Cenovus Rejects MEG Bid Speculation, Highlights Organic Growth Strategy

Table of Contents

Cenovus's Official Statement on MEG Energy Bid Speculation

While Cenovus hasn't explicitly confirmed a formal bid from MEG Energy, the company issued a statement addressing market speculation regarding a potential acquisition. Although specific details of the purported bid remain undisclosed, Cenovus firmly rejected any such proposal. The company's reasoning, as communicated through press releases and official channels, centers on its belief that the proposed valuation didn't adequately reflect Cenovus's intrinsic value and future growth potential. The rejection also highlighted the strategic incompatibility of the two companies' operational focus and long-term vision.

- Specific details of the rejected bid (if any): While details are scant, market analysts suggest the proposed deal involved a substantial premium over Cenovus's prevailing market capitalization. However, Cenovus felt this premium didn't align with its long-term value creation plans.

- Key reasons cited by Cenovus for the rejection: Cenovus emphasized its confidence in its existing organic growth strategy, believing it offers superior long-term shareholder value compared to a potential acquisition. Concerns about potential regulatory hurdles and integration challenges also likely played a role.

- Mention any potential legal implications or regulatory hurdles: The rejection of an unspecified bid avoids any legal entanglement and complex regulatory processes potentially associated with a merger or acquisition. This streamlines Cenovus's focus on its internal growth plans.

Cenovus's Commitment to Organic Growth

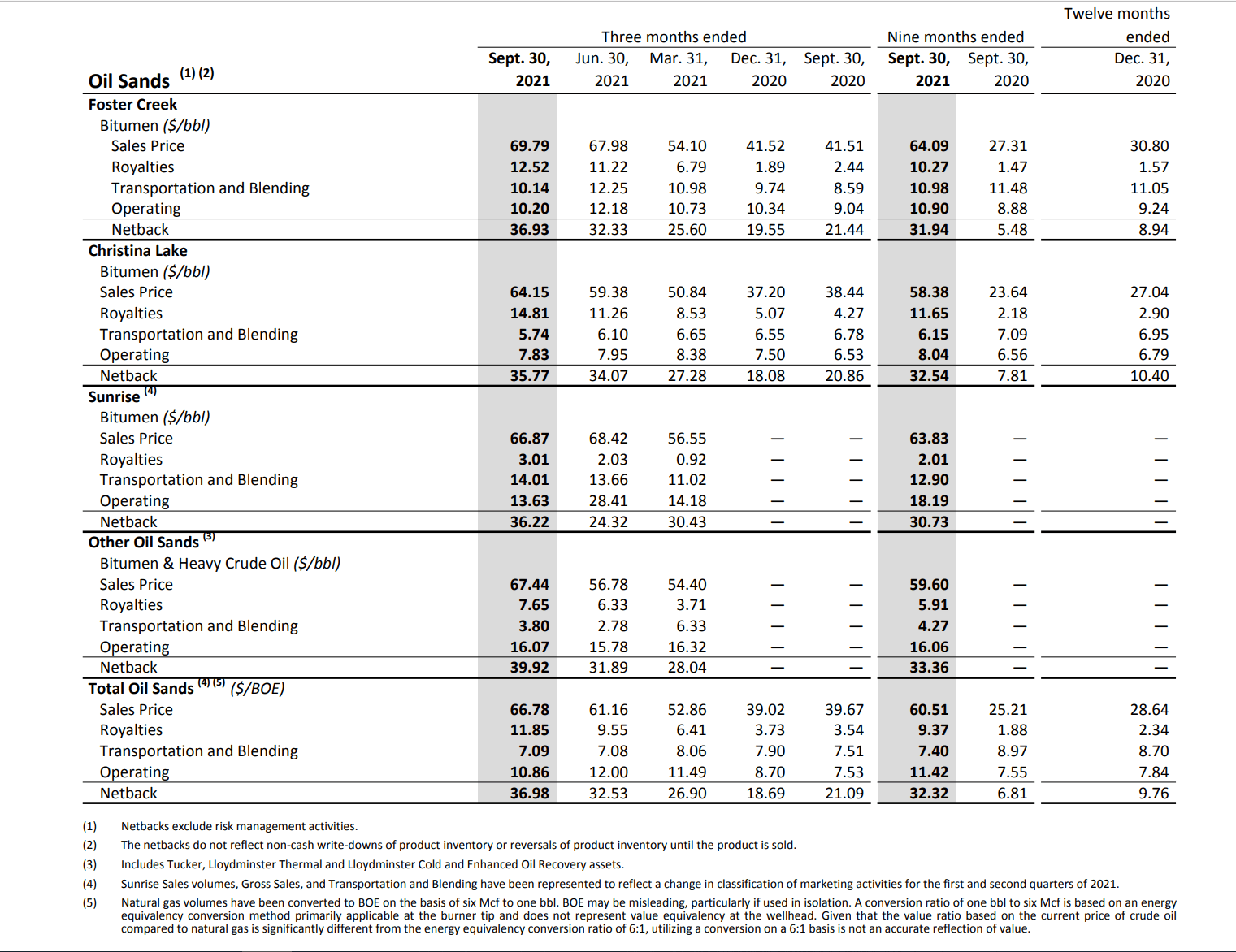

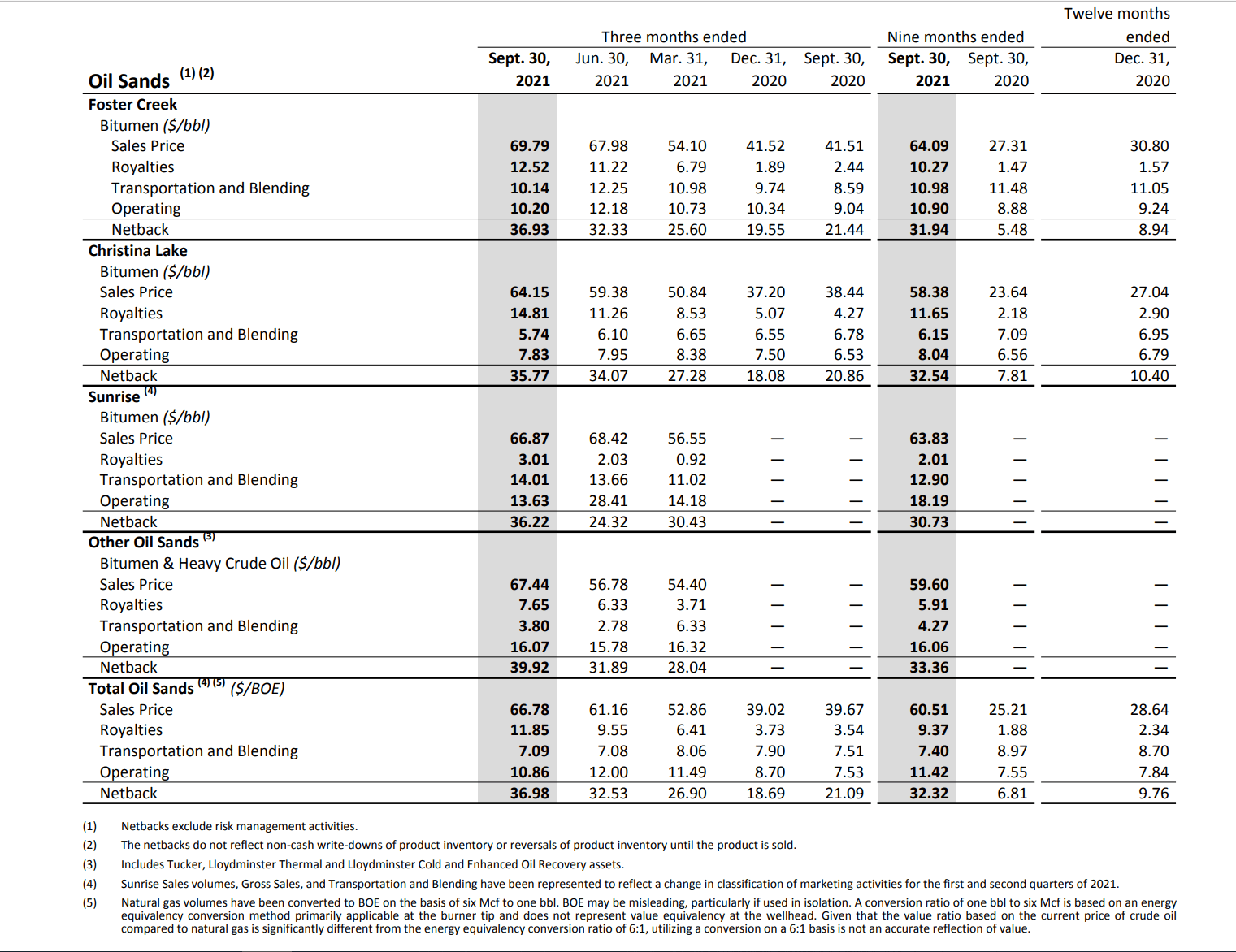

Cenovus's organic growth strategy focuses on maximizing value from its existing assets and operational expertise. This approach contrasts with acquisitions, which inherently carry higher risk and integration costs. Cenovus's strategy involves targeted capital expenditure in exploration and production, particularly within its oil sands operations. This includes initiatives to enhance operational efficiency and reduce costs across its upstream and downstream operations. This strategic decision minimizes external financial risks and fosters a more sustainable growth trajectory.

- Specific examples of organic growth projects: This includes investments in new well development projects within its existing oil sands leases, upgrades to its refining infrastructure, and improved technological applications for enhanced oil recovery.

- Projected increases in production capacity and revenue: Cenovus projects substantial increases in both production capacity and revenue over the coming years, driven by these organic growth initiatives and improved operational efficiency.

- Details about planned investments in technology and innovation: Significant investments are being made in advanced technologies to enhance drilling efficiency, optimize production processes, and reduce environmental impact.

- Expected timeline for achieving growth targets: Cenovus has outlined a clear timeline, with specific milestones and targets for production growth and cost reduction over the next 3-5 years.

Financial Implications of the Rejected Bid and Organic Growth Focus

The financial implications of choosing organic growth over an acquisition are significant. While a successful acquisition could potentially lead to immediate gains, the associated risks and integration complexities could offset these benefits. Cenovus's management believes that its organic growth strategy offers a more predictable path to increased shareholder value and long-term profitability. The projected return on investment (ROI) for organic growth initiatives is deemed more favorable compared to the uncertainties associated with a merger.

- Projected financial gains/losses under each scenario: While precise figures are unavailable regarding the rejected bid, Cenovus's internal projections for organic growth indicate substantial increases in revenue, profit margins, and ultimately, shareholder returns.

- Assessment of the long-term strategic benefits of organic growth: The long-term benefits encompass reduced financial risk, greater control over operational decisions, and better alignment with Cenovus's core competencies.

- Comparison of financial risks associated with both approaches: The organic growth approach represents a lower-risk strategy, compared to the considerable financial and operational uncertainties associated with a large-scale acquisition.

Market Reaction and Investor Sentiment

The market's reaction to Cenovus's announcement has been mixed. While the initial response saw a slight dip in the stock price, it quickly rebounded, indicating investor confidence in the company's chosen strategy. Trading volume increased significantly following the news, reflecting heightened investor interest. Many analysts view Cenovus's focus on organic growth favorably, praising the company's commitment to a sustainable and less risky approach to growth.

- Stock price fluctuations after the announcement: The initial dip was short-lived, indicating a swift recovery of investor confidence in Cenovus's long-term strategy.

- Analyst ratings and predictions: Many analysts have upgraded their ratings for Cenovus following the announcement, reflecting a more positive outlook on the company's prospects.

- Key factors influencing investor sentiment: Investor confidence is driven by Cenovus's clear organic growth strategy, its strong financial position, and the potential for significant returns through focused internal expansion.

Conclusion

Cenovus Energy's decision to reject speculated merger or acquisition attempts by MEG Energy and embrace an organic growth strategy represents a significant strategic shift. This commitment prioritizes internal expansion, operational efficiency, and sustainable growth, minimizing financial risk and potentially delivering superior long-term returns for shareholders. The market's overall positive response underscores investor confidence in this approach. Follow Cenovus's organic growth journey by visiting their investor relations website for updates on their progress and future announcements. Learn more about Cenovus's long-term strategy and its commitment to maximizing shareholder value through organic growth initiatives at [link to Cenovus investor relations website].

Featured Posts

-

Sharp Decline In Amsterdam Stock Market 7 Drop At Open Due To Trade War

May 25, 2025

Sharp Decline In Amsterdam Stock Market 7 Drop At Open Due To Trade War

May 25, 2025 -

Investing In Apple Aapl Identifying Crucial Price Levels

May 25, 2025

Investing In Apple Aapl Identifying Crucial Price Levels

May 25, 2025 -

Is News Corps Stock Price Underestimating Its True Worth

May 25, 2025

Is News Corps Stock Price Underestimating Its True Worth

May 25, 2025 -

Is The Dax Party Over The Threat Of A Wall Street Recovery

May 25, 2025

Is The Dax Party Over The Threat Of A Wall Street Recovery

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025

Latest Posts

-

Los Hijos De Alberto De Monaco Hacen Su Primera Comunion

May 25, 2025

Los Hijos De Alberto De Monaco Hacen Su Primera Comunion

May 25, 2025 -

Francis Sultana Designing The Interiors Of Robuchon Restaurants In Monaco

May 25, 2025

Francis Sultana Designing The Interiors Of Robuchon Restaurants In Monaco

May 25, 2025 -

Vestidos Iconicos El Baile De La Rosa 2025 Y Sus Looks Mas Memorables

May 25, 2025

Vestidos Iconicos El Baile De La Rosa 2025 Y Sus Looks Mas Memorables

May 25, 2025 -

Rsmya Mwnakw Ymdd Eqd Takwmy Mynamynw

May 25, 2025

Rsmya Mwnakw Ymdd Eqd Takwmy Mynamynw

May 25, 2025 -

Primera Comunion De Jacques Y Gabriella De Monaco Fotos Y Detalles

May 25, 2025

Primera Comunion De Jacques Y Gabriella De Monaco Fotos Y Detalles

May 25, 2025