Should You Invest In XRP (Ripple) While It's Below $3? A Comprehensive Guide

Table of Contents

1. Understanding XRP's Current Market Position

Analyzing the Current Price of XRP

XRP, the native cryptocurrency of Ripple Labs, has experienced significant price fluctuations throughout its history. While it once reached an all-time high significantly above $3, its current price is considerably lower. This volatility is a key factor to consider when deciding whether to invest in XRP (Ripple). [Insert chart showing XRP price history here].

- Market Sentiment: The overall sentiment surrounding XRP is heavily influenced by ongoing regulatory scrutiny and legal battles. Positive news can lead to price surges, while negative developments can trigger sharp declines.

- Regulatory Updates: Regulatory clarity concerning XRP's classification as a security or a currency is crucial for its long-term growth. Any positive developments in this area could significantly impact its price.

- Technological Advancements: Ripple continues to develop and improve its technology, such as RippleNet. Advancements in speed, efficiency, and scalability can contribute to positive market sentiment.

- Comparison to Other Cryptos: Comparing XRP's performance against Bitcoin (BTC) and Ethereum (ETH) provides valuable context. While BTC and ETH tend to exhibit strong correlations, XRP's price movements can be more independent due to its unique focus on cross-border payments. [Insert comparison chart here].

- Price Predictions: Numerous analysts offer price predictions for XRP, but it's crucial to approach these with caution. Always consider the source's credibility and potential biases.

2. Ripple's Technology and Use Cases

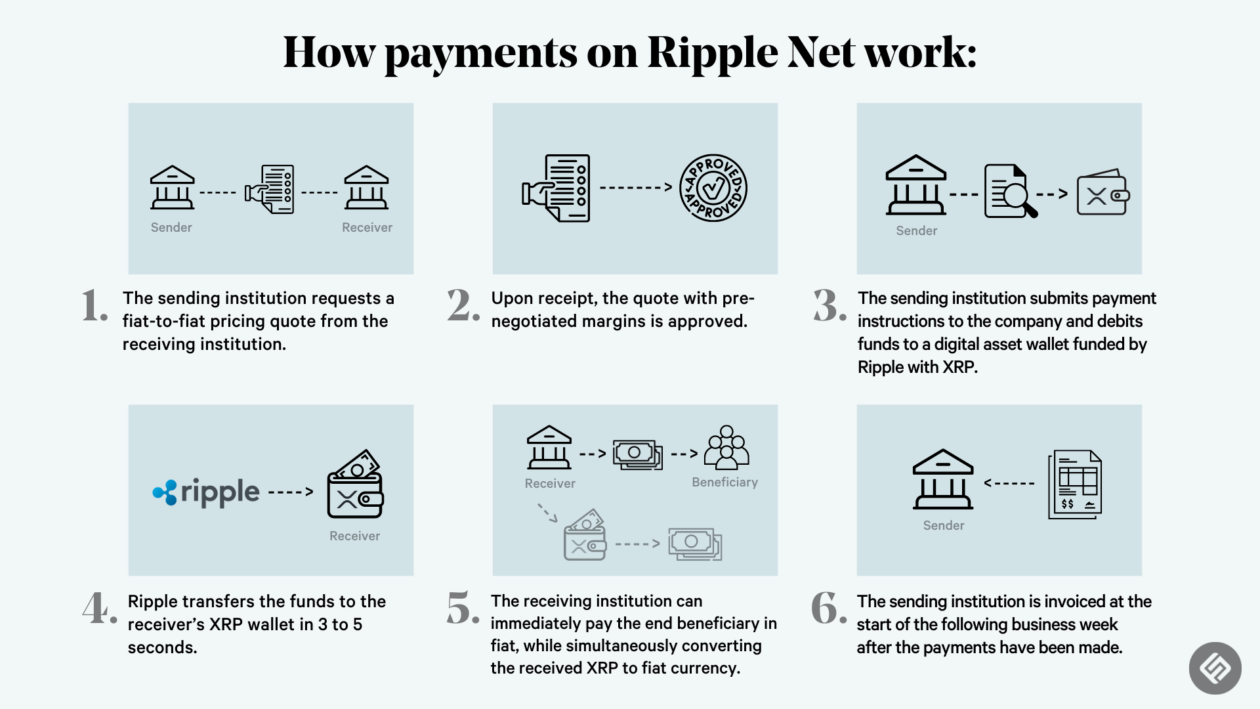

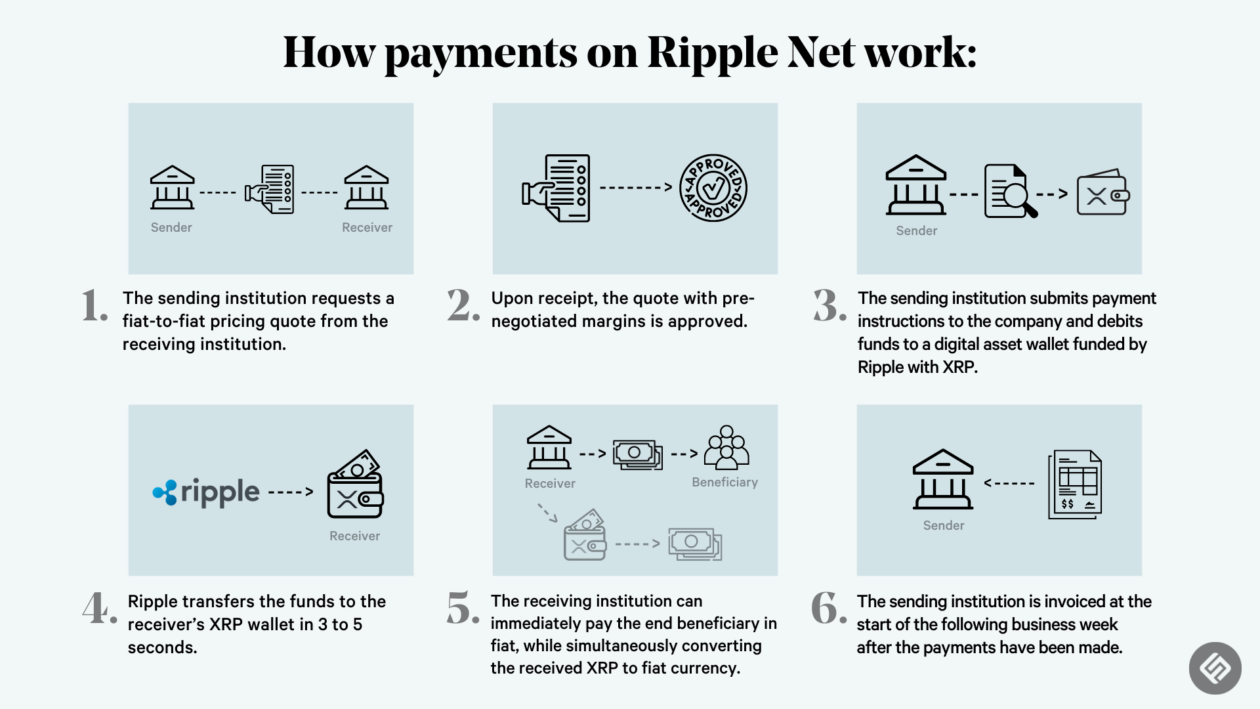

Exploring the RippleNet Network

RippleNet is a real-time gross settlement system (RTGS), currency exchange, and remittance network. It facilitates cross-border payments for banks and financial institutions, offering a faster, cheaper, and more transparent alternative to traditional methods.

- Speed and Cost-Effectiveness: XRP transactions on RippleNet are significantly faster and cheaper than traditional SWIFT transfers. This efficiency is a major selling point for banks and other financial institutions.

- Partnerships: Ripple has secured partnerships with numerous banks and financial institutions globally. These partnerships demonstrate the growing adoption of RippleNet and the potential for widespread use of XRP.

- Addressing Challenges in Traditional Banking: RippleNet addresses the inefficiencies and high costs associated with traditional cross-border payments, offering a more streamlined and efficient solution.

3. Regulatory Landscape and Legal Battles

The SEC Lawsuit and its Impact

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and overall market perception. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies.

- Arguments Presented: The SEC argues that XRP sales constitute an investment contract, while Ripple contends that XRP is a currency used for facilitating transactions on its network.

- Potential Implications: A favorable ruling for Ripple could lead to a significant increase in XRP's price, while an unfavorable ruling could cause a substantial drop.

- Regulatory Uncertainty: The uncertainty surrounding the lawsuit creates volatility in XRP's price, making it a risky investment for those averse to uncertainty.

4. Risk Assessment and Investment Strategies

Diversification and Portfolio Management

Investing in cryptocurrencies, including XRP, carries inherent risks. It's crucial to diversify your portfolio and not invest more than you can afford to lose.

- Volatility and Potential Loss of Capital: Cryptocurrency markets are highly volatile, and prices can fluctuate dramatically in short periods. This volatility represents a significant risk for investors.

- Investment Strategies: Consider dollar-cost averaging (DCA), a strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. Long-term holding is another strategy to mitigate short-term volatility risks.

- Risk Tolerance: Assess your own risk tolerance before investing in XRP or any cryptocurrency. If you're uncomfortable with significant price swings, this might not be the right investment for you.

5. Alternatives to XRP

Comparing XRP to other cryptocurrencies

Several cryptocurrencies offer similar functionalities to XRP, such as facilitating cross-border payments.

- Stellar Lumens (XLM): XLM is a cryptocurrency built on the Stellar network, which also focuses on cross-border payments and microtransactions.

- Litecoin (LTC): LTC is often considered a faster and cheaper alternative to Bitcoin.

Each alternative offers unique strengths and weaknesses compared to XRP. Researching these alternatives can help you make a more informed investment decision.

3. Conclusion

Investing in XRP (Ripple) while it's below $3 presents both opportunities and risks. The potential for significant growth exists, driven by the adoption of RippleNet and technological advancements. However, the ongoing SEC lawsuit and inherent volatility of the cryptocurrency market create substantial uncertainty. Before you decide to invest in XRP (Ripple), carefully weigh the potential rewards against the inherent risks. Thorough research is crucial to forming your own informed opinion on whether to invest in XRP below $3. Consider your risk tolerance, diversify your portfolio, and don't invest more than you can afford to lose. Remember, this is not financial advice; conduct your own due diligence before making any investment decisions related to XRP or any other cryptocurrency.

Featured Posts

-

Significant Oil Spill Leads To Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025

Significant Oil Spill Leads To Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025 -

Te Ipukarea Society Unveiling The Mysteries Of Rare Seabirds

May 01, 2025

Te Ipukarea Society Unveiling The Mysteries Of Rare Seabirds

May 01, 2025 -

Priscilla Pointer Dallas And Carrie Actress Dies At Age 100

May 01, 2025

Priscilla Pointer Dallas And Carrie Actress Dies At Age 100

May 01, 2025 -

Nikki Burdines Departure From Nashvilles News 2 Morning Show Confirmed

May 01, 2025

Nikki Burdines Departure From Nashvilles News 2 Morning Show Confirmed

May 01, 2025 -

Frances Rugby Triumph Duponts Masterclass Against Italy

May 01, 2025

Frances Rugby Triumph Duponts Masterclass Against Italy

May 01, 2025

Latest Posts

-

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025 -

Bof As Rationale Why Current Stock Market Valuations Are Not A Concern

May 01, 2025

Bof As Rationale Why Current Stock Market Valuations Are Not A Concern

May 01, 2025 -

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

May 01, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

May 01, 2025 -

Stock Market Valuations Bof As Reassuring View For Investors

May 01, 2025

Stock Market Valuations Bof As Reassuring View For Investors

May 01, 2025 -

Russias Black Sea Beaches Closed The Impact Of A Large Oil Spill

May 01, 2025

Russias Black Sea Beaches Closed The Impact Of A Large Oil Spill

May 01, 2025