Trade War Intensifies: Further Losses For Dutch Stocks

Table of Contents

Impact of Tariffs on Dutch Exports

Escalating tariffs are directly impacting Dutch export-oriented industries, significantly hindering their growth and profitability. Sectors like agriculture and manufacturing, traditionally cornerstones of the Dutch economy, are feeling the brunt of these trade restrictions. The "Dutch export market," heavily reliant on global trade, is particularly vulnerable.

-

Specific Examples: Companies specializing in agricultural products like dairy and flowers are facing substantial tariff increases in key export markets. Similarly, manufacturers of high-tech equipment and machinery are experiencing reduced demand due to increased import costs in their target regions.

-

Key Export Goods Affected:

- Dairy products: Tariffs have increased by an average of 15%, leading to a 10% decline in export volume.

- Cut flowers: A 20% tariff increase has resulted in a 12% drop in revenue for major Dutch flower exporters.

- Agricultural machinery: Increased tariffs in key markets have reduced export orders by approximately 8%.

-

Tariff Impact Statistics: The combined effect of these tariffs is a significant decline in overall export revenue, impacting the bottom line of numerous Dutch companies and contributing to the overall weakening of the Dutch export market. Preliminary estimates suggest a potential loss of billions of Euros in export revenue for 2023. The "tariff impact" is clearly a significant factor in the current downturn.

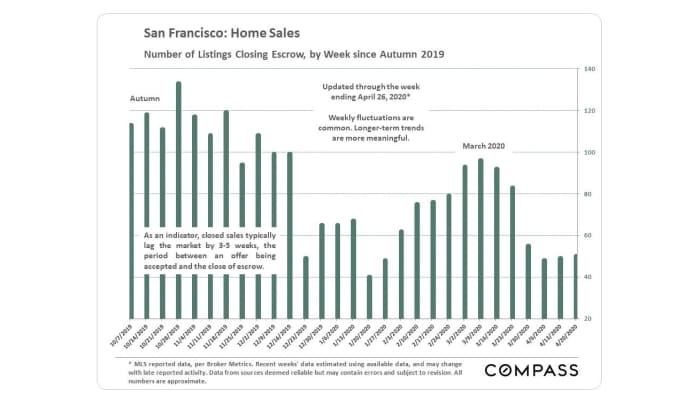

Investor Sentiment and Market Volatility

The uncertainty surrounding the trade war is severely impacting investor sentiment in the Dutch stock market. This lack of confidence is fueling increased market volatility, leading to significant drops in stock prices. The AEX index, a key indicator of the Dutch stock market's performance, has experienced considerable declines, reflecting this negative investor sentiment.

- Decreased Investor Confidence Indicators:

- AEX Index decline of X% in the last quarter.

- Increased volatility as measured by the VIX index.

- Reduced foreign investment in Dutch equities.

- Lower corporate earnings expectations.

The "Dutch stock market" is currently grappling with the twin challenges of reduced investor confidence and heightened market volatility, creating a challenging environment for both businesses and investors. The term "market volatility" accurately describes the current situation, with sharp price swings becoming increasingly common.

The Weakening Euro and its Influence

The weakening Euro is further exacerbating the negative effects of the trade war on Dutch companies operating internationally. Currency fluctuations add another layer of complexity, impacting profitability and competitiveness. A weaker Euro increases the cost of imports for Dutch businesses while simultaneously reducing the value of their exports in foreign markets.

-

Correlation between Euro Exchange Rate and Stock Performance: A clear negative correlation has been observed between the Euro's exchange rate and the performance of Dutch stocks, particularly those with significant international exposure.

-

Implications for Profitability and Competitiveness: The combined impact of tariffs and a weaker Euro is squeezing profit margins and eroding the competitiveness of many Dutch firms in the global market. The "Euro exchange rate" has become a critical factor in the overall economic health of the Netherlands. The impact of "currency fluctuation" on Dutch competitiveness cannot be overstated.

Government Response and Potential Mitigation Strategies

The Dutch government has implemented several measures to mitigate the negative impacts of the trade war on businesses. These include subsidies, tax breaks, and support programs aimed at helping companies adjust to the changing global trade landscape. However, the effectiveness of these measures is still being assessed.

- Government Support Measures:

- Subsidies for export promotion and market diversification.

- Tax breaks for companies investing in research and development.

- Financial aid programs for businesses facing severe economic hardship.

The "Dutch government's" response, while significant, is not a guaranteed solution. Further "economic policy" adjustments may be necessary to effectively counter the detrimental effects of the trade war. The development of effective "trade mitigation" strategies remains a top priority for policymakers.

Conclusion: Trade War Intensifies: Navigating the Challenges for Dutch Stocks

The intensifying trade war is having a significant and multifaceted negative impact on Dutch stocks. Across various sectors, businesses are facing challenges related to increased tariffs, reduced investor confidence, and currency fluctuations. While the Dutch government is taking steps to mitigate these losses, the long-term outlook remains uncertain. There are few immediate signs of significant recovery.

To navigate this challenging environment, investors need to stay informed about the evolving trade situation and consider diversifying their portfolios to mitigate risks associated with the "Trade War Intensifies: Further Losses for Dutch Stocks" situation. Seeking professional financial advice is strongly recommended. Understanding the interplay of these factors is essential for making informed investment decisions in the current volatile market.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav

May 25, 2025 -

Amsterdam Markets React To Trade War 7 Initial Plunge

May 25, 2025

Amsterdam Markets React To Trade War 7 Initial Plunge

May 25, 2025 -

Princess Road Accident Emergency Services Respond To Pedestrian Hit By Vehicle

May 25, 2025

Princess Road Accident Emergency Services Respond To Pedestrian Hit By Vehicle

May 25, 2025 -

Kriza V Nemecku Prehlad Spolocnosti S Hromadnymi Prepustaniami

May 25, 2025

Kriza V Nemecku Prehlad Spolocnosti S Hromadnymi Prepustaniami

May 25, 2025 -

Trump Tariffs And Apple Assessing Buffetts Risk

May 25, 2025

Trump Tariffs And Apple Assessing Buffetts Risk

May 25, 2025

Latest Posts

-

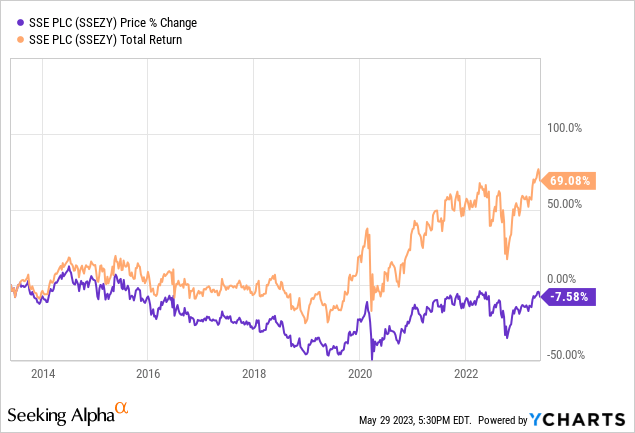

The 3 Billion Question Sses Spending Cuts And What They Mean

May 25, 2025

The 3 Billion Question Sses Spending Cuts And What They Mean

May 25, 2025 -

Rio Tintos Defence Of Its Pilbara Mining Practices

May 25, 2025

Rio Tintos Defence Of Its Pilbara Mining Practices

May 25, 2025 -

Significant Spending Cuts At Sse 3 Billion Reduction Explained

May 25, 2025

Significant Spending Cuts At Sse 3 Billion Reduction Explained

May 25, 2025 -

Rio Tinto Defends Its Pilbara Operations Amidst Environmental Concerns

May 25, 2025

Rio Tinto Defends Its Pilbara Operations Amidst Environmental Concerns

May 25, 2025 -

3 Billion Slash To Sse Spending Analysis And Implications

May 25, 2025

3 Billion Slash To Sse Spending Analysis And Implications

May 25, 2025