Japan's Economy Faces Headwinds: The Steep Bond Yield Curve Explained

Table of Contents

What is a Steep Bond Yield Curve?

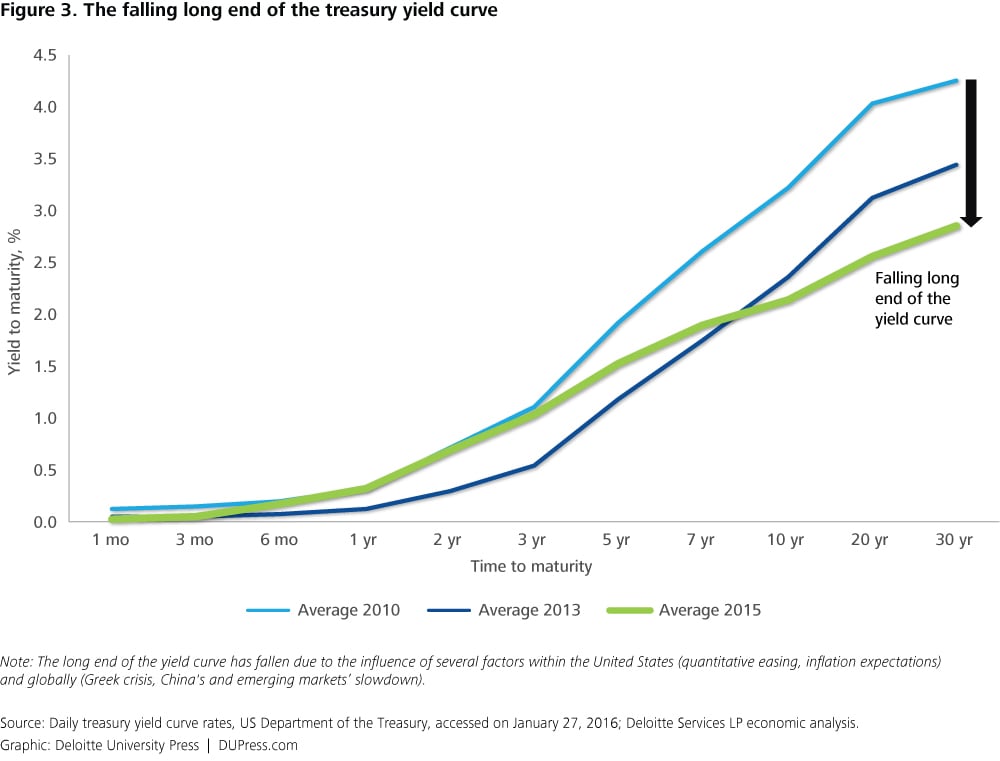

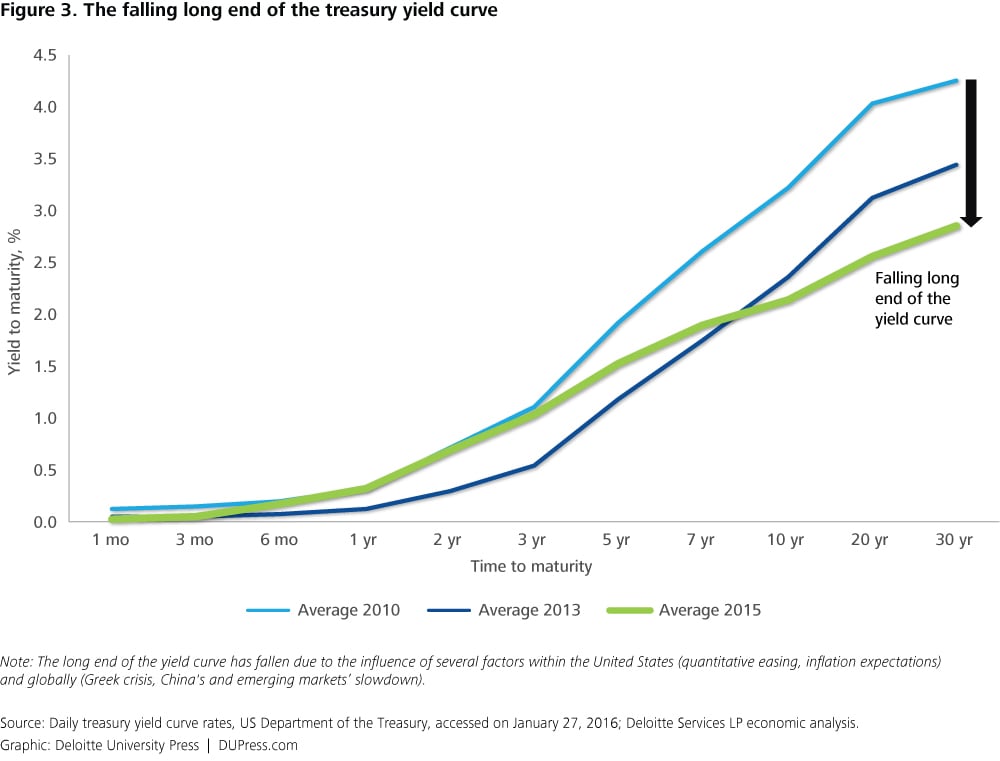

A bond yield curve is a graphical representation of the yields of bonds with different maturities. It plots the yield (return) on the vertical axis against the time to maturity (duration) on the horizontal axis. Yield curves can take several shapes, the most common being normal, inverted, and flat.

- Normal Yield Curve: Long-term bond yields are higher than short-term yields, reflecting the expectation of higher returns for tying up capital for longer periods. This is typically associated with a healthy, growing economy.

- Inverted Yield Curve: Short-term bond yields are higher than long-term yields, often seen as a predictor of an upcoming recession. Investors are willing to accept lower returns on long-term bonds because they anticipate lower interest rates or economic slowdown in the future.

- Flat Yield Curve: Short-term and long-term bond yields are roughly equal. This can indicate uncertainty about the future direction of the economy.

A steep bond yield curve, unlike the others, shows a significant difference between long-term and short-term yields, with long-term yields considerably higher. Think of it like this: Imagine a hill. A normal curve is a gently sloping hill, an inverted curve is a downhill slope, and a flat curve is a plateau. A steep yield curve is a very steep, almost vertical hill. This steepness reflects the market’s expectation of significantly higher interest rates in the future, often associated with rapid economic growth or aggressive monetary policy. However, this rapid growth can be unsustainable, making a steep curve a potential warning sign.

- Definition: A graphical representation of the yields of bonds with different maturities.

- Steep Curve: Long-term bond yields significantly higher than short-term yields.

- Implication: Reflects expectations of future interest rate increases and economic growth (potentially unsustainable).

Causes of the Steep Bond Yield Curve in Japan

The current steep bond yield curve in Japan is a complex issue with several contributing factors:

-

The Bank of Japan's (BOJ) Monetary Policy: The BOJ's Yield Curve Control (YCC) policy, designed to keep long-term interest rates low, has played a significant role. Recent adjustments to this policy, aimed at allowing more flexibility in long-term yields, have contributed to the steepening. The BOJ's attempts to manage the yield curve haven't been entirely successful in the face of other economic pressures.

-

Inflation and Rising Global Interest Rates: Rising inflation globally, and in Japan, has eroded the BOJ's ability to maintain ultra-low interest rates. Simultaneously, rising interest rates in other major economies, like the US and Europe, make Japanese bonds less attractive to international investors, pushing up yields on longer-term Japanese government bonds.

-

Government Debt and Fiscal Policy: Japan's massive government debt burden adds to investor concerns. Increased government borrowing to finance spending pushes up bond yields. The fiscal policy choices of the Japanese government therefore impact the bond market significantly.

-

Bullet points:

- BOJ's Yield Curve Control (YCC) policy and its recent adjustments.

- Rising inflation pressures eroding the BOJ's control.

- Increased global interest rates impacting Japanese bond attractiveness.

- Growing government debt burden impacting investor confidence.

Implications of a Steep Bond Yield Curve for the Japanese Economy

A steep bond yield curve, while sometimes signaling robust growth, can also pose serious challenges for the Japanese economy:

-

Increased Borrowing Costs: Higher long-term yields translate to increased borrowing costs for businesses and consumers, potentially hindering investment and economic growth. This can stifle business expansion and consumer spending, impacting overall economic activity.

-

Pressure on the Japanese Yen: A steep yield curve can put downward pressure on the Japanese Yen, making imports more expensive and potentially negatively affecting the country's trade balance. A weaker Yen can also fuel inflation further.

-

Impact on Economic Growth and Investment: The uncertainty created by a rapidly shifting yield curve can damage investor confidence, leading to reduced investment both domestically and from foreign investors. This uncertainty can discourage long-term planning and economic expansion.

-

Bullet points:

- Higher borrowing costs potentially hindering economic growth.

- Increased pressure on the Japanese Yen, impacting imports and exports.

- Uncertainty impacting investor confidence and potential for reduced investment.

- Increased risk of a potential economic downturn.

Potential Scenarios and Future Outlook

The future trajectory of Japan's economy and its bond yield curve depends heavily on the BOJ's policy response and global economic conditions:

-

BOJ Maintaining YCC: If the BOJ continues its YCC policy, it might lead to further weakening of the Yen and increased pressure on the bond market. This could result in a more volatile and unpredictable economic environment.

-

BOJ Abandoning YCC: Abandoning YCC could lead to a period of increased volatility as interest rates adjust to market forces. This could initially lead to even higher yields but might ultimately stabilize the market in the long term. However, this adjustment period could be disruptive to the economy.

-

Global Economic Conditions: The global economic climate will play a significant role. A global recession, for instance, could lead to a flattening or even inversion of the yield curve, regardless of BOJ policies.

-

Bullet points:

- BOJ maintaining YCC: potential for further yen weakening.

- BOJ abandoning YCC: potential for increased volatility and higher interest rates.

- Impact of global economic conditions on the Japanese yield curve.

- Predictions from economists and financial analysts (Note: This section would ideally include cited predictions from reputable sources).

Conclusion

The steep bond yield curve in Japan presents a complex economic challenge. Understanding the interplay of the BOJ's monetary policy, global interest rates, and domestic fiscal conditions is vital to predicting the future trajectory of the Japanese economy. While the current steep bond yield curve signals potential risks, analyzing its causes and implications allows for informed decision-making. Continued monitoring of the steep bond yield curve and the BOJ's policy response is crucial for investors and businesses operating in the Japanese market. Stay informed on the latest developments concerning the steep bond yield curve in Japan to make sound financial decisions.

Featured Posts

-

Game 5 Highlights Jaylen Brown And Josh Harts Wifes Response

May 17, 2025

Game 5 Highlights Jaylen Brown And Josh Harts Wifes Response

May 17, 2025 -

Impact Of The Gops Plan On Student Loan Borrowers And Pell Grants

May 17, 2025

Impact Of The Gops Plan On Student Loan Borrowers And Pell Grants

May 17, 2025 -

The Zuckerberg Trump Dynamic Implications For The Tech Industry And Beyond

May 17, 2025

The Zuckerberg Trump Dynamic Implications For The Tech Industry And Beyond

May 17, 2025 -

Josh Cavallos Courageous Journey Kicking Down Walls In Football

May 17, 2025

Josh Cavallos Courageous Journey Kicking Down Walls In Football

May 17, 2025 -

Should The Knicks Trade Landry Shamet A Roster Analysis

May 17, 2025

Should The Knicks Trade Landry Shamet A Roster Analysis

May 17, 2025

Latest Posts

-

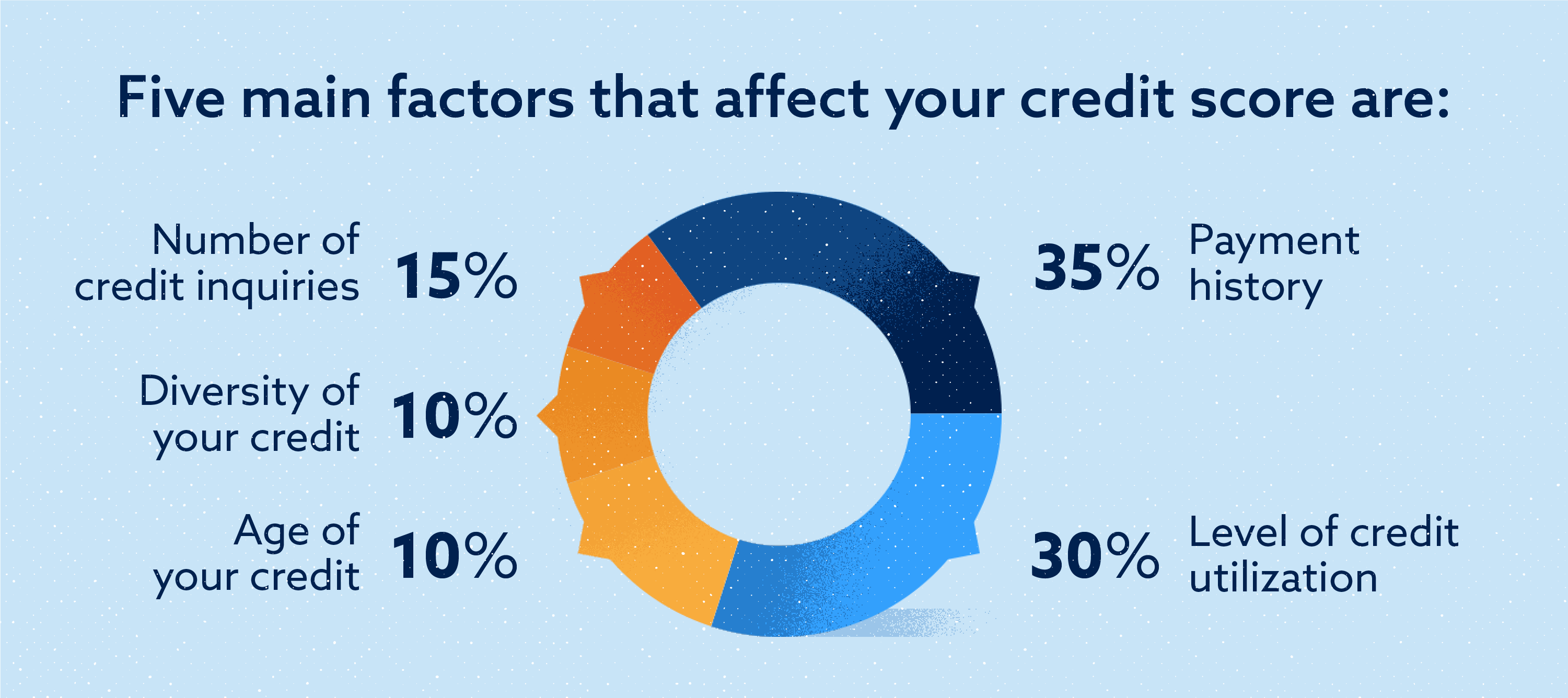

Ignoring Student Loan Payments The Impact On Your Credit Score

May 17, 2025

Ignoring Student Loan Payments The Impact On Your Credit Score

May 17, 2025 -

Midday Interview Securing The Fountain City Classic Scholarship

May 17, 2025

Midday Interview Securing The Fountain City Classic Scholarship

May 17, 2025 -

Would Privatizing Student Loans Under Trump Benefit Borrowers

May 17, 2025

Would Privatizing Student Loans Under Trump Benefit Borrowers

May 17, 2025 -

Refinancing Federal Student Loans Is A Private Lender Right For You

May 17, 2025

Refinancing Federal Student Loans Is A Private Lender Right For You

May 17, 2025 -

Federal Vs Private Student Loan Refinancing A Comparison Guide

May 17, 2025

Federal Vs Private Student Loan Refinancing A Comparison Guide

May 17, 2025