5 Tips To Secure A Private Credit Role In Today's Market

Table of Contents

Develop In-Demand Skills for Private Credit Roles

Private credit professionals need a unique blend of hard and soft skills. Mastering these key areas will significantly boost your candidacy.

Master Financial Modeling and Analysis

Proficiency in financial modeling is paramount in private credit. You must be adept at analyzing complex financial statements, forecasting cash flows, and assessing credit risk. This requires a deep understanding of financial ratios, valuation methodologies, and risk management techniques.

- Become proficient in Excel and specialized financial modeling software. Software like Argus, Bloomberg Terminal, and Capital IQ are commonly used. Practice building complex models and understand their limitations.

- Practice building models for various private credit scenarios. This includes leveraged buyouts (LBOs), distressed debt analysis, and real estate financing. The more scenarios you practice, the better prepared you'll be for diverse situations.

- Obtain relevant certifications. While not always mandatory, certifications like the Chartered Financial Analyst (CFA) charter or Chartered Alternative Investment Analyst (CAIA) designation demonstrate a commitment to excellence and significantly enhance your credibility.

Understand Credit Underwriting Principles

A deep understanding of credit underwriting is crucial for any private credit professional. This involves assessing borrower creditworthiness, structuring deals, and managing risk effectively.

- Study credit risk assessment methodologies and frameworks. Familiarize yourself with different approaches to assessing credit risk, including qualitative and quantitative methods.

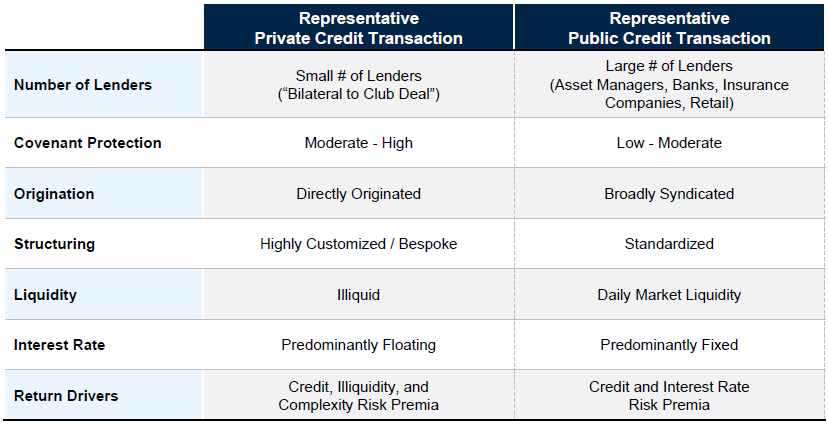

- Learn about different types of private credit instruments. Understand the nuances of senior secured loans, mezzanine debt, unitranche loans, and other private credit structures. Knowing the risks and rewards associated with each is vital.

- Develop strong analytical and problem-solving skills. Private credit often involves complex situations requiring creative solutions. Practice analyzing data, identifying patterns, and formulating effective strategies.

Network Strategically within the Private Credit Industry

Building a strong network is essential for navigating the private credit landscape. It’s not just about who you know, but about building genuine relationships.

- Join relevant professional organizations. The CFA Institute, the Alternative Credit Council (ACC), and other industry-specific groups offer networking opportunities and valuable insights.

- Attend industry conferences and workshops. These events provide opportunities to learn from experts, meet potential employers, and expand your professional network.

- Actively engage on LinkedIn and other professional networking platforms. Share insightful content, participate in relevant discussions, and connect with professionals in the private credit field.

Tailor Your Resume and Cover Letter for Private Credit Positions

Your resume and cover letter are your first impression. Make them count by highlighting your relevant skills and experience.

Highlight Relevant Experience

Showcase your experience in financial analysis, credit underwriting, portfolio management, or related fields. Quantify your achievements whenever possible.

- Use action verbs to describe your accomplishments. Start your bullet points with strong action verbs to demonstrate your impact.

- Quantify your achievements using metrics and numbers. Instead of simply stating your responsibilities, show the results you achieved. For example, "Increased portfolio returns by 15%."

- Focus on results and impact. Employers want to see what you've accomplished, not just what you've done.

Customize for Each Application

Avoid generic application materials. Tailor your resume and cover letter to each specific job description.

- Carefully read the job description and identify key requirements. Highlight the skills and experience that directly address these requirements.

- Highlight the skills and experience that match the job requirements. Don't just list your skills; demonstrate how they align with the specific needs of the role.

- Customize your resume and cover letter to reflect the specific company and role. Research the company and understand its investment strategy and culture.

Ace the Private Credit Interview Process

The interview is your chance to showcase your skills and personality. Thorough preparation is key.

Prepare for Technical Questions

Expect in-depth questions on financial modeling, credit analysis, industry trends, and specific deals.

- Review key financial concepts and formulas. Brush up on your knowledge of discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant financial concepts.

- Practice answering common interview questions. Prepare for questions about your experience, skills, and career aspirations. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Prepare examples from your experience to illustrate your skills. Use specific examples to demonstrate your abilities and accomplishments.

Showcase Your Soft Skills

Private credit requires strong communication, teamwork, and problem-solving skills.

- Prepare examples demonstrating your communication skills. Highlight instances where you effectively communicated complex information to diverse audiences.

- Demonstrate your ability to work collaboratively in a team. Provide examples of successful teamwork and your contributions to team success.

- Highlight your problem-solving skills and ability to think critically. Showcase your ability to analyze complex situations and develop effective solutions.

Ask Thoughtful Questions

Asking insightful questions demonstrates your engagement and interest.

- Ask questions about the firm's investment strategy. Show that you've researched the company and understand its approach to investing.

- Inquire about the team culture and work environment. This shows that you're interested in more than just the job itself.

- Ask about opportunities for professional development. This demonstrates your ambition and commitment to continuous learning.

Leverage Your Network and Seek Mentorship

Networking and mentorship can significantly accelerate your job search.

Informational Interviews

Connect with people working in private credit to learn more about the industry and potential opportunities.

- Reach out to your network for informational interviews. Let people know your career goals and ask for advice.

- Prepare thoughtful questions for your interviews. Show that you've done your homework and are genuinely interested in learning from their experience.

- Follow up with thank-you notes. Express your gratitude and reiterate your interest in the field.

Mentorship

Find a mentor who can provide guidance and support throughout your job search.

- Seek out mentors within your network or through professional organizations. Look for experienced professionals who can offer valuable insights and advice.

- Attend industry events and networking opportunities. These events are great places to connect with potential mentors.

- Actively engage with your mentor and seek their advice. Build a strong relationship with your mentor and ask for their feedback on your job search strategy.

Stay Updated on Industry Trends in Private Credit

The private credit market is dynamic. Staying informed is crucial.

Continuous Learning

The private credit market is constantly evolving. Stay informed about the latest trends and developments.

- Read industry publications and research reports. Stay up-to-date on market trends and regulatory changes.

- Attend industry conferences and webinars. These events provide valuable insights and networking opportunities.

- Follow key industry influencers on social media. Connect with thought leaders and stay abreast of the latest developments.

Conclusion

Securing a private credit role requires dedication and strategic planning. By developing in-demand skills, tailoring your application materials, acing the interview process, leveraging your network, and staying updated on industry trends, you significantly increase your chances of success. Remember to continually refine your skills and network within the private credit community. Start implementing these five tips today to boost your chances of securing your ideal private credit role!

Featured Posts

-

Dylan Farrows Accusations Against Woody Allen Sean Penns Skepticism

May 25, 2025

Dylan Farrows Accusations Against Woody Allen Sean Penns Skepticism

May 25, 2025 -

Rising Global Forest Loss The Devastating Impact Of Wildfires

May 25, 2025

Rising Global Forest Loss The Devastating Impact Of Wildfires

May 25, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Importance

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Importance

May 25, 2025 -

Buy And Hold Investing The Long Games Gut Wrenching Reality

May 25, 2025

Buy And Hold Investing The Long Games Gut Wrenching Reality

May 25, 2025 -

Climate Change And The Rise Of Invasive Fungi A Growing Health Concern

May 25, 2025

Climate Change And The Rise Of Invasive Fungi A Growing Health Concern

May 25, 2025

Latest Posts

-

Coheres Copyright Infringement Case A Legal Analysis

May 25, 2025

Coheres Copyright Infringement Case A Legal Analysis

May 25, 2025 -

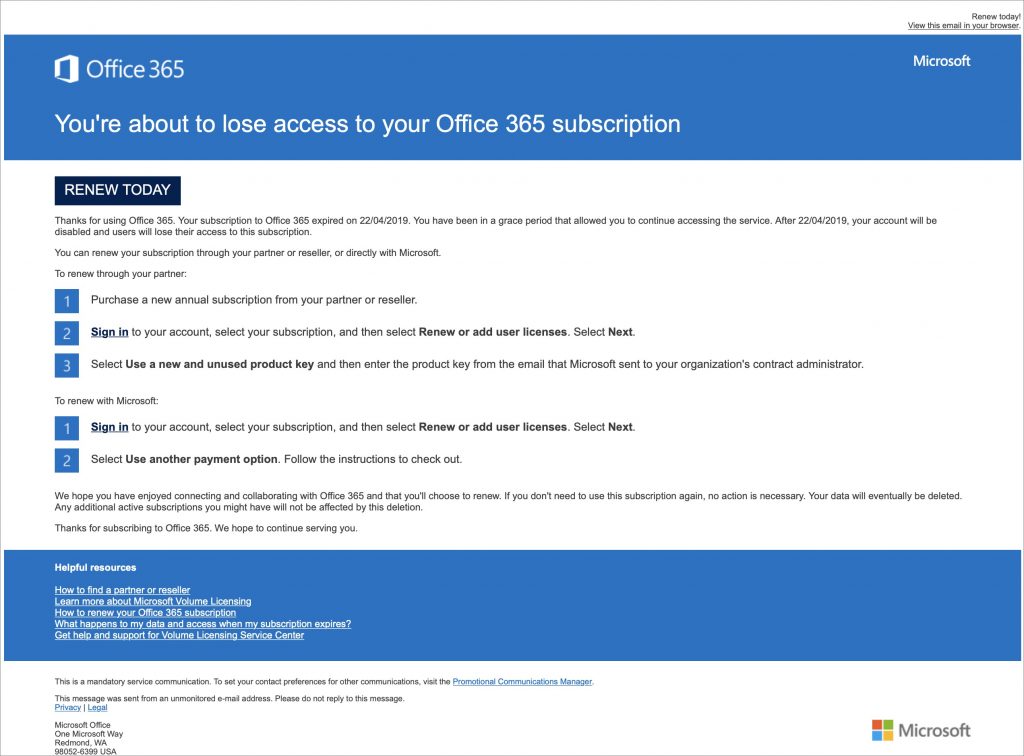

Crooks Office365 Hack Of Executive Inboxes Yields Millions Say Federal Officials

May 25, 2025

Crooks Office365 Hack Of Executive Inboxes Yields Millions Say Federal Officials

May 25, 2025 -

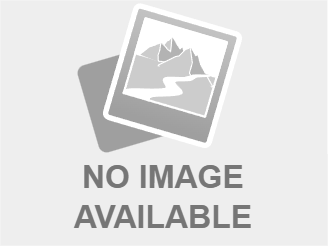

Organic Growth Takes Precedence Cenovus Ceo On Potential Meg Acquisition

May 25, 2025

Organic Growth Takes Precedence Cenovus Ceo On Potential Meg Acquisition

May 25, 2025 -

Cenovus Rejects Meg Bid Speculation Highlights Organic Growth Strategy

May 25, 2025

Cenovus Rejects Meg Bid Speculation Highlights Organic Growth Strategy

May 25, 2025 -

Office365 Intrusion Nets Millions For Crook According To Federal Authorities

May 25, 2025

Office365 Intrusion Nets Millions For Crook According To Federal Authorities

May 25, 2025