Shrinking Japanese Economy: Q1 Contraction And Tariff Concerns

Table of Contents

Q1 Contraction: A Deeper Dive into the Numbers

The Q1 contraction represents a significant setback for the Japanese economy. While precise figures vary depending on the source, initial reports indicate a [Insert Specific Percentage]% decrease in GDP compared to the previous quarter. This is a sharp reversal from the [Insert Percentage]% growth projected by economists and marks a substantial slowdown compared to the [Insert Percentage]% growth experienced in Q4 of [Previous Year]. This economic slowdown is deeply concerning and necessitates a closer look at the contributing factors.

Several key elements contributed to this decline:

-

Weak Consumer Spending: Rising inflation, stagnant wages, and a lingering sense of economic uncertainty have significantly dampened consumer spending, a crucial engine of Japan's economy. High energy prices and food costs are particularly impacting household budgets. This drop in consumer spending is reflected in decreased retail sales and reduced overall consumption.

-

Reduced Business Investment: Uncertainty surrounding global trade and the domestic economic outlook has led to a decrease in business investment. Companies are hesitant to commit to expansion projects and new hires, opting for a more cautious approach to capital expenditure. This business investment slump further exacerbates the economic slowdown.

-

Impact of the Global Economic Slowdown: The global economic slowdown, characterized by high inflation in many countries and fears of a potential recession, is inevitably impacting Japan. Reduced global demand for Japanese exports and disruptions to international supply chains are contributing factors to the Q1 contraction. Japan's GDP growth is heavily influenced by the health of the global economy.

-

Supply Chain Disruptions: Ongoing supply chain bottlenecks, stemming from both global and domestic factors, are creating production delays and increasing costs for Japanese businesses. These disruptions further constrain economic indicators and hamper growth.

Escalating Tariff Concerns: A Threat to Japanese Exports

Escalating trade tariffs pose a significant threat to the Japanese economy, particularly its export-oriented industries. Trade disputes, especially with [mention specific countries and the nature of the dispute, e.g., the US over certain automotive parts], have resulted in increased tariffs on Japanese goods. This directly impacts Japanese exports to key markets, leading to a potential export decline.

The automotive and electronics sectors, crucial pillars of the Japanese economy, are particularly vulnerable to these increased tariffs. The impact is multifaceted:

-

Impact on Japanese Businesses and Employment: Reduced export demand due to tariffs leads to decreased production, impacting Japanese businesses' profitability and potentially resulting in job losses. This translates into reduced GDP growth and heightened economic slowdown.

-

Potential for Retaliatory Tariffs from Japan: The imposition of tariffs on Japanese goods could trigger retaliatory measures from Japan, potentially escalating the trade war and further harming global trade relationships. This would exacerbate the already challenging trade war impact on the Japanese economy.

Interconnectedness of Domestic and Global Factors

The Q1 contraction is not solely attributable to global factors. Japan's domestic challenges, particularly its aging population and shrinking workforce, exacerbate the impact of global issues like trade tariffs and recession fears. These demographic trends create a weaker domestic demand base, making the economy more vulnerable to external shocks.

The Japanese government has responded with a range of fiscal policy and monetary policy interventions, including [mention specific measures taken by the government, e.g., stimulus packages, interest rate adjustments]. However:

-

Effectiveness of Government Interventions: The effectiveness of these interventions remains to be seen, as many economists are debating whether the measures are sufficient to counter the deep-seated economic challenges faced by Japan.

-

Potential for Further Economic Stimulus: Further economic stimulus may be necessary to boost consumer confidence and encourage investment, but concerns about increasing public debt limit the scope of potential interventions.

Looking Ahead: Forecasting the Future of the Japanese Economy

Expert opinions on the future of the Japanese economy are varied. While some predict a modest recovery in the coming quarters, others forecast a prolonged period of stagnation or even further contraction. The economic forecast hinges on several factors, including the resolution of trade disputes, the global economic outlook, and the success of government interventions.

Potential scenarios include:

-

Best-Case Scenario: Resolution of trade disputes, a rebound in global demand, and successful government stimulus measures lead to a gradual economic recovery.

-

Worst-Case Scenario: Escalating trade tensions, a global recession, and ineffective government interventions result in a prolonged period of economic contraction.

-

Most Likely Scenario: A period of slow, uneven growth, punctuated by occasional setbacks, with challenges from both domestic and global factors persisting. The economic outlook remains uncertain.

Opportunities for recovery exist, but significant risks and challenges remain:

-

Opportunities for Economic Recovery: Technological innovation, investment in infrastructure, and structural reforms could support economic recovery. Focusing on future growth areas like renewable energy and technological advancements are crucial.

-

Risks and Challenges Ahead: Aging population, high public debt, and potential escalation of trade disputes continue to pose significant risks.

Conclusion: Navigating the Challenges of the Shrinking Japanese Economy

The Q1 contraction and escalating tariff concerns paint a challenging picture for the Japanese economy. The interconnectedness of domestic demographic issues and global trade dynamics highlights the complexity of the situation. The Japanese economic downturn necessitates a multi-pronged approach, addressing both internal structural weaknesses and external trade pressures. The Japanese economic challenges are significant but not insurmountable. While the economic outlook remains uncertain, proactive policy measures, technological innovation, and global cooperation are essential for navigating this challenging period and fostering a sustainable economic recovery. Stay informed about the evolving situation by following reputable economic news sources and conducting further research on the shrinking Japanese economy and its future trajectory. Understanding the nuances of the Japanese economic challenges is critical for investors and policymakers alike.

Featured Posts

-

Exclusive Access Donors Promised Vip Military Events With Trump

May 17, 2025

Exclusive Access Donors Promised Vip Military Events With Trump

May 17, 2025 -

Thibodeaus Plea For Resolve Knicks Suffer Devastating 37 Point Loss

May 17, 2025

Thibodeaus Plea For Resolve Knicks Suffer Devastating 37 Point Loss

May 17, 2025 -

Knicks Redemption Thibodeaus Evolution And The Turnaround

May 17, 2025

Knicks Redemption Thibodeaus Evolution And The Turnaround

May 17, 2025 -

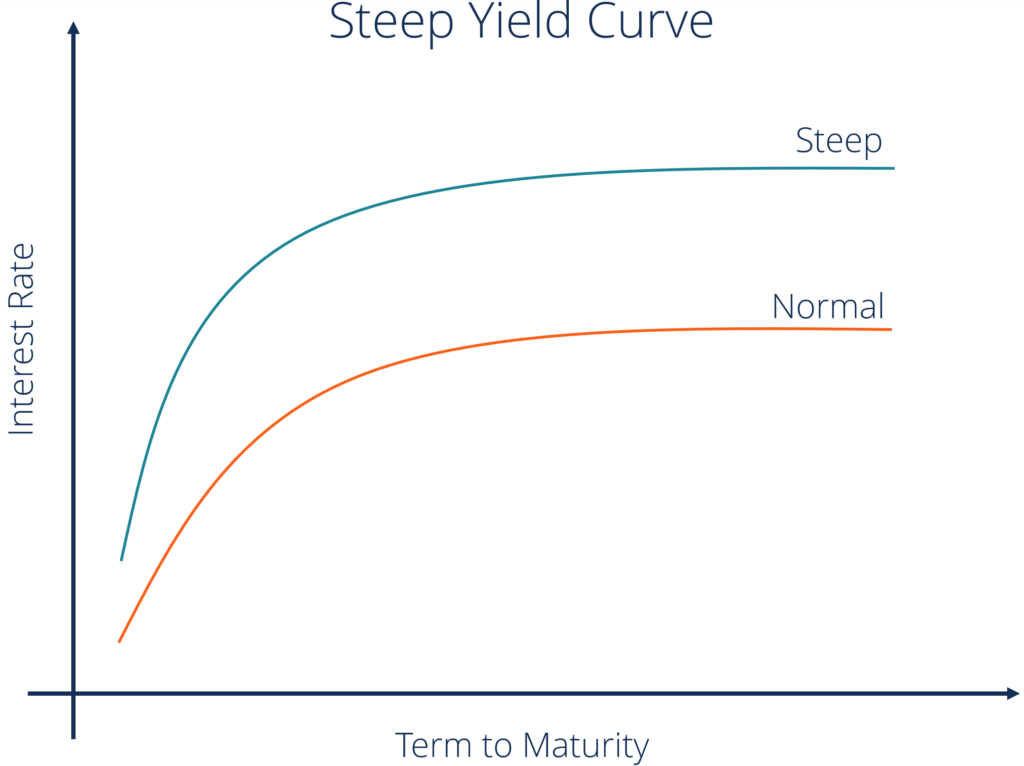

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025 -

Hudsons Bay Offloads Iconic Brands To Canadian Tire A 30 Million Deal

May 17, 2025

Hudsons Bay Offloads Iconic Brands To Canadian Tire A 30 Million Deal

May 17, 2025

Latest Posts

-

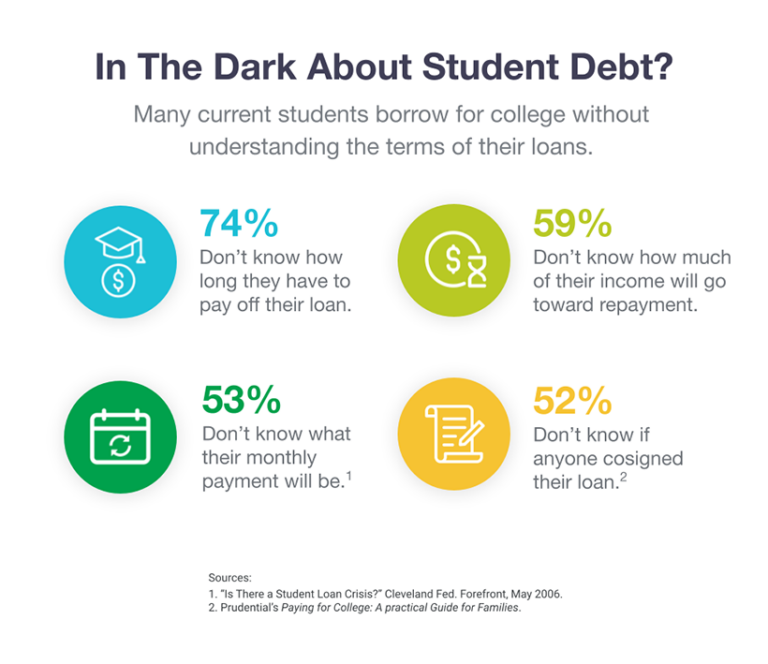

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025 -

When Does Refinancing Federal Student Loans Make Sense

May 17, 2025

When Does Refinancing Federal Student Loans Make Sense

May 17, 2025 -

Federal Student Loan Refinancing A Comprehensive Guide

May 17, 2025

Federal Student Loan Refinancing A Comprehensive Guide

May 17, 2025 -

Refinancing Federal Student Loans Is It Right For You

May 17, 2025

Refinancing Federal Student Loans Is It Right For You

May 17, 2025 -

The Consequences Of Consistently Late Student Loan Payments

May 17, 2025

The Consequences Of Consistently Late Student Loan Payments

May 17, 2025