Why Elevated Stock Market Valuations Shouldn't Deter Investors: BofA

Table of Contents

The Limitations of Traditional Valuation Metrics in a Low-Interest-Rate Environment

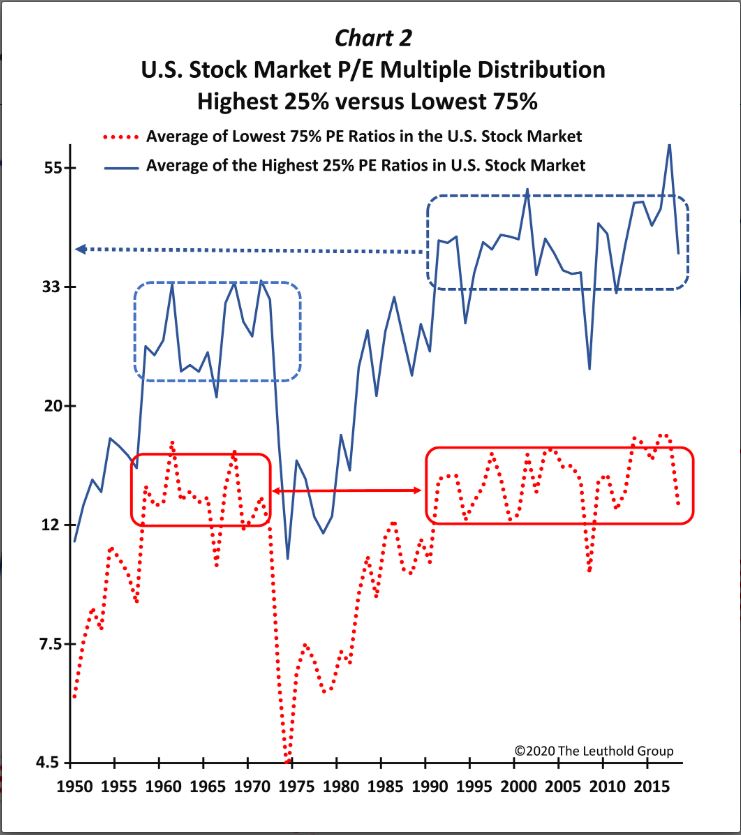

Traditional valuation metrics, like the Price-to-Earnings (P/E) ratio, are often used to assess whether a stock or the overall market is overvalued. However, these metrics can be misleading in a low-interest-rate environment like the one we've experienced in recent years. The low-interest-rate landscape fundamentally alters how we should interpret these standard valuation tools.

- Low interest rates reduce the discount rate used in valuation models. Lower discount rates mean future cash flows are valued more highly in the present, leading to higher valuations across the board. This isn't necessarily a sign of overvaluation, but rather a reflection of the prevailing monetary policy.

- Traditional metrics may not accurately reflect the long-term growth potential of companies. Focusing solely on historical earnings and current P/E ratios can obscure the potential for future growth driven by innovation and technological advancements.

- The focus should shift from absolute valuation levels to relative valuations within sectors. Instead of fixating on whether the overall market is "overvalued," investors should compare valuations within specific sectors, identifying undervalued opportunities within a potentially high-valuation overall market. This requires a more granular and sector-specific approach to investment analysis. For example, while technology stocks might appear overvalued based on historical P/E ratios, comparing them to other high-growth sectors can reveal relative value.

The Power of Long-Term Growth and Technological Innovation

Technological innovation is a powerful engine driving corporate earnings growth and justifying higher valuations. Companies leveraging breakthroughs in artificial intelligence, renewable energy, biotechnology, and other fields are poised for significant long-term growth, even if their current valuations seem high based on traditional metrics.

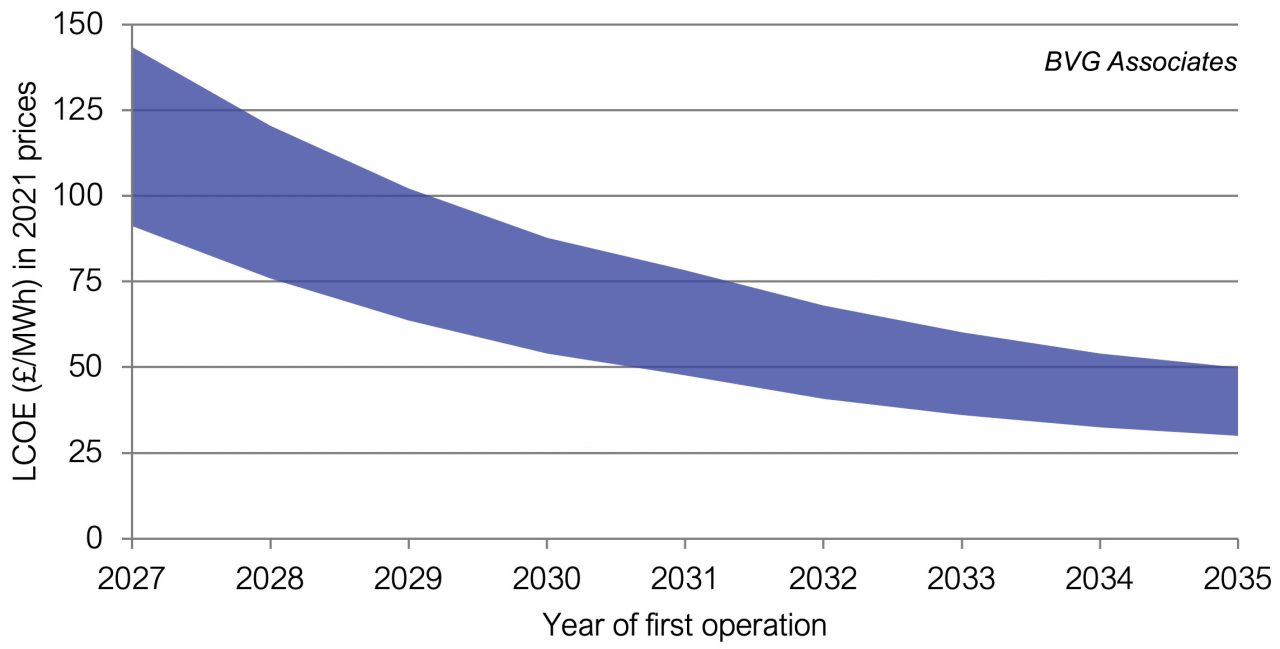

- Sectors driving innovation: Technology, renewable energy, biotechnology, and cloud computing are prime examples of sectors experiencing rapid innovation and creating significant future earnings potential. These companies may warrant higher valuations, reflecting their potential for long-term growth and market disruption.

- Increased productivity and higher future earnings: Technological advancements lead to increased productivity, cost reductions, and the creation of entirely new markets, ultimately driving higher future earnings. Investors need to understand how these drivers of growth translate into long-term value creation.

- Investing in companies positioned for long-term growth: Focusing on companies that are actively involved in technological innovation and market disruption is crucial for long-term investment success, even in a market with elevated valuations. This requires analyzing a company's competitive advantage, its leadership position within its sector, and its capacity for future growth.

Strategic Asset Allocation and Diversification

In a market environment with potentially elevated valuations, a well-diversified investment strategy is paramount. This involves mitigating risk by spreading investments across various asset classes and sectors.

- Benefits of diversification: Diversification across asset classes (stocks, bonds, real estate, commodities) helps to reduce the overall volatility of a portfolio. Even if one asset class underperforms, others may offset those losses. Diversification across sectors is equally important to reduce reliance on specific industries.

- Strategies for mitigating risk: Value investing, focusing on companies with lower valuations relative to their fundamentals, remains a valuable strategy. Sector rotation, strategically shifting investments between sectors based on economic cycles and market trends, is another important approach.

- Long-term investment horizon: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations are less relevant when focused on the long-term growth potential of investments. A long-term perspective can help weather the temporary effects of market volatility and elevated valuations.

BofA's Specific Arguments and Recommendations

BofA's recent research (cite specific report here) acknowledges the concerns surrounding elevated stock market valuations but emphasizes the significant influence of low interest rates on valuation models. Their analysis highlights the importance of focusing on long-term growth prospects and strategic asset allocation.

- Key predictions: BofA's forecasts (cite specific data from the report) suggest continued growth in specific sectors, despite the high valuations. They might predict continued growth driven by technological innovation, for instance.

- Investment strategies: BofA likely recommends a diversified approach, focusing on companies with strong growth potential in key sectors. They might suggest actively managing portfolios and utilizing value investing strategies.

- Supporting data: Include direct quotes or data points from the BofA report to support your points, providing authority and credibility to your analysis.

Conclusion: Navigating Elevated Stock Market Valuations for Long-Term Success

Elevated stock market valuations shouldn't automatically deter investors. Low interest rates affect traditional valuation metrics, long-term growth driven by technological innovation offers significant opportunities, and a strategic, diversified approach to investment can mitigate risk. Don't let concerns about elevated stock market valuations paralyze your investment decisions. Develop a sound long-term strategy, diversify your portfolio across asset classes and sectors, and consider seeking professional advice from a financial advisor to help you navigate the complexities of the current market and develop a personalized approach to investing in the face of potentially high valuations.

Featured Posts

-

Risk Assessment And Mitigation In Financing A 270 M Wh Bess Project In Belgium

May 04, 2025

Risk Assessment And Mitigation In Financing A 270 M Wh Bess Project In Belgium

May 04, 2025 -

Anna Kendrick And Rebel Wilson An Unexpected Friendship Forged On The Set Of Pitch Perfect

May 04, 2025

Anna Kendrick And Rebel Wilson An Unexpected Friendship Forged On The Set Of Pitch Perfect

May 04, 2025 -

Rising Costs Jeopardize Offshore Wind Farm Development

May 04, 2025

Rising Costs Jeopardize Offshore Wind Farm Development

May 04, 2025 -

Financial Models For A 270 M Wh Battery Energy Storage System Bess Project In Belgium

May 04, 2025

Financial Models For A 270 M Wh Battery Energy Storage System Bess Project In Belgium

May 04, 2025 -

Tories Accuse Nigel Farage Of Sham Announcement Reform Party Defections

May 04, 2025

Tories Accuse Nigel Farage Of Sham Announcement Reform Party Defections

May 04, 2025

Latest Posts

-

Analyzing The Alleged Rivalry A Timeline Of Blake Lively And Anna Kendricks Interactions

May 04, 2025

Analyzing The Alleged Rivalry A Timeline Of Blake Lively And Anna Kendricks Interactions

May 04, 2025 -

A Comprehensive Timeline Of The Reported Feud Between Blake Lively And Anna Kendrick

May 04, 2025

A Comprehensive Timeline Of The Reported Feud Between Blake Lively And Anna Kendrick

May 04, 2025 -

Blake Lively Vs Anna Kendrick Tracing The Timeline Of Their Alleged Feud

May 04, 2025

Blake Lively Vs Anna Kendrick Tracing The Timeline Of Their Alleged Feud

May 04, 2025 -

Unmasking The Truth A Timeline Of The Blake Lively Anna Kendrick Conflict

May 04, 2025

Unmasking The Truth A Timeline Of The Blake Lively Anna Kendrick Conflict

May 04, 2025 -

Comparing Styles Blake Lively And Anna Kendricks Understated Red Carpet Looks

May 04, 2025

Comparing Styles Blake Lively And Anna Kendricks Understated Red Carpet Looks

May 04, 2025