Analysis: Japan's Economic Contraction Before US Tariff Hikes

Table of Contents

Pre-existing Economic Weaknesses in Japan

Before the threat of US tariffs loomed large, Japan's economy was already facing headwinds. Several pre-existing weaknesses contributed to the slowing growth, creating a vulnerable foundation that amplified the impact of external shocks.

Domestic Demand Stagnation

Sluggish consumer spending and investment were significant factors contributing to Japan's economic contraction. Several internal factors hindered economic dynamism:

- Low wage growth: Despite years of Abenomics, wage growth remained stubbornly low, limiting consumer spending power.

- Aging population: Japan's rapidly aging population led to a shrinking workforce and reduced consumption.

- High household debt: High levels of household debt constrained consumer spending and reduced economic vitality.

- Lack of business investment: Businesses remained hesitant to invest, hampered by uncertainty and low returns.

Abenomics, despite its ambitious goals, had limited success in stimulating sustainable growth and addressing these deep-seated issues. The program's impact on boosting domestic demand and fostering robust economic expansion proved insufficient to counter the emerging economic challenges.

Global Economic Slowdown

Japan's economy, heavily reliant on exports, is acutely sensitive to global economic conditions. The pre-tariff contraction coincided with a broader slowdown in the global economy:

- Slowing global trade: A decline in global trade volumes directly impacted Japan's export-oriented industries.

- Uncertainties in the European Union: Economic instability and political uncertainty in the EU negatively affected global demand and investor confidence.

- Emerging market vulnerabilities: Weaknesses in several emerging markets further dampened global economic growth and reduced demand for Japanese goods.

This interconnected global economic landscape highlights Japan's vulnerability to external shocks. As an export-oriented nation, any downturn in global demand significantly impacts its economic performance.

The Impact of Anticipated US Tariffs

The threat of US tariffs, even before implementation, introduced significant uncertainty into the Japanese economy, exacerbating existing weaknesses.

Uncertainty and Investor Sentiment

The looming prospect of tariffs created considerable uncertainty among businesses and investors, leading to a decline in economic activity:

- Reduced business confidence: Businesses postponed investment plans, fearing reduced competitiveness and market access.

- Postponed investment plans: Uncertainty surrounding future trade relations discouraged long-term investment decisions.

- Decreased exports to the US: The anticipation of tariffs led to a decline in exports to the US, impacting key sectors of the Japanese economy.

This uncertainty itself acted as a significant economic drag, even before the tariffs were actually imposed, highlighting the psychological impact of trade disputes on economic activity.

Specific Sectors Affected

Certain Japanese industries faced a disproportionate impact from the anticipated tariffs:

- Automotive: The automotive industry, a major exporter to the US, felt the pressure of potential tariffs acutely.

- Electronics: The electronics sector, another significant exporter to the US, also experienced decreased demand and investment due to the anticipated tariffs.

- Agricultural products: Japanese agricultural exports to the US faced potential significant disruptions and reduced competitiveness.

Analyzing the export volume and value of these sectors to the US market reveals the substantial contribution of these industries to the overall economic contraction.

Other Contributing Factors

Beyond pre-existing weaknesses and the looming tariffs, other factors contributed to Japan's economic contraction.

Natural Disasters

Japan's geography makes it vulnerable to natural disasters, which can significantly disrupt economic activity:

- Damage to infrastructure: Typhoons and other natural disasters caused damage to infrastructure, disrupting supply chains and increasing reconstruction costs.

- Disruption to production: Natural disasters directly impacted production, leading to output losses and reduced economic activity.

- Increased costs: The costs associated with disaster recovery and rebuilding further strained the economy.

Quantifying the economic impact of these disasters using relevant statistics paints a clearer picture of their contribution to the overall economic downturn.

Yen Appreciation

The strengthening of the yen against other currencies negatively impacted Japanese exports:

- Reduced export competitiveness: A stronger yen made Japanese goods more expensive in international markets, reducing their competitiveness.

- Lower export volumes: The reduced competitiveness led to lower export volumes, impacting economic growth.

Understanding the relationship between currency fluctuations and economic growth is essential in analyzing Japan's economic performance during this period.

Conclusion

Japan's economic contraction before the implementation of US tariffs was a multifaceted issue. While the anticipated tariffs contributed to uncertainty and negatively impacted investor sentiment, pre-existing weaknesses in domestic demand and the broader global economic slowdown played equally significant roles. The interplay of these internal and external factors created a perfect storm, highlighting Japan's vulnerability to both internal economic weaknesses and external global shocks. Further research is necessary to fully disentangle the specific contribution of each factor. To gain a more comprehensive understanding of this period, continued analysis of Japan's economic contraction and the intricate interplay of contributing factors is essential.

Featured Posts

-

Trumps Vip Military Events Exclusive Access For Donors Revealed

May 17, 2025

Trumps Vip Military Events Exclusive Access For Donors Revealed

May 17, 2025 -

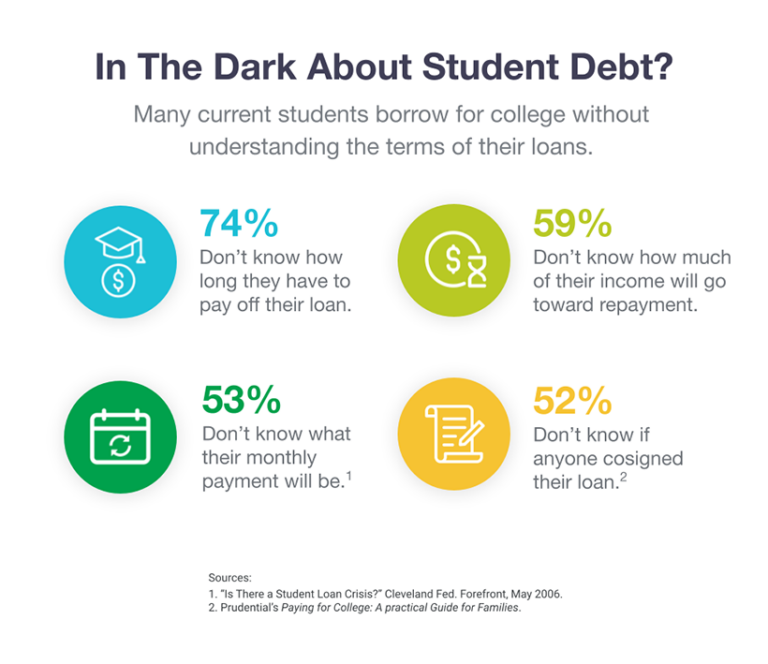

Ignoring Student Loan Payments The Impact On Your Credit Score

May 17, 2025

Ignoring Student Loan Payments The Impact On Your Credit Score

May 17, 2025 -

Nbas No Call Controversy Pistons Game 4 Loss And The Aftermath

May 17, 2025

Nbas No Call Controversy Pistons Game 4 Loss And The Aftermath

May 17, 2025 -

Creatine For Beginners A Simple Explanation

May 17, 2025

Creatine For Beginners A Simple Explanation

May 17, 2025 -

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Halt

May 17, 2025

Double Trouble In Hollywood Writers And Actors Strike Brings Industry To Halt

May 17, 2025

Latest Posts

-

Is Refinancing Federal Student Loans Worth It

May 17, 2025

Is Refinancing Federal Student Loans Worth It

May 17, 2025 -

Navigating Home Buying With Existing Student Loan Payments

May 17, 2025

Navigating Home Buying With Existing Student Loan Payments

May 17, 2025 -

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025 -

When Does Refinancing Federal Student Loans Make Sense

May 17, 2025

When Does Refinancing Federal Student Loans Make Sense

May 17, 2025 -

Federal Student Loan Refinancing A Comprehensive Guide

May 17, 2025

Federal Student Loan Refinancing A Comprehensive Guide

May 17, 2025