Trump's Tax Bill: Republican Opposition And Potential Roadblocks

Table of Contents

Internal Divisions Within the Republican Party

The passage of Trump's tax bill wasn't a smooth affair; it faced considerable resistance from within the Republican Party itself. Deep-seated ideological differences and concerns about the bill's potential consequences created significant friction.

Fiscal Conservatives' Concerns

Fiscal conservatives within the Republican Party expressed serious reservations about the long-term fiscal implications of the tax cuts. Their main concerns centered on:

- Massive tax cuts for corporations: Critics argued that these cuts disproportionately benefited large corporations at the expense of the national debt.

- Insufficient spending cuts: The lack of corresponding spending cuts to offset the revenue loss from the tax cuts fueled concerns about a ballooning national debt.

- Increased national debt: Projections suggested a significant increase in the national debt over the coming decade due to the tax cuts.

Prominent Republican fiscal conservatives voiced their opposition. For instance, [Insert quote from a prominent fiscal conservative criticizing the bill's fiscal impact]. These concerns were backed by analyses projecting a potential increase in the national debt by [Insert projected increase in national debt – cite source].

Moderate Republicans' Reservations

Moderate Republicans also expressed reservations, focusing on the bill's potential impact on social programs and the middle class. Their key concerns included:

- Elimination of certain deductions: The elimination of specific tax deductions disproportionately affected middle-class families, leading to tax increases for some.

- Tax increases for some families: While the bill aimed to reduce taxes for many, some middle- and lower-income families faced tax increases due to changes in deductions and credits.

- Impact on social programs: Concerns arose about the potential for future cuts to social programs to offset the revenue losses from the tax cuts.

Moderate Republicans like [Insert name of a moderate Republican] voiced their concerns, stating [Insert quote expressing reservations about the bill's impact on the middle class – cite source]. Data showed that [Insert data on the potential impact on different income groups – cite source], highlighting the uneven distribution of tax benefits.

The Role of Lobbying and Special Interests

The influence of lobbying groups and special interests played a significant role in shaping the bill and further fueling Republican dissent.

- Pharmaceutical lobby: The pharmaceutical industry heavily lobbied for specific provisions benefiting them.

- Real estate lobby: The real estate industry also exerted significant influence on certain aspects of the bill.

- Corporate lobbyists: Numerous corporate lobbyists worked to shape the bill to their advantage, contributing to internal Republican disagreements.

The lobbying efforts surrounding Trump's tax bill resulted in [Insert examples of lobbying efforts influencing specific provisions – cite sources]. Analysis of lobbying spending revealed that [Insert data on lobbying spending related to the tax bill – cite source], showcasing the considerable influence of special interests.

Procedural Hurdles and Senate Filibusters

The legislative process itself posed significant obstacles to the passage of Trump's tax bill. The Senate, in particular, presented a formidable challenge.

The Senate's Role in Shaping the Legislation

The Senate's unique legislative procedures, particularly the 60-vote threshold to overcome a filibuster, presented a major hurdle.

- 60-vote threshold: The need for 60 votes to overcome a filibuster meant that the bill required bipartisan support or a unified Republican caucus to pass.

- Potential for filibusters: The controversial nature of the bill made it a prime target for filibusters, potentially stalling or even killing the legislation.

- Legislative process: The complex legislative process, involving committees, amendments, and floor debates, further complicated the bill's passage.

[Insert examples of past successful and unsuccessful filibusters on tax legislation – cite sources]. Data on successful and failed filibusters demonstrate the significant impact of Senate procedures on the fate of legislation [Insert data on successful and failed filibusters – cite source].

Reconciliation Process and its Limitations

The Republican leadership used the budget reconciliation process to bypass the Senate filibuster. However, this process had limitations:

- Strict rules: The reconciliation process imposed strict rules on the types of provisions that could be included in the bill.

- Limited amendments: The process limited the ability to amend the bill significantly, restricting opportunities for compromise.

- Time constraints: The tight timeline associated with reconciliation put pressure on the legislative process.

Using reconciliation meant that [Insert instances where the reconciliation process limited changes to the bill – cite source]. Data on the use of reconciliation in previous tax legislation shows [Insert data on the use of reconciliation in previous tax legislation – cite source], highlighting both its effectiveness and limitations.

Public Opinion and Political Fallout

Public opinion and the potential electoral consequences played a crucial role in shaping the debate surrounding Trump's tax bill.

Public Reaction to the Proposed Tax Cuts

Public reaction to the proposed tax cuts was divided, with varying levels of support across different demographics.

- Polling data: Polling data revealed a mixed public response, with [Insert polling data showcasing public opinion on the tax cuts – cite source].

- News articles and editorials: News articles and editorials reflected the diverse opinions and concerns surrounding the bill.

- Approval/disapproval ratings: Approval/disapproval ratings for the bill fluctuated throughout the legislative process. [Insert data on approval/disapproval ratings related to the bill – cite source].

Potential Electoral Consequences

The tax bill had the potential to significantly impact the upcoming elections and the Republican Party's standing.

- Voter segments: The bill had the potential to galvanize some voter segments while alienating others, depending on its perceived impact on their economic well-being.

- Analysts' predictions: Analysts offered varying predictions regarding the electoral consequences of the bill, emphasizing the uncertainties involved.

- Voter preferences: Data on voter preferences showed [Insert data on voter preferences and their relation to the tax bill – cite source], indicating the potential for significant political consequences.

Conclusion: Understanding the Challenges Facing Trump's Tax Bill

Trump's tax bill faced numerous challenges, including deep internal divisions within the Republican Party, significant procedural hurdles in the Senate, and a mixed public reaction. Fiscal conservatives worried about the increased national debt, while moderate Republicans expressed concerns about the bill's impact on the middle class and social programs. The Senate's legislative procedures and the limitations of the reconciliation process further complicated the bill's passage. Public opinion remained divided, with potential electoral consequences for the Republican Party. The long-term implications of Trump's tax bill continue to be debated, with ongoing discussions about its effect on economic inequality, the national debt, and the overall health of the American economy. Understanding these multifaceted challenges is crucial to analyzing the long-term effects of this landmark legislation. To further explore this complex topic, we encourage you to research additional sources and form your own informed opinion on Trump's Tax Bill and its enduring legacy.

Featured Posts

-

Ryan Reynolds And Wrexham Afc A Historic Promotion Party

Apr 29, 2025

Ryan Reynolds And Wrexham Afc A Historic Promotion Party

Apr 29, 2025 -

Luxury Carmakers Face Headwinds In China Case Studies Of Bmw And Porsche

Apr 29, 2025

Luxury Carmakers Face Headwinds In China Case Studies Of Bmw And Porsche

Apr 29, 2025 -

Fox News Faces Defamation Lawsuit From Jan 6th Figure Ray Epps

Apr 29, 2025

Fox News Faces Defamation Lawsuit From Jan 6th Figure Ray Epps

Apr 29, 2025 -

Is The One Plus 13 R Worth It Comparing It To The Google Pixel 9a

Apr 29, 2025

Is The One Plus 13 R Worth It Comparing It To The Google Pixel 9a

Apr 29, 2025 -

Activision Blizzard Acquisition Ftcs Appeal Could Block Microsoft Deal

Apr 29, 2025

Activision Blizzard Acquisition Ftcs Appeal Could Block Microsoft Deal

Apr 29, 2025

Latest Posts

-

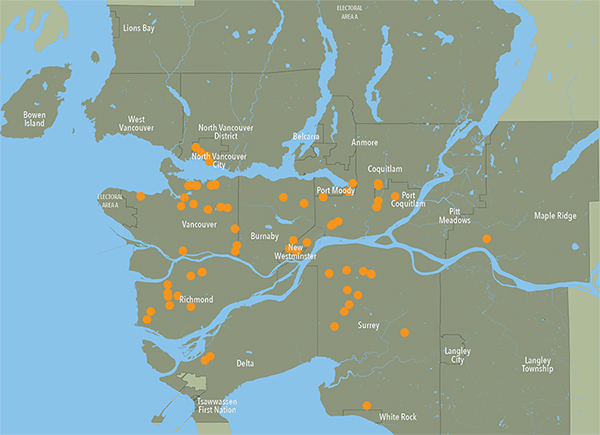

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025 -

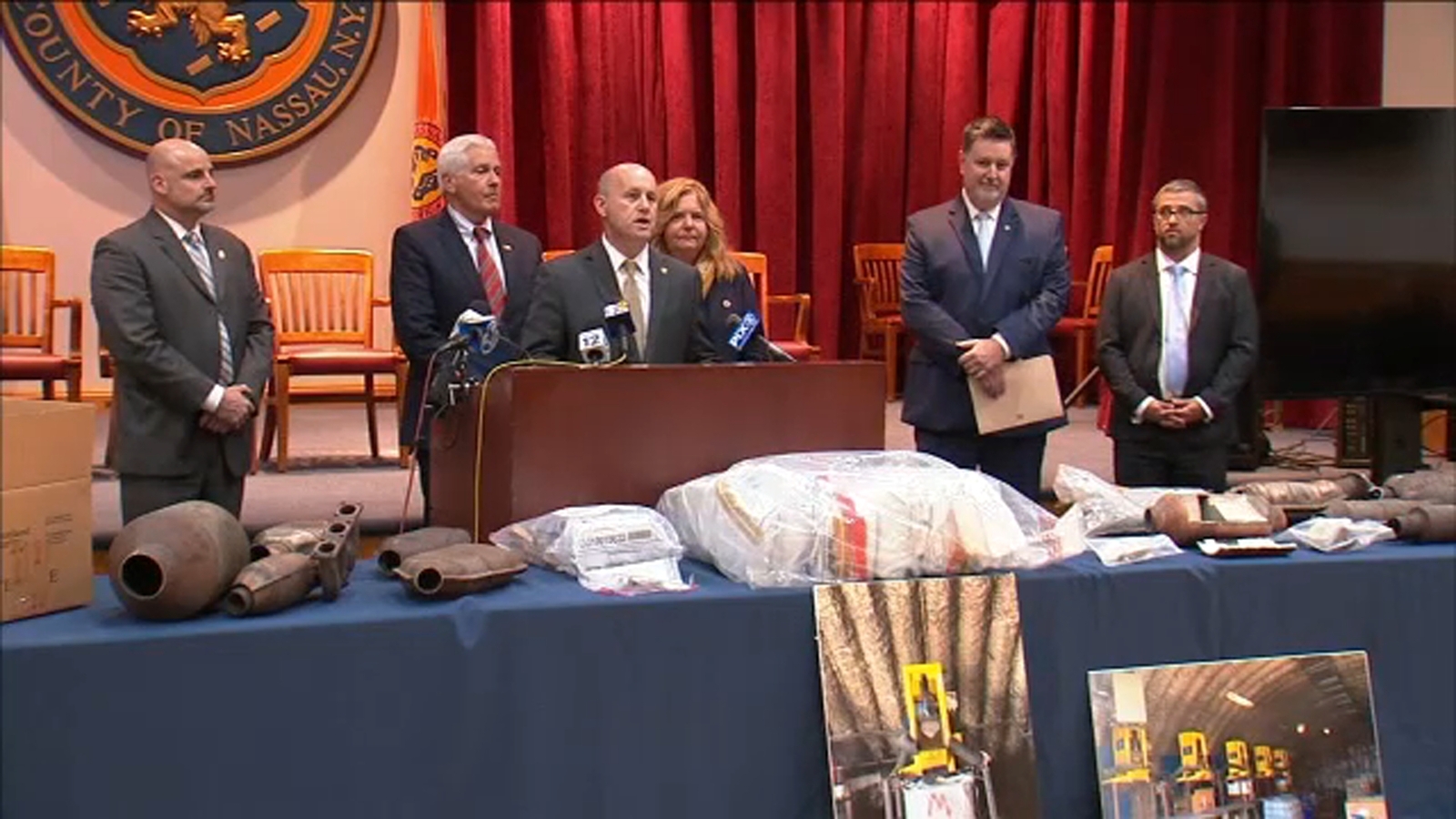

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 29, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 29, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Authorities Say

Apr 29, 2025

Office365 Executive Inboxes Targeted Millions Stolen Authorities Say

Apr 29, 2025 -

Navigating The Difficulties Of All American Production

Apr 29, 2025

Navigating The Difficulties Of All American Production

Apr 29, 2025 -

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025