Will Berkshire Hathaway Sell Apple Stock After Buffett Steps Down?

Table of Contents

Berkshire Hathaway's massive stake in Apple has become synonymous with Warren Buffett's investing prowess. This shrewd investment, representing a significant portion of Berkshire's portfolio, has generated billions in profits. But with Buffett's eventual succession looming, a critical question arises: will Berkshire Hathaway sell its Apple stock? This article delves into the potential scenarios, considering the perspectives of the current management team, market trends, and Apple's future prospects.

The Buffett Factor: His Influence on the Apple Investment

Warren Buffett's personal endorsement of Apple has been a key driver of Berkshire Hathaway's investment. His long-term investment strategy, famously emphasizing value investing and holding onto winning stocks for extended periods, perfectly aligns with his Apple holdings.

- Buffett's admiration for Apple's brand strength and loyal customer base: Apple's unparalleled brand recognition and fiercely loyal customer base represent a significant moat against competition, a factor that strongly appeals to Buffett's value-oriented investment philosophy.

- His focus on long-term value creation rather than short-term gains: Buffett's patient approach to investing contrasts sharply with short-term trading strategies. His belief in Apple's long-term growth potential is a cornerstone of Berkshire's continued investment.

- His belief in Apple’s management team and its innovative capacity: Buffett has repeatedly praised Apple's management team, highlighting their ability to innovate and adapt to changing market conditions. This confidence in leadership is a critical component of his investment thesis.

Buffett's departure will undoubtedly introduce uncertainty. While his influence on the company's culture and investment approach is undeniable, the question remains: will his successors share his unwavering faith in Apple? The potential impact on Berkshire's investment decisions is a significant consideration.

Berkshire Hathaway's Post-Buffett Strategy & Apple

Greg Abel and Ajit Jain, potential successors to Buffett, possess distinct investment philosophies. Understanding their approaches is crucial to predicting Berkshire Hathaway's future actions regarding its Apple stock.

- Analysis of their previous investment decisions and risk tolerance: Examining Abel and Jain's track records will shed light on their risk appetites and preferred investment styles. Do they favor similar long-term, value-oriented investments, or might they pursue a more diversified portfolio?

- Potential shifts in Berkshire's investment strategy after the transition: A shift in leadership could lead to a reevaluation of Berkshire's existing investments, including its Apple stake. This potential change warrants careful consideration.

- Will they maintain the same level of commitment to Apple? This is the central question. Will Abel or Jain see the same value in Apple that Buffett has, or might they opt for a different allocation of Berkshire's resources?

The Berkshire Hathaway investment committee will also play a vital role in shaping future investment decisions. Their collective wisdom and expertise will be instrumental in navigating this transition period and determining the fate of Berkshire's substantial Apple holdings.

Apple's Future Prospects and Their Impact on Berkshire's Decision

Apple's future performance will undoubtedly play a significant role in Berkshire Hathaway's decision to hold or sell. Analyzing Apple's current financial health and future growth potential is essential.

- Discussion of Apple's innovation pipeline and product roadmap: Apple's continued innovation in areas like wearables, services, and augmented reality will be critical for sustained growth. A robust product pipeline will bolster Berkshire's confidence.

- Evaluation of competitive threats and market saturation risks: Increasing competition from other tech giants poses a potential challenge to Apple's dominance. Assessing these threats is crucial to understanding the long-term viability of the Apple investment.

- Projected growth in key markets (e.g., services, wearables): The growth potential in emerging markets and the expansion of services like Apple Music and Apple TV+ will significantly impact Apple's overall valuation and, consequently, Berkshire's decision.

The strength of Apple's future earnings and its ability to maintain its market leadership will directly influence Berkshire Hathaway's strategy. A continued robust performance will likely encourage them to retain their stake, while weakening prospects might prompt a reconsideration.

Market Conditions and External Factors

Broader economic trends and geopolitical events can significantly influence Berkshire Hathaway's investment choices. These external factors must be considered.

- Impact of interest rate changes and inflation on investment decisions: Rising interest rates and inflationary pressures can affect investment valuations and potentially lead to portfolio adjustments.

- Geopolitical risks and their influence on the tech sector: Geopolitical instability and trade tensions can impact the tech sector's performance, impacting Apple and Berkshire's investment.

- Potential shifts in investor sentiment towards tech stocks: Changing investor sentiment, driven by market fluctuations or technological shifts, could influence Berkshire's decision to adjust its holdings.

These external factors can create unpredictable market volatility, potentially impacting Berkshire's decision to maintain or divest its Apple stock.

Conclusion

While Warren Buffett's departure will undoubtedly mark a significant change for Berkshire Hathaway, the future of their Apple investment remains uncertain. The decision will likely hinge on a combination of factors, including the investment philosophies of Buffett's successors, Apple's future performance, and broader market conditions. The interplay of these elements will shape the trajectory of this legendary investment.

Call to Action: Stay informed about the evolving situation and the potential implications for investors. Continue following the discussion on "Will Berkshire Hathaway Sell Apple Stock After Buffett Steps Down?" by subscribing to our newsletter for updates and in-depth analyses of Berkshire Hathaway's investment strategies.

Featured Posts

-

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025 -

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudba I Nyneshnyaya Zhizn

May 24, 2025

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudba I Nyneshnyaya Zhizn

May 24, 2025 -

Hot Wheels Ferrari Mamma Mia A Look At The New Releases

May 24, 2025

Hot Wheels Ferrari Mamma Mia A Look At The New Releases

May 24, 2025 -

Delayed But Delivered Accenture Promotes 50 000 Staff Members

May 24, 2025

Delayed But Delivered Accenture Promotes 50 000 Staff Members

May 24, 2025 -

Crystal Palace Eyeing Kyle Walker Peters On A Free

May 24, 2025

Crystal Palace Eyeing Kyle Walker Peters On A Free

May 24, 2025

Latest Posts

-

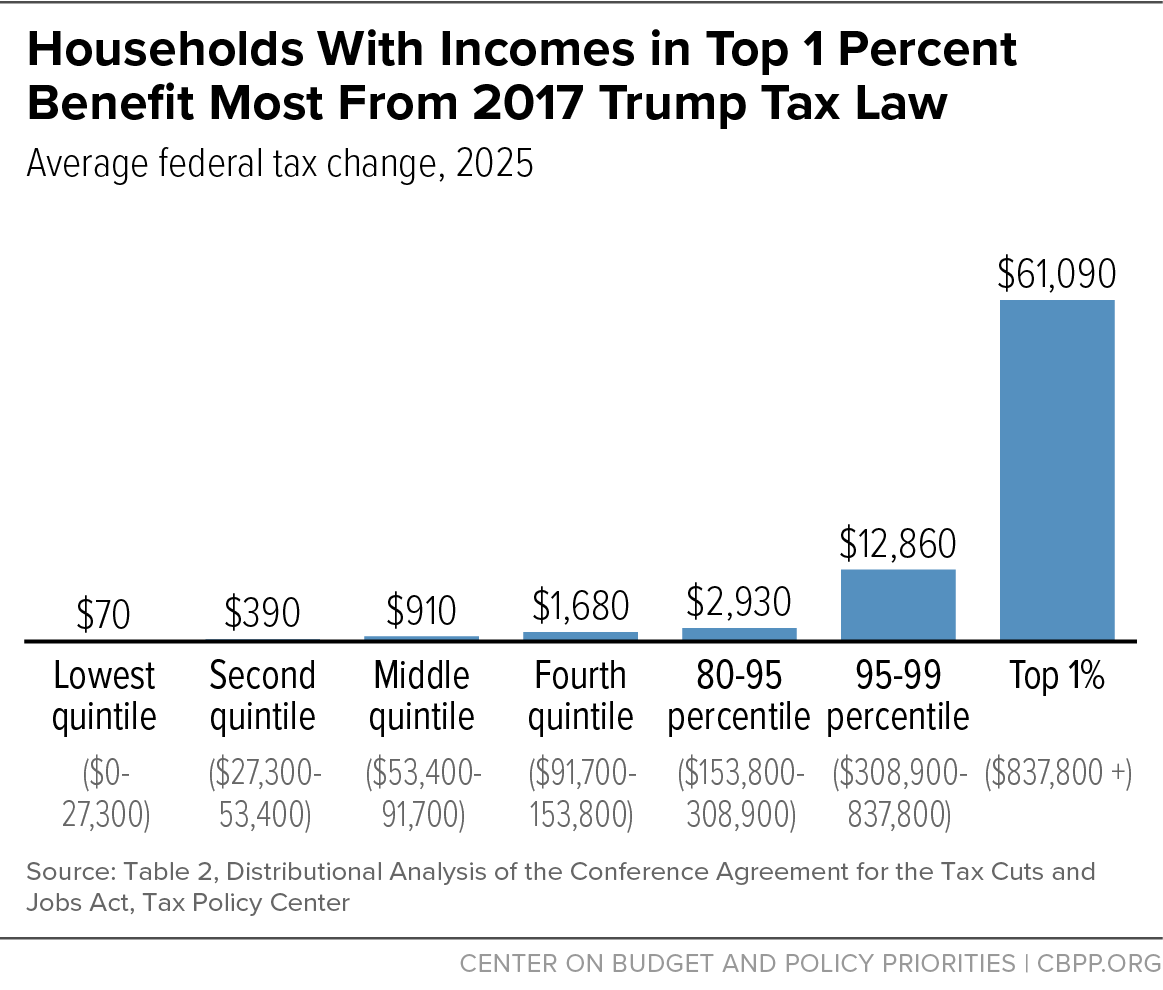

Analysis The House Passed Trump Tax Bill And What It Means

May 24, 2025

Analysis The House Passed Trump Tax Bill And What It Means

May 24, 2025 -

Orbital Space Crystals A New Frontier In Pharmaceutical Development

May 24, 2025

Orbital Space Crystals A New Frontier In Pharmaceutical Development

May 24, 2025 -

Last Minute Changes Alter Trump Tax Bill Before House Passage

May 24, 2025

Last Minute Changes Alter Trump Tax Bill Before House Passage

May 24, 2025 -

From Parishioner To Viral Sensation A Tik Tokers Story With Pope Leo

May 24, 2025

From Parishioner To Viral Sensation A Tik Tokers Story With Pope Leo

May 24, 2025 -

Air Traffic Controllers Link Newark Airport Issues To Trump Administration Policy

May 24, 2025

Air Traffic Controllers Link Newark Airport Issues To Trump Administration Policy

May 24, 2025