U.S. Dollar's Performance Under Scrutiny: Parallels To The Nixon Presidency

Table of Contents

The Nixon Shock: A Turning Point for the U.S. Dollar

The Nixon Shock, announced on August 15, 1971, marked a dramatic shift in the global monetary system. Years of unsustainable economic policies, including the Vietnam War's escalating costs and growing inflation, had put immense pressure on the U.S. dollar. Under the Bretton Woods system, the dollar was pegged to gold, meaning other currencies were indirectly pegged to gold through their exchange rates with the dollar. This system, however, was beginning to crumble under the weight of persistent trade deficits and a loss of confidence in the dollar's convertibility to gold.

- Closing the Gold Window: Nixon's decisive action to close the "gold window"—preventing foreign governments from exchanging dollars for gold—effectively ended the Bretton Woods system and ushered in an era of floating exchange rates.

- Immediate Consequences: The immediate consequences were swift and dramatic. The dollar was devalued, leading to increased inflation both domestically and internationally. The fixed exchange rate regime, previously offering stability, was replaced by a system vulnerable to speculation and volatility.

- Long-Term Effects: The long-term effects of the Nixon Shock were profound. The dollar's role as the world's dominant currency was challenged, albeit not overturned. The move towards floating exchange rates increased currency market volatility, creating new risks and opportunities for global trade and investment. The global monetary system fundamentally changed, introducing a new era of uncertainty and requiring constant adjustments to macroeconomic policies worldwide. Keywords used: Nixon Shock 1971, gold standard, Bretton Woods system, dollar devaluation, inflation, global monetary system.

Current Challenges Facing the U.S. Dollar: A Modern Parallel?

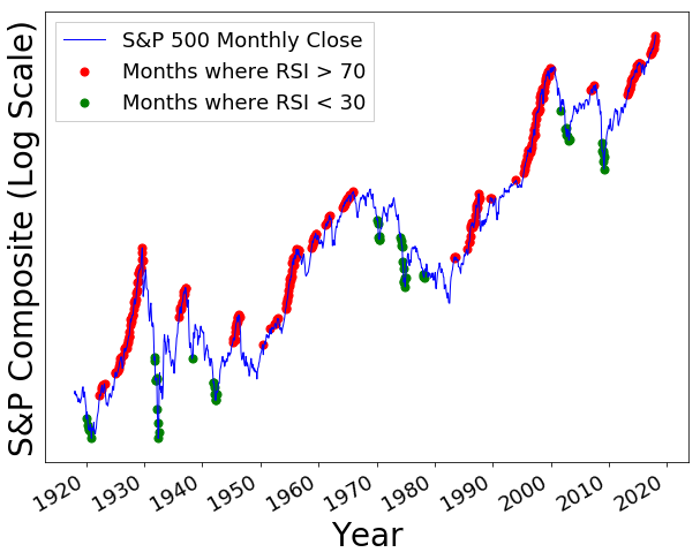

Today, the U.S. dollar faces a complex array of challenges that echo, in some ways, the pressures leading to the Nixon Shock. While the gold standard is long gone, several factors are contributing to the dollar's current instability.

- Inflationary Pressures: High inflation rates in the U.S. are eroding the dollar's purchasing power, both domestically and internationally. This reduces the dollar's attractiveness as a store of value.

- Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, aimed at combating inflation, create another layer of complexity. While intended to stabilize the economy, these hikes can also strengthen the dollar in the short term but may trigger a recession and further destabilize the economy in the long run.

- Geopolitical Risks: The ongoing war in Ukraine, rising tensions with China, and other geopolitical hotspots are creating uncertainty in global markets, weakening investor confidence in the dollar. The flight-to-safety phenomenon, where investors move towards perceived safe-haven assets during times of uncertainty, could support the dollar in the short term, but this is not sustainable.

- National Debt: The soaring U.S. national debt raises concerns about the country's long-term fiscal health, potentially undermining investor confidence in the dollar's stability. Keywords used: U.S. dollar value, inflation rate, interest rate hikes, geopolitical risks, national debt, Federal Reserve, monetary policy.

Key Similarities and Differences Between Then and Now

Comparing the economic conditions surrounding the Nixon Shock with the present situation reveals both striking similarities and significant differences.

-

Similarities:

- High inflation rates in both periods.

- Concerns about the U.S.'s economic competitiveness and its trade deficits.

- A sense of uncertainty and a loss of confidence in the dollar's long-term stability.

-

Differences:

- The absence of a fixed exchange rate system tied to gold today.

- A more interconnected and complex global economy.

- The role of technology and globalization in influencing currency markets.

- Different geopolitical landscapes and power dynamics.

The Role of Geopolitical Instability

Geopolitical instability plays a significant role in shaping the U.S. dollar's performance. The current geopolitical climate is marked by increased tensions between major world powers, creating uncertainty and influencing the flow of capital. The "flight to safety" phenomenon often sees investors seeking refuge in U.S. dollar-denominated assets, temporarily boosting the dollar's value. However, prolonged geopolitical uncertainty can ultimately undermine confidence in the dollar's long-term stability. Keywords: geopolitical instability, flight to safety, currency markets, international relations.

Navigating the Uncertain Future of the U.S. Dollar

The parallels between the Nixon era and today's economic climate concerning the U.S. dollar's performance are striking. While the specifics differ, both periods highlight the vulnerability of the dollar to inflationary pressures, geopolitical risks, and a general loss of confidence in the long-term stability of the U.S. economy. The significant challenges currently facing the U.S. dollar underscore the need for careful economic management and a clear understanding of the complexities of the global financial system. The future of the U.S. dollar remains uncertain, subject to the interplay of various economic and political factors. Understanding the U.S. dollar's trajectory requires constant monitoring and analysis of these factors. To stay informed about the U.S. dollar's performance and its implications for the global economy, subscribe to our newsletter or follow us on social media for regular updates. Keywords: U.S. dollar future, economic outlook, global economy, currency forecast.

Featured Posts

-

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025 -

Why Stretched Stock Market Valuations Are Not A Cause For Alarm According To Bof A

Apr 28, 2025

Why Stretched Stock Market Valuations Are Not A Cause For Alarm According To Bof A

Apr 28, 2025 -

12 3 Win For Yankees Max Frieds First Game A Success Against Pirates

Apr 28, 2025

12 3 Win For Yankees Max Frieds First Game A Success Against Pirates

Apr 28, 2025 -

Kuxiu Solid State Power Bank Review Is The Premium Price Worth The Extended Lifespan

Apr 28, 2025

Kuxiu Solid State Power Bank Review Is The Premium Price Worth The Extended Lifespan

Apr 28, 2025 -

Bof As View Addressing Investor Concerns About Stretched Stock Market Valuations

Apr 28, 2025

Bof As View Addressing Investor Concerns About Stretched Stock Market Valuations

Apr 28, 2025

Latest Posts

-

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025

Yankees Avoid Sweep Rodons Gem Leads To Victory

Apr 28, 2025 -

Decoding Musks X Debt Sale A Financial Deep Dive

Apr 28, 2025

Decoding Musks X Debt Sale A Financial Deep Dive

Apr 28, 2025 -

X Corporations Financial Transformation Insights From The Recent Debt Sale

Apr 28, 2025

X Corporations Financial Transformation Insights From The Recent Debt Sale

Apr 28, 2025 -

Financial Update Musks X Debt Sale And Its Implications

Apr 28, 2025

Financial Update Musks X Debt Sale And Its Implications

Apr 28, 2025 -

Recent X Debt Sale Unveiling The Financial Implications For Musks Company

Apr 28, 2025

Recent X Debt Sale Unveiling The Financial Implications For Musks Company

Apr 28, 2025