Your Guide To Finance Loans Interest Rates Emis And Loan Tenure Explained

May 28, 2025

Your Guide To Finance Loans Interest Rates Emis And Loan Tenure Explained

May 28, 2025 -

Bad Credit Tribal Loans Secure Guaranteed Approval From Direct Lenders

May 28, 2025

Bad Credit Tribal Loans Secure Guaranteed Approval From Direct Lenders

May 28, 2025 -

Finance Loans 101 A Step By Step Application Process

May 28, 2025

Finance Loans 101 A Step By Step Application Process

May 28, 2025 -

A German View The Rayan Cherki Situation

May 28, 2025

A German View The Rayan Cherki Situation

May 28, 2025