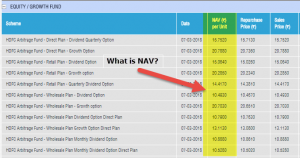

Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Accurately tracking the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for monitoring its performance. Several reliable sources provide this information, both real-time and historical data. Knowing where to look ensures you have the most up-to-date picture of your investment.

-

Amundi's Official Website: The primary source for accurate NAV data is the asset manager's website itself. Amundi regularly updates this information, providing transparency to investors. Look for dedicated sections on ETF details and fact sheets.

-

Major Financial News Websites: Reputable financial news sources such as Bloomberg, Yahoo Finance, and Google Finance often include real-time and historical ETF NAV data. These platforms typically provide comprehensive market data, including charts and graphs for easy visualization.

-

Your Brokerage Account Platform: Most brokerage accounts display the current NAV of your held ETFs directly within your portfolio overview. This offers convenient access alongside your other investment information.

-

Dedicated ETF Data Providers: Several specialized providers focus on ETF data, often offering advanced analytics and tools beyond basic NAV information. These can be subscription services or offer free limited access.

Understanding the Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

The daily fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF's NAV are influenced by various interconnected factors. Understanding these factors is key to interpreting the NAV data accurately.

-

Performance of the Dow Jones Industrial Average Constituent Stocks: The ETF's NAV directly reflects the performance of the 30 companies comprising the Dow Jones Industrial Average. Positive performance in the underlying stocks leads to a higher NAV, while negative performance decreases it.

-

Currency Exchange Rates: As a UCITS ETF, the Amundi Dow Jones Industrial Average UCITS ETF might hold assets denominated in currencies other than your base currency. Fluctuations in exchange rates can impact the NAV.

-

Management Fees and Expenses: The ETF's management fees and operating expenses slightly reduce the NAV over time. These costs are factored into the daily calculations.

-

Dividend Distributions: When underlying companies in the Dow Jones Industrial Average pay dividends, the ETF distributes a portion to its shareholders. This distribution momentarily reduces the NAV.

-

Market Sentiment and Overall Economic Conditions: Broader market trends and overall economic health play a significant role. Positive economic news and investor confidence generally boost the NAV, while negative sentiment can depress it.

Interpreting and Utilizing Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Understanding how to interpret the NAV data is crucial for leveraging it for informed investment choices. The NAV itself, while important, is only one piece of the puzzle.

-

Calculating Percentage Changes in NAV Over Time: Tracking the percentage change in NAV over specific periods (daily, weekly, monthly, or yearly) provides a clear picture of the ETF's growth or decline.

-

Comparing NAV to Market Price to Identify Arbitrage Opportunities: While less common with highly liquid ETFs, discrepancies between the NAV and market price can present short-term arbitrage opportunities.

-

Using NAV Data for Long-Term Performance Analysis: Consistent monitoring of the NAV over the long term is essential for assessing the ETF's overall performance and its alignment with your investment goals.

-

The Role of NAV in Assessing Investment Risk: Analyzing the NAV's volatility can provide insights into the ETF's risk profile. Higher volatility suggests higher risk.

Tools and Resources for Tracking Amundi Dow Jones Industrial Average UCITS ETF NAV

Efficient NAV tracking doesn't have to be tedious. Several tools can automate the process and enhance your analysis.

-

Spreadsheet Software (Excel, Google Sheets): Manually inputting NAV data into a spreadsheet allows for customized calculations and charting.

-

Financial Data Tracking Software: Many software solutions offer automated data feeds, including real-time NAV updates, eliminating manual data entry.

-

Brokerage Account Portfolio Trackers: Most brokerage platforms provide portfolio tracking tools that include the NAV of your held ETFs.

-

Dedicated ETF Tracking Websites and Apps: Specialized websites and mobile apps cater specifically to ETF tracking, offering advanced features and analytical tools.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Tracking

Successfully tracking the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF involves understanding where to find the data, the factors that influence it, and how to interpret it effectively. Utilizing the resources and tools discussed will allow for informed investment decisions. By actively monitoring the Net Asset Value (NAV) and understanding its relationship to the underlying Dow Jones Industrial Average and market conditions, you can make sound investment choices. Continue your research by exploring other ETFs that align with your investment strategy and risk tolerance. Remember, consistent monitoring of the Net Asset Value (NAV) is key to long-term success.

Featured Posts

-

Discover Local And Global Destinations England Airpark And Alexandria International Airport Launch Ae Xplore

May 24, 2025

Discover Local And Global Destinations England Airpark And Alexandria International Airport Launch Ae Xplore

May 24, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 24, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 24, 2025 -

Fly Local Explore Global The Ae Xplore Campaign Launches At England Airpark And Alexandria International Airport

May 24, 2025

Fly Local Explore Global The Ae Xplore Campaign Launches At England Airpark And Alexandria International Airport

May 24, 2025 -

Escape To The Countryside Homes Activities And More

May 24, 2025

Escape To The Countryside Homes Activities And More

May 24, 2025 -

Kharkovschina Svadebniy Den S Pochti 40 Parami Molodozhenov

May 24, 2025

Kharkovschina Svadebniy Den S Pochti 40 Parami Molodozhenov

May 24, 2025

Latest Posts

-

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025 -

Buffetts Apple Bet A Deep Dive Into Tariff Related Risks And Rewards

May 24, 2025

Buffetts Apple Bet A Deep Dive Into Tariff Related Risks And Rewards

May 24, 2025 -

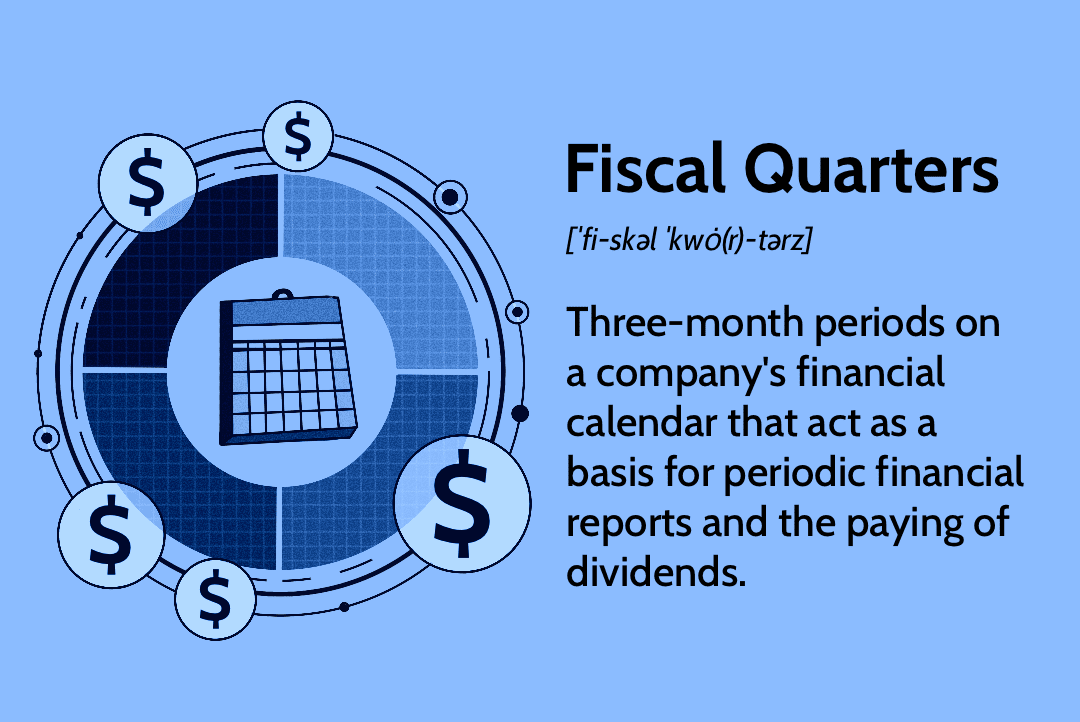

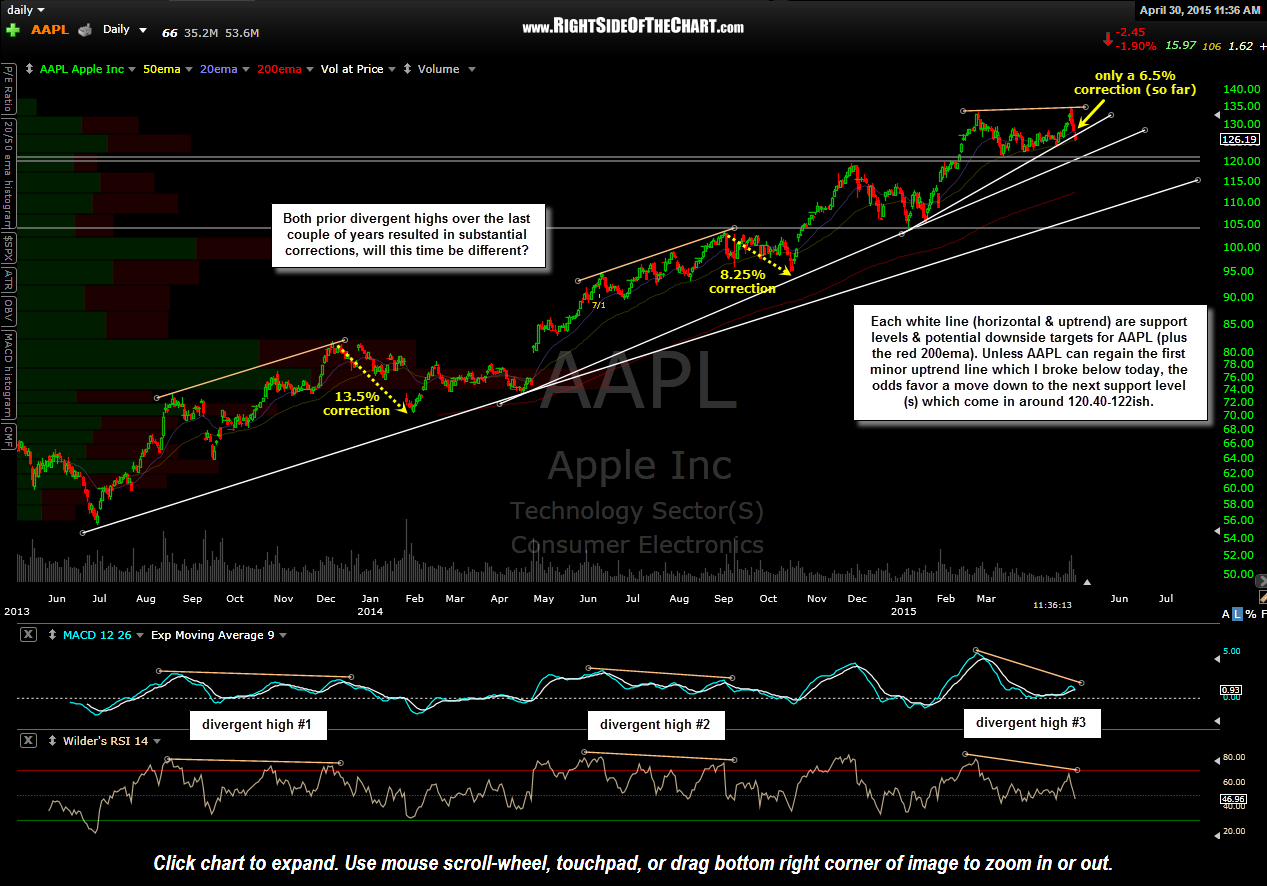

Apple Stock Below Key Support Ahead Of Fiscal Q2 Report

May 24, 2025

Apple Stock Below Key Support Ahead Of Fiscal Q2 Report

May 24, 2025 -

Forecasting Apple Stock Aapl Price Movements Key Levels To Consider

May 24, 2025

Forecasting Apple Stock Aapl Price Movements Key Levels To Consider

May 24, 2025 -

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025