XRP Outpaces Solana: Increased Trading Volume Fuels ETF Hopes

Table of Contents

Analyzing XRP's Recent Trading Volume Surge

XRP's trading volume has seen a remarkable increase in recent weeks, surpassing Solana's by a considerable margin. While precise figures fluctuate daily, reports indicate a percentage increase (insert percentage and source if available) compared to the previous quarter. This substantial growth can be attributed to several key factors:

-

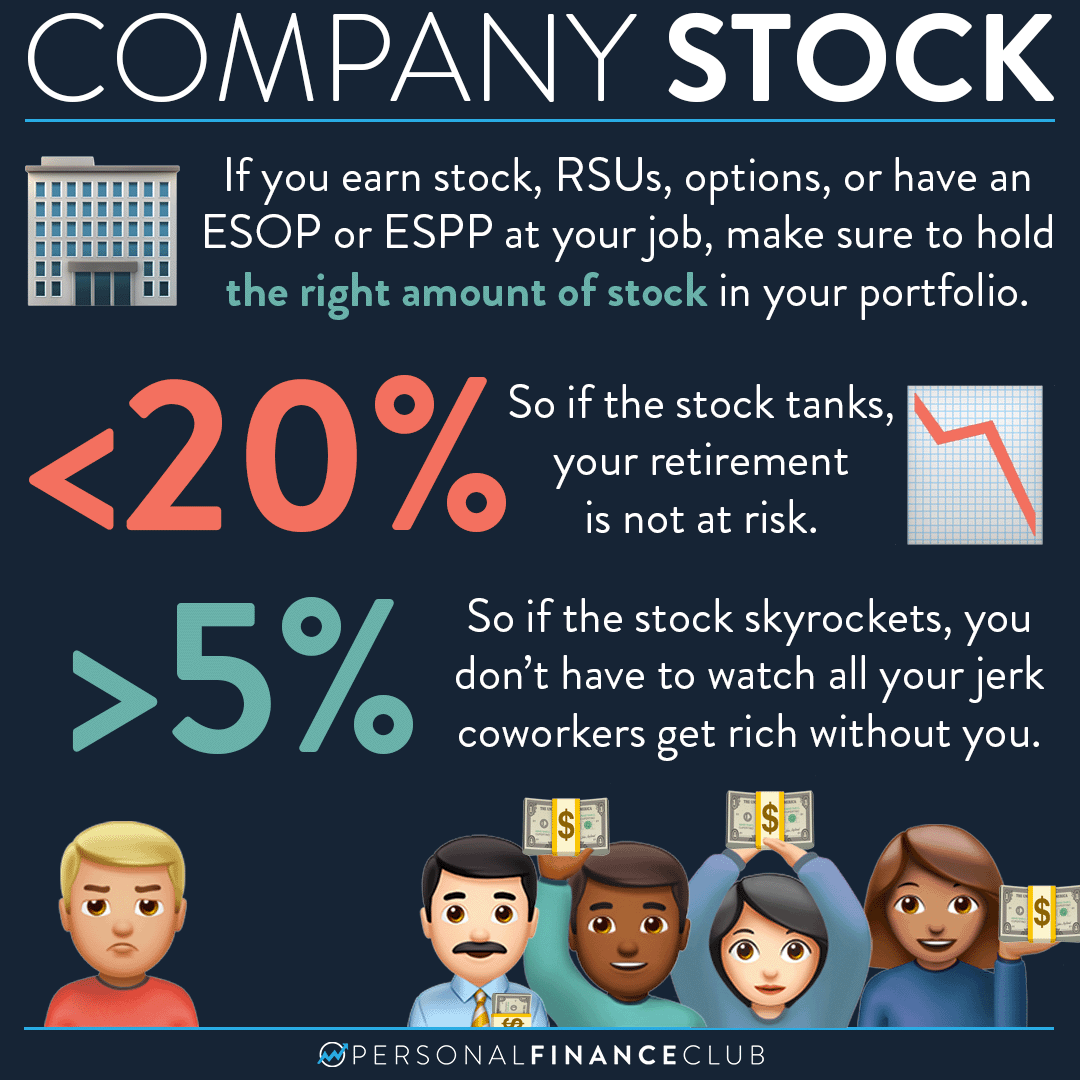

Increased Institutional Interest: Several reports suggest a growing appetite for XRP among institutional investors. This is possibly fueled by Ripple's ongoing legal battle reaching a crucial stage and the potential for a positive outcome. (Cite specific reports or news articles here). The anticipation of a favorable ruling may be driving institutional investment.

-

Retail Investor Activity: Increased retail investor interest also plays a significant role. The comparatively lower price point of XRP compared to other cryptocurrencies makes it more accessible to a wider range of retail traders. Furthermore, positive news surrounding the Ripple lawsuit and ETF speculation contribute to the surge in retail trading activity. (Include data on retail trading volume if available).

-

Ripple's Ongoing Legal Battle: Ironically, Ripple's legal battle with the SEC might be contributing to the increased trading volume. While uncertainty remains, a potential win could dramatically increase XRP's price and legitimacy, attracting more investors. Conversely, even a negative outcome might generate short-term trading activity as investors react to the news.

-

Market Speculation Regarding ETF Approval: The anticipation of an XRP ETF approval is arguably the most significant catalyst for the recent surge. The potential for an exchange-traded product offering XRP exposure to a broader range of investors would massively increase demand and liquidity.

Solana's Performance in Comparison

While XRP enjoys a period of significant growth, Solana's trading volume has remained relatively stagnant. This disparity highlights the diverging market sentiments surrounding the two cryptocurrencies. A direct comparison of trading volumes (include data if available) shows a clear gap in performance.

Several factors contribute to Solana's comparatively weaker position:

-

Market Competition: Solana faces intense competition from other layer-1 blockchains offering similar functionalities. The emergence of newer, faster, and more scalable networks has diverted some investor interest away from Solana.

-

Technological Challenges: Solana has experienced network outages and scalability issues in the past. These incidents, though seemingly resolved, can erode investor confidence and impact trading volume.

-

Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain, affecting all players, but Solana, perhaps, more intensely. Any regulatory changes could impact its trading volume negatively.

The Growing Likelihood of an XRP ETF

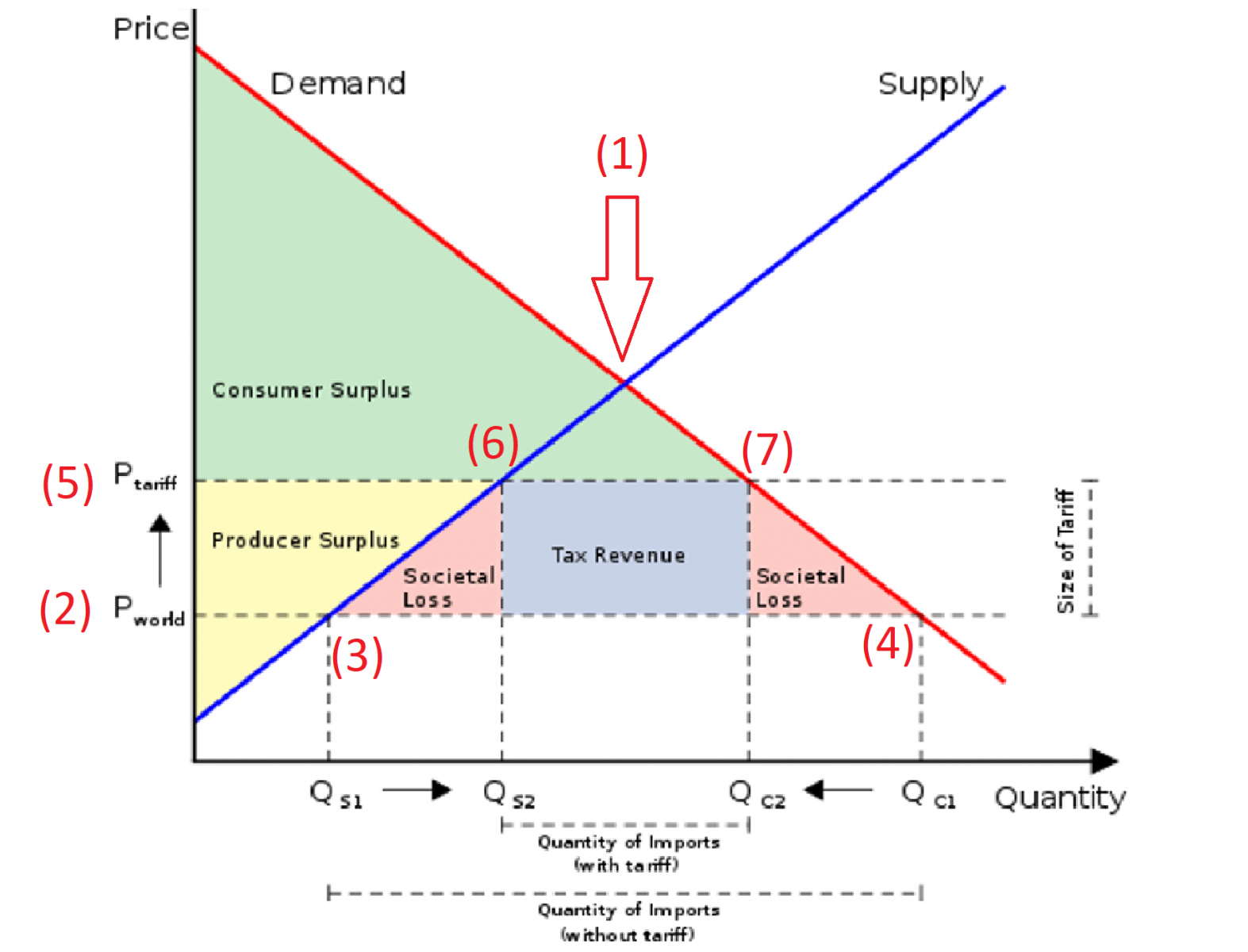

The possibility of an XRP ETF is gaining traction. Recent SEC decisions on other crypto ETFs, although not directly related to XRP, are setting a precedent. (Mention specific SEC decisions and their implications). The arguments for and against XRP ETF approval are equally compelling:

-

Arguments for: XRP's established technology, wide adoption in cross-border payments, and relatively clear regulatory path (compared to other crypto assets) strengthen the case for ETF approval. Its use cases are already well established, making it a relatively less risky asset for ETF inclusion.

-

Arguments against: The ongoing Ripple lawsuit remains a significant hurdle. A negative outcome could severely dampen investor enthusiasm and delay, if not derail, ETF approval. Regulatory uncertainty remains a primary concern across the cryptocurrency market.

Conclusion: XRP's Momentum and the Future of ETF Applications

XRP's recent outperformance of Solana, fueled by increased trading volume and anticipation of an XRP ETF, highlights a shift in market sentiment. Several factors, ranging from increased institutional interest to speculation around ETF approval, have propelled XRP's growth. Conversely, Solana’s performance has been comparatively muted due to market competition, technological challenges, and regulatory uncertainty. The approval of an XRP ETF would not only significantly boost XRP's price but also have broader implications for the cryptocurrency market, potentially attracting mainstream institutional investment. Stay tuned for further updates on XRP's performance and the evolving landscape of crypto ETFs. Keep an eye on the growing momentum behind XRP outpacing Solana!

Featured Posts

-

Liberation Day Tariffs And Stock Market Volatility A Comprehensive Overview

May 08, 2025

Liberation Day Tariffs And Stock Market Volatility A Comprehensive Overview

May 08, 2025 -

Intelligence Geometrique Des Corneilles Une Analyse Comparee Avec Les Babouins

May 08, 2025

Intelligence Geometrique Des Corneilles Une Analyse Comparee Avec Les Babouins

May 08, 2025 -

Investors Are Piling Into This Hot New Spac Stock Should You Follow Suit

May 08, 2025

Investors Are Piling Into This Hot New Spac Stock Should You Follow Suit

May 08, 2025 -

Sommer Thumb Injury Blow For Inter Milan Ahead Of Crucial Matches

May 08, 2025

Sommer Thumb Injury Blow For Inter Milan Ahead Of Crucial Matches

May 08, 2025 -

Charlotte Hornets Veteran Options To Fill Taj Gibsons Role

May 08, 2025

Charlotte Hornets Veteran Options To Fill Taj Gibsons Role

May 08, 2025