Why Investors Shouldn't Panic: BofA's View On Current Stock Market Valuations

Table of Contents

BofA's Assessment of Current Stock Market Valuations

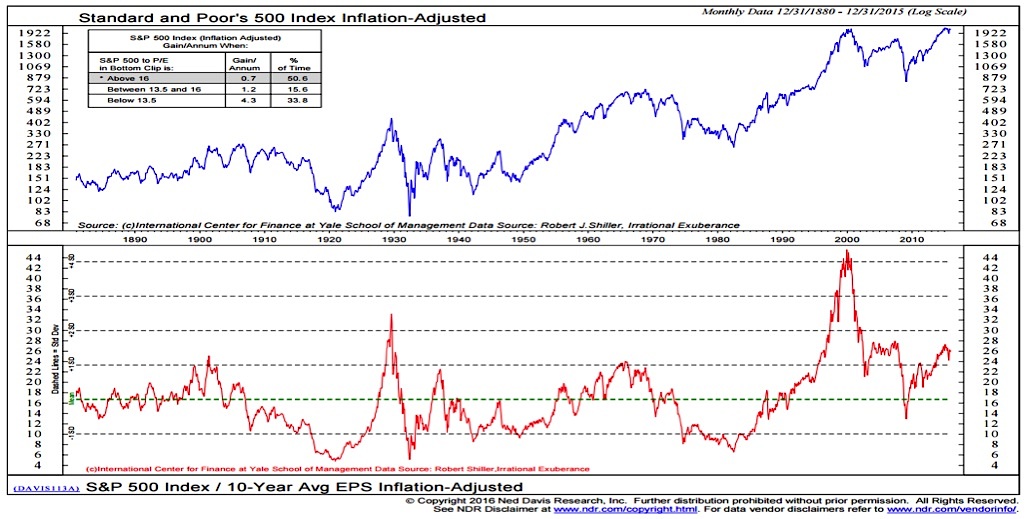

BofA employs a multifaceted approach to assessing stock market valuations, utilizing a combination of established methods. Their analysis incorporates various metrics, including but not limited to the Price-to-Earnings (P/E) ratio, discounted cash flow (DCF) analysis, and comparisons to historical market multiples. These methods help them paint a comprehensive picture of whether current valuations are overinflated, undervalued, or fairly priced.

BofA's recent findings suggest a nuanced view. While certain sectors might show signs of overvaluation based on specific metrics, their overall assessment considers future earnings expectations and macroeconomic factors. They are not predicting an immediate crash, but rather a period of potential volatility. This is supported by their analysis showing that while some valuations are elevated compared to historical averages, they are not at levels typically associated with major market corrections. The data suggests a degree of resilience within the market, even against current global headwinds.

- Specific valuation metrics used by BofA: P/E ratio, PEG ratio, Price-to-Sales ratio, DCF analysis, and market capitalization-to-GDP ratio.

- Key sectors BofA is focusing on: Technology, Financials, Consumer Discretionary, and Energy.

- BofA's view on the current market's overall valuation: Relatively fair, with pockets of overvaluation and undervaluation across different sectors.

Factors Supporting BofA's Optimistic Outlook

BofA's cautiously optimistic outlook is underpinned by several key macroeconomic factors and positive market indicators. Their analysis suggests that while challenges exist, the underlying strength of the economy and corporate earnings provides a buffer against significant downturns.

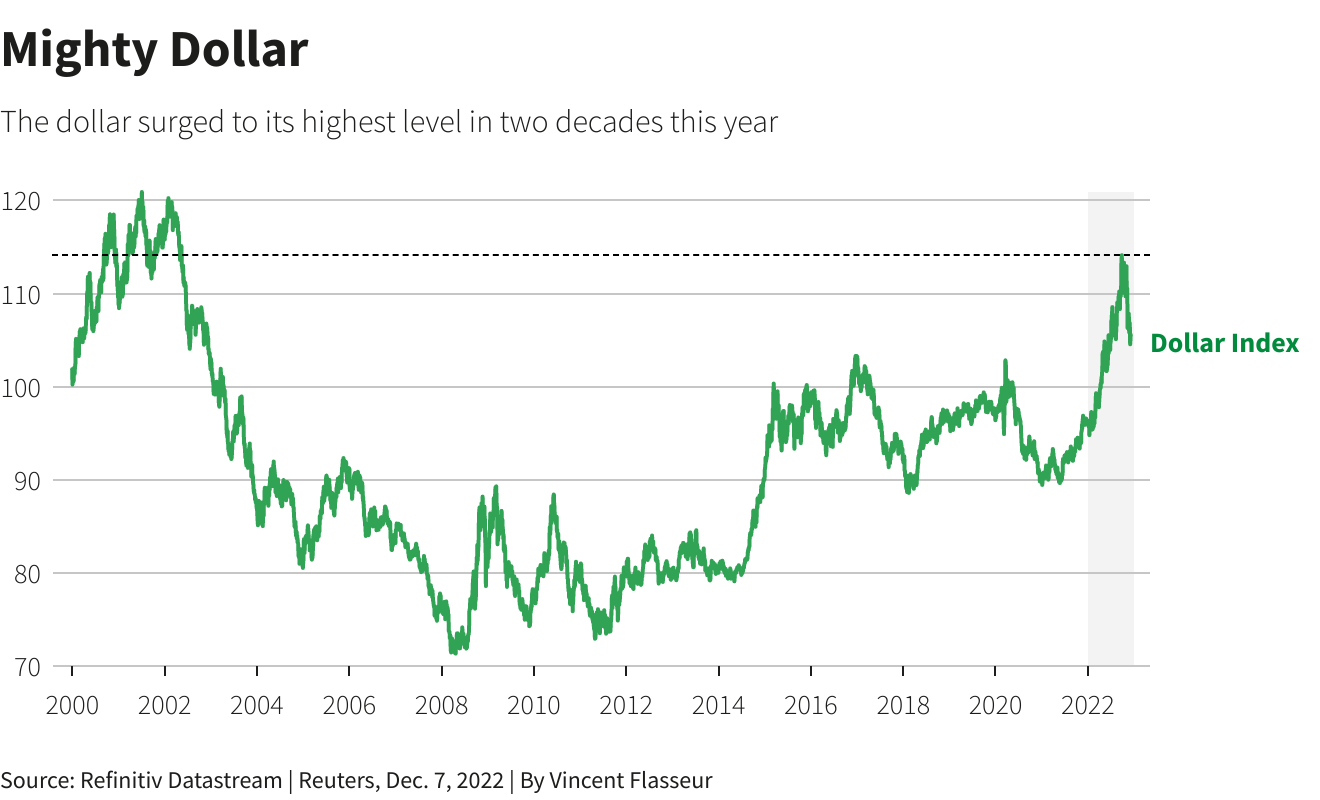

The current economic climate, although presenting some headwinds, displays surprising resilience. Interest rate hikes, while impacting borrowing costs, are also designed to control inflation. BofA's projections anticipate a moderation of inflation in the coming quarters, reducing pressure on consumer spending and corporate profits. Furthermore, strong corporate earnings reports from various sectors suggest continued profitability, indicating that companies are adapting to the current economic environment.

- Strong points of the current economic climate: Resilient consumer spending, positive employment figures, and ongoing technological innovation.

- Positive industry trends impacting stock valuations: Growth in renewable energy, advancements in artificial intelligence, and the ongoing digital transformation.

- BofA's predictions for future market performance: Moderate growth with potential for increased volatility in the short term.

Addressing Potential Risks and Concerns

While BofA maintains a relatively optimistic outlook, they acknowledge several potential risks and concerns. Geopolitical uncertainty remains a significant factor, impacting supply chains and global economic stability. The persistence of inflation, though predicted to moderate, could still pose challenges. Furthermore, the possibility of a mild recession cannot be entirely discounted.

However, BofA's analysis suggests that these risks are either already priced into the market or are manageable within a broader context of economic growth and strong corporate performance. Their risk management strategies advocate for diversification and a focus on fundamentally strong companies. The potential rewards, based on their analysis, outweigh the identified risks for long-term investors.

- Identified market risks according to BofA's analysis: Geopolitical instability, persistent inflation, potential recession, and rising interest rates.

- BofA's strategies to mitigate these risks: Diversification of investment portfolios, focusing on companies with strong balance sheets, and maintaining a long-term investment horizon.

- Comparison of risk vs. reward based on their analysis: BofA suggests that the potential for long-term growth outweighs the identified short-term risks, particularly for investors with a diversified portfolio.

Investment Strategies Based on BofA's Analysis

BofA's assessment of current stock market valuations suggests a balanced approach to investment strategies. While acknowledging the potential for volatility, they advise against panic selling and instead recommend a focus on long-term growth. Diversification across different sectors and asset classes is crucial to mitigate risk. Investors should focus on fundamentally strong companies with robust earnings and a track record of consistent performance.

Sector allocation should be tailored to individual risk tolerance and investment goals. While some sectors might appear overvalued, others offer compelling opportunities for growth. BofA suggests a cautious approach to highly speculative investments, advocating for a focus on value and long-term potential.

- Suggested asset allocation strategies: A diversified portfolio across stocks, bonds, and potentially alternative investments, adjusted based on risk tolerance.

- Recommendations for specific investment sectors: Focusing on sectors exhibiting strong fundamentals and future growth potential, considering BofA’s sector-specific valuations.

- Advice on risk management techniques: Diversification, regular portfolio rebalancing, and a long-term investment horizon.

Conclusion: Why Investors Shouldn't Panic: A Summary and Call to Action

BofA's analysis of current stock market valuations reveals a relatively balanced picture. While acknowledging potential risks, their assessment suggests that the market is not significantly overvalued and that opportunities for long-term growth remain. The underlying strength of the economy, coupled with strong corporate earnings, provides a degree of resilience against short-term volatility. Panic selling is therefore ill-advised.

Understanding stock market valuations is crucial for making informed investment decisions. Don't let market volatility dictate your investment strategy. Learn more about BofA's view on current stock market valuations and consider their insights when making your investment choices. A long-term perspective and rational decision-making are key to navigating the complexities of the market. For further details and supporting data, refer to BofA's latest market reports and analyses [link to relevant BofA resources].

Featured Posts

-

Unlocking The Wisdom Lessons From Buffetts Apple Investment

May 06, 2025

Unlocking The Wisdom Lessons From Buffetts Apple Investment

May 06, 2025 -

The Falling Dollar And Its Disruptive Effects On Asian Economies

May 06, 2025

The Falling Dollar And Its Disruptive Effects On Asian Economies

May 06, 2025 -

Stock Market Performance Dow And S And P 500 Live Updates May 5

May 06, 2025

Stock Market Performance Dow And S And P 500 Live Updates May 5

May 06, 2025 -

Asian Currencies In Turmoil The Impact Of A Weakening Dollar

May 06, 2025

Asian Currencies In Turmoil The Impact Of A Weakening Dollar

May 06, 2025 -

Chris Pratt Reacts To Patrick Schwarzenegger In White Lotus

May 06, 2025

Chris Pratt Reacts To Patrick Schwarzenegger In White Lotus

May 06, 2025

Latest Posts

-

Schwarzeneggers Superman Audition What Went Wrong Corenswets Casting Explained

May 06, 2025

Schwarzeneggers Superman Audition What Went Wrong Corenswets Casting Explained

May 06, 2025 -

Copper Market Outlook Analysis Of China Us Trade Relations

May 06, 2025

Copper Market Outlook Analysis Of China Us Trade Relations

May 06, 2025 -

Patrick Schwarzenegger On His Missed Chance At Superman David Corenswet And The Audition

May 06, 2025

Patrick Schwarzenegger On His Missed Chance At Superman David Corenswet And The Audition

May 06, 2025 -

Rising Copper Prices A Response To Sino American Trade Negotiations

May 06, 2025

Rising Copper Prices A Response To Sino American Trade Negotiations

May 06, 2025 -

Copper Market Volatility Impact Of China Us Trade Discussions

May 06, 2025

Copper Market Volatility Impact Of China Us Trade Discussions

May 06, 2025