The Bank Of England And A Half-Point Rate Cut: A Necessary Intervention?

Table of Contents

The Current Economic Landscape & The Need for Intervention

The UK's economic outlook is undeniably challenging. Inflation, currently hovering around [insert current inflation figure]%, far exceeds the BoE's target of 2%. This high inflation erodes purchasing power, impacting consumer spending and business confidence. GDP growth has slowed significantly [insert GDP growth figures], raising concerns about a potential recession. Unemployment, while relatively low [insert unemployment figures], could rise sharply if economic activity continues to contract. Global factors further complicate the situation. The ongoing war in Ukraine, persistent supply chain disruptions, and rising energy prices all contribute to the UK's economic woes. The government's fiscal policy also plays a crucial role, with recent tax changes and spending decisions impacting economic growth and inflation.

- High inflation rates: The cost of living crisis is squeezing household budgets, forcing consumers to cut back on discretionary spending.

- Slowing economic growth: Businesses are facing increased uncertainty, leading to reduced investment and hiring.

- Impact of energy prices: Soaring energy costs are placing a significant burden on both households and businesses.

- The role of government fiscal policy: Government spending and taxation decisions significantly influence the overall economic environment.

Arguments for a Bank of England Half-Point Rate Cut

Proponents of a half-point rate cut argue that it's a necessary stimulus to prevent a deeper economic downturn. Lowering interest rates could potentially boost economic activity through several channels.

- Lower borrowing costs for businesses: Reduced interest rates make borrowing cheaper for businesses, encouraging investment in new projects and job creation.

- Increased consumer spending: Lower mortgage rates could free up disposable income for consumers, leading to increased spending and boosting demand.

- Potential boost to economic growth: Increased investment and consumer spending could stimulate economic growth and help to avoid a recession.

- Mitigation of recessionary risks: A rate cut could act as a buffer against the negative impacts of a potential recession.

A Bank of England half-point rate cut could provide a much-needed injection of confidence into the economy, encouraging businesses and consumers to spend and invest.

Arguments Against a Bank of England Half-Point Rate Cut

However, a half-point rate cut isn't without risks. Critics warn that it could exacerbate existing inflationary pressures and destabilize the pound.

- Risk of exacerbating inflation: A rate cut could increase demand without a corresponding increase in supply, leading to higher prices.

- Potential for currency devaluation: Lower interest rates could make the pound less attractive to foreign investors, potentially leading to devaluation and increased import costs.

- Impact on savers and pensioners: Reduced interest rates would further diminish the already low returns on savings accounts, impacting the income of savers and pensioners.

- Concerns about effectiveness: Monetary policy might be ineffective in addressing structural economic issues such as supply chain bottlenecks. A rate cut might not address the root causes of inflation.

Alternative Monetary Policy Options

The BoE has other tools at its disposal besides interest rate cuts. These include:

- Quantitative easing (QE): The BoE could purchase government bonds to increase the money supply, potentially lowering long-term interest rates. However, QE can be inflationary and may not always be effective.

- Forward guidance: Clearly communicating the BoE's intentions regarding future interest rates can influence market expectations and potentially stabilize the economy. However, this relies on credibility and accurate forecasting.

- Targeted interventions: The BoE could implement targeted support measures for specific sectors of the economy most affected by the current crisis. This requires careful identification of vulnerable sectors and effective policy implementation.

Conclusion

The decision of whether or not to implement a Bank of England half-point rate cut is a complex one, fraught with potential benefits and drawbacks. While a rate cut could stimulate economic activity and mitigate recessionary risks, it also carries the risk of exacerbating inflation and devaluing the pound. The BoE must carefully weigh these competing considerations. Considering the current economic climate and the risks associated with a significant rate cut, a more cautious approach, potentially involving a smaller rate cut or a combination of other monetary policy tools, might be more prudent. We encourage readers to share their opinions on the Bank of England rate cut decision and the broader implications of this crucial decision for the UK economy. What are your thoughts on the BoE interest rate policy and the impact of a half-point rate cut? Let's discuss!

Featured Posts

-

Kripto Varliklarin Miras Birakilmasinda Guevenlik Oenlemleri

May 08, 2025

Kripto Varliklarin Miras Birakilmasinda Guevenlik Oenlemleri

May 08, 2025 -

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

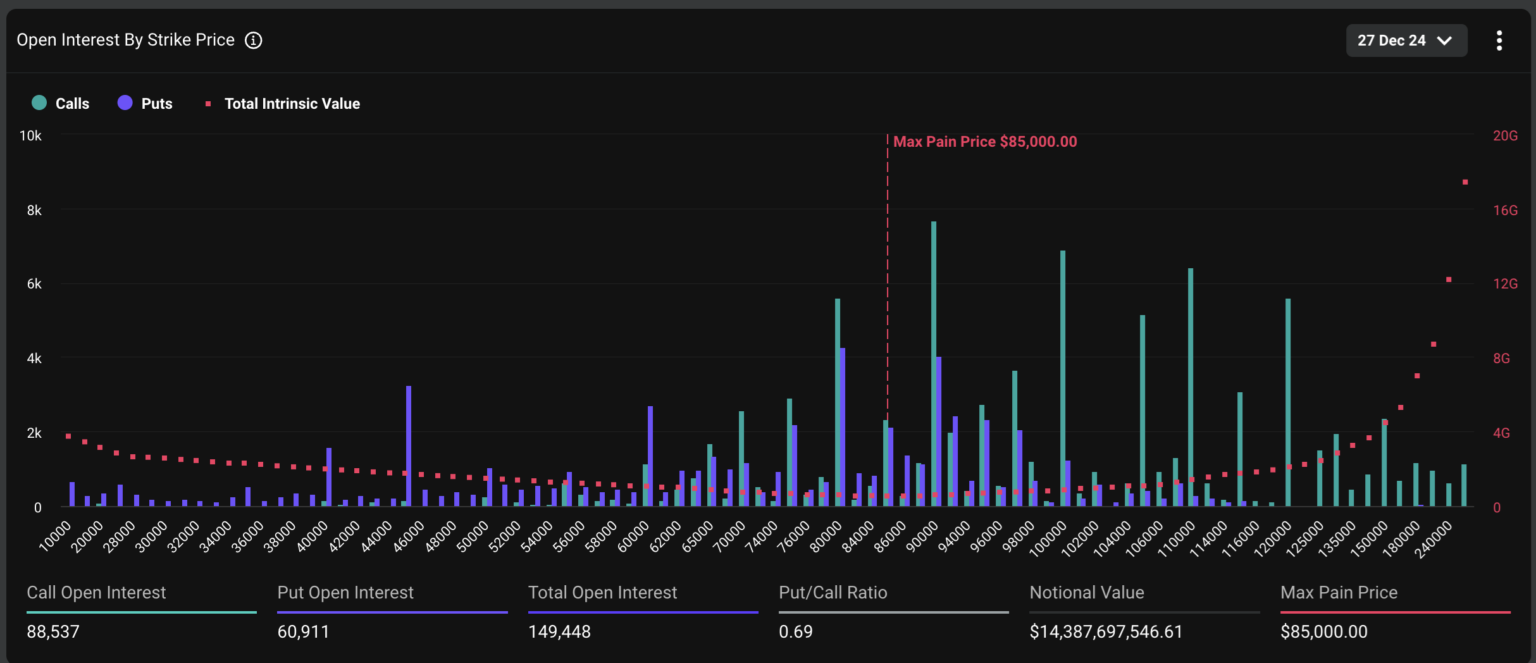

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025 -

El Psg Se Impone Al Lyon En Un Partido Clave

May 08, 2025

El Psg Se Impone Al Lyon En Un Partido Clave

May 08, 2025

Latest Posts

-

Nathan Fillion From Wwii Movie To The Rookie A Career Highlight

May 08, 2025

Nathan Fillion From Wwii Movie To The Rookie A Career Highlight

May 08, 2025 -

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025 -

Bitcoin And Ethereum Options Expiration Billions At Stake Volatility Ahead

May 08, 2025

Bitcoin And Ethereum Options Expiration Billions At Stake Volatility Ahead

May 08, 2025 -

Ethereums Future Will The Price Fall Below 1 500 Support Level Analysis

May 08, 2025

Ethereums Future Will The Price Fall Below 1 500 Support Level Analysis

May 08, 2025