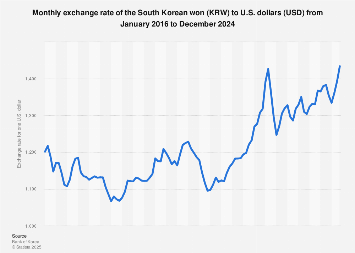

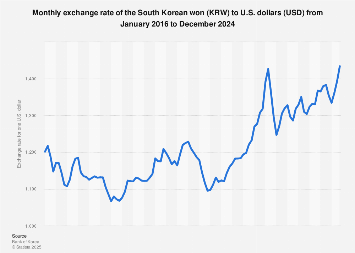

KRW/USD Exchange Rate: Trump's Criticism And The Potential For A Stronger Won

Table of Contents

Trump's Criticism and its Impact on the KRW/USD Exchange Rate

H3: Accusations of Currency Manipulation: A central theme during the Trump administration was the accusation that South Korea was manipulating its currency, the Won (KRW), to gain an unfair trade advantage against the US dollar (USD). This rhetoric significantly impacted the KRW/USD exchange rate.

- Specific examples: Trump frequently labeled South Korea a "currency manipulator" on social media and in public statements, particularly during periods of heightened trade tensions. These pronouncements often coincided with sharp fluctuations in the KRW/USD exchange rate.

- Market reactions: The immediate market response to these accusations was typically a weakening of the Won against the dollar, reflecting investor uncertainty and concerns about potential retaliatory measures from the US.

- Economic theory: The accusation of currency manipulation hinges on the idea that a country is deliberately undervaluing its currency to make its exports cheaper and more competitive internationally. While South Korea has denied these accusations, the mere suggestion created considerable market volatility.

H3: Trade Tensions and their Effect on the Won: The trade disputes between the US and South Korea under Trump's leadership significantly influenced the KRW/USD exchange rate. These tensions were fueled by concerns over trade imbalances and intellectual property rights.

- Trade disputes: Specific disputes, such as those related to steel and aluminum tariffs, directly impacted the KRW/USD exchange rate. The imposition of tariffs increased uncertainty, impacting South Korean exports to the US.

- Impact on exports and imports: The uncertainty caused by these trade disputes led to fluctuations in the KRW/USD exchange rate, impacting the price competitiveness of South Korean exports and the cost of imports. This created significant challenges for South Korean businesses.

Factors Contributing to a Potential Stronger Won

H3: South Korea's Economic Strength: Despite global headwinds, South Korea boasts a robust economy characterized by strong export performance, technological innovation, and relatively resilient domestic demand. These factors contribute to a stronger Won.

- Key economic indicators: Positive GDP growth, low inflation, and a healthy current account surplus all point towards a strong economic foundation that supports a higher KRW/USD exchange rate.

- Role of technology companies: The success of South Korean tech giants like Samsung and Hyundai, major exporters of advanced electronics and automobiles, significantly contributes to the country's economic strength and influences the KRW/USD exchange rate.

H3: Global Economic Conditions: The KRW/USD exchange rate isn't solely determined by domestic factors; global economic conditions play a critical role.

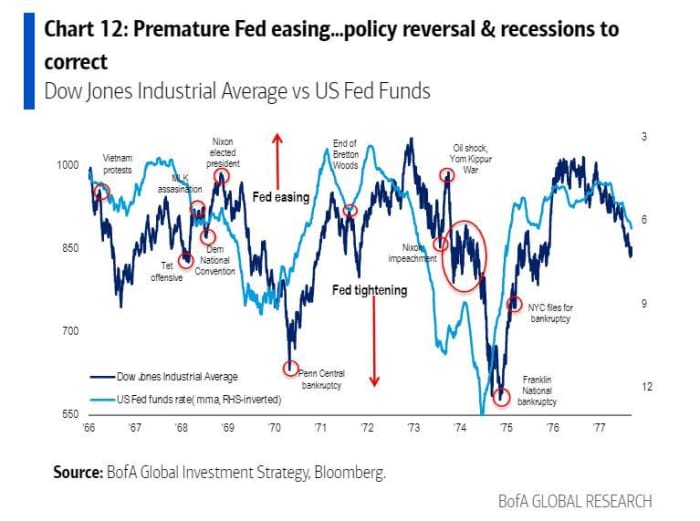

- US Federal Reserve policies: Changes in US interest rates directly impact the flow of capital between the US and South Korea, influencing the KRW/USD exchange rate. Higher US interest rates tend to attract investment away from South Korea, weakening the Won.

- Global trade patterns: Shifts in global demand for South Korean goods, particularly semiconductors and electronics, have a direct impact on the KRW/USD exchange rate.

- Safe-haven assets: During times of global uncertainty, the Won can be perceived as a safe-haven asset, potentially leading to an increase in its value against the dollar.

H3: Intervention by the Bank of Korea: The Bank of Korea (BOK) can intervene in the foreign exchange market to influence the KRW/USD exchange rate. However, such interventions are typically carefully calibrated.

- Past interventions: The BOK has intervened in the past to manage volatility in the KRW/USD exchange rate, using tools such as buying or selling US dollars in the foreign exchange market.

- Conditions for intervention: Interventions are usually triggered by excessive volatility or a sharp and unexpected movement in the exchange rate deemed detrimental to the South Korean economy.

- Limitations and risks: Central bank interventions have limitations and inherent risks. Excessive intervention can distort market mechanisms and potentially lead to unintended consequences.

Forecasting the Future of the KRW/USD Exchange Rate

H3: Analyzing Expert Opinions: Forecasting the KRW/USD exchange rate requires analyzing various perspectives. Leading economists and financial institutions offer a range of predictions, often influenced by their interpretations of global and domestic economic factors.

- Range of predictions: These predictions often vary depending on the assumed scenarios for global growth, US monetary policy, and geopolitical stability.

- Supporting rationales: Each prediction is typically justified by a detailed analysis of economic indicators and geopolitical risks.

H3: Long-Term Outlook and Uncertainties: Predicting the KRW/USD exchange rate is inherently uncertain. Unforeseen events can significantly impact the trajectory.

- Geopolitical risks: Unpredictable geopolitical events, such as escalating regional tensions or unexpected changes in global trade relations, can substantially affect the KRW/USD exchange rate.

- Technological disruptions: Rapid technological advancements can lead to shifts in global demand, impacting the South Korean economy and the KRW/USD exchange rate.

Conclusion

The KRW/USD exchange rate is influenced by a complex interplay of factors, including Trump's past criticism, South Korea's economic performance, global economic conditions, and the potential for Bank of Korea intervention. Understanding these dynamics is crucial for navigating the complexities of the South Korean economy and international trade. While forecasting the future is challenging, keeping abreast of economic indicators, geopolitical developments, and expert opinions is essential. Stay informed about the KRW/USD exchange rate by regularly checking reputable financial news sources and seeking professional financial advice to optimize your investment strategies and international trade dealings. Understanding the KRW/USD exchange rate is vital for success in today's interconnected global economy.

Featured Posts

-

Arsenal Eye Bundesliga Duo Latest Update From Journalist

Apr 25, 2025

Arsenal Eye Bundesliga Duo Latest Update From Journalist

Apr 25, 2025 -

Harrogate Spring Flower Show To Welcome 40 000 Attendees

Apr 25, 2025

Harrogate Spring Flower Show To Welcome 40 000 Attendees

Apr 25, 2025 -

Open Ai And Chat Gpt An Ftc Probe And Its Implications For Ai Development

Apr 25, 2025

Open Ai And Chat Gpt An Ftc Probe And Its Implications For Ai Development

Apr 25, 2025 -

Linda Evangelistas Honest Account First Time Showing Mastectomy Scars To Friends

Apr 25, 2025

Linda Evangelistas Honest Account First Time Showing Mastectomy Scars To Friends

Apr 25, 2025 -

The Jlc Reverso And Jack O Connell A Perfect Pairing

Apr 25, 2025

The Jlc Reverso And Jack O Connell A Perfect Pairing

Apr 25, 2025

Latest Posts

-

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025 -

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 26, 2025

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 26, 2025 -

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025 -

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025