How Net Asset Value (NAV) Impacts Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the value of what you own per share. For the Amundi Dow Jones Industrial Average UCITS ETF, calculating the NAV involves several key components:

- Market value of the underlying assets: This is the primary component and represents the total market value of the 30 constituent stocks of the Dow Jones Industrial Average held by the ETF. Fluctuations in the prices of these 30 companies directly impact the ETF's NAV.

- Value of any cash holdings: The ETF may hold some cash reserves, which are also included in the NAV calculation. This cash can come from dividends received, proceeds from selling stocks, or other sources.

- Less: ETF expenses and management fees: The ETF incurs expenses related to management, administration, and trading. These expenses are deducted from the total asset value before calculating the NAV per share.

Illustrative Example:

Let's say the total market value of the 30 Dow Jones stocks held by the ETF is €100 million, and the ETF has €1 million in cash. If the total expenses are €500,000 and there are 10 million outstanding shares, the NAV calculation would be: (€100,000,000 + €1,000,000 - €500,000) / 10,000,000 = €10.05 per share.

- Market value of the 30 Dow Jones Industrial Average components

- Value of any cash holdings

- Less: ETF expenses and management fees

- Divided by: Number of outstanding shares

How Daily NAV Changes Affect Your Amundi Dow Jones Industrial Average UCITS ETF Investment

The daily price fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF are closely linked to its NAV. While the ETF price might deviate slightly from the NAV due to factors like supply and demand, the NAV provides the underlying value of your investment.

- Rising NAV means increased investment value: If the underlying stocks perform well, the NAV rises, increasing the value of your investment.

- Falling NAV means decreased investment value: Conversely, if the market declines, and the Dow Jones Industrial Average falls, the NAV will also fall, decreasing your investment value.

- Impact of market volatility on NAV: Market volatility significantly impacts the NAV. Periods of high volatility can lead to larger daily fluctuations in the NAV.

- Factors contributing to tracking error: Tracking error refers to the difference between the ETF's performance and that of the underlying index (Dow Jones Industrial Average). This can be due to various factors, including trading costs and the ETF's expense ratio, slightly affecting the direct relationship between price and NAV.

Understanding NAV and Your Investment Strategy

Understanding NAV is crucial for making informed investment decisions. Monitoring the NAV alongside the ETF's market price gives you a comprehensive view of your investment's performance.

- Regularly checking NAV to assess performance: Regularly reviewing the NAV allows you to track the performance of your investment over time.

- Comparing NAV with benchmark indices: Comparing the NAV with the Dow Jones Industrial Average itself helps assess how effectively the ETF tracks its benchmark.

- Using NAV information to time buys and sells (with cautionary note about market timing): While some investors try to use NAV to time their buying and selling, it's crucial to remember that market timing is risky. Long-term strategies are generally preferred.

- NAV as a key indicator for long-term investment strategy: For long-term investors, the NAV provides a reliable measure of the underlying value of their investment, allowing them to assess their long-term growth.

Where to Find the Daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

- Amundi's official website: Amundi, the ETF provider, typically publishes the daily NAV on its website.

- Major financial news websites and portals: Many financial news websites and portals provide real-time or end-of-day NAV data for various ETFs.

- Your brokerage platform: Your brokerage account will also usually display the NAV of your holdings.

Conclusion:

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for monitoring your investment's performance and making informed decisions. Daily NAV fluctuations reflect the market value of your holdings. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF investment by regularly checking its Net Asset Value (NAV). Learn more about managing your ETF investments and understanding NAV by visiting [link to relevant resource/Amundi website].

Featured Posts

-

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025 -

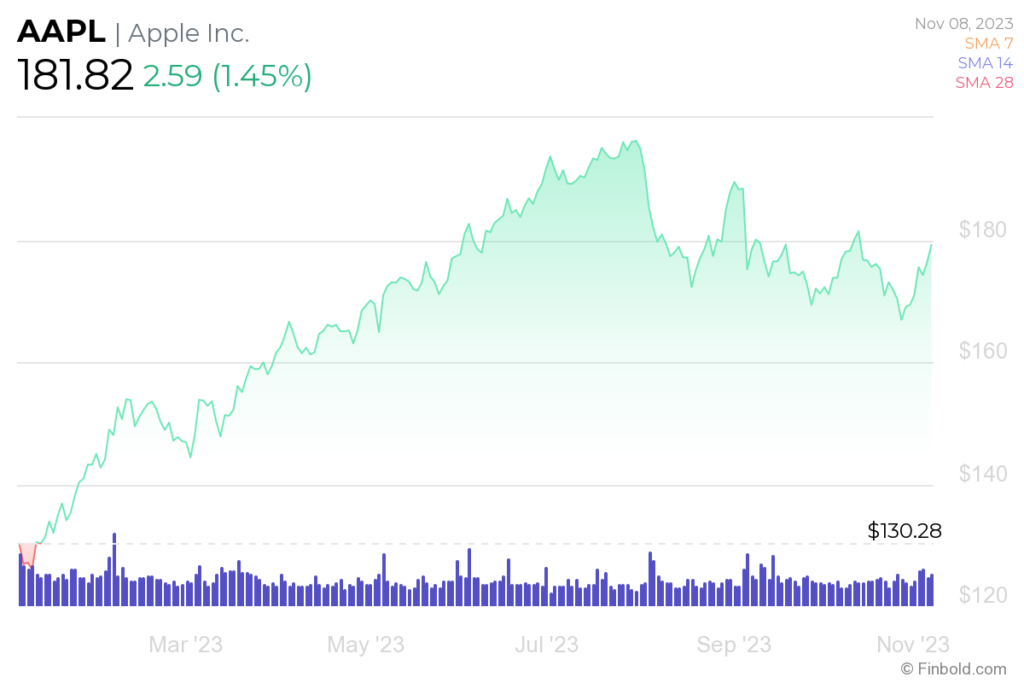

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025 -

Van Overturns On M6 Leading To Extensive Traffic Delays

May 24, 2025

Van Overturns On M6 Leading To Extensive Traffic Delays

May 24, 2025 -

Camunda Con 2025 Amsterdam How Orchestration Drives Success In Ai And Automation

May 24, 2025

Camunda Con 2025 Amsterdam How Orchestration Drives Success In Ai And Automation

May 24, 2025 -

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025

Latest Posts

-

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025 -

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025 -

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025 -

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025 -

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025