Is XRP's Price Recovery Stalled By The Derivatives Market?

Table of Contents

The Growing XRP Derivatives Market

The trading volume and open interest in XRP derivatives contracts have experienced substantial growth across major cryptocurrency exchanges. This expansion suggests a growing institutional and retail interest in using derivatives to manage risk or speculate on XRP's price.

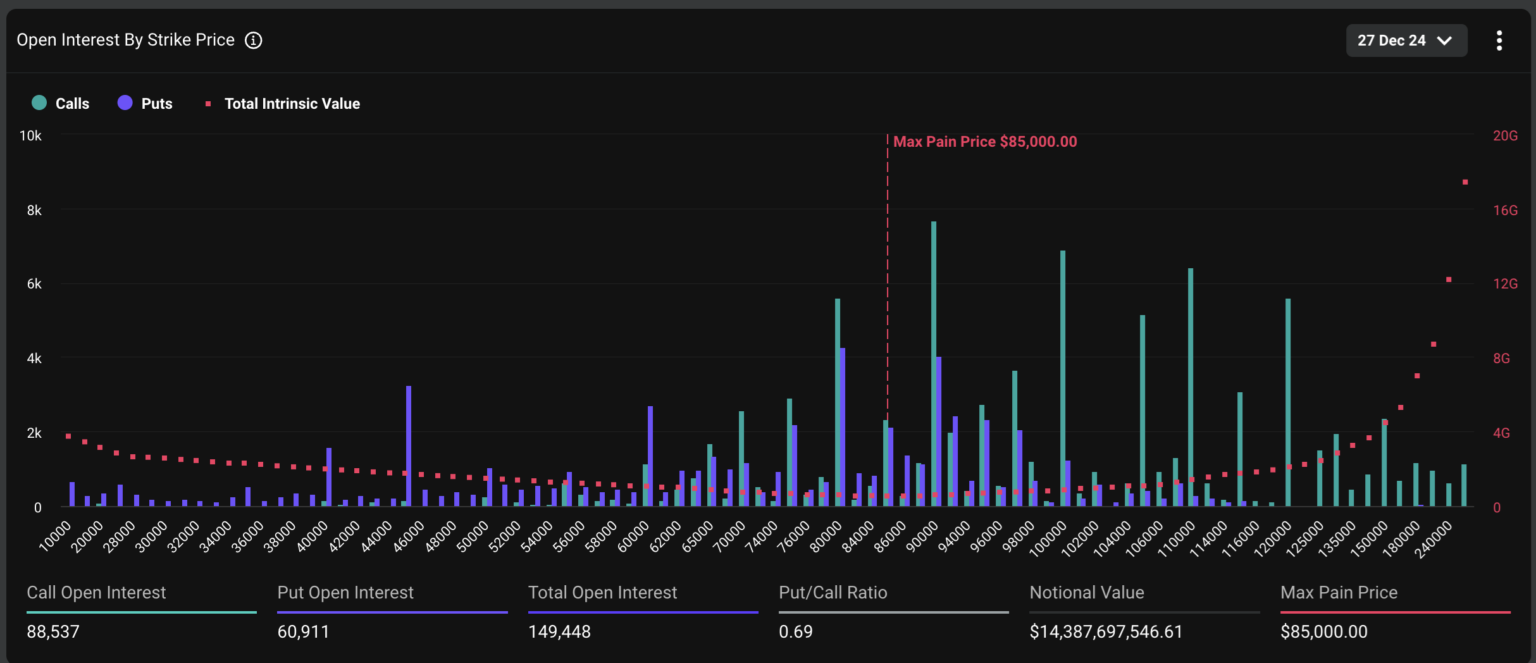

- Growth in futures and options contracts: The number of XRP futures and options contracts traded daily has increased significantly over the past year, indicating expanding market depth.

- Major exchanges offering XRP derivatives: Leading cryptocurrency exchanges like Binance, BitMEX, and Deribit now offer a wide range of XRP derivatives products, attracting both institutional and individual traders.

- Increasing institutional participation in the derivatives market: The rise of institutional investors in the crypto space suggests sophisticated hedging and speculative strategies are influencing XRP price dynamics within the derivatives market.

- Data illustrating the market's expansion: (Note: This section would ideally include charts and graphs showing the growth of XRP derivatives trading volume and open interest over time. Sources should be clearly cited.) For example, one could show a comparative graph demonstrating the growth of XRP spot trading volume versus its derivatives market counterpart.

How Derivatives Can Influence XRP Price

Derivatives trading can significantly influence XRP's price through various mechanisms, both suppressing and amplifying price movements. Understanding these dynamics is crucial for assessing the impact of the derivatives market on XRP's price recovery.

- Hedging activities by institutional investors: Large institutions might use XRP futures to hedge against potential losses in their spot XRP holdings, potentially reducing upward pressure on the spot price.

- Speculative trading and its impact on price volatility: Speculative trading in XRP derivatives can increase price volatility, leading to sharp price swings that hinder sustained recovery.

- Short selling and its downward pressure on XRP price: Short selling in the derivatives market exerts downward pressure on XRP's spot price, as traders profit from price declines. This can further hinder any price recovery attempts.

- Arbitrage opportunities influencing spot vs. derivatives prices: Arbitrage opportunities between spot and derivatives markets can create price discrepancies, potentially causing short-term price fluctuations that mask underlying trends in XRP's fundamental value.

Analyzing the Correlation Between XRP Spot Price and Derivatives Market Activity

Analyzing historical data reveals a complex relationship between XRP's spot price and the activity in its derivatives market. Identifying correlations can help determine the extent to which derivatives trading influences price.

- Presentation of historical price and volume data: A detailed analysis should compare XRP's spot price with the trading volume and open interest in its derivatives contracts over a significant period.

- Statistical analysis (correlation coefficients, regression analysis): Statistical methods can quantify the strength and direction of the relationship between spot price and derivatives market activity.

- Discussion of observed relationships and potential causal links: Interpreting the statistical results requires careful consideration of potential confounding factors and causal relationships. Is the derivatives market influencing the spot price, or are other factors driving both?

- Visual representations (charts and graphs): Visualizations, such as scatter plots and time series graphs, are crucial for presenting the findings clearly and effectively. (Note: This section would ideally include such charts and graphs, with clear labeling and data sources.)

Alternative Factors Affecting XRP Price Recovery

Besides the derivatives market, several other factors influence XRP's price. It's crucial to consider these to gain a comprehensive understanding of its price behavior.

- Regulatory uncertainty surrounding Ripple's ongoing legal battle: The SEC lawsuit against Ripple significantly impacts investor sentiment and market confidence. A favorable outcome could boost XRP's price, while an unfavorable one could further suppress it.

- Overall cryptocurrency market sentiment and Bitcoin's price action: The general sentiment within the crypto market and Bitcoin's price movements heavily influence XRP's price. A bearish crypto market generally dampens XRP's price.

- Adoption rate of XRP by financial institutions and payment processors: Increased adoption of XRP for cross-border payments could drive its price upward.

- Technological advancements and improvements within the XRP Ledger: Improvements in the XRP Ledger's functionality and scalability could positively impact XRP's price.

The Ripple Case and its Influence

The ongoing SEC lawsuit against Ripple Labs significantly impacts both the spot and derivatives markets for XRP. Uncertainty surrounding the outcome creates volatility. A positive resolution could trigger a substantial price increase, while a negative one could lead to further declines. The legal uncertainty itself contributes to a cautious approach by both investors and traders, potentially limiting price appreciation.

Conclusion

This article explored the potential influence of the growing XRP derivatives market on XRP's price recovery. We analyzed potential mechanisms through which derivatives trading impacts XRP’s price, examined the correlation between spot and derivatives markets, and considered other contributing factors, such as regulatory uncertainty surrounding Ripple's legal battle. The relationship is complex, and while the derivatives market may play a significant role, it is certainly not the sole factor determining XRP's price.

Call to Action: While the role of the XRP derivatives market in influencing price remains complex and multifaceted, understanding its dynamics is crucial for navigating the volatility of the XRP market. Stay informed about the latest developments in both the spot and derivatives markets to make well-informed decisions regarding your XRP investments. Continue your research on XRP price and its relationship with the derivatives market to develop a comprehensive investment strategy.

Featured Posts

-

Papa Francesco E Il Conclave Chi Sono I Cardinali Scelti Dal Sud Del Mondo E Dalle Periferie

May 07, 2025

Papa Francesco E Il Conclave Chi Sono I Cardinali Scelti Dal Sud Del Mondo E Dalle Periferie

May 07, 2025 -

Laram W Alkhtwt Aljwyt Alsynyt Aljnwbyt Twqean Mdhkrt Tfahm Ltezyz Alrbt Aljwy Byn Afryqya Walsyn

May 07, 2025

Laram W Alkhtwt Aljwyt Alsynyt Aljnwbyt Twqean Mdhkrt Tfahm Ltezyz Alrbt Aljwy Byn Afryqya Walsyn

May 07, 2025 -

Lane Hutson Peut Il Devenir Un Defenseur Elite Dans La Lnh

May 07, 2025

Lane Hutson Peut Il Devenir Un Defenseur Elite Dans La Lnh

May 07, 2025 -

Two Year Hiatus Ends Lewis Capaldis Mental Health Charity Gig

May 07, 2025

Two Year Hiatus Ends Lewis Capaldis Mental Health Charity Gig

May 07, 2025 -

Chinese Plastics Makers Face Iran Supply Disruption Amid Us Sanctions

May 07, 2025

Chinese Plastics Makers Face Iran Supply Disruption Amid Us Sanctions

May 07, 2025

Latest Posts

-

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025

Volatility Alert Billions In Bitcoin And Ethereum Options Expire Soon

May 08, 2025 -

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025 -

Bitcoin And Ethereum Options Expiration Billions At Stake Volatility Ahead

May 08, 2025

Bitcoin And Ethereum Options Expiration Billions At Stake Volatility Ahead

May 08, 2025 -

Ethereums Future Will The Price Fall Below 1 500 Support Level Analysis

May 08, 2025

Ethereums Future Will The Price Fall Below 1 500 Support Level Analysis

May 08, 2025 -

Saving Private Ryan Nathan Fillions Powerful 3 Minute Performance

May 08, 2025

Saving Private Ryan Nathan Fillions Powerful 3 Minute Performance

May 08, 2025