Interpreting The Net Asset Value (NAV) For The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is the NAV and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

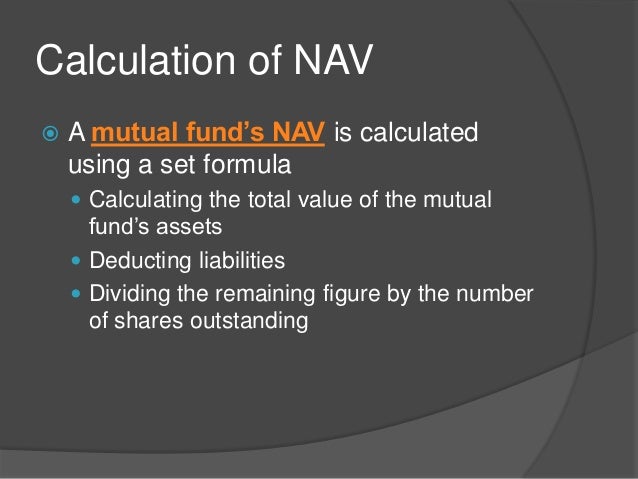

The Net Asset Value (NAV) of an ETF, like the Amundi Dow Jones Industrial Average UCITS ETF, represents the net value of its assets minus its liabilities, divided by the number of outstanding shares. This figure reflects the intrinsic value of each share. For the Amundi Dow Jones Industrial Average UCITS ETF, which tracks the Dow Jones Industrial Average, the NAV calculation is directly influenced by the performance of its underlying holdings – the 30 major US companies comprising the index.

The fund manager plays a vital role in maintaining the ETF's portfolio, aiming to closely replicate the index's composition. Any adjustments to the portfolio, such as rebalancing or incorporating dividend reinvestments, will impact the NAV. The NAV is typically calculated daily, providing investors with an up-to-date valuation.

- Assets: Market value of the underlying 30 Dow Jones Industrial Average stocks held by the ETF.

- Liabilities: Expenses incurred by the fund, including management fees, administrative costs, and other operational expenses.

- NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV calculation, ETF valuation, asset calculation, liability calculation.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several factors influence the Amundi Dow Jones Industrial Average UCITS ETF's NAV. Understanding these factors is critical for interpreting NAV movements and making informed investment decisions.

- Market Fluctuations: Changes in the market value of the underlying Dow Jones Industrial Average components directly impact the ETF's NAV. A bull market generally leads to a higher NAV, while a bear market results in a lower NAV.

- Currency Exchange Rates: While the Dow Jones Industrial Average is a US-dollar denominated index, currency fluctuations could impact the NAV if the ETF holds assets denominated in other currencies.

- Dividends: Dividends paid by the underlying companies are reinvested back into the ETF, generally increasing the total assets and, consequently, the NAV.

- Fund Expenses and Management Fees: These expenses reduce the overall value of the assets, thus impacting the NAV. The expense ratio, expressed as a percentage of assets under management, is a key factor to consider.

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV factors, market impact on NAV, currency risk, dividend impact, expense ratio.

Interpreting the NAV for Investment Decisions

The Amundi Dow Jones Industrial Average UCITS ETF NAV is a powerful tool for tracking performance and making informed investment decisions. However, it's crucial to interpret it correctly.

- Tracking Performance: Compare the NAV over time to assess the ETF's performance against its benchmark (the Dow Jones Industrial Average).

- Premium/Discount: The ETF's market price might deviate from its NAV, creating a premium (market price > NAV) or discount (market price < NAV). This difference can be influenced by supply and demand dynamics.

- Buy/Sell Decisions: While not the sole determinant, the NAV can be a factor in buy/sell decisions. Analyzing NAV trends alongside other market indicators provides a more comprehensive view.

- Long-Term Perspective: Focus on long-term NAV trends rather than short-term fluctuations. Short-term volatility is common in the market, and focusing solely on daily changes can lead to impulsive and potentially poor investment choices.

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV interpretation, ETF investment strategy, buy and sell signals, long-term investment, premium discount.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Reliable sources are critical for obtaining accurate Amundi Dow Jones Industrial Average UCITS ETF NAV data. You can access this information through several channels:

- Amundi Website: The official Amundi website is a primary source for real-time and historical NAV data.

- Financial Data Providers: Reputable financial data providers like Bloomberg, Yahoo Finance, and Google Finance often provide real-time and historical NAV data for ETFs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform usually displays the current NAV.

Always ensure you're using reliable sources to avoid misinformation which could lead to poor investment choices.

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV data, where to find ETF NAV, reliable data sources.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for successful investment in this index-tracking ETF. By understanding how it's calculated, the factors influencing it, and how to interpret it, you can make more informed decisions about your investment strategy. Remember to always consult reliable sources for accurate NAV data and consider long-term trends rather than reacting to short-term market fluctuations. Learn more about managing your investments by understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV and other key ETF metrics. Further research into the ETF and similar investment strategies is highly recommended.

Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV summary, investment decisions, ETF analysis, financial literacy.

Featured Posts

-

Camunda Con 2025 Unlocking The Potential Of Ai And Automation Through Orchestration In Amsterdam

May 24, 2025

Camunda Con 2025 Unlocking The Potential Of Ai And Automation Through Orchestration In Amsterdam

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value Nav

May 24, 2025 -

Us Band Hints At Glastonbury Performance Before Official Announcement

May 24, 2025

Us Band Hints At Glastonbury Performance Before Official Announcement

May 24, 2025 -

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025 -

89 Svadeb V Odin Den Kharkovschina Otmetila Krasivuyu Datu

May 24, 2025

89 Svadeb V Odin Den Kharkovschina Otmetila Krasivuyu Datu

May 24, 2025

Latest Posts

-

Apple Stock Aapl Important Price Levels And Future Predictions

May 24, 2025

Apple Stock Aapl Important Price Levels And Future Predictions

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025 -

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025 -

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025