The Economic Reality Of Election Promises: Assessing The Potential For Deficits

Table of Contents

Analyzing the Cost of Election Promises

Scrutinizing the financial implications of campaign promises is paramount. Voters deserve a clear understanding of how proposed policies will be funded and their long-term effects on the economy. Too often, campaign rhetoric lacks the detailed cost analysis necessary for informed decision-making.

- Detailed cost analysis often lacking in campaign rhetoric: Many promises are made without specifying the exact costs involved, leading to unrealistic expectations.

- Need for independent verification of proposed spending: Independent economic analysis is crucial to verify the figures presented by political parties.

- Consideration of long-term budgetary impact beyond initial projections: The initial cost of a policy may be low, but long-term maintenance and operational costs can significantly increase the overall burden on the national budget.

Methodologies for cost estimation vary, but generally involve independent economic modeling based on government budgetary frameworks and historical data. For example, analysts might utilize econometric models to predict the impact of tax changes on government revenue. Comparing past election promises with their actual costs provides valuable insight. For instance, analyzing the projected versus actual costs of past infrastructure projects can highlight the discrepancies between campaign pledges and budgetary reality.

The Impact of Tax Cuts and Increased Spending on the National Debt

Fiscal policy choices—specifically tax cuts and increased spending—have a direct impact on government debt. Understanding this relationship is critical to assessing the long-term economic consequences of election promises.

- Impact of tax cuts on government revenue: Tax cuts can stimulate economic activity, but they also reduce government revenue, potentially leading to larger budget deficits.

- Analysis of potential increases in government spending on social programs, infrastructure, etc.: Increased spending on social programs and infrastructure can be beneficial, but it also needs to be financed through increased taxes, borrowing, or cuts in other areas.

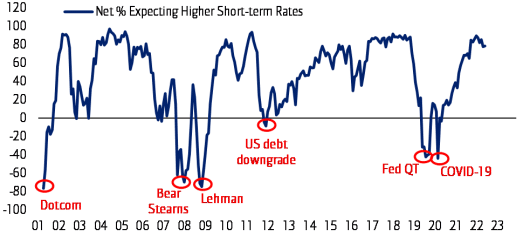

- Effect on the national debt and potential implications for interest rates: A rising national debt can lead to higher interest rates, increasing the cost of borrowing for both the government and the private sector.

Fiscal sustainability is essential for long-term economic planning. This involves ensuring that government spending and revenue are balanced over time. Different economic models, such as Keynesian and neoclassical models, offer varying perspectives on the optimal balance between government spending, taxation, and debt. Charts and graphs illustrating potential debt trajectories under different policy scenarios can help visualize the potential fiscal consequences of election promises. For example, a simple graph could compare debt projections under a scenario of significant tax cuts with a scenario of increased taxation.

Unforeseen Economic Factors and Their Influence on Budget Projections

Long-term budgetary forecasting inherently involves uncertainty and risk. Economic models, while helpful, cannot perfectly predict unforeseen events.

- Impact of economic shocks (recessions, global crises): Recessions and global crises can dramatically impact government revenue and increase demand for social safety nets, leading to larger budget deficits.

- Influence of unforeseen events (e.g., natural disasters, pandemics): Unforeseen events require significant emergency spending, further straining the national budget.

- Limitations of economic models in predicting unexpected events: Economic models are based on assumptions and historical data; they may not accurately reflect the impact of truly unprecedented events.

Contingency planning and fiscal reserves are crucial to mitigate these risks. Maintaining a healthy fiscal reserve allows governments to respond effectively to unforeseen circumstances without resorting to drastic spending cuts or tax increases. Transparency and accountability in managing public finances are paramount to build public trust and ensure responsible spending.

The Role of Independent Economic Analysis in Evaluating Election Promises

Independent economic analysis plays a vital role in assessing the feasibility of election promises. Unbiased analysis from credible sources is crucial to counter potential political bias.

- Sources of independent economic analysis (think tanks, academic institutions): Numerous think tanks and academic institutions provide independent economic analyses of government policies and budgets.

- Criteria for evaluating the credibility of economic forecasts: It's essential to evaluate the methodology, data sources, and potential biases of economic forecasts to assess their credibility.

- Role of media in scrutinizing and reporting on the economic aspects of election campaigns: The media plays a crucial role in disseminating information about the economic implications of election promises to the public.

Citizens can access independent economic analyses from reputable sources, such as university research centers, non-partisan think tanks, and international organizations. Understanding these analyses empowers voters to make informed decisions based on the economic reality of election promises.

Conclusion

The economic reality of election promises often reveals a significant potential for increased government deficits. Critical analysis of campaign pledges, focusing on detailed cost estimates and long-term budgetary impacts, is crucial. Transparency in budgetary processes and access to independent economic analysis empower voters to make informed choices. Understanding the fiscal implications of various policies is key to responsible governance. We urge readers to engage in informed voting by critically evaluating election pledges and assessing the economic impact of different proposals. Seek out independent analyses before making electoral decisions, promoting responsible engagement with the economic reality of election promises and understanding the fiscal implications of each candidate's platform.

Featured Posts

-

Navigating The Legal System After A Car Accident The Need For A Lawyer

Apr 25, 2025

Navigating The Legal System After A Car Accident The Need For A Lawyer

Apr 25, 2025 -

Dope Thief Trailer Brian Tyree Henry And Wagner Moura In Ridley Scotts Pulse Pounding New Show

Apr 25, 2025

Dope Thief Trailer Brian Tyree Henry And Wagner Moura In Ridley Scotts Pulse Pounding New Show

Apr 25, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof A Weighs In

Apr 25, 2025

Should Investors Worry About Current Stock Market Valuations Bof A Weighs In

Apr 25, 2025 -

Analysis Of Nestle Nesn Sales Performance The Role Of Coffee And Cocoa Pricing

Apr 25, 2025

Analysis Of Nestle Nesn Sales Performance The Role Of Coffee And Cocoa Pricing

Apr 25, 2025 -

Ubs Alters India And Hong Kong Economic Predictions

Apr 25, 2025

Ubs Alters India And Hong Kong Economic Predictions

Apr 25, 2025

Latest Posts

-

Analyzing The Rhetoric Surrounding Gavin Newsoms Policies

Apr 26, 2025

Analyzing The Rhetoric Surrounding Gavin Newsoms Policies

Apr 26, 2025 -

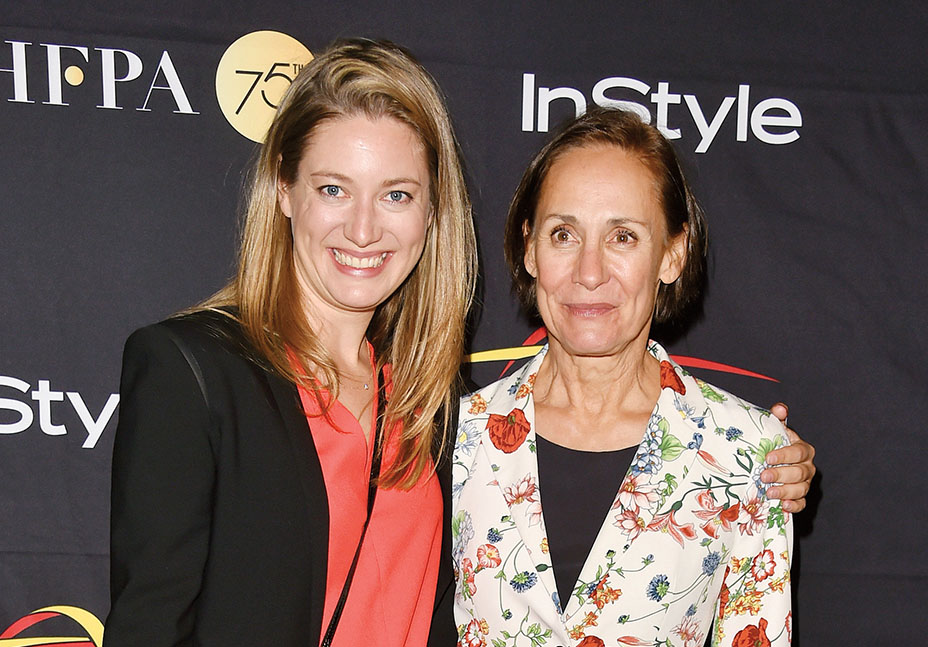

Hollywood Nepotism A Thunderbolt Stars Honest Confession

Apr 26, 2025

Hollywood Nepotism A Thunderbolt Stars Honest Confession

Apr 26, 2025 -

Outrage As Newsom Interviews Steve Bannon Former Republican Representative Speaks Out

Apr 26, 2025

Outrage As Newsom Interviews Steve Bannon Former Republican Representative Speaks Out

Apr 26, 2025 -

Gavin Newsoms Stance On Trans Athletes A Deeply Unfair Policy

Apr 26, 2025

Gavin Newsoms Stance On Trans Athletes A Deeply Unfair Policy

Apr 26, 2025 -

The Political Landscape Assessing Governor Newsoms Actions

Apr 26, 2025

The Political Landscape Assessing Governor Newsoms Actions

Apr 26, 2025