UBS Alters India And Hong Kong Economic Predictions

Table of Contents

Revised Growth Projections for India

Downgraded GDP Growth for India

UBS has downgraded its GDP growth prediction for India. While the previous forecast projected robust growth, the new prediction reflects a more cautious outlook. This downward revision is primarily attributed to a confluence of factors, including the global economic slowdown, persistent inflationary pressures, and adjustments in India's monetary policy.

- Weakening Exports: Global demand contraction has impacted India's export-oriented sectors, leading to slower growth.

- Inflationary Pressures: High inflation continues to erode consumer purchasing power and stifle investment. The Reserve Bank of India's (RBI) efforts to curb inflation through interest rate hikes have also impacted economic activity.

- Monetary Policy Changes: The RBI's tighter monetary policy, while aiming to control inflation, has inadvertently dampened investment and overall economic growth.

UBS's report cites a specific drop in projected GDP growth for India – for example, a revised forecast of X% compared to the previous prediction of Y%. These figures, coupled with detailed analysis from the UBS report, solidify the reasoning behind the downgrade. Keywords like India GDP, Indian economy, economic slowdown India, UBS India forecast, and GDP growth rate India highlight the specific focus of this section.

Impact on Key Sectors in India

The revised forecast significantly impacts various sectors within the Indian economy. The technology sector, a key driver of growth, is expected to experience a slowdown in investment and hiring. The agricultural sector, while generally more resilient, might feel the pinch due to reduced rural demand. Manufacturing may also face headwinds due to weakened global demand and higher input costs.

- Technology: Reduced venture capital funding and a potential hiring freeze in some tech companies.

- Agriculture: Lower agricultural output due to climate change and reduced rural spending.

- Manufacturing: Decreased production due to higher interest rates and weaker export demand.

The overall impact could lead to increased unemployment and a potential rise in social unrest. The keywords Indian economy sectors, Indian economic growth sectors, and Indian job market help contextualize these impacts within the broader Indian economic landscape.

Altered Outlook for Hong Kong's Economy

Revised GDP Growth Prediction for Hong Kong

UBS has also revised its GDP growth prediction for Hong Kong, offering a less optimistic outlook than previously anticipated. This alteration stems from several factors, including the ongoing geopolitical complexities, the performance of China's economy (a major trading partner), and the impact of global interest rate hikes.

- Geopolitical Factors: The impact of ongoing global uncertainties and regional tensions on Hong Kong’s economy.

- China's Economic Performance: The slowdown in China's economy directly affects Hong Kong's trade and tourism sectors.

- Interest Rate Hikes: Increased interest rates globally impact Hong Kong's financial markets and investment flows.

The revised forecast shows a lower projected GDP growth for Hong Kong – for instance, a revised estimate of Z% compared to the earlier prediction of W%. These figures, backed by data and analysis from the UBS report, emphasize the significance of the change. Keywords such as Hong Kong GDP, Hong Kong economy, economic outlook Hong Kong, UBS Hong Kong forecast, and GDP growth rate Hong Kong specifically target relevant searches.

Challenges and Opportunities for Hong Kong's Economy

Hong Kong's economy faces significant challenges, including the lingering effects of the pandemic, competition from other Asian financial centers, and the need to diversify its economic base. However, the revised forecast also presents opportunities for strategic adaptation and growth in specific sectors.

- Challenges: Maintaining competitiveness, attracting investment, managing inflation, and navigating geopolitical complexities.

- Opportunities: Developing new technologies, strengthening its position as a regional hub for innovation, and fostering sustainable growth.

The keywords Hong Kong economic challenges and Hong Kong economic opportunities highlight the dual nature of this section.

Comparison and Contrast of India and Hong Kong Forecasts

While both India and Hong Kong have experienced downward revisions in their growth predictions from UBS, the underlying reasons differ significantly. India's revision is primarily driven by domestic factors like inflation and monetary policy, while Hong Kong's is more heavily influenced by external factors like geopolitical uncertainties and China's economic performance. The interconnectedness between the two economies is undeniable, with China's economic slowdown impacting both nations.

- Similarities: Both economies experienced downgrades; both face global economic headwinds.

- Differences: The primary drivers of the revisions differ; India's challenges are more internally focused, whereas Hong Kong's are more externally driven.

The keyword phrase India-Hong Kong economic comparison and India-Hong Kong economic relations are crucial for capturing searches focused on the comparative analysis of both economies.

Conclusion: Understanding the UBS Revised Economic Predictions for India and Hong Kong

UBS's revised economic predictions for India and Hong Kong highlight the complexities of the global economic landscape. While both nations face challenges, the underlying reasons for the downward revisions differ considerably. India's forecast is primarily impacted by domestic inflationary pressures and monetary policy adjustments, while Hong Kong's is more heavily influenced by external factors like geopolitical instability and China's economic performance. These revised predictions carry significant implications for investors and businesses operating in these crucial markets. To gain a deeper understanding of the detailed analysis and underlying data supporting these revised forecasts, we encourage you to read the full UBS report. Further research into related economic indicators such as inflation rates, interest rates, and trade balances will provide a more comprehensive understanding of the India and Hong Kong economic predictions and their implications.

Featured Posts

-

Jack O Connell On Michael Caine The Daunted Spitting Experience

Apr 25, 2025

Jack O Connell On Michael Caine The Daunted Spitting Experience

Apr 25, 2025 -

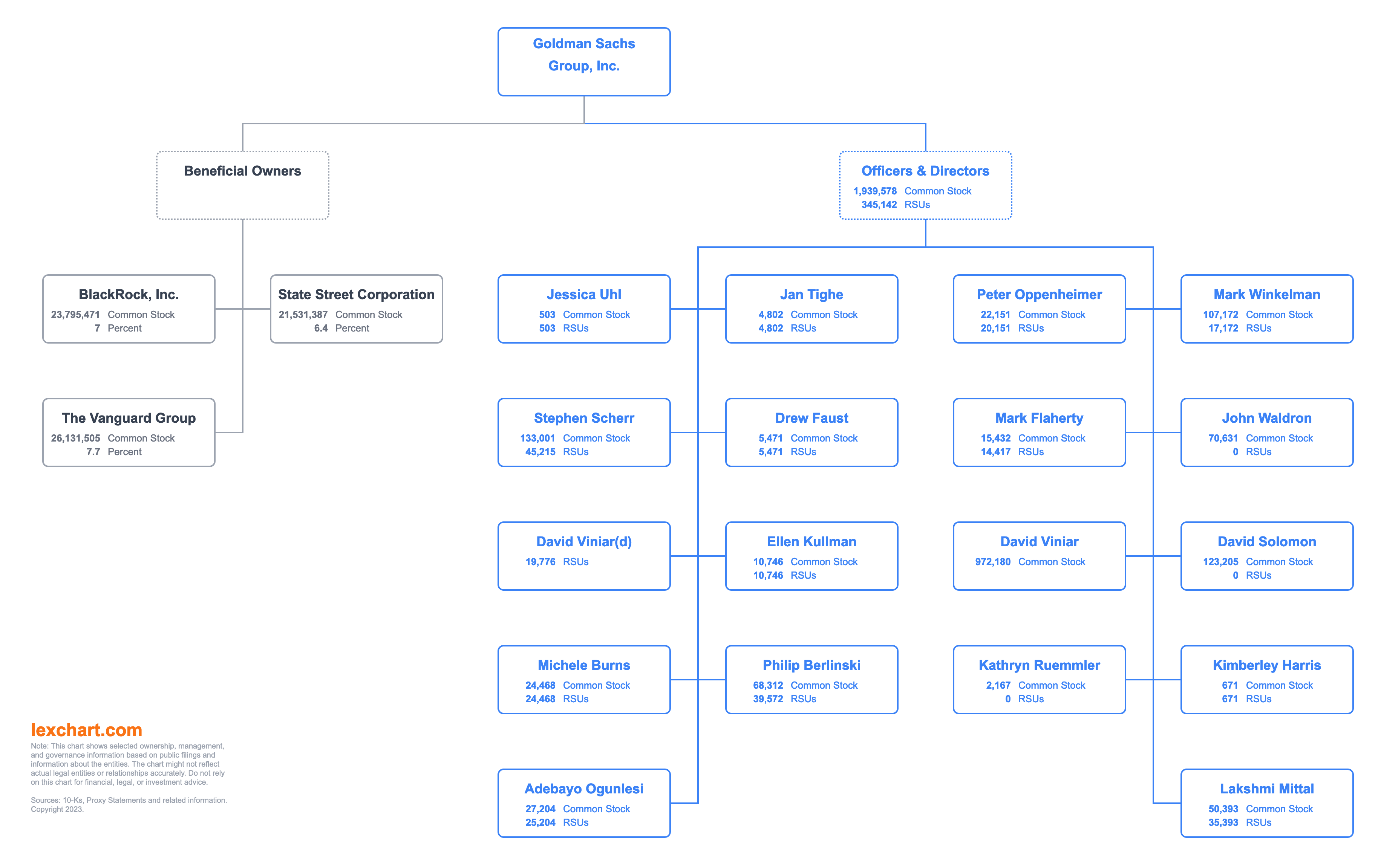

Goldman Sachs Coalitions Fiscal Policy Looser Than Labor S

Apr 25, 2025

Goldman Sachs Coalitions Fiscal Policy Looser Than Labor S

Apr 25, 2025 -

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 25, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 25, 2025 -

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

Apr 25, 2025

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

Apr 25, 2025 -

Crude Oil Market Update Key Developments On April 24th

Apr 25, 2025

Crude Oil Market Update Key Developments On April 24th

Apr 25, 2025

Latest Posts

-

Nhung Buc Anh Voi La Mat Trong Bua Tiec Buffet

Apr 25, 2025

Nhung Buc Anh Voi La Mat Trong Bua Tiec Buffet

Apr 25, 2025 -

Is Makeup Harmful To Your Skin A Dermatologists Perspective

Apr 25, 2025

Is Makeup Harmful To Your Skin A Dermatologists Perspective

Apr 25, 2025 -

Hinh Anh Voi An Tiec Buffet Trang Diem An Tuong

Apr 25, 2025

Hinh Anh Voi An Tiec Buffet Trang Diem An Tuong

Apr 25, 2025 -

Is Makeup Bad For Your Skin The Truth About Cosmetics And Skincare

Apr 25, 2025

Is Makeup Bad For Your Skin The Truth About Cosmetics And Skincare

Apr 25, 2025 -

Voi Trang Diem Du Tiec Buffet Hinh Anh Doc Dao

Apr 25, 2025

Voi Trang Diem Du Tiec Buffet Hinh Anh Doc Dao

Apr 25, 2025