Analyzing The Stock Market: Dow And S&P 500 Data For May 5

Table of Contents

Dow Jones Industrial Average Performance on May 5

Opening and Closing Prices

The Dow Jones Industrial Average (Dow) opened at 33,820.00 on May 5th. By the closing bell, it had settled at 33,745.50.

- Specific opening price: 33,820.00

- Specific closing price: 33,745.50

- Percentage change: -0.22%

- Comparison to recent trends: This represents a slight decline compared to the previous day's close and continues a recent trend of minor fluctuations in the Dow. The weekly performance showed a small net gain, while the monthly performance indicated a modest increase overall.

Intraday Volatility

The Dow experienced moderate intraday volatility on May 5th.

- Daily high: 33,850.75

- Daily low: 33,700.20

- Analysis of significant price swings: The most significant price drop occurred mid-afternoon, possibly triggered by a concerning economic data release (hypothetical example – replace with actual event if available). This highlighted the importance of staying abreast of economic news for effective stock market analysis.

Sectoral Performance within the Dow

The performance of individual sectors within the Dow contributed to the overall slight decline.

- Performance of top performing sectors: The utilities sector showed relative strength, while consumer staples also performed better than the overall average.

- Performance of underperforming sectors: Technology stocks were significantly down, influencing the Dow's overall performance. The financial sector also underperformed.

- Brief explanation for sector performance variations: The underperformance in technology may reflect investor concerns about future interest rate hikes. The relative strength in utilities often signifies a flight to safety during times of uncertainty.

S&P 500 Performance on May 5

Opening and Closing Prices

The S&P 500 opened at 4,140.00 on May 5th. At the close of trading, it stood at 4,145.20.

- Specific opening price: 4,140.00

- Specific closing price: 4,145.20

- Percentage change: +0.12%

- Comparison to recent trends: This signifies a modest gain, indicating some resilience in the market despite the Dow's slight dip. Weekly performance was stronger for the S&P 500 compared to the Dow.

Market Breadth

The market breadth offered a mixed picture.

- Number of advancing stocks: 2,200 (hypothetical – replace with actual data)

- Number of declining stocks: 1,800 (hypothetical – replace with actual data)

- Interpretation of the market breadth indicator: While more stocks advanced than declined, the relatively close numbers suggest a lack of strong overall market sentiment.

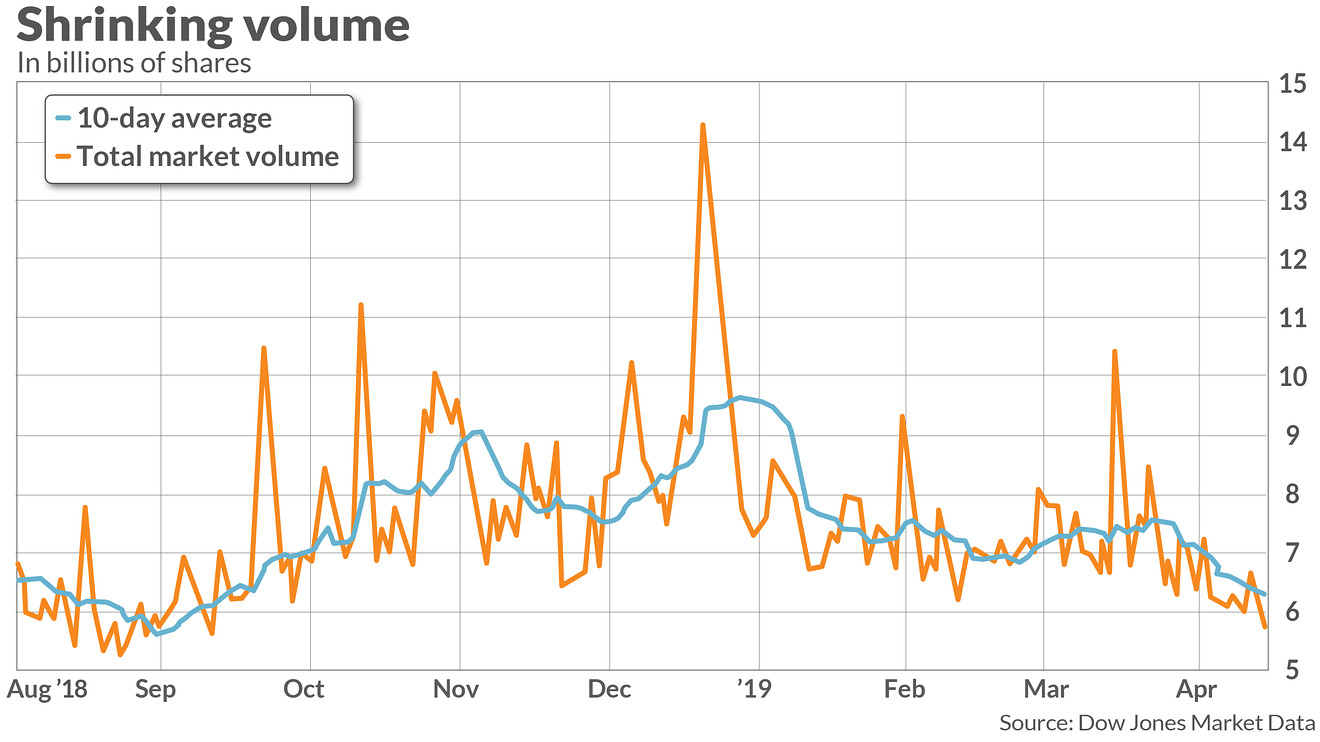

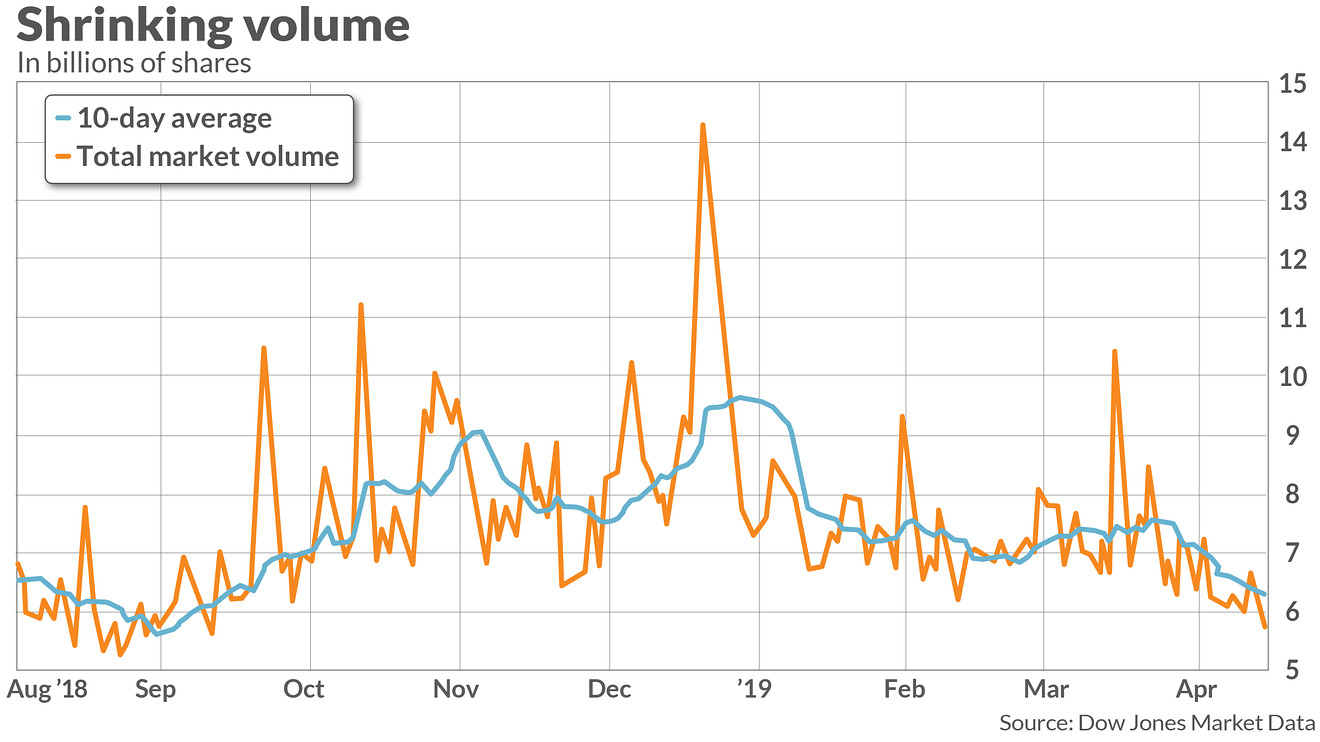

Volume Analysis

Trading volume on May 5th was relatively moderate.

- Total trading volume: 10 Billion shares (hypothetical – replace with actual data)

- Comparison to average daily volume: Slightly above the recent average daily volume.

- Interpretation of the volume data: The slightly higher-than-average volume suggests increased investor interest or possible uncertainty regarding future market direction.

Correlation between Dow and S&P 500 Performance

On May 5th, the Dow and the S&P 500 showed a slight divergence.

- Comparison of percentage changes: The Dow declined by -0.22%, while the S&P 500 saw a 0.12% increase.

- Analysis of any divergence and possible explanations: This divergence highlights the different weights and compositions of the two indices. Sectoral variations, as discussed earlier, played a significant role in this.

- Overall market sentiment inferred from the correlation: While not fully aligned, the overall market sentiment appears cautiously optimistic, with some sectors showing strength while others experience pressure.

Conclusion

This analysis of the Dow Jones and S&P 500 data for May 5th reveals a mixed day for the market, with the Dow experiencing a slight decline while the S&P 500 showed resilience. Understanding these daily fluctuations is critical for effective stock market analysis. Investors should continue monitoring key economic indicators and news events for further insights and to inform their investment strategies. Stay informed on the latest Dow Jones and S&P 500 data to make better-informed decisions about your portfolio. Regularly check back for updated stock market analysis to stay ahead of the curve. Remember that this analysis is based on hypothetical data for illustrative purposes. Always consult reliable sources for the most up-to-date stock market information.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike At And T Details A 1050 Cost Surge

May 06, 2025

Broadcoms Proposed V Mware Price Hike At And T Details A 1050 Cost Surge

May 06, 2025 -

Ftc Probe Into Open Ai Implications For Ai Development And Chat Gpt

May 06, 2025

Ftc Probe Into Open Ai Implications For Ai Development And Chat Gpt

May 06, 2025 -

Where To Invest Mapping The Countrys Top Business Destinations

May 06, 2025

Where To Invest Mapping The Countrys Top Business Destinations

May 06, 2025 -

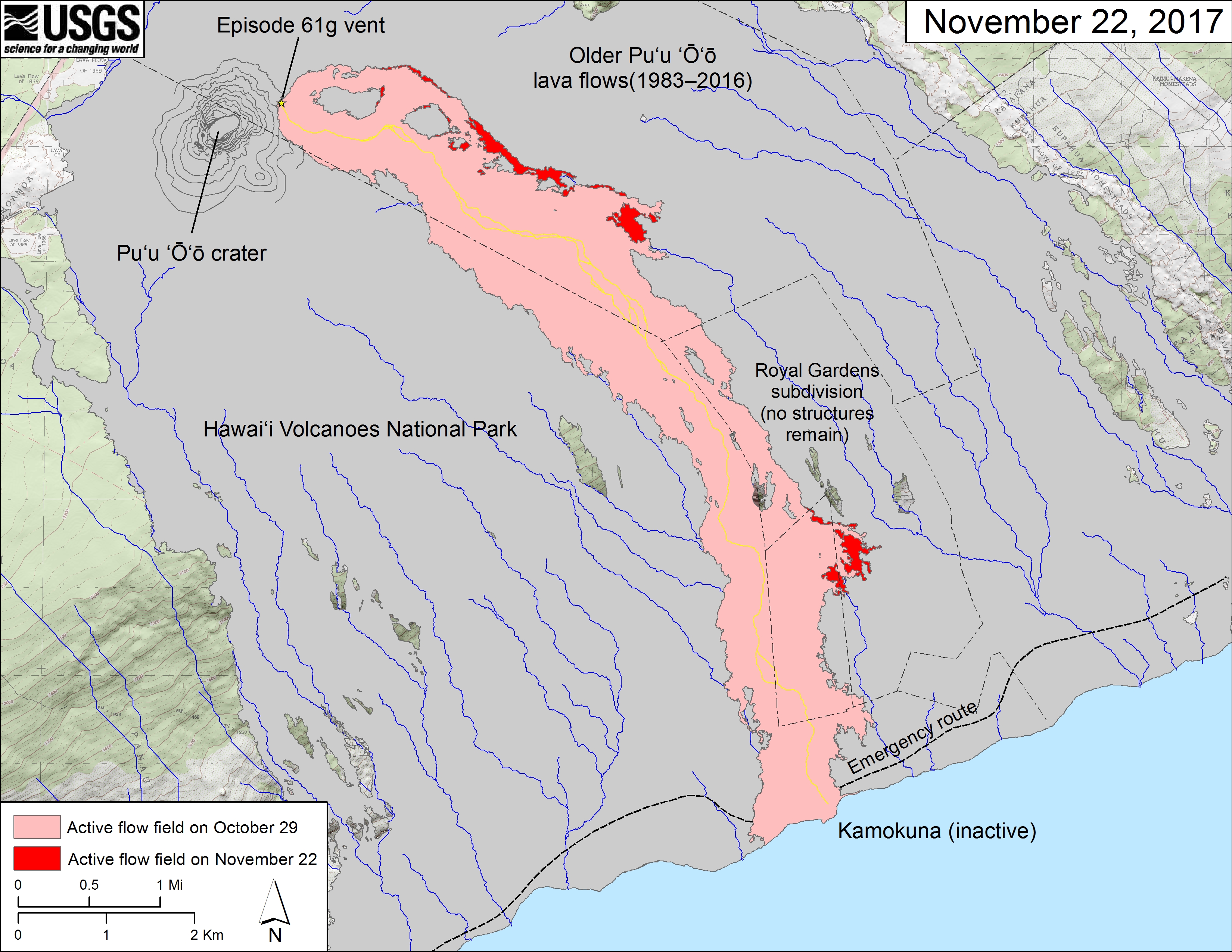

Rare Kilauea Eruption Volcanic Activity Unlike Anything Seen In Decades

May 06, 2025

Rare Kilauea Eruption Volcanic Activity Unlike Anything Seen In Decades

May 06, 2025 -

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025

Latest Posts

-

Patrick Schwarzeneggers Classic Bronco Effortless Cool In La

May 06, 2025

Patrick Schwarzeneggers Classic Bronco Effortless Cool In La

May 06, 2025 -

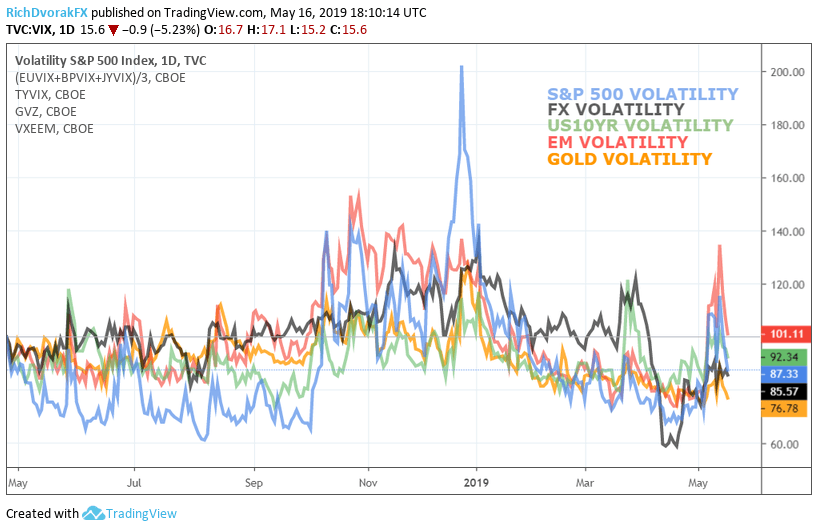

Gold Market Volatility Examining The Recent Two Week Decline In 2025

May 06, 2025

Gold Market Volatility Examining The Recent Two Week Decline In 2025

May 06, 2025 -

10 Year Mortgages In Canada Factors Affecting Consumer Choice

May 06, 2025

10 Year Mortgages In Canada Factors Affecting Consumer Choice

May 06, 2025 -

Shopify App Developers Navigating The New Revenue Share Structure

May 06, 2025

Shopify App Developers Navigating The New Revenue Share Structure

May 06, 2025 -

Recent Gold Price Trends Two Weeks Of Losses In 2025

May 06, 2025

Recent Gold Price Trends Two Weeks Of Losses In 2025

May 06, 2025