Sharp Decline In Indonesia's Reserves: Two-Year Low Amidst Rupiah Volatility

Table of Contents

Factors Contributing to the Decline in Indonesia's Reserves

Several interconnected factors have contributed to the alarming decrease in Indonesia's foreign exchange reserves. The weakening Rupiah, increased import costs, government spending patterns, capital outflows, and global economic headwinds all play significant roles.

Weakening Rupiah: A Major Factor

The weakening of the Rupiah against the US dollar is a primary driver of the decline in Indonesia's reserves. A weaker Rupiah means that the same amount of foreign currency buys fewer Rupiah, effectively reducing the value of the country's reserves when measured in US dollars. This depreciation is fueled by several factors:

- Global Economic Uncertainty: Global economic instability, including geopolitical tensions and concerns about a potential recession, reduces investor confidence and leads to capital flight from emerging markets like Indonesia.

- Rising US Interest Rates: Increased interest rates in the US make dollar-denominated assets more attractive to investors, drawing capital away from Indonesia and putting downward pressure on the Rupiah.

- Inflationary Pressures: Rising inflation both domestically and globally erodes purchasing power and affects investor sentiment.

Increased Import Costs: Draining Reserves

Indonesia's reliance on imports, particularly in sectors like energy and raw materials, significantly impacts its foreign exchange reserves. Higher global commodity prices necessitate larger outflows of foreign currency to finance these imports, further depleting Indonesia's reserves.

- Energy Imports: Indonesia's substantial reliance on energy imports makes it particularly vulnerable to fluctuations in global oil and gas prices.

- Raw Material Imports: The import of essential raw materials for various industries adds to the pressure on foreign exchange reserves.

Government Spending and its Impact

Government spending, while crucial for economic development, can also influence reserve levels. Large-scale infrastructure projects and social programs often require significant foreign currency outlays. While essential for long-term growth, these expenditures can strain reserves in the short term if not carefully managed.

- Infrastructure Projects: Ambitious infrastructure projects, while beneficial for the economy, can demand substantial foreign currency investments.

- Social Programs: Government spending on social welfare programs, although vital, can also contribute to pressure on foreign exchange reserves.

Capital Outflows: Investor Sentiment

Economic uncertainty, both domestically and globally, can lead to capital outflows as foreign investors withdraw their investments from Indonesia. This reduces the inflow of foreign currency, exacerbating the pressure on reserves.

- Geopolitical Risks: Regional or global geopolitical instability can trigger capital flight.

- Economic Policy Concerns: Uncertainty about future economic policies can also lead investors to seek safer havens.

Global Economic Headwinds: External Pressures

The global economic climate plays a crucial role. Factors such as rising inflation in developed economies, global supply chain disruptions, and the ongoing war in Ukraine all put immense pressure on emerging economies like Indonesia, impacting its reserves.

Impact of the Reserve Decline on the Indonesian Economy

The decline in Indonesia's reserves has several significant implications for the Indonesian economy.

Rupiah Volatility and its Consequences

The continued volatility of the Rupiah poses a considerable risk. Fluctuations in the exchange rate make it difficult for businesses to plan and can lead to increased import costs and inflationary pressures.

Inflationary Pressures and Consumer Impact

The decline in reserves, coupled with a weakening Rupiah and rising import costs, can fuel inflation, directly impacting consumer purchasing power and potentially leading to social unrest.

Debt Servicing Challenges

Reduced reserves can make it more challenging for Indonesia to service its external debt, potentially leading to increased borrowing costs and further economic strain.

Investor Confidence and Foreign Investment

The decline in reserves can negatively impact investor confidence, potentially deterring foreign investment, which is crucial for economic growth and stability.

Import Dependence and Vulnerability

Indonesia's significant reliance on imports makes it particularly vulnerable to external shocks and fluctuations in global commodity prices, further stressing its foreign exchange reserves.

Government Response and Potential Solutions

The Indonesian government is likely to implement various measures to address the declining reserves and Rupiah volatility.

Monetary Policy Adjustments: Interest Rate Hikes

Adjusting monetary policy, such as raising interest rates, can help stabilize the Rupiah by attracting foreign investment and curbing inflation. However, this can also slow down economic growth.

Fiscal Policy Measures: Targeted Spending

Implementing prudent fiscal policy measures, such as controlling government spending and prioritizing essential expenditures, can help alleviate pressure on reserves.

Foreign Investment Attraction: Incentives and Reforms

Attracting foreign investment through incentives and structural reforms is critical to bolstering reserves and supporting economic growth.

Diversification Strategies: Reducing Import Reliance

Diversifying the economy to reduce reliance on specific imports and export markets can improve resilience to external shocks. This includes promoting domestic production and exploring new trade partnerships.

International Collaboration and Support

Seeking collaboration and support from international organizations like the IMF can provide financial assistance and technical expertise to help stabilize the economy.

Conclusion: Understanding and Managing the Fluctuations in Indonesia's Reserves

The sharp decline in Indonesia's reserves is a result of the interplay between a weakening Rupiah, increased import costs, government spending, capital outflows, and significant global economic headwinds. The potential risks and implications for the Indonesian economy are substantial, impacting inflation, debt servicing, investor confidence, and import dependence. The Indonesian government's response will be crucial in mitigating these risks and restoring stability. Staying informed about developments concerning Indonesia's reserves and the Indonesian economy's resilience is essential. Further research into Rupiah exchange rates, Indonesian economic policy, and Southeast Asian economics will provide a deeper understanding of this complex issue. Understanding the dynamics of Indonesia's reserves is paramount for navigating the current economic challenges and ensuring long-term stability.

Featured Posts

-

Aeroport Permi Zakryt Podrobnosti O Snegopade I Zaderzhkakh Reysov

May 09, 2025

Aeroport Permi Zakryt Podrobnosti O Snegopade I Zaderzhkakh Reysov

May 09, 2025 -

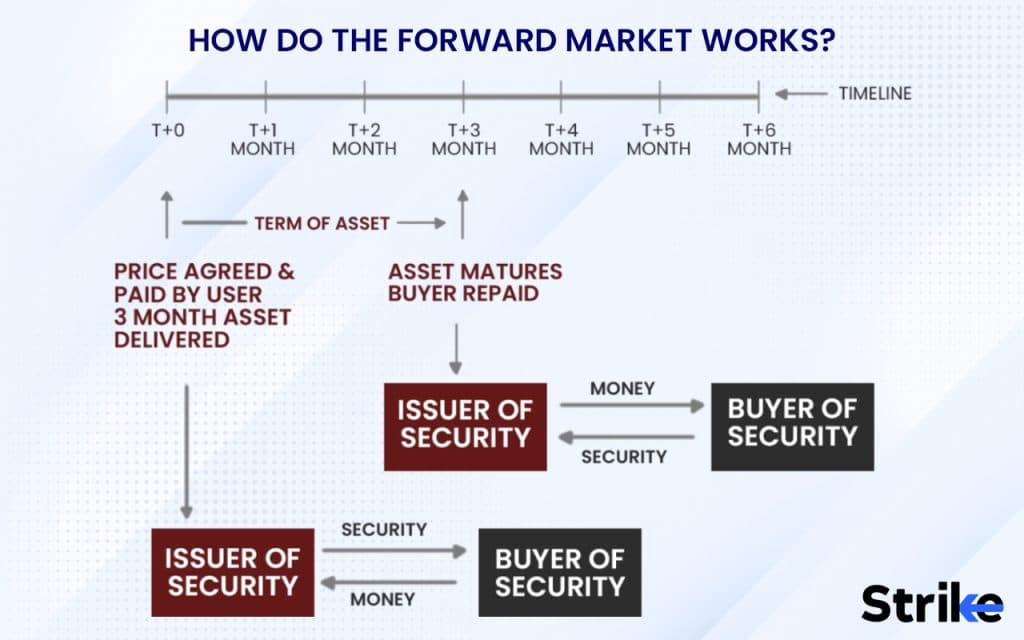

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025 -

Investing In Palantir Evaluating The Recent 30 Price Drop

May 09, 2025

Investing In Palantir Evaluating The Recent 30 Price Drop

May 09, 2025 -

Otkaz Ot Vizita V Kiev 9 Maya Starmer Makron Merts Tusk Ne Priedut

May 09, 2025

Otkaz Ot Vizita V Kiev 9 Maya Starmer Makron Merts Tusk Ne Priedut

May 09, 2025 -

Investing In Palantir Should You Buy Before May 5th

May 09, 2025

Investing In Palantir Should You Buy Before May 5th

May 09, 2025