Trump's Tariff Decision: 8% Jump In Euronext Amsterdam Stocks

Table of Contents

Understanding the Tariff Decision and its Global Impact

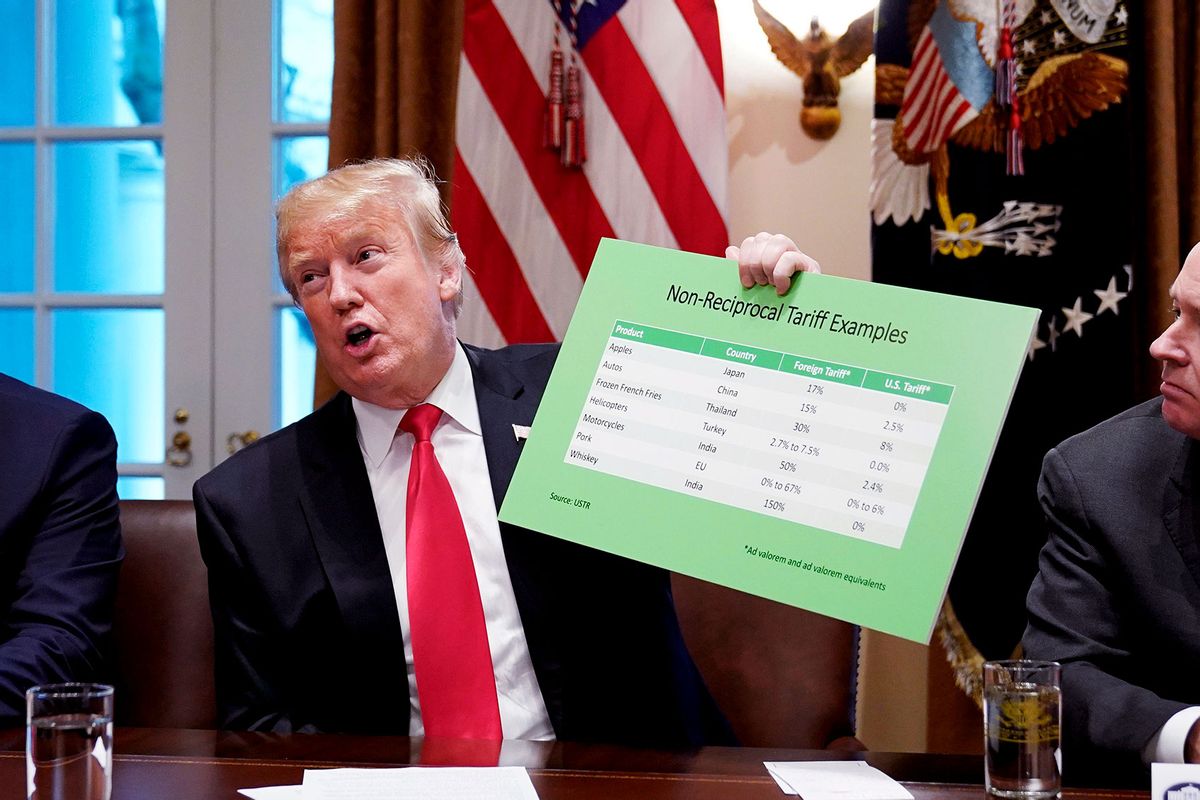

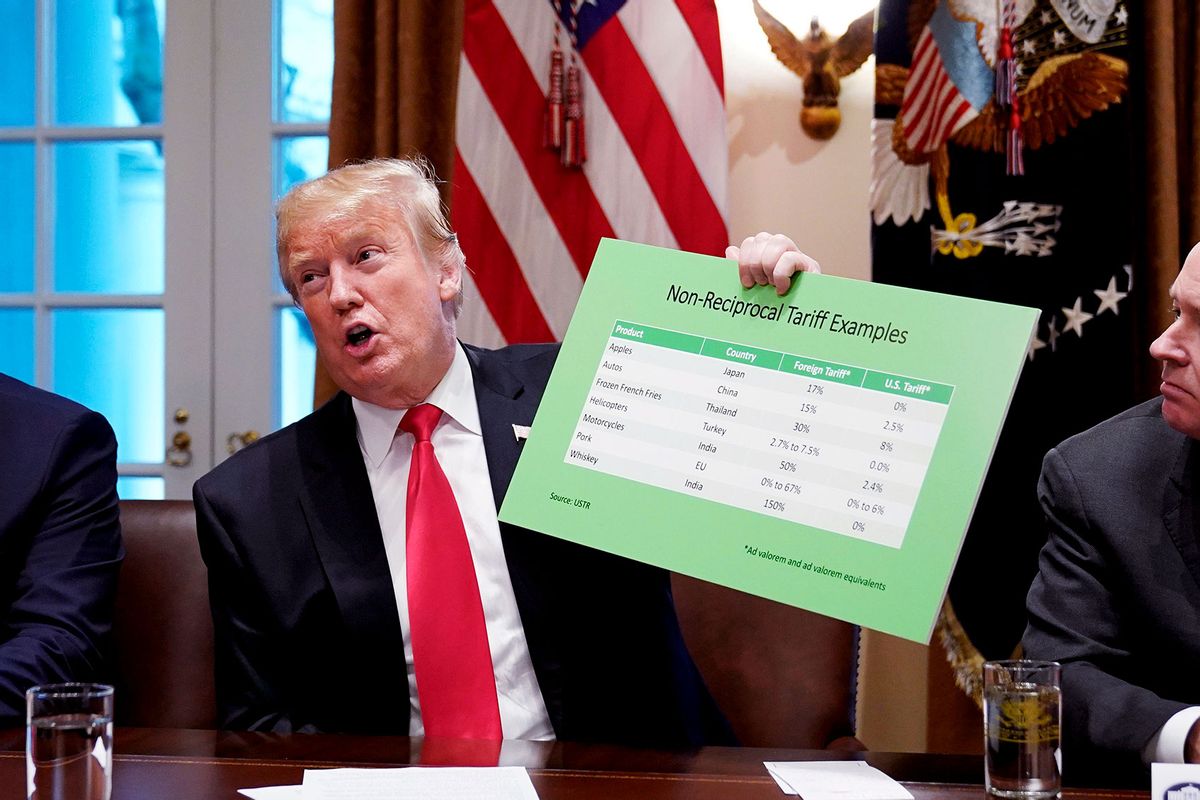

Specifics of Trump's Tariff Announcement

President Trump's announcement detailed the imposition of new tariffs on specific goods imported from various countries. The rationale behind the decision, often cited by the administration, was to protect American industries and jobs from unfair competition.

-

Key aspects of the tariff announcement included:

- Tariffs targeting specific sectors like steel, aluminum, and certain agricultural products.

- Countries significantly affected included [List specific countries impacted, e.g., China, the European Union].

- The stated aim was to level the playing field for American businesses.

-

Potential retaliatory measures: The affected countries swiftly announced retaliatory tariffs on US goods, escalating the trade war and contributing to global market uncertainty. This tit-for-tat exchange further fueled market volatility and impacted investor sentiment.

Initial Market Reactions Across the Globe

The initial reactions in other major stock markets were varied. The New York Stock Exchange saw a modest dip, reflecting concerns about the potential for a protracted trade war. The London Stock Exchange experienced a similar, though less pronounced, decline.

- Comparison of market reactions: While the Euronext Amsterdam saw a surge, other major exchanges exhibited more cautious reactions, reflecting the diverse and nuanced impact of Trump's tariffs on different economies and sectors.

- Market indices data: The Dow Jones Industrial Average fell by [Insert percentage] following the announcement, while the FTSE 100 experienced a [Insert percentage] decrease, illustrating the global impact of the tariff decision and the uncertainty surrounding its long-term consequences.

Euronext Amsterdam's Unexpected Surge: Analysis and Contributing Factors

Sector-Specific Analysis

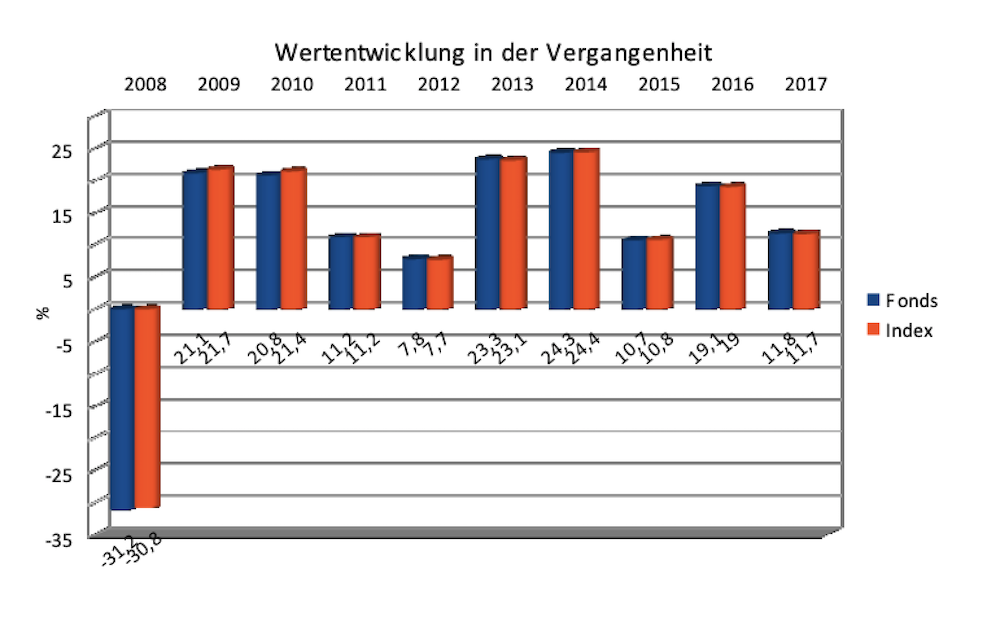

The 8% surge in Euronext Amsterdam was not uniform across all sectors. Certain industries benefited disproportionately from the tariff announcement. Specifically, companies competing directly with US imports in affected sectors saw significant gains.

- Top performing sectors and companies: [List specific sectors and companies with examples, e.g., European steel manufacturers, companies producing alternative materials to those now more expensive due to tariffs].

- Stock price movements: [Include charts or graphs illustrating the sharp increase in stock prices for the identified sectors. Ensure the charts are appropriately labeled and sourced.] This visual representation will reinforce the article's claims and enhance its SEO performance.

Investor Sentiment and Speculation

The 8% surge in Euronext Amsterdam can also be attributed to shifting investor sentiment and speculation. Many investors saw the tariffs as an opportunity, believing that European companies would benefit from reduced competition from the now more expensive US imports. This triggered a wave of buying, further driving up stock prices.

- Analyst comments and predictions: Many analysts initially predicted a short-term impact, but the sustained surge indicates a more complex dynamic at play, potentially reflecting the belief that the long-term effects could benefit European companies.

- Influence of media coverage: The media's portrayal of the tariff decision and its potential consequences undoubtedly played a role in shaping investor perceptions and driving their subsequent actions.

Long-Term Implications and Investment Strategies

Potential Risks and Uncertainties

While the short-term impact on Euronext Amsterdam was positive for some sectors, long-term risks remain. The escalating trade war could disrupt global supply chains, leading to increased production costs and inflation.

- Negative consequences for European businesses: The retaliatory tariffs imposed by other countries could negatively impact European businesses reliant on exports to those markets.

- Potential regulatory responses from the EU: The EU is likely to implement its own countermeasures, adding another layer of uncertainty and potentially further impacting market stability.

Opportunities for Investors

Despite the risks, the market volatility created by Trump's tariff decision also presents investment opportunities. Careful analysis of sectors less affected by the tariffs, or those poised to benefit from the shift in global trade dynamics, can yield potential returns.

- Cautious advice on investment strategies: During times of uncertainty, diversification is crucial. Spread investments across different asset classes and geographic regions to mitigate risk.

- Risk management techniques: Employing stop-loss orders and other risk management strategies is essential to protect investments against potential market downturns.

Conclusion

Trump's tariff decision has had a profound and multifaceted impact on global markets. The 8% jump in Euronext Amsterdam stocks, while initially positive for certain sectors, highlights the unpredictable nature of trade policy and its ripple effects on international investment. The reasons behind this surge are complex, involving sector-specific advantages, investor speculation, and the broader context of the escalating trade war. Understanding these dynamics is critical for navigating the long-term implications.

Call to Action: Stay informed about the evolving situation surrounding Trump's tariffs and their impact on Euronext Amsterdam and other global markets. Monitor market trends closely and consider adjusting your investment strategy accordingly based on your risk tolerance. Continue researching the effects of Trump's tariff decisions to make informed financial decisions and navigate this period of market volatility effectively.

Featured Posts

-

M6 Traffic Delays Latest Updates On Crash Impact

May 24, 2025

M6 Traffic Delays Latest Updates On Crash Impact

May 24, 2025 -

Breaking Pedestrian Struck By Car On Princess Road Live Updates From The Scene

May 24, 2025

Breaking Pedestrian Struck By Car On Princess Road Live Updates From The Scene

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Explained

May 24, 2025 -

Vozrastnye Kharakteristiki Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025

Vozrastnye Kharakteristiki Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Latest Posts

-

The Thames Water Executive Bonus Issue Public Outrage And Corporate Accountability

May 24, 2025

The Thames Water Executive Bonus Issue Public Outrage And Corporate Accountability

May 24, 2025 -

Scrutinizing Thames Water Executive Bonuses Under The Microscope

May 24, 2025

Scrutinizing Thames Water Executive Bonuses Under The Microscope

May 24, 2025 -

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025 -

Environmental Concerns In The Pilbara A Response From Rio Tinto

May 24, 2025

Environmental Concerns In The Pilbara A Response From Rio Tinto

May 24, 2025 -

How Sses 3 Billion Spending Cut Will Affect Energy Consumers

May 24, 2025

How Sses 3 Billion Spending Cut Will Affect Energy Consumers

May 24, 2025