Profitable Dividend Investing Made Simple: A Straightforward Strategy For Growth

Table of Contents

Understanding Dividend Investing Fundamentals

What are Dividends?

Dividends are a portion of a company's profits that are distributed to its shareholders. Think of it as a reward for owning a share of a successful business. Receiving dividends represents a return on your investment, providing a regular income stream in addition to potential capital appreciation. Understanding how dividends work is crucial for profitable dividend investing.

Types of Dividend Stocks

Companies pay dividends on different schedules and with varying strategies. Two main approaches are:

-

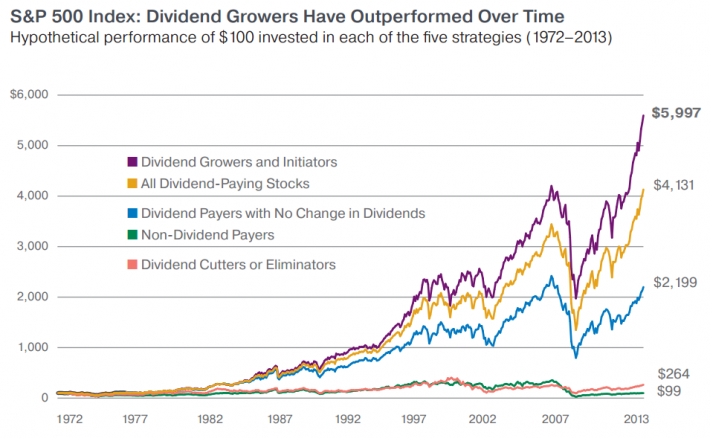

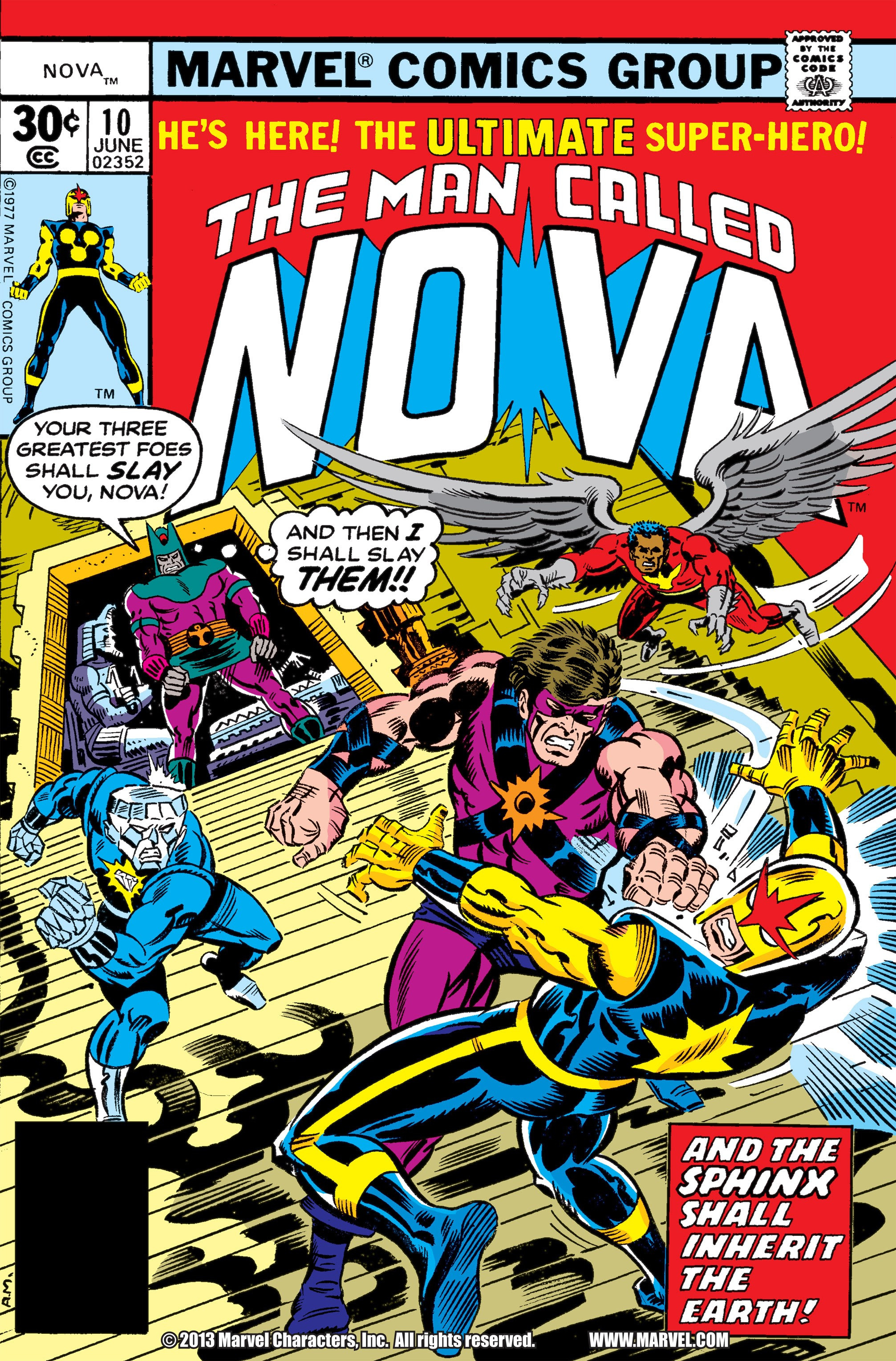

Dividend Growth Stocks: These companies focus on consistently increasing their dividend payments over time. This provides a growing income stream and often reflects a company's strong financial health and commitment to shareholders. Examples include many companies in the Dividend Aristocrats index, a group of S&P 500 companies with 25+ years of consecutive dividend increases. You can find more information on these and other dividend stocks on sites like [link to reputable financial resource].

-

High-Yield Dividend Stocks: These stocks offer a higher dividend yield compared to the overall market, making them attractive for income-focused investors. However, it's crucial to carefully assess the company's financial stability before investing, as high yields can sometimes signal underlying risks. Real Estate Investment Trusts (REITs) are a common source of high-yield dividends. Explore REIT options through platforms like [link to a reputable brokerage or resource].

Dividend Yield vs. Payout Ratio

Two key metrics to consider when evaluating dividend stocks are:

-

Dividend Yield: This represents the annual dividend payment relative to the stock's price. A higher yield generally indicates a higher potential income stream, but it's crucial to consider the payout ratio.

-

Payout Ratio: This shows the percentage of a company's earnings that are paid out as dividends. A high payout ratio (e.g., above 90%) can indicate a lack of reinvestment in the company's future growth, potentially impacting long-term sustainability. A lower payout ratio (e.g., below 60%) generally suggests more financial stability.

Building a Profitable Dividend Portfolio

Diversification is Key

Diversification is crucial in any investment strategy, and profitable dividend investing is no exception. Spreading your investments across different sectors and companies reduces risk. Consider these strategies:

-

Exchange-Traded Funds (ETFs): ETFs offer diversified exposure to a basket of dividend-paying stocks across various sectors, providing instant diversification.

-

Mutual Funds: Similar to ETFs, mutual funds pool investments from multiple investors, allowing for diversification within a single fund.

-

Individual Stocks: Selecting individual stocks allows for more targeted investment in specific companies, but requires more research and carries higher risk if not properly diversified.

Selecting High-Quality Dividend Stocks

Don't solely focus on high yields; prioritize the overall quality and financial health of the company. Look for:

-

Stable Financial History: Check the company's historical financial statements to ensure consistent profitability and a strong track record.

-

Strong Earnings Growth: Look for companies demonstrating consistent earnings growth, indicating a healthy and expanding business.

-

Consistent Dividend Increases: Companies with a history of increasing dividend payments show a commitment to rewarding shareholders.

-

Reasonable Valuation: Avoid overvalued stocks; use metrics like the price-to-earnings ratio (P/E) to assess whether the stock price is justified by its earnings. Utilize stock screening tools like [link to a reputable stock screening tool] to filter companies based on these criteria.

Reinvesting Dividends for Compounding Growth

Reinvesting your dividends is a powerful strategy for accelerating wealth creation. This is often referred to as a Dividend Reinvestment Plan (DRIP).

-

Mechanics of DRIPs: Many brokerage accounts offer automatic DRIP programs, allowing you to automatically reinvest dividends to purchase more shares.

-

Long-Term Benefits: Reinvesting dividends allows you to buy more shares at current market prices, increasing your overall ownership and future dividend payments, leading to exponential growth over time.

Managing Your Dividend Portfolio for Long-Term Growth

Regularly Review and Rebalance

Regularly review your portfolio (e.g., annually or quarterly) to monitor the performance of your investments and make necessary adjustments.

-

Portfolio Review Schedule: Aim for a consistent review schedule to stay informed about market trends and the health of your investments.

-

Rebalancing Strategies: Periodically rebalance your portfolio to maintain your target asset allocation and avoid overexposure to any single stock or sector.

Staying Informed about Market Trends

Stay updated on economic conditions and industry news that may impact your dividend stocks.

-

Reliable Financial News Sources: Follow reputable financial news outlets and websites for market updates.

-

Investment Tools: Utilize financial news platforms and investment research tools to track your investments and the broader market.

Tax Implications of Dividend Income

Be aware of the tax implications of dividend income in your jurisdiction. This information is crucial for accurate financial planning.

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts (if available in your location) to potentially reduce your tax burden on dividend income.

Conclusion

Building a successful profitable dividend investing strategy involves understanding the fundamentals, diversifying your portfolio, selecting high-quality stocks, and managing your investments effectively. By following these steps and consistently reviewing your portfolio, you can create a steady stream of passive income and build long-term wealth. Start building your passive income stream today with a well-researched dividend investing strategy. Research dividend stocks, open a brokerage account, and begin your journey towards financial independence. Remember, consistent profitable dividend investing can lead to significant long-term growth and financial security.

Featured Posts

-

Judges Hot Start Highlights The Braves Struggles Early In The Season

May 12, 2025

Judges Hot Start Highlights The Braves Struggles Early In The Season

May 12, 2025 -

John Wicks Las Vegas Become Baba Yaga

May 12, 2025

John Wicks Las Vegas Become Baba Yaga

May 12, 2025 -

Henry Cavill As Marvels Nova Exploring The Rumor

May 12, 2025

Henry Cavill As Marvels Nova Exploring The Rumor

May 12, 2025 -

Rory Mc Ilroy And Shane Lowry Six Strokes Back In Zurich Classic Defense

May 12, 2025

Rory Mc Ilroy And Shane Lowry Six Strokes Back In Zurich Classic Defense

May 12, 2025 -

Remembering Chris Newsom Halls Crossroads Baseball Tournament

May 12, 2025

Remembering Chris Newsom Halls Crossroads Baseball Tournament

May 12, 2025

Latest Posts

-

L Ancienne Miss Meteo Et Eric Antoine Un Couple Discret A La Premiere Parisienne

May 12, 2025

L Ancienne Miss Meteo Et Eric Antoine Un Couple Discret A La Premiere Parisienne

May 12, 2025 -

Ensuring Quality Control Addressing Challenges In Automated Lyophilized Vial Inspection

May 12, 2025

Ensuring Quality Control Addressing Challenges In Automated Lyophilized Vial Inspection

May 12, 2025 -

Improving The Accuracy Of Automated Visual Inspection For Lyophilized Vials

May 12, 2025

Improving The Accuracy Of Automated Visual Inspection For Lyophilized Vials

May 12, 2025 -

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere De Son Spectacle

May 12, 2025

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere De Son Spectacle

May 12, 2025 -

Automated Visual Inspection Of Lyophilized Vials Challenges And Solutions

May 12, 2025

Automated Visual Inspection Of Lyophilized Vials Challenges And Solutions

May 12, 2025