Mercer International Reports Q4 2024 Earnings And $0.075 Dividend

Table of Contents

Q4 2024 Financial Performance Overview

Mercer International's Q4 2024 financial performance reveals a [positive/negative - replace with actual data] picture compared to the previous quarter and the same period last year. The company reported [insert actual figures] in revenue, showcasing [positive/negative - replace with actual data] growth compared to Q3 2024 and [positive/negative - replace with actual data] year-over-year growth. This revenue increase can be attributed to [mention key reasons based on the actual report].

Key financial metrics for Mercer International's Q4 2024 include:

- Revenue: [Insert actual figure]

- Net Income: [Insert actual figure]

- Earnings Per Share (EPS): [Insert actual figure]

- Operating Income: [Insert actual figure]

- Gross Profit: [Insert actual figure]

A year-over-year comparison reveals [positive/negative - replace with actual data] trends in key areas. For example, net income saw a [percentage]% change compared to Q4 2023, primarily driven by [mention specific factors]. The company faced challenges in [mention specific challenges, if any], which impacted [mention specific metrics affected]. However, [mention positive counterpoints or mitigating factors]. The overall financial performance relative to analysts' expectations was [above/below/in line - replace with actual data], signaling [positive/negative - replace with actual data] market sentiment. Mercer International Q4 results provide a valuable snapshot of the company's financial health.

$0.075 Dividend Announcement and Implications

Mercer International announced a dividend of $0.075 per share, payable on [insert payment date] to shareholders of record on [insert record date]. This $0.075 dividend represents a [increase/decrease/same - replace with actual data] compared to the previous dividend payment and translates to a dividend yield of [insert yield percentage] based on the current stock price. For shareholders, this represents a [positive/negative - replace with actual data] return on investment.

The dividend payout ratio, calculated as [insert calculation and result], suggests [positive/negative - replace with actual data] implications for the company's future financial health. A higher payout ratio indicates a greater portion of earnings being distributed to shareholders, potentially limiting funds available for reinvestment and growth. Conversely, a lower payout ratio suggests a greater focus on internal growth initiatives. The implications of this specific dividend payout ratio for Mercer International are [explain the implications based on actual figures]. The decision to declare this dividend showcases [positive/negative - replace with actual data] confidence in the company's future prospects.

Market Reaction and Future Outlook

The market reacted to the Mercer International Q4 2024 earnings and dividend announcement with a [increase/decrease - replace with actual data] in the company's stock price. [Explain the reasons for this change]. This reaction reflects the market’s assessment of the company’s financial health and future potential.

Mercer International's guidance for the next quarter and the upcoming year indicates [positive/negative - replace with actual data] expectations. The company anticipates [mention specific guidance provided by the company]. Significant factors that may influence future performance include [list key factors such as market conditions, industry trends, economic forecasts etc.]. Analyst predictions suggest [mention analyst opinions, if available], reflecting a [positive/negative - replace with actual data] outlook on Mercer International's future stock performance.

Conclusion: Investing in Mercer International After Q4 2024 Results

Mercer International's Q4 2024 earnings report presents a [positive/negative - replace with actual data] picture, with [mention key positive/negative points from the report]. The $0.075 dividend announced adds to the overall picture, offering a tangible return for shareholders. The company's future prospects appear [positive/negative - replace with actual data], contingent on [mention key factors affecting the future prospects]. Considering the Q4 2024 results and the declared dividend, Mercer International presents [positive/negative - replace with actual data] investment opportunities.

To learn more about Mercer International's investment opportunities and access detailed financial information, visit their investor relations page: [Insert Link]. Consider Mercer International's performance and dividend opportunities carefully before making any investment decisions.

Featured Posts

-

Detained Palestinian Student Awaits Hearing After Citizenship Interview

Apr 25, 2025

Detained Palestinian Student Awaits Hearing After Citizenship Interview

Apr 25, 2025 -

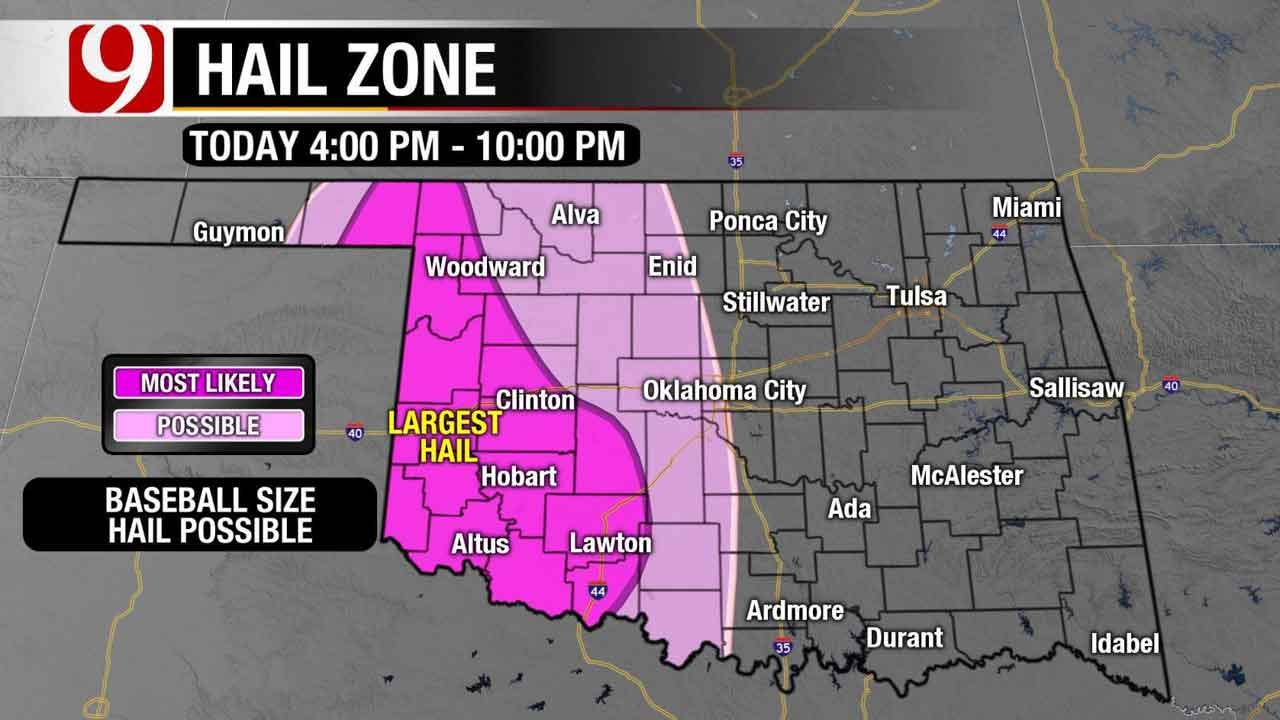

Severe Weather In Oklahoma Wednesdays Storm Timeline With Hail And Wind Predictions

Apr 25, 2025

Severe Weather In Oklahoma Wednesdays Storm Timeline With Hail And Wind Predictions

Apr 25, 2025 -

Dementia Prevention Exploring The Potential Protective Effects Of The Shingles Vaccine

Apr 25, 2025

Dementia Prevention Exploring The Potential Protective Effects Of The Shingles Vaccine

Apr 25, 2025 -

Everything You Need To Know Stagecoach 2025 Lineup And Cheapest Tickets

Apr 25, 2025

Everything You Need To Know Stagecoach 2025 Lineup And Cheapest Tickets

Apr 25, 2025 -

Smi O Vizite Kota Kelloga V Ukrainu 20 Fevralya Poslednie Novosti

Apr 25, 2025

Smi O Vizite Kota Kelloga V Ukrainu 20 Fevralya Poslednie Novosti

Apr 25, 2025

Latest Posts

-

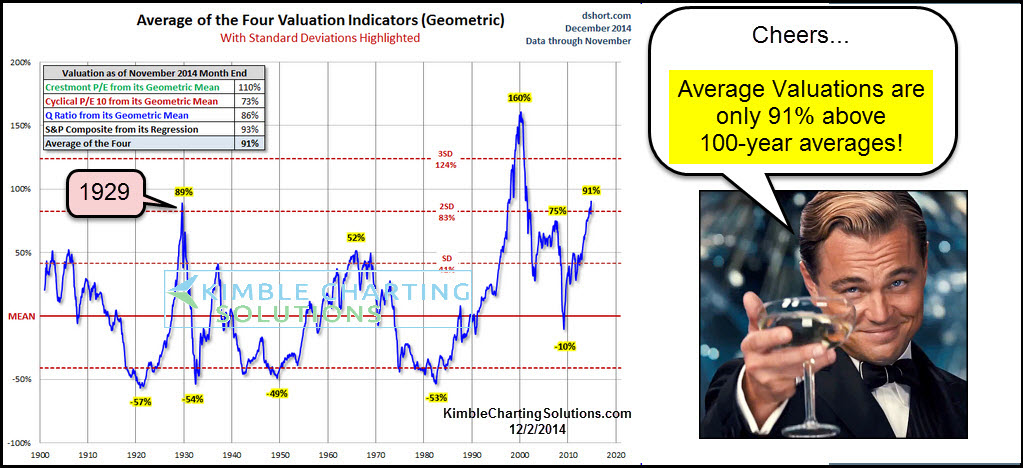

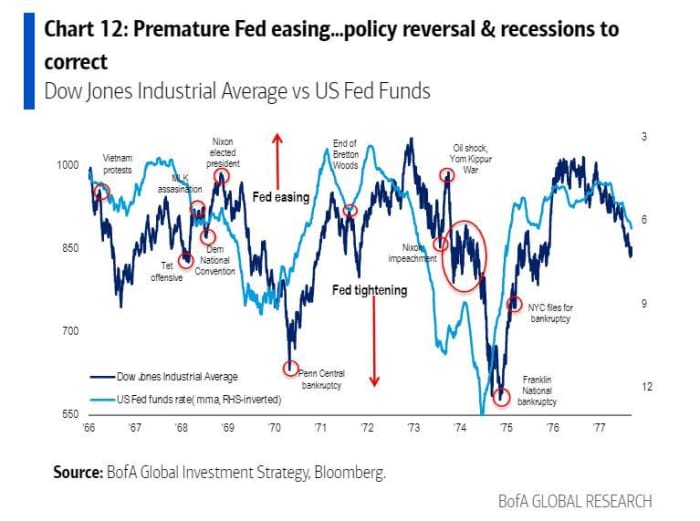

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025 -

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 26, 2025

High Stock Valuations And Investor Concerns A Bof A Analysis

Apr 26, 2025 -

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025 -

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025