Canada's Economic Outlook: Dodge Predicts Ultra-Low Growth In 2024

Table of Contents

Dodge's Prediction: Ultra-Low Growth for Canada in 2024

Dodge's economic forecast for Canada in 2024 paints a picture of significantly slowed growth. While the exact percentage fluctuates slightly depending on the specific Dodge report, the consensus points to ultra-low growth, significantly below the historical average. This prediction contrasts sharply with previous years' growth rates and reflects a more pessimistic outlook than many other forecasts currently circulating.

- Specific percentage predicted by Dodge: While precise numbers vary across different Dodge reports, expect projections in the range of 0.5% to 1.5% GDP growth. This is a considerable drop from previous years' growth rates.

- Comparison to previous years’ growth rates: Canada experienced significantly higher growth rates in the years leading up to 2024. Comparing 2024's projected ultra-low growth to these past highs highlights the severity of the predicted slowdown.

- Mention any revisions from previous Dodge forecasts: Dodge regularly revises its forecasts based on evolving economic data. It's important to consult the most recent report for the most up-to-date prediction.

- Brief mention of other prominent economic forecasts (and their differences): Other forecasters may offer varying predictions, some more optimistic than Dodge's ultra-low growth assessment. However, the general consensus across many leading institutions points towards a significant economic slowdown in Canada.

Key Factors Contributing to Slow Growth

Several interconnected factors contribute to Dodge's pessimistic outlook for Canadian economic growth in 2024. These factors collectively create a challenging environment for sustained economic expansion. Keywords such as Canadian inflation, interest rates Canada, housing market Canada, global economic slowdown, and Canadian consumer spending are all relevant here.

- High inflation and its impact on consumer spending: Persistent inflation erodes purchasing power, reducing consumer spending and slowing down economic activity. This is a significant headwind for growth.

- The effects of rising interest rates on borrowing and investment: The Bank of Canada's efforts to curb inflation through interest rate hikes increase borrowing costs for consumers and businesses, dampening investment and economic expansion. This affects both mortgage rates Canada and business investment Canada.

- The cooling Canadian housing market and its ripple effects: The housing market slowdown impacts construction activity, reducing jobs and consumer confidence. This has a significant ripple effect across the economy.

- Global economic uncertainty and its influence on Canadian exports: Global economic uncertainty, including potential recessions in major trading partners, negatively impacts Canadian exports, further slowing economic growth.

The Impact of High Interest Rates on the Canadian Economy

The Bank of Canada's interest rate hikes, aimed at controlling Canadian inflation, have profound consequences for the Canadian economy. This aggressive monetary policy Canada directly impacts several key sectors.

- Impact on consumer borrowing and debt levels: Higher interest rates increase the cost of borrowing, impacting consumer debt levels and reducing disposable income.

- Effects on the housing market (sales, prices): Higher mortgage rates Canada directly affect housing affordability, leading to reduced sales and potentially lower prices.

- Influence on business investment and expansion plans: Higher borrowing costs discourage businesses from investing and expanding, hindering job creation and economic growth.

Potential Upsides and Downsides of the Forecast

While Dodge's forecast is predominantly pessimistic, there are both potential upsides and downsides to consider. Understanding these risks to Canadian economy and the potential for economic uncertainty Canada is vital.

- Potential for a faster-than-expected economic recovery: Unexpected positive developments, such as a quicker-than-anticipated reduction in inflation or increased global demand, could lead to a more robust recovery.

- Risks of a more prolonged period of slow growth or even recession: If the current challenges persist or worsen, the period of slow growth could extend, potentially leading to a recession.

- Factors that could positively or negatively impact the forecast: Unforeseen geopolitical events, changes in government policy, or shifts in global commodity prices could all significantly affect the accuracy of the forecast. Canada's economic resilience will play a crucial role.

Implications for Canadians and the Government

Dodge's ultra-low growth prediction has significant implications for Canadians and the government. Keywords like Canadian job market, government spending Canada, fiscal policy Canada, and Canadian household debt are important here.

- Potential job losses and increased unemployment: Slow economic growth often translates to job losses and increased unemployment rates, impacting household incomes.

- Strain on household budgets due to inflation and higher interest rates: The combination of high inflation and rising interest rates puts a strain on household budgets, increasing financial pressures on many Canadians.

- Government response options, including fiscal and monetary policy adjustments: The government may need to implement fiscal and monetary policy adjustments to mitigate the negative impacts of the economic slowdown.

Conclusion

Dodge's prediction of ultra-low growth for Canada in 2024 paints a concerning picture, highlighting the significant challenges posed by inflation, high interest rates, and global economic uncertainty. While a potential for economic recovery Canada exists, the forecast underscores the need for careful economic management and proactive measures to mitigate the risks. Understanding the Canadian economic outlook is crucial for both individuals and the government.

Call to Action: Stay informed about Canada's economic outlook and the implications for you by regularly checking reputable sources for updated forecasts on the Canadian economy and exploring strategies for navigating this period of ultra-low growth. Understanding the potential impact of the Canadian economic outlook is crucial for making informed financial decisions.

Featured Posts

-

Hjwm Israyyl Ela Qaflt Ghzt Qbalt Malta Tghtyt Wsayl Alielam Alerbyt

May 03, 2025

Hjwm Israyyl Ela Qaflt Ghzt Qbalt Malta Tghtyt Wsayl Alielam Alerbyt

May 03, 2025 -

Police Investigation Launched Following Bullying Claims Against Rupert Lowe In Uk Reform

May 03, 2025

Police Investigation Launched Following Bullying Claims Against Rupert Lowe In Uk Reform

May 03, 2025 -

Riot Fest 2025 Full Lineup Announced Green Day And Weezer Lead The Charge

May 03, 2025

Riot Fest 2025 Full Lineup Announced Green Day And Weezer Lead The Charge

May 03, 2025 -

What The Florida And Wisconsin Turnouts Reveal About The Political Climate

May 03, 2025

What The Florida And Wisconsin Turnouts Reveal About The Political Climate

May 03, 2025 -

Expert Analysis Souness On Manchester Uniteds Transfer Failure

May 03, 2025

Expert Analysis Souness On Manchester Uniteds Transfer Failure

May 03, 2025

Latest Posts

-

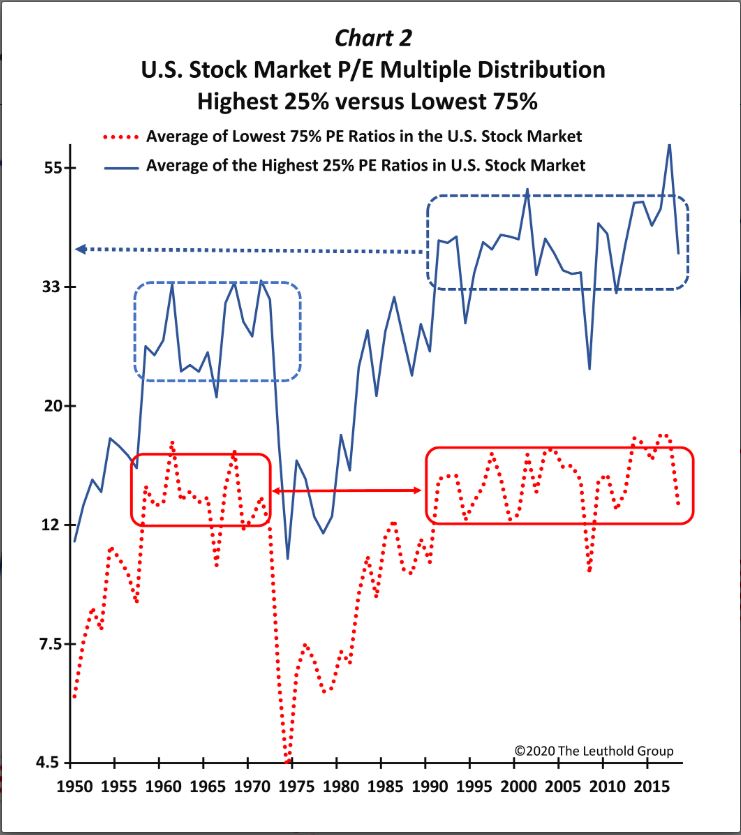

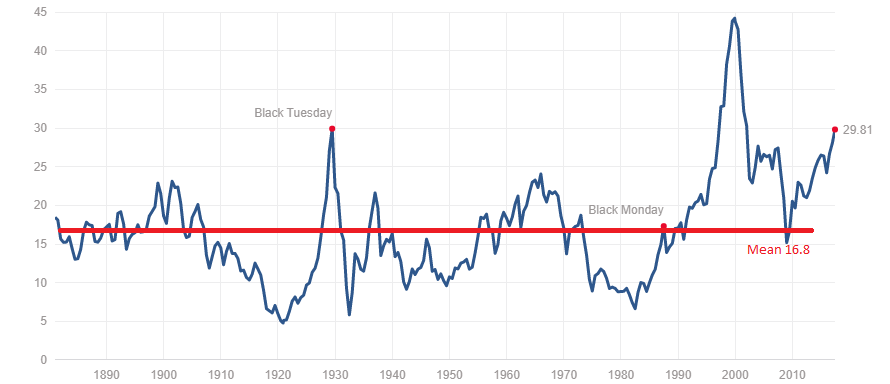

Why Elevated Stock Market Valuations Shouldnt Deter Investors Bof A

May 04, 2025

Why Elevated Stock Market Valuations Shouldnt Deter Investors Bof A

May 04, 2025 -

Stock Market Valuations Bof As Reassurance For Investors

May 04, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 04, 2025 -

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025 -

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025