Will A Wall Street Rebound Undermine The DAX's Recent Success?

Table of Contents

The DAX, Germany's leading stock market index, has recently enjoyed a period of significant gains. However, a looming question for investors is whether this success can withstand a potential rebound on Wall Street. This article delves into the complex relationship between the German and US stock markets, examining the factors that could either support or hinder the DAX's positive trajectory. We will analyze correlations, risk factors, and offer insights into the future outlook for investors navigating this dynamic interplay between the DAX and Wall Street.

Correlation Between Wall Street and the DAX

The DAX and Wall Street, represented by indices like the S&P 500 and the Dow Jones Industrial Average, are inextricably linked within the global financial system. Understanding their correlation is crucial for investors seeking to make informed decisions.

Historical Performance Analysis

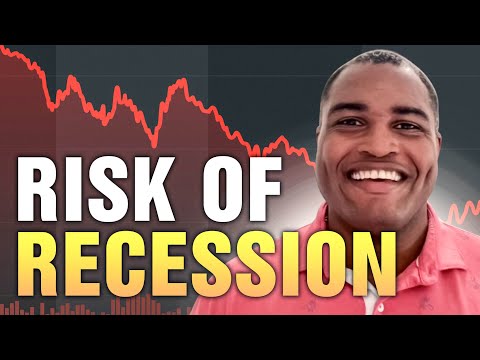

Analyzing past performance reveals a generally positive correlation between Wall Street and the DAX. However, the strength of this correlation fluctuates.

- Positive Correlations: Periods of strong economic growth in the US often translate into positive performance for the DAX, as global investor confidence increases. For example, the period between 2017 and early 2020 saw strong synchronized growth in both markets.

- Negative Correlations: Conversely, significant downturns on Wall Street, like the 2008 financial crisis or the initial COVID-19 market crash, usually negatively impact the DAX, albeit sometimes with a delayed effect. The speed and depth of the impact can vary depending on factors like the nature of the crisis and the specific sectors affected.

- Data Sources: Reliable data for this analysis can be sourced from financial data providers like Refinitiv, Bloomberg, and Yahoo Finance. Visual representations, such as charts comparing the DAX and S&P 500 performance over time, would further enhance understanding.

Identifying Key Influencers

Several factors drive the correlation between Wall Street and the DAX:

- Global Economic Events: Macroeconomic factors like interest rate changes by the Federal Reserve, global inflation rates, and shifts in commodity prices impact both markets simultaneously.

- Investor Sentiment: Positive investor sentiment in the US often spills over into European markets, boosting the DAX. Conversely, negative sentiment can lead to capital flight from European assets, including the DAX.

- Sector-Specific Performance: The performance of specific sectors, such as technology or automobiles, can influence both indices differently depending on their relative weightings and individual company performance. A strong performance in the US tech sector might not always translate directly to a similar performance in the German technology sector.

Potential Risks to the DAX from a Wall Street Rebound

While a Wall Street rebound can be positive globally, it also presents potential risks for the DAX.

Capital Flight

A robust Wall Street rebound could trigger capital flight from the DAX to the US market.

- Higher Expected Returns: Investors might seek higher potential returns offered by recovering US stocks, leading to a decrease in investment in the DAX.

- Perceived Lower Risk: The US market, perceived by some as more stable, might attract risk-averse investors who pull capital from what they consider a riskier European market like the DAX.

Currency Fluctuations

Fluctuations in the EUR/USD exchange rate significantly impact the DAX's performance relative to Wall Street.

- EUR Appreciation: A strengthening Euro against the US dollar could make German stocks relatively more expensive for US investors, potentially hindering DAX performance even if the underlying fundamentals are strong.

- EUR Depreciation: Conversely, a weakening Euro might make German assets cheaper and more attractive, offsetting some of the negative impact of a Wall Street rebound.

Sectoral Differences

The weightings of different sectors within the DAX and US indices vary, resulting in divergent performance.

- Divergent Growth: A sector performing exceptionally well in the US might not see parallel success in Germany. This sector-specific disparity can affect the overall index performance differently.

- Convergence in Certain Sectors: Conversely, sectors with global reach like pharmaceuticals or automotive might see synchronized growth in both markets, potentially mitigating the negative impact of capital flight.

Opportunities for the DAX Despite a Wall Street Rebound

Despite the potential risks, a Wall Street rebound doesn't necessarily doom the DAX.

Defensive Sectors

Certain DAX sectors could exhibit resilience, even during a Wall Street rally.

- Luxury Goods: High-end brands often remain insulated from broader economic downturns, potentially outperforming during market volatility.

- Healthcare: The healthcare sector generally enjoys consistent demand, making it less vulnerable to market fluctuations than other cyclical sectors.

Diversification Benefits

A diversified portfolio that includes both US and German stocks mitigates risk.

- Reduced Volatility: Holding both DAX and US stocks can reduce overall portfolio volatility, as they don't always move in perfect unison.

- Balanced Returns: Diversification allows investors to capitalize on opportunities in different markets, smoothing out returns over time.

Unique Growth Potential in German Industries

Specific German industries might outperform their US counterparts.

- Renewable Energy: Germany's strong commitment to renewable energy could lead to significant growth opportunities in this sector.

- Technology (Specific Niches): Germany has strengths in specific technology niches, offering unique investment possibilities.

Conclusion

The relationship between a Wall Street rebound and the DAX's performance is complex, involving correlations, risks, and opportunities. While a Wall Street rally could lead to capital flight and currency fluctuations impacting the DAX, certain sectors within the DAX might show resilience, and a diversified portfolio provides a buffer. Investors should carefully analyze these factors and understand the potential risks and rewards before making any investment decisions.

Call to Action: Understanding the intricate interplay between Wall Street and the DAX is vital for informed investment choices. Conduct thorough research, consult with financial experts, and consider the insights provided here to navigate the complexities of investing in the DAX and US markets effectively. Further exploration of DAX performance relative to Wall Street trends is highly recommended for those seeking optimal investment strategies.

Featured Posts

-

Relx Trotseert Economische Zwakte Met Ai Voorspellingen Voor Sterke Groei Tot 2025

May 25, 2025

Relx Trotseert Economische Zwakte Met Ai Voorspellingen Voor Sterke Groei Tot 2025

May 25, 2025 -

Evrovidenie 2025 Konchita Vurst Nazvala Chetyrekh Favoritov

May 25, 2025

Evrovidenie 2025 Konchita Vurst Nazvala Chetyrekh Favoritov

May 25, 2025 -

Avoid Crowds Smart Travel Dates Around Memorial Day 2025

May 25, 2025

Avoid Crowds Smart Travel Dates Around Memorial Day 2025

May 25, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 25, 2025 -

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf An Investors Guide

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf An Investors Guide

May 25, 2025

Latest Posts

-

Hollywood Star Sean Penn Makes Headlining Claims Public Response

May 25, 2025

Hollywood Star Sean Penn Makes Headlining Claims Public Response

May 25, 2025 -

Sean Penn Recent Appearance Sparks Concern And Controversy

May 25, 2025

Sean Penn Recent Appearance Sparks Concern And Controversy

May 25, 2025 -

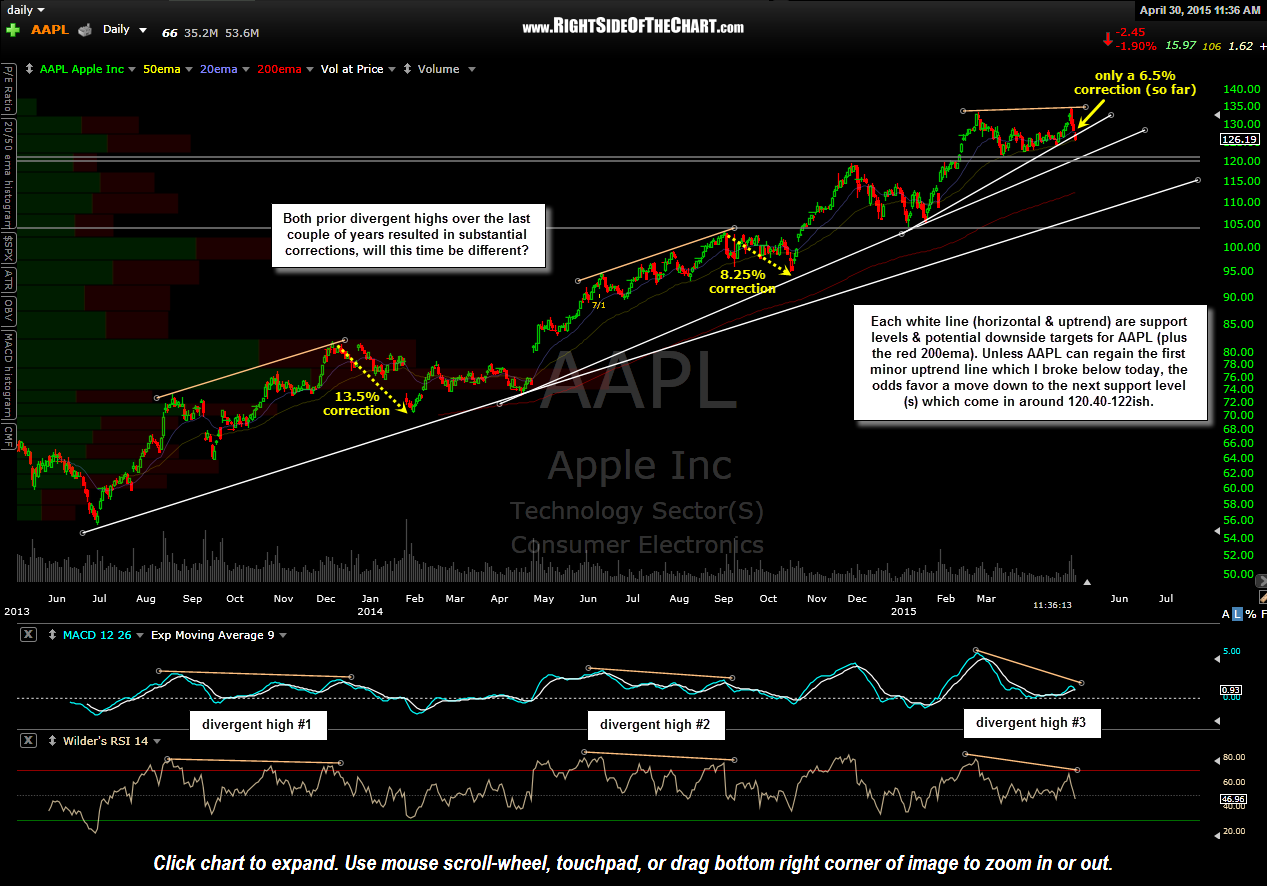

Aapl Stock Important Price Levels And Future Predictions

May 25, 2025

Aapl Stock Important Price Levels And Future Predictions

May 25, 2025 -

Apple Stock Aapl Price Analysis Key Levels To Watch

May 25, 2025

Apple Stock Aapl Price Analysis Key Levels To Watch

May 25, 2025 -

Wedbush Remains Bullish On Apple Despite Price Target Reduction Long Term Investment Analysis

May 25, 2025

Wedbush Remains Bullish On Apple Despite Price Target Reduction Long Term Investment Analysis

May 25, 2025