Trade War Fallout: Which Cryptocurrency Will Prevail?

Table of Contents

Bitcoin (BTC) – The Established King?

Bitcoin, the original cryptocurrency, boasts a significant first-mover advantage and a substantial market capitalization. Its history, dating back to 2009, has solidified its position as a prominent digital asset. However, its dominance is not without challenges.

-

Strengths:

- Decentralization: Bitcoin's decentralized nature makes it resistant to censorship and single points of failure, a crucial factor during geopolitical instability.

- Established Network Effect: Its extensive network and widespread adoption create a robust ecosystem and enhance its value proposition.

- Store of Value Narrative: Many view Bitcoin as a digital gold, a store of value that can hedge against inflation and currency devaluation – a particularly appealing proposition during times of trade conflict.

-

Weaknesses:

- Volatility: Bitcoin's price is notoriously volatile, making it a risky investment despite its potential as a hedge.

- Scalability Issues: Transaction processing speed and fees can be problematic, limiting its usability for mass adoption.

- Regulatory Uncertainty: The regulatory landscape surrounding Bitcoin varies widely across jurisdictions, creating uncertainty for investors.

-

Trade War Impact Analysis: Historically, Bitcoin has shown some resilience during economic downturns. Its performance during previous periods of market uncertainty suggests that its scarcity and decentralized nature could make it an attractive safe haven asset during trade wars. However, the overall volatility remains a significant risk factor.

Bitcoin's Resilience During Past Economic Crises

Bitcoin's price has demonstrated a tendency to decouple from traditional markets during periods of economic stress. For example, its value increased during the 2020 market crash induced by the COVID-19 pandemic. While past performance is not indicative of future results, these instances suggest a potential for Bitcoin to serve as a refuge for investors seeking alternative investments during trade-related market volatility.

Ethereum (ETH) – The Smart Contract Challenger

Ethereum transcends the limitations of a simple currency. Its blockchain technology supports smart contracts, decentralized applications (dApps), and the burgeoning Decentralized Finance (DeFi) ecosystem.

-

Strengths:

- Smart Contract Capabilities: This functionality opens doors to a wide range of applications, potentially revolutionizing various sectors beyond simple financial transactions.

- DeFi Ecosystem: The flourishing DeFi ecosystem on Ethereum offers innovative financial tools and services, increasing its utility and potential for growth.

- Potential for Widespread Adoption: Ethereum's versatility could drive widespread adoption in various industries, bolstering its long-term value.

-

Weaknesses:

- Scalability Challenges: Similar to Bitcoin, Ethereum faces scalability issues, impacting transaction speeds and costs.

- Competition from Other Smart Contract Platforms: The emergence of competing platforms presents a challenge to Ethereum's dominance in the smart contract space.

-

Trade War Impact Analysis: The need for secure, transparent, and decentralized financial systems could propel the growth of Ethereum and its DeFi ecosystem during periods of international trade conflict. The ability to facilitate cross-border transactions without reliance on traditional financial institutions could be particularly valuable.

Stablecoins – The Safe Haven Option?

Stablecoins, pegged to fiat currencies like the US dollar, aim to minimize volatility. They offer a relatively stable alternative to more volatile cryptocurrencies.

-

Strengths:

- Price Stability: Their value remains relatively consistent, reducing risk for investors seeking to avoid market fluctuations.

- Reduced Volatility: This makes them suitable for everyday transactions and as a safe haven during market uncertainty.

- Ease of Use for Transactions: Stablecoins are often easier to use for everyday transactions compared to other cryptocurrencies.

-

Weaknesses:

- Reliance on Centralized Entities: Many stablecoins are issued and backed by centralized entities, raising concerns about their stability and transparency.

- Regulatory Risks: The regulatory status of stablecoins is still evolving, posing potential risks to investors.

-

Trade War Impact Analysis: The stability offered by stablecoins might attract investors seeking refuge from market volatility during trade wars. However, the reliance on centralized entities and regulatory uncertainties need to be carefully considered.

Altcoins – The Wild Card

The vast world of altcoins encompasses a diverse range of cryptocurrencies with unique functionalities and potential.

-

Strengths:

- Innovation: Altcoins often introduce innovative technologies and solutions, pushing the boundaries of blockchain technology.

- Specialized Use Cases: Many altcoins cater to specific niches, offering specialized solutions for various industries.

- Potentially Higher Returns (But Also Higher Risks): While potentially offering higher returns, altcoins also carry significantly higher risk due to their volatility and often less established nature.

-

Weaknesses:

- Volatility: Altcoins are generally much more volatile than Bitcoin or stablecoins.

- Lack of Adoption: Many altcoins struggle to gain widespread adoption, limiting their potential for growth.

- Regulatory Uncertainty: The regulatory landscape for altcoins is largely undefined and varies widely globally.

-

Trade War Impact Analysis: Certain altcoins focused on privacy, cross-border payments, or supply chain management could potentially benefit from trade wars, as they offer solutions to the challenges posed by trade restrictions. However, it's crucial to recognize the high-risk nature of investing in this category.

Geopolitical Factors and Regulatory Landscape

Geopolitical events and the regulatory landscape significantly influence cryptocurrency markets.

- Impact of Government Regulations: Government regulations on cryptocurrency adoption vary drastically across countries, impacting the growth and adoption of various cryptocurrencies.

- Influence of Trade Wars on Regulatory Responses: Trade wars may lead to changes in regulatory approaches toward cryptocurrencies, potentially affecting market dynamics.

- National Interests and Cryptocurrency Favoritism: Certain nations might favor specific cryptocurrencies based on their national interests, potentially influencing market trends.

Conclusion

Predicting which cryptocurrency will “win” in the aftermath of trade wars is impossible. Bitcoin offers potential as a store of value, Ethereum boasts a robust DeFi ecosystem, stablecoins provide relative stability, and altcoins present a high-risk, high-reward proposition. Each cryptocurrency has its own strengths and weaknesses, and market conditions will influence their performance. There is no guaranteed winner, and the market remains highly volatile.

It is crucial to conduct thorough research and understand the risks involved before investing in any cryptocurrency. Avoid making investment decisions solely based on speculation. The potential impact of Trade War Fallout Cryptocurrency is significant, but careful consideration of risk tolerance and market analysis are paramount. Continue learning about the various cryptocurrencies mentioned in this article and consult with a financial advisor before making any investment decisions.

Featured Posts

-

The 5 Most Public Disputes Involving Stephen King

May 09, 2025

The 5 Most Public Disputes Involving Stephen King

May 09, 2025 -

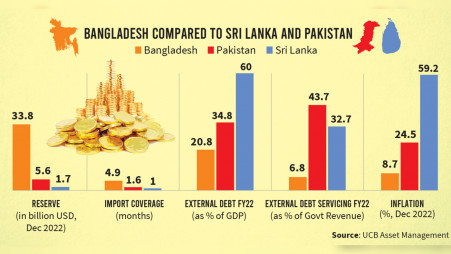

Pakistan Sri Lanka Bangladesh Pledge To Strengthen Capital Market Ties

May 09, 2025

Pakistan Sri Lanka Bangladesh Pledge To Strengthen Capital Market Ties

May 09, 2025 -

Fatal Collision On Elizabeth City Road Driver Hits Pedestrians

May 09, 2025

Fatal Collision On Elizabeth City Road Driver Hits Pedestrians

May 09, 2025 -

Weight Watchers Bankruptcy Filing Amidst Weight Loss Drug Rise

May 09, 2025

Weight Watchers Bankruptcy Filing Amidst Weight Loss Drug Rise

May 09, 2025 -

The Real Safe Bet Investing In Stability

May 09, 2025

The Real Safe Bet Investing In Stability

May 09, 2025