Trump's Trade War: Wall Street Bets On A Brighter Future

Table of Contents

The Lingering Impact of Tariffs

The initial impact of Trump's trade war was undeniably disruptive. Across various sectors, the effects were keenly felt. The agricultural industry, for example, faced significant challenges due to retaliatory tariffs imposed by key trading partners, leading to reduced exports and financial hardship for many farmers. Similarly, the manufacturing sector experienced increased costs and reduced competitiveness in global markets.

- Increased prices for consumers: Tariffs directly increased the cost of imported goods, leading to higher prices for consumers and impacting purchasing power.

- Supply chain disruptions: The imposition of tariffs forced businesses to re-evaluate their supply chains, leading to delays, increased costs, and in some cases, a complete restructuring of their sourcing strategies.

- Retaliatory tariffs from other countries: The US's imposition of tariffs provoked retaliatory measures from countries like China and the EU, creating a cycle of escalating trade tensions.

- Short-term economic slowdown in affected industries: The uncertainty and increased costs stemming from the trade war contributed to a short-term economic slowdown in several key sectors.

However, the long-term picture reveals a significant shift. Businesses responded to the challenges by diversifying their supply chains, exploring alternative sourcing options, and investing in automation and technology to improve efficiency and reduce reliance on imported goods. This adaptation, while costly and disruptive in the short term, has laid the groundwork for greater resilience in the face of future global economic uncertainties.

Reshoring and the Rise of Domestic Manufacturing

One of the most significant outcomes of Trump's trade war has been the accelerated trend of reshoring – the relocation of manufacturing and production back to the United States. The increased costs and uncertainties associated with global supply chains incentivized companies to reconsider their offshoring strategies.

- Reduced reliance on foreign suppliers: Companies began to prioritize domestic sourcing to mitigate the risks associated with tariffs and geopolitical instability.

- Increased job creation in the US manufacturing sector: Reshoring efforts led to a resurgence of manufacturing jobs in the US, boosting employment and economic activity in many communities.

- Government incentives and support for domestic production: Government policies, including tax breaks and subsidies, further encouraged reshoring initiatives, accelerating the trend.

- Improved national security by reducing dependence on foreign sources: The trade war highlighted the vulnerability of relying heavily on foreign suppliers for critical goods and materials, leading to a renewed focus on bolstering domestic production for national security reasons.

While reshoring presents significant opportunities, challenges remain. These include higher labor costs in the US compared to some overseas locations and the need for significant investments in infrastructure and technology to support increased domestic production. However, the long-term benefits of a more resilient and domestically focused manufacturing sector are widely recognized.

Investment Opportunities Created by Trade War Uncertainty

The volatility and uncertainty surrounding Trump's trade war presented unique investment opportunities for shrewd investors. The market adjustments created pockets of value and growth in unexpected places.

- Opportunities in sectors benefiting from reshoring: Companies involved in domestic manufacturing, logistics, and supply chain management experienced significant growth as businesses shifted production back to the US.

- Strategic acquisitions of struggling businesses: The trade war created opportunities to acquire struggling companies at discounted prices, allowing investors to restructure and revitalize businesses impacted by tariffs.

- Increased demand for certain commodities: The disruption in global supply chains led to increased demand for certain commodities, creating lucrative investment opportunities in these areas.

- Growth in alternative supply chains: The need to diversify supply chains fueled the growth of new logistics companies and alternative sourcing strategies, creating investment opportunities in these emerging sectors.

However, investing in a post-trade-war environment requires careful consideration of the risks. Geopolitical uncertainty, fluctuating commodity prices, and the ongoing evolution of global trade relations all contribute to a dynamic and unpredictable market.

The Role of Government Policy in Shaping the Future

Government policy plays a crucial role in shaping the long-term economic consequences of Trump's trade war and influencing future trade relations.

- New trade agreements: Post-trade war, governments have sought to renegotiate existing trade agreements and forge new ones to create more stable and predictable trade relationships.

- Focus on strengthening domestic industries: Many governments are prioritizing policies aimed at supporting domestic industries, boosting competitiveness, and reducing reliance on foreign suppliers.

- Regulation and oversight of global supply chains: Governments are increasingly focused on regulating and overseeing global supply chains to ensure transparency, ethical practices, and resilience against future disruptions.

- Investment in infrastructure and technology: Investments in infrastructure and technology are crucial for supporting the growth of domestic manufacturing and facilitating a smooth transition to more resilient supply chains.

The long-term effects of these policies will significantly shape the global economic landscape, influencing investment decisions and shaping future trade dynamics.

Conclusion

While Trump's trade war caused significant short-term disruptions, including increased prices, supply chain disruptions, and economic slowdowns in specific sectors, it also spurred adjustments and created opportunities. The resulting reshoring trend, coupled with strategic investments and government policies aimed at strengthening domestic industries, is contributing to a more resilient and potentially prosperous future for certain sectors. The long-term effects are still unfolding, but the overall trend suggests a shift towards greater domestic production and a more strategically diversified global economy.

Understanding the lingering effects of Trump's Trade War and its impact on investment strategies is crucial for navigating the complexities of the current global market. Stay informed about the latest developments and consider how these shifts might impact your investments and business decisions. Learn more about the lasting legacy of trade wars and how to capitalize on emerging opportunities.

Featured Posts

-

Hate Crime Investigation Five Teenagers Arrested For Assaulting 16 Year Old

May 29, 2025

Hate Crime Investigation Five Teenagers Arrested For Assaulting 16 Year Old

May 29, 2025 -

Cuaca Jawa Tengah 23 April 2024 Peringatan Hujan Dan Angin Kencang

May 29, 2025

Cuaca Jawa Tengah 23 April 2024 Peringatan Hujan Dan Angin Kencang

May 29, 2025 -

Istanbul Peace Talks Lulas Push For Putin Zelenskyy Meeting

May 29, 2025

Istanbul Peace Talks Lulas Push For Putin Zelenskyy Meeting

May 29, 2025 -

Sinners The Louisiana Filmed Horror Movie You Wont Want To Miss

May 29, 2025

Sinners The Louisiana Filmed Horror Movie You Wont Want To Miss

May 29, 2025 -

Stranger Things 5 Release Date Speculation Cast Updates And Potential Storylines

May 29, 2025

Stranger Things 5 Release Date Speculation Cast Updates And Potential Storylines

May 29, 2025

Latest Posts

-

Russell Brand Not Guilty Plea On Rape And Sexual Assault Charges

May 31, 2025

Russell Brand Not Guilty Plea On Rape And Sexual Assault Charges

May 31, 2025 -

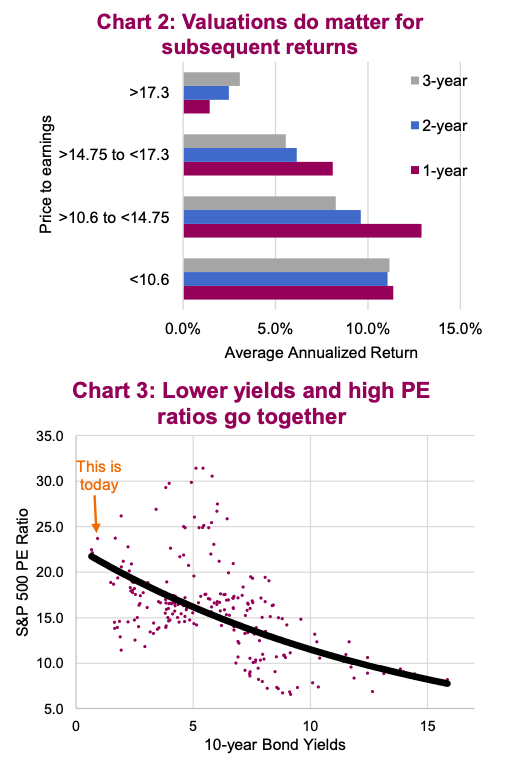

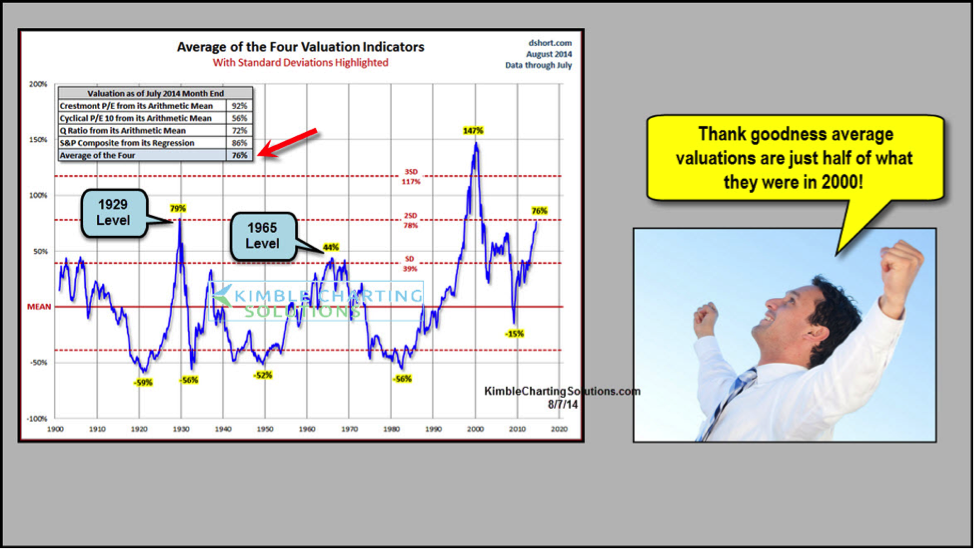

Why Investors Should Remain Calm Despite High Stock Market Valuations Bof A

May 31, 2025

Why Investors Should Remain Calm Despite High Stock Market Valuations Bof A

May 31, 2025 -

Understanding Stock Market Valuations Bof As Case For Investor Confidence

May 31, 2025

Understanding Stock Market Valuations Bof As Case For Investor Confidence

May 31, 2025 -

Spain Blackout Investigation Iberdrola Highlights Grid Issues

May 31, 2025

Spain Blackout Investigation Iberdrola Highlights Grid Issues

May 31, 2025 -

Blackout In Spain The Iberdrola Grid Blame Game Intensifies

May 31, 2025

Blackout In Spain The Iberdrola Grid Blame Game Intensifies

May 31, 2025