Effective Succession Planning For Multi-Generational Wealth

Table of Contents

Understanding Your Family's Wealth and Goals

Before embarking on any succession planning, a thorough understanding of your family's current financial landscape and future aspirations is crucial. This involves a comprehensive assessment of your assets and a clear articulation of your family's shared vision.

Assessing Assets: A Foundation for Your Plan

Accurately assessing your family's assets is the cornerstone of effective multi-generational wealth planning. This includes:

- Real Estate: Properties need professional appraisals to determine their market value, considering location, condition, and potential rental income.

- Investments: Stocks, bonds, mutual funds, and other investments must be carefully evaluated, taking into account current market conditions and future growth potential.

- Businesses: Family businesses require a thorough valuation, considering profitability, market share, and intangible assets like brand recognition.

- Intellectual Property: Patents, trademarks, and copyrights represent valuable assets that need to be appropriately documented and valued.

- Liabilities: It's equally crucial to account for all outstanding debts, mortgages, and other liabilities to obtain a net worth picture. Ignoring liabilities can lead to inaccurate planning.

Defining Family Values and Goals: Shaping Your Future

Succession planning isn't just about money; it's about preserving family values and achieving shared goals. This requires open and honest communication:

- Family Meetings: Regular meetings provide a platform for open discussion and collaborative decision-making.

- Surveys and Questionnaires: These tools can help gather diverse perspectives and identify areas of agreement and disagreement.

- Professional Facilitation: A neutral third party can facilitate discussions, manage conflict, and ensure everyone's voice is heard.

- Establishing Clear Objectives: Defining objectives, whether they are philanthropic endeavors, funding education for future generations, or ensuring the continued success of a family business, provides a roadmap for your wealth transfer strategy.

Identifying Potential Heirs and Their Roles: Preparing the Next Generation

Identifying potential heirs and assessing their skills and interests is crucial for a successful wealth transfer. This includes:

- Mentorship Programs: These programs can help prepare the next generation for their future roles in managing family wealth.

- Family Council Formation: A family council can provide a structured forum for decision-making and conflict resolution.

- Open Communication: Honest and transparent communication about expectations and responsibilities is vital to avoid future conflicts.

Developing a Comprehensive Succession Plan

A comprehensive succession plan incorporates legal, financial, and business strategies designed to preserve and grow your family’s wealth.

Legal and Tax Considerations: Protecting Your Legacy

Navigating the legal and tax landscape is crucial for minimizing liabilities and maximizing the transfer of wealth. This requires:

- Consultations with Professionals: Seek expert advice from estate planning attorneys, financial advisors, and tax professionals.

- Exploring Trust Structures: Various trust structures offer different levels of control and tax advantages. Choosing the right structure is essential.

- Estate Planning Documents: A well-drafted will, power of attorney, and healthcare directives are essential to ensure your wishes are carried out.

Financial Strategies for Wealth Preservation and Growth: Ensuring Long-Term Prosperity

Maintaining and growing your family's wealth requires a well-defined financial strategy:

- Investment Diversification: Spreading investments across different asset classes reduces risk and maximizes potential returns.

- Risk Management: Implementing strategies to mitigate potential risks, such as inflation and market downturns, is crucial.

- Long-Term Investment Strategy: A long-term investment strategy aligned with your family's goals is essential for sustainable wealth preservation.

Business Succession Planning: Ensuring Continuity

If your family owns a business, a specific succession plan is essential for ensuring its continued success:

- Phased Transition Plan: A gradual transfer of ownership and management responsibilities minimizes disruption and maximizes value.

- Identifying Key Personnel: Identify and train key employees to ensure the business's continued operation.

- Employee Retention Strategies: Implement strategies to retain valuable employees during the transition.

Communication and Family Governance: Building a Strong Foundation

Effective communication and a well-defined governance structure are crucial for managing multi-generational wealth.

Open and Honest Communication: The Cornerstone of Success

Open and honest communication prevents misunderstandings and fosters trust among family members:

- Regular Family Meetings: Establish regular meetings to discuss family matters and wealth management.

- Mediation Services: In case of conflict, mediation services can help facilitate resolution.

- Conflict Resolution Strategies: Develop strategies for addressing disagreements and maintaining family harmony.

Establishing a Family Governance Structure: Creating a Framework for Decision-Making

A clear governance structure provides a framework for managing family wealth:

- Family Constitution: A formal document outlining family values, principles, and decision-making processes.

- Family Council: A body composed of family members and advisors responsible for overseeing the family's wealth.

- Independent Advisors: Utilize independent advisors for objective counsel and conflict resolution.

Professional Advice: Seeking Expert Guidance

Engaging a multidisciplinary team of professionals is vital for successful succession planning:

- Multidisciplinary Team: This team should include lawyers, financial advisors, tax professionals, and potentially other specialists.

- Regular Reviews and Updates: The succession plan should be reviewed and updated regularly to adapt to changing circumstances.

Securing Your Family's Future Through Effective Succession Planning

Effective succession planning for multi-generational wealth requires a multifaceted approach. This involves a thorough assessment of assets, a clear understanding of family values and goals, a well-defined legal and financial strategy, and a robust communication and governance structure. Remember, open communication, professional guidance, and a well-defined plan are critical for preserving your family legacy. Don't delay securing your family's legacy. Begin your multi-generational wealth succession plan today. Contact us to discuss your effective succession planning needs and ensure a smooth transfer of wealth to future generations.

Featured Posts

-

Unlocking The Potential Of Cassis Blackcurrant From Farm To Table

May 22, 2025

Unlocking The Potential Of Cassis Blackcurrant From Farm To Table

May 22, 2025 -

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025 -

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025 -

Actors Join Writers Strike Hollywood Faces Unprecedented Production Shutdown

May 22, 2025

Actors Join Writers Strike Hollywood Faces Unprecedented Production Shutdown

May 22, 2025 -

Half Dome Secures Abn Group Victoria Account

May 22, 2025

Half Dome Secures Abn Group Victoria Account

May 22, 2025

Latest Posts

-

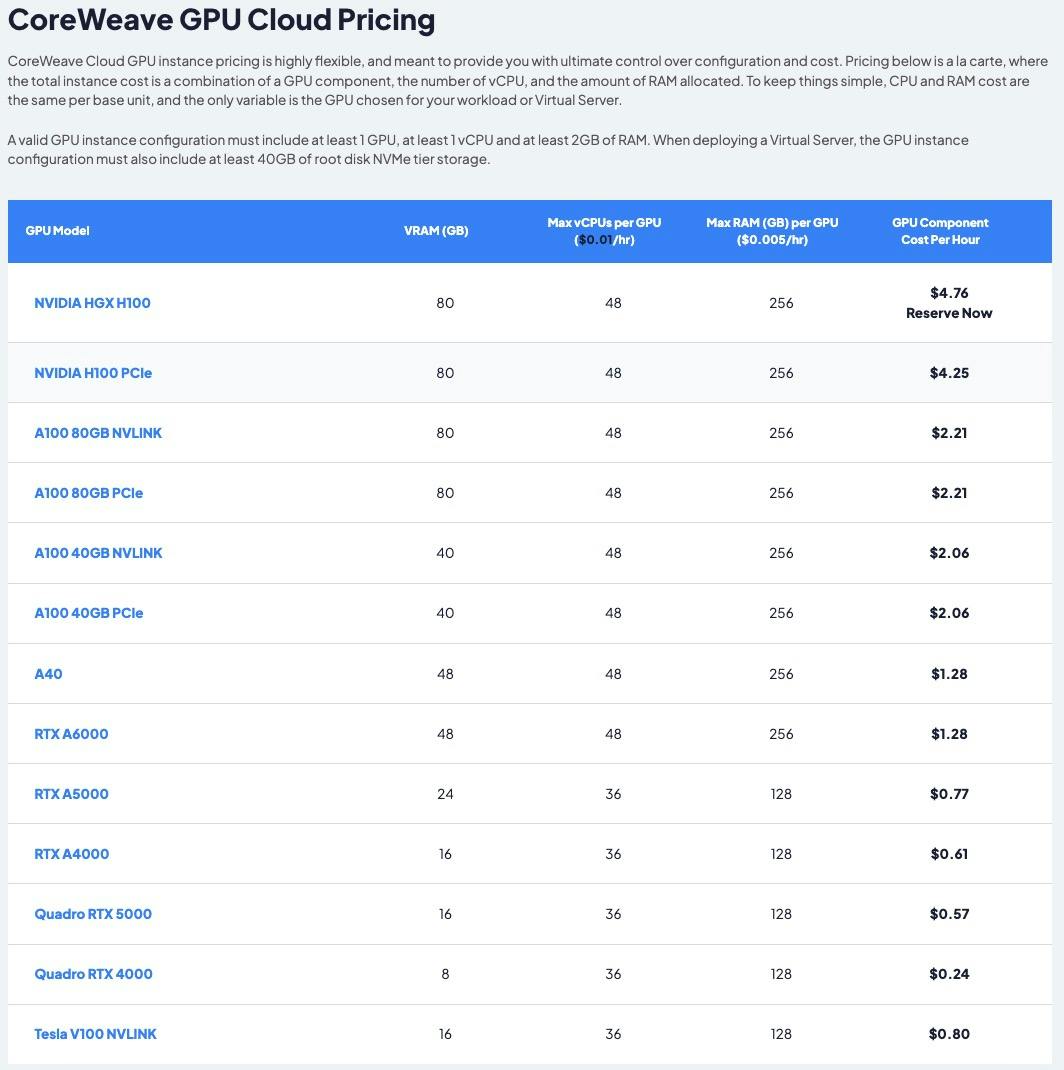

Core Weave Stock A Deep Dive Into Recent Developments

May 22, 2025

Core Weave Stock A Deep Dive Into Recent Developments

May 22, 2025 -

Investment In Core Weave Crwv Understanding Last Weeks Market Activity

May 22, 2025

Investment In Core Weave Crwv Understanding Last Weeks Market Activity

May 22, 2025 -

Analyzing The Current State Of Core Weave Stock

May 22, 2025

Analyzing The Current State Of Core Weave Stock

May 22, 2025 -

Analyzing The Recent Increase In Core Weave Crwv Stock Value

May 22, 2025

Analyzing The Recent Increase In Core Weave Crwv Stock Value

May 22, 2025 -

Understanding Core Weave Stocks Recent Market Activity

May 22, 2025

Understanding Core Weave Stocks Recent Market Activity

May 22, 2025