Beijing's Trade War Losses: A Deeper Dive Into The Economic Realities

Table of Contents

The Impact on Export-Oriented Industries

The trade war significantly hampered Beijing's export-oriented industries, leading to a decline in production and job losses.

Decline in Manufacturing Exports

Beijing's manufacturing sector, a cornerstone of its economy, experienced a sharp decline in exports. The trade war impact on manufacturing was particularly acute in sectors like electronics, textiles, and machinery.

- Reduced Exports of Electronics: Exports of smartphones, computers, and other electronics from Beijing-based manufacturers decreased by an estimated 15% in the peak years of the trade war, according to data from the Ministry of Commerce. This impacted major players and resulted in factory closures and job cuts.

- Textile Industry Downturn: The textile and apparel industry suffered a similar fate, with export volumes falling by approximately 12%, impacting numerous small and medium-sized enterprises (SMEs) within Beijing's industrial zones.

- Machinery Exports Hit Hard: Exports of machinery and equipment, crucial for China's infrastructure development, also saw a noticeable decline, negatively affecting both large state-owned enterprises and private companies. The tariff effects on Chinese exports made Beijing's products less competitive globally.

The overall decline in manufacturing exports contributed significantly to Beijing's trade war losses.

Reduced Foreign Direct Investment (FDI)

The trade war significantly discouraged foreign direct investment (FDI) in Beijing. The uncertainty surrounding future tariffs and the escalating trade tensions created a climate of apprehension among foreign investors.

- Sharp Decline in FDI Inflows: Data indicates a substantial reduction in FDI inflows into Beijing during the trade war period. Many multinational corporations delayed or canceled investment plans, opting for alternative locations with more predictable trade environments.

- Reasons for Decreased Investment: The primary reasons cited for this decrease were the increased costs associated with tariffs, the uncertainty surrounding future trade policies, and a general downturn in global investment confidence. The trade war FDI impact on Beijing was far-reaching, affecting job creation and long-term economic growth.

- Impact on Job Creation: The reduction in FDI translated to fewer job opportunities, impacting not only foreign-owned companies but also the local businesses that support them.

Agricultural Sector Challenges

The trade war also presented significant challenges to Beijing's agricultural sector, impacting both imports and exports.

Disruption of Supply Chains

The trade war disrupted agricultural supply chains, affecting both the import and export of agricultural products.

- Soybean Trade Disruption: The imposition of tariffs on US soybeans severely impacted China's reliance on US imports, forcing a search for alternative suppliers and impacting pricing. This exemplifies the broader trade war agriculture impact on China's food security.

- Impact on Farmers and Businesses: The disruption caused significant challenges for farmers and agricultural businesses, forcing adjustments in production and marketing strategies.

- Reduced Agricultural Exports: Beijing’s agricultural exports also experienced setbacks, facing increased tariffs in various international markets, further adding to the agricultural export losses.

Increased Domestic Food Prices

The disruptions in agricultural supply chains led to increased domestic food prices in Beijing.

- Price Increases for Key Commodities: Prices of soybeans, pork, and other key agricultural commodities experienced noticeable increases, impacting consumer budgets.

- Impact on Consumers: The increased food prices put a strain on household budgets, particularly impacting low-income families.

- Government Responses: The government implemented measures to mitigate price volatility and ensure food security, but the impact of the trade war on food prices remained significant. The trade war food security implications for Beijing were concerning.

The Ripple Effect on Related Industries

The impact of the trade war extended beyond the directly affected sectors, creating a ripple effect across related industries.

Logistics and Transportation

The reduced trade volume significantly impacted Beijing's logistics and transportation sectors.

- Decreased Shipping Activity: Shipping companies experienced a reduction in cargo volume, leading to decreased revenue and potential job losses.

- Job Losses in the Sector: The downturn in shipping activity resulted in job losses within the logistics and transportation industries, both directly and indirectly.

- Impact on Related Industries: Warehousing, freight forwarding, and other related industries also suffered as a consequence of the reduced trade flow. The trade war logistics impact on Beijing was substantial.

Financial Market Volatility

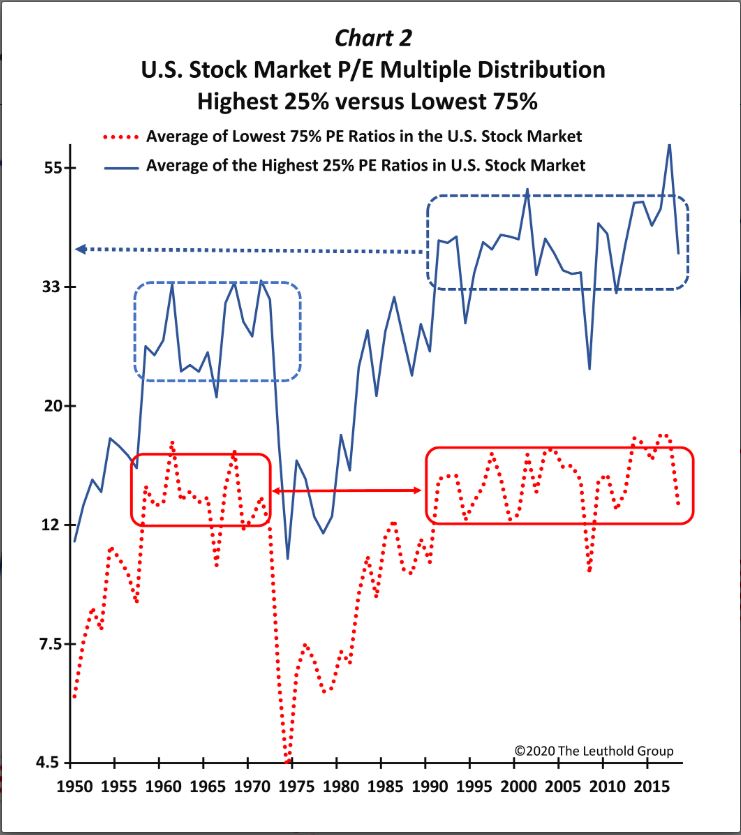

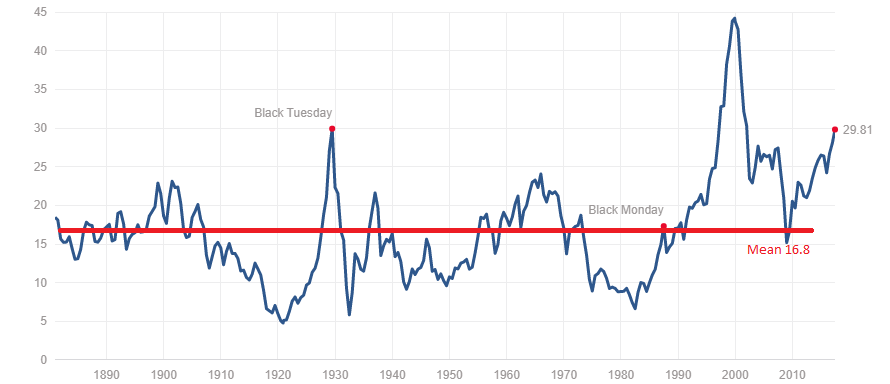

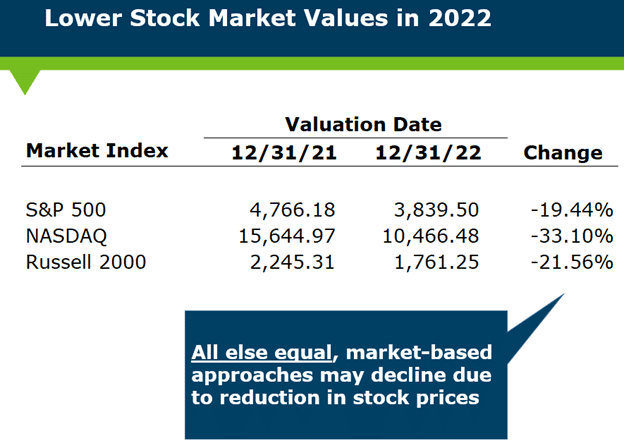

The trade war introduced significant volatility into Beijing's financial markets.

- Stock Market Fluctuations: The Beijing stock market experienced considerable fluctuations in response to the escalating trade tensions, reflecting investor uncertainty.

- Investor Sentiment: Investor sentiment turned negative, leading to capital flight and decreased investment in both the stock market and the broader economy.

- Government Interventions: The government implemented various measures to stabilize the market and boost investor confidence, but the impact of the trade war on financial markets remained considerable. The trade war financial markets impact in Beijing underscores the interconnectedness of the global economy.

Conclusion

The US-China trade war inflicted substantial economic losses on Beijing, impacting key sectors like manufacturing, agriculture, and logistics. The decline in exports, reduced FDI, and disruptions to supply chains resulted in significant economic hardship. The long-term implications are complex and still unfolding, including potential shifts in Beijing's economic strategy and the need for greater diversification. To understand the full scope of Beijing's trade war losses and their ongoing effects, further research is crucial. Explore additional resources on the economic implications of this pivotal period in Sino-American relations to gain a deeper understanding of the lasting impact of these trade war losses on Beijing’s economic development.

Featured Posts

-

Leaked Texts Expose Heated Confrontation Between Farage And Lowe

May 03, 2025

Leaked Texts Expose Heated Confrontation Between Farage And Lowe

May 03, 2025 -

Le Discours De Macron Au Gabon Une Rupture Avec La Francafrique

May 03, 2025

Le Discours De Macron Au Gabon Une Rupture Avec La Francafrique

May 03, 2025 -

Reform Uk Facing Exodus Branch Officers Quit Over Mp Treatment

May 03, 2025

Reform Uk Facing Exodus Branch Officers Quit Over Mp Treatment

May 03, 2025 -

Tragedy Spurs Generosity Kendals Poppy Atkinson Fundraiser Success

May 03, 2025

Tragedy Spurs Generosity Kendals Poppy Atkinson Fundraiser Success

May 03, 2025 -

Macron Au Gabon La Fin De La Francafrique

May 03, 2025

Macron Au Gabon La Fin De La Francafrique

May 03, 2025

Latest Posts

-

Why Elevated Stock Market Valuations Shouldnt Deter Investors Bof A

May 04, 2025

Why Elevated Stock Market Valuations Shouldnt Deter Investors Bof A

May 04, 2025 -

Stock Market Valuations Bof As Reassurance For Investors

May 04, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 04, 2025 -

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025 -

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025