Understanding The Next Key Price Levels For Apple Stock (AAPL)

Table of Contents

Analyzing Apple's Recent Financial Performance and Future Projections

Apple's financial health is a primary driver of its stock price. Analyzing its recent performance and future projections provides valuable insights into potential AAPL stock price movements.

Revenue Growth and Profitability

Apple's recent quarterly earnings reports reveal a mixed bag. While revenue growth has been strong in certain sectors, challenges remain in others. Let's examine the key metrics:

- Q[Insert Quarter] 2024: Revenue of [Insert Revenue Figure], representing a [Insert Percentage]% increase/decrease compared to the same quarter last year. Net income reached [Insert Net Income Figure], and EPS stood at [Insert EPS Figure].

- Key Growth Drivers: The iPhone continues to be a significant revenue generator, while the Services segment showcases impressive growth potential fueled by subscriptions like Apple Music, iCloud, and the App Store. The Mac segment has also shown resilience, although growth may be more moderate compared to Services.

- Potential Risks: Increased competition in the smartphone market, particularly from Android manufacturers, and economic headwinds influencing consumer spending present potential challenges to future revenue growth. Supply chain disruptions also remain a lingering concern.

Product Innovation and Market Competition

Apple's innovation pipeline is crucial for sustained growth. Upcoming product releases and the competitive landscape play a significant role in shaping the AAPL stock price prediction.

- Upcoming Products: The anticipated release of [Mention Specific Products, e.g., new iPhone models, Apple Watch Series, etc.] is expected to boost sales and potentially drive the AAPL stock price higher. New features and technological advancements in these products will be key factors.

- Competitive Threats: Samsung remains a major competitor in the smartphone market, constantly vying for market share. Google's Android ecosystem continues to evolve, posing a long-term challenge. The increasing competition in the wearables market also demands attention.

Assessing Market Sentiment and Investor Expectations

Understanding market sentiment and investor expectations is crucial for predicting AAPL stock price movement.

Analyst Ratings and Price Targets

Financial analysts provide valuable insights into the future trajectory of AAPL stock. Analyzing their ratings and price targets gives a clearer picture of market sentiment.

- Analyst Consensus: A recent survey of analysts reveals a consensus "Buy" rating for AAPL stock. Many analysts have raised their price targets recently.

- Price Target Range: Price targets currently range from [Insert Lower Price Target] to [Insert Higher Price Target], reflecting a range of opinions regarding the future potential of Apple stock (AAPL). A significant increase in the number of upgrades could indicate a bullish trend.

- Key Analysts: [List a few key analysts and their price targets. Example: Goldman Sachs – $200, Morgan Stanley – $190, etc.]

Macroeconomic Factors and Market Volatility

Broader economic conditions significantly influence investor behavior and market trends, impacting even established companies like Apple.

- Interest Rates and Inflation: Rising interest rates can impact consumer spending and potentially affect Apple's sales, impacting the AAPL stock price. High inflation may also reduce consumer purchasing power.

- Recessionary Fears: Concerns about a potential recession can lead to increased market volatility, impacting investor confidence and potentially causing a sell-off in technology stocks, including AAPL.

- Investor Risk Appetite: A risk-off sentiment in the market, often seen during periods of economic uncertainty, can drive investors to move away from growth stocks like Apple, leading to temporary price declines.

Technical Analysis: Identifying Key Support and Resistance Levels

Technical analysis provides another lens through which to analyze potential AAPL stock price movements.

Chart Patterns and Indicators

Utilizing technical indicators and identifying chart patterns can pinpoint key support and resistance levels.

- Moving Averages: The 50-day and 200-day moving averages can act as significant support or resistance levels. A break above the 200-day moving average could signal a bullish trend.

- RSI (Relative Strength Index): The RSI can indicate overbought or oversold conditions. Readings above 70 suggest an overbought market, while readings below 30 suggest an oversold market.

- MACD (Moving Average Convergence Divergence): The MACD can help identify potential trend changes. A bullish crossover (MACD line crossing above the signal line) could be a buy signal.

- Chart Patterns: Identifying chart patterns like head and shoulders, double tops/bottoms, and triangles can provide insights into potential price reversals or continuations. (Include a chart if possible)

Potential Price Targets Based on Technical Analysis

Based on the technical analysis, potential price targets for AAPL stock can be suggested:

- Short-Term Target (3-6 months): [Insert Price Target] – This target is based on the confluence of support levels, bullish indicators, and expected near-term product launches.

- Long-Term Target (12-18 months): [Insert Price Target] – This target is based on a more bullish outlook, considering sustained revenue growth and continued product innovation.

Conclusion: Key Takeaways and Call to Action

This analysis indicates that Apple Stock (AAPL) presents a complex investment landscape. While strong fundamentals underpin Apple's growth potential, macroeconomic factors and market sentiment will inevitably influence price fluctuations. The potential price targets identified are based on several factors, including the company's financial performance, analyst expectations, and technical indicators. Remember that these are potential targets, and actual performance may vary. It’s crucial to conduct your own thorough research before making any investment decisions. Continue monitoring the Apple Stock (AAPL) price levels, paying close attention to news and developments affecting the company and the broader market. Consult reputable financial resources and advisors for in-depth analysis to inform your investment strategy while keeping an eye on the next key price levels for AAPL.

Featured Posts

-

2026 Porsche Cayenne Ev Spy Photos Reveal Early Design Details

May 24, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal Early Design Details

May 24, 2025 -

Net Asset Value Nav Of The Amundi Djia Ucits Etf What You Need To Know

May 24, 2025

Net Asset Value Nav Of The Amundi Djia Ucits Etf What You Need To Know

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

Planning Your Country Escape Top Tips For A Smooth Transition

May 24, 2025

Planning Your Country Escape Top Tips For A Smooth Transition

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

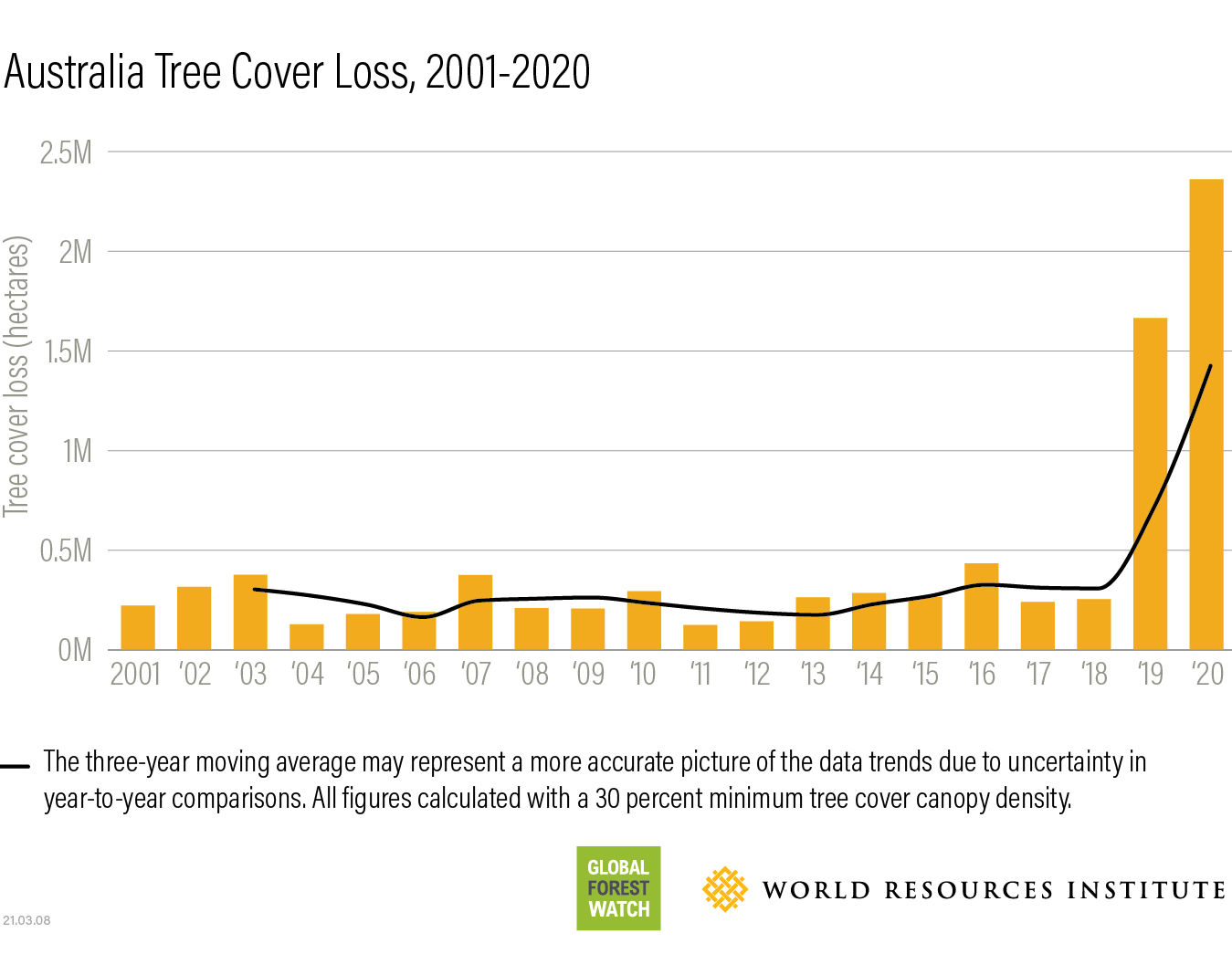

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025 -

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025