Buffett's Departure: What's Next For Berkshire Hathaway's Apple Investment?

Table of Contents

The Significance of Buffett's Influence on Berkshire Hathaway's Investment Strategy

Buffett's influence on Berkshire Hathaway's investment strategy, particularly regarding Apple, is undeniable. His long-term value investing philosophy, characterized by patience and a focus on fundamentally strong companies, guided the initial investment and its sustained growth. His personal involvement, built on thorough due diligence and a deep understanding of Apple's business model, played a crucial role in the decision-making process.

- Buffett's emphasis on value investing: The Oracle of Omaha famously prioritizes companies with strong fundamentals, sustainable competitive advantages, and a clear path to long-term growth. Apple, with its powerful brand, loyal customer base, and recurring revenue streams, perfectly fits this model.

- His trust in Apple's long-term prospects: Buffett recognized Apple's potential early on and has consistently expressed confidence in its ability to navigate the ever-changing technological landscape. This unwavering belief solidified the investment strategy.

- The impact of his reputation on investor confidence: Buffett's reputation for shrewd investment decisions significantly boosted investor confidence in Apple. His endorsement acted as a powerful signal, further driving up Apple's stock price and making the Berkshire Hathaway investment even more lucrative.

Potential Scenarios After Buffett's Departure

Several scenarios could unfold regarding Berkshire Hathaway's Apple investment after Buffett’s departure. These range from maintaining the status quo to a complete divestment.

Maintaining the Status Quo

One possibility is that Berkshire Hathaway will maintain its current Apple investment strategy under new leadership. This involves continuing to hold the substantial Apple stake, reinvesting dividends, and potentially increasing holdings as opportunities arise. The success of this strategy hinges on the expertise and investment philosophy of the new management team, which possesses significant financial acumen. Continued growth and a strong dividend policy would likely solidify this approach.

Partial or Gradual Divestment

Another scenario involves a gradual reduction of Berkshire Hathaway's Apple holdings. Reasons for this could include portfolio diversification, rebalancing, or a shift in investment priorities under new leadership. A partial divestment would likely be implemented strategically, minimizing market impact. However, such a move would undoubtedly cause some market volatility as investors react to the change in Berkshire Hathaway's position.

A Complete Sale of Apple Shares

While less likely, a complete sale of Berkshire Hathaway's Apple stake remains a possibility. This drastic move might be driven by unforeseen circumstances, such as a significant shift in the tech industry landscape, a change in Apple’s fundamentals, or a complete overhaul of Berkshire Hathaway's investment philosophy under new management. A complete sell-off would create significant market ripples, potentially leading to a substantial drop in Apple's stock price in the short term.

The Impact on Apple's Stock Price

Berkshire Hathaway's significant stake in Apple has a profound impact on the company's stock valuation. Any changes to that stake, regardless of the scenario, will cause market fluctuations.

- Short-term volatility: A sudden announcement of a partial or complete divestment would likely cause short-term volatility in Apple's stock price as investors react to the news.

- Long-term market stability: In the long run, however, the impact might be less pronounced, particularly if the changes are strategically managed. Apple's fundamental strength will likely continue to support its stock price.

- Impact on investor sentiment: Investor sentiment plays a significant role. A perceived shift in confidence in Apple by Berkshire Hathaway could negatively affect investor sentiment, at least in the short term.

Berkshire Hathaway's Succession Plan and its Role

Berkshire Hathaway's succession plan will play a crucial role in determining the future of its Apple investment. The expertise and investment philosophies of the individuals who succeed Buffett will shape investment decisions. The level of continuity in the investment strategy will significantly influence investor confidence and market reactions. A smooth transition and a clear communication of the new investment strategy are key to minimizing uncertainty.

Conclusion: The Future of Berkshire Hathaway's Apple Investment Post-Buffett

The future of Berkshire Hathaway's Apple investment after Buffett's departure is uncertain, with several potential scenarios ranging from maintaining the status quo to a complete divestment. Buffett's influence on the investment strategy has been profound, and any changes will undoubtedly cause market fluctuations. The success of Berkshire Hathaway's future Apple strategy depends on effective succession planning, a clear communication of the new investment approach, and the expertise of the next generation of investment managers. To stay abreast of the developments and understand the full impact on Berkshire Hathaway’s Apple holdings, continue monitoring the situation closely. Understanding the future of Berkshire Hathaway's Apple investment is crucial for investors and market analysts alike.

Featured Posts

-

Escape To The Country Budgeting And Financing Your Rural Retreat

May 24, 2025

Escape To The Country Budgeting And Financing Your Rural Retreat

May 24, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6th Claims

May 24, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details On The Jan 6th Claims

May 24, 2025 -

Hot Wheels Ferrari Mamma Mia A Look At The New Releases

May 24, 2025

Hot Wheels Ferrari Mamma Mia A Look At The New Releases

May 24, 2025 -

Significant Delays On M6 Southbound Following Accident

May 24, 2025

Significant Delays On M6 Southbound Following Accident

May 24, 2025 -

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025

Latest Posts

-

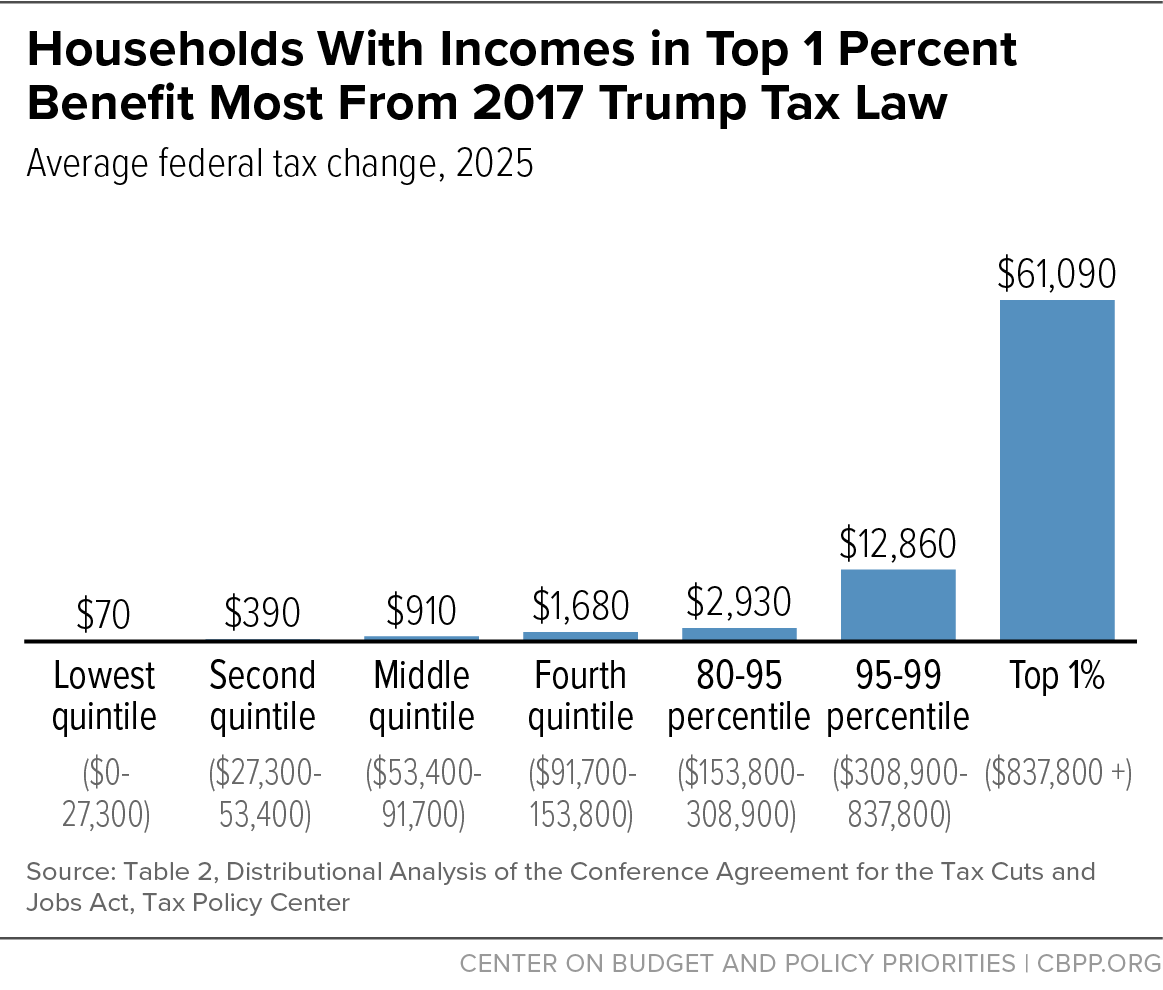

Analysis The House Passed Trump Tax Bill And What It Means

May 24, 2025

Analysis The House Passed Trump Tax Bill And What It Means

May 24, 2025 -

Orbital Space Crystals A New Frontier In Pharmaceutical Development

May 24, 2025

Orbital Space Crystals A New Frontier In Pharmaceutical Development

May 24, 2025 -

Last Minute Changes Alter Trump Tax Bill Before House Passage

May 24, 2025

Last Minute Changes Alter Trump Tax Bill Before House Passage

May 24, 2025 -

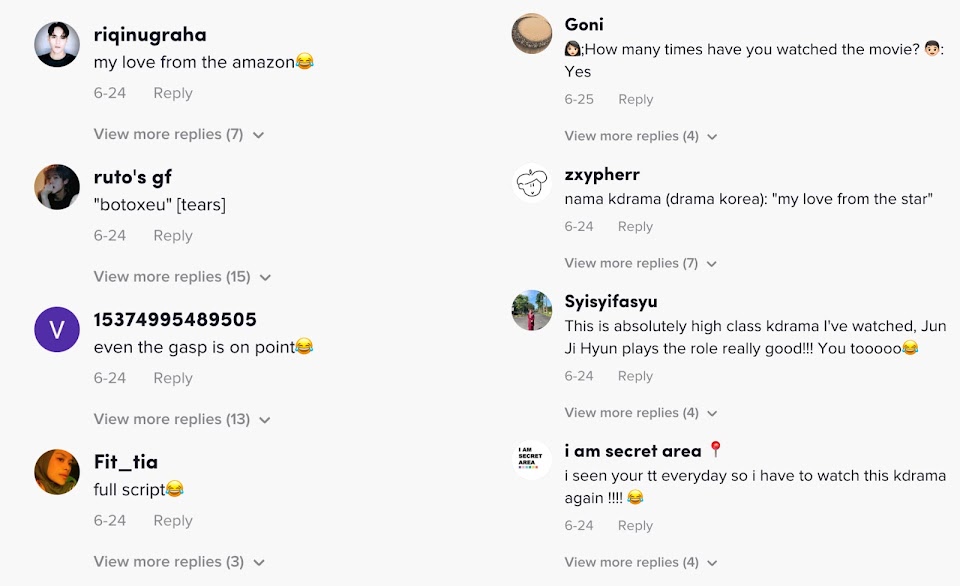

From Parishioner To Viral Sensation A Tik Tokers Story With Pope Leo

May 24, 2025

From Parishioner To Viral Sensation A Tik Tokers Story With Pope Leo

May 24, 2025 -

Air Traffic Controllers Link Newark Airport Issues To Trump Administration Policy

May 24, 2025

Air Traffic Controllers Link Newark Airport Issues To Trump Administration Policy

May 24, 2025