5 Key Dos And Don'ts To Succeed In The Private Credit Market

Table of Contents

Do Your Due Diligence: Thoroughly Vetting Potential Investments (Keyword: Due Diligence Private Credit)

Successful private lending hinges on thorough due diligence. Before committing capital, meticulously investigate every aspect of the investment. This includes a comprehensive evaluation of the borrower, the collateral, and the overall market conditions.

Understanding the Borrower's Financial Health:

- Analyze financial statements rigorously: Scrutinize income statements, balance sheets, and cash flow statements to identify trends and potential red flags. Look for inconsistencies and unexplained variances.

- Verify the accuracy of provided information through independent sources: Don't rely solely on the borrower's provided data. Cross-reference information with credit reports, industry benchmarks, and other reliable sources.

- Assess the borrower's debt-to-equity ratio and cash flow: A high debt-to-equity ratio can indicate significant financial risk. Evaluate the borrower's ability to service debt based on their projected cash flow.

- Conduct background checks on key personnel: Investigate the management team's experience, reputation, and history. Look for any indications of past financial misconduct or legal issues.

Evaluating the Collateral:

- Assess the value and liquidity of the collateral: Determine the fair market value of the collateral using independent appraisals. Consider how easily the collateral can be liquidated in case of default.

- Consider potential risks associated with the collateral type (real estate, equipment, etc.): Real estate values can fluctuate, and equipment can depreciate. Understand these inherent risks and factor them into your investment decision.

- Ensure proper legal documentation secures your interest in the collateral: Engage legal counsel to ensure that all necessary documentation is in place to protect your interests in the event of default.

Market Research and Competitive Analysis:

- Research comparable transactions in the private credit market: Analyze similar deals to benchmark the terms and conditions of your potential investment.

- Analyze market trends and potential risks: Understand the current economic climate and identify any potential systemic risks that could impact your investment.

- Assess the overall attractiveness of the investment opportunity: Consider the risk-adjusted return and compare it to other potential investment opportunities.

Don't Neglect Risk Management: Mitigating Potential Losses (Keyword: Private Credit Risk Management)

Private credit risk management is paramount. Even with thorough due diligence, unforeseen circumstances can arise. A robust risk management strategy is essential to protect your investment.

Diversify Your Portfolio:

- Spread investments across multiple borrowers and sectors: Don't put all your eggs in one basket. Diversification reduces your exposure to any single borrower or industry-specific risk.

- Reduce the impact of potential defaults on your overall returns: Diversification helps to mitigate the impact of a potential default on your overall portfolio performance.

Implement Robust Legal Frameworks:

- Secure comprehensive loan agreements with clear terms and conditions: Work with legal counsel to create watertight loan agreements that clearly define all terms and conditions, including repayment schedules, interest rates, and default provisions.

- Establish mechanisms for dispute resolution: Include clauses in your agreements that specify how disputes will be resolved.

- Consult with legal professionals specializing in private lending: Seek expert advice to ensure your legal documents are comprehensive and compliant with all relevant regulations.

Monitor Investments Regularly:

- Stay informed about the borrower's financial performance: Regularly review financial statements and key performance indicators (KPIs) to monitor the borrower's progress.

- Identify potential problems early and take corrective actions: Early identification of issues can help you take proactive measures to mitigate potential losses.

Do Build Strong Relationships: Networking and Deal Sourcing (Keyword: Private Credit Networking)

Building a strong network is crucial for success in the private credit market. Networking allows you to source deals, gain insights, and build trust.

Network Strategically:

- Attend industry conferences and events: These events provide opportunities to meet potential borrowers, investors, and intermediaries.

- Cultivate relationships with intermediaries, such as brokers and placement agents: Intermediaries can provide access to deal flow and valuable market intelligence.

- Build rapport with potential borrowers and investors: Strong relationships can lead to preferential treatment and access to exclusive opportunities.

Develop a Strong Reputation:

- Deliver on promises and build trust with your clients: A positive reputation is invaluable in this relationship-driven industry.

- Maintain ethical standards in all your business dealings: Integrity is key to building long-term relationships.

Leverage Your Network:

- Seek referrals from trusted sources: Referrals can lead to high-quality investment opportunities.

- Utilize online platforms to connect with potential opportunities: Online networks and platforms can connect you with a wider range of potential borrowers and investors.

Don't Underestimate the Importance of Legal Expertise (Keyword: Private Credit Legal)

Navigating the legal complexities of private credit is critical. Engage experienced legal counsel to ensure compliance and protect your interests.

Seek Legal Counsel:

- Consult with experienced lawyers specializing in private lending and secured transactions: These lawyers possess the specialized knowledge required to navigate the intricacies of private lending transactions.

- Ensure legal compliance with all relevant regulations: Stay informed about changes in laws and regulations to maintain compliance.

Thorough Contract Review:

- Scrutinize all loan documents carefully: Don't sign anything without a thorough review by your legal counsel.

- Clarify any ambiguities or concerns before signing: Ensure that all aspects of the agreement are clear and understood before committing.

Understand Regulatory Compliance:

- Stay informed about changes in regulations and legislation: The regulatory landscape for private lending can change, so staying updated is important.

- Ensure your operations comply with all applicable laws: Non-compliance can lead to significant penalties and legal issues.

Do Understand the Exit Strategy: Planning for Liquidity (Keyword: Private Credit Exit Strategies)

Having a clear private credit exit strategy is essential. Consider how and when you will realize your investment returns.

Develop a Clear Exit Strategy:

- Define your desired return and timeframe: Set realistic goals for your investment returns and establish a timeframe for achieving those goals.

- Consider potential exit options, such as refinancing or sale: Explore different options for exiting your investment, such as refinancing the loan or selling it to another investor.

Build in Liquidity Options:

- Include provisions in loan agreements for early repayment or sale: Negotiate clauses in your loan agreements that allow for early repayment or the sale of the loan.

Monitor Market Conditions:

- Stay abreast of market trends to optimize exit timing: Market conditions can significantly impact the value of your investment. Monitor these trends to optimize your exit timing and maximize your return.

Conclusion

Successfully navigating the private credit market demands careful planning and execution. By following these key dos and don'ts—thorough due diligence, robust risk management, strong relationship building, sound legal expertise, and a well-defined exit strategy—you can significantly increase your chances of success. Remember that consistent diligence and a proactive approach are paramount to thriving in this dynamic sector of the private credit market. Start planning your private credit investment strategy today!

Featured Posts

-

Portugal Vence A Belgica 1 0 Resumen Del Partido Y Goles

May 17, 2025

Portugal Vence A Belgica 1 0 Resumen Del Partido Y Goles

May 17, 2025 -

The Allegation Of Harboring Aliens How Immigration Agents Investigated Columbia University

May 17, 2025

The Allegation Of Harboring Aliens How Immigration Agents Investigated Columbia University

May 17, 2025 -

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025 -

Bayesian Superyacht Incident Mast Failure Investigated In Fatal Accident Probe

May 17, 2025

Bayesian Superyacht Incident Mast Failure Investigated In Fatal Accident Probe

May 17, 2025 -

May 16th Oil Market Report Prices Trends And Analysis

May 17, 2025

May 16th Oil Market Report Prices Trends And Analysis

May 17, 2025

Latest Posts

-

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025

Federal Charges Filed Individual Accused Of Millions In Office365 Executive Account Hacks

May 17, 2025 -

Office365 Data Breach Millions Stolen Suspect Arrested

May 17, 2025

Office365 Data Breach Millions Stolen Suspect Arrested

May 17, 2025 -

What Is Creatine And How Does It Work

May 17, 2025

What Is Creatine And How Does It Work

May 17, 2025 -

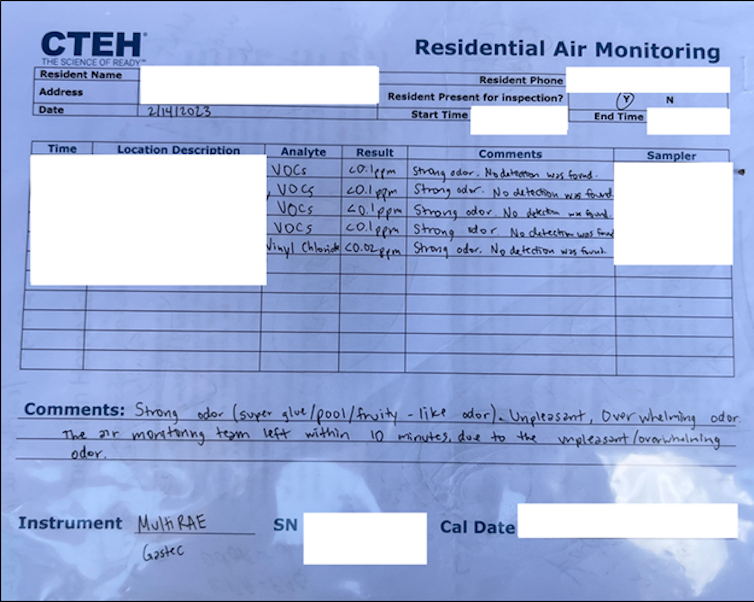

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025 -

Creatine For Beginners A Simple Explanation

May 17, 2025

Creatine For Beginners A Simple Explanation

May 17, 2025