Understanding High Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

BofA's Valuation Metrics and Their Significance

Bank of America, like many financial institutions, utilizes several key valuation metrics to assess the overall health and potential risks within the stock market. Understanding these metrics is crucial for interpreting BofA's perspective on high stock market valuations. Let's examine some of their preferred tools:

-

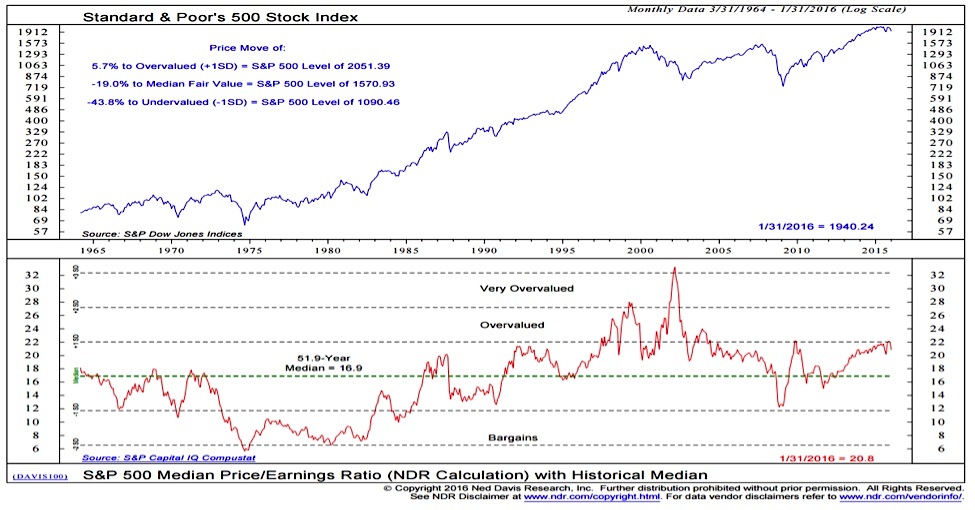

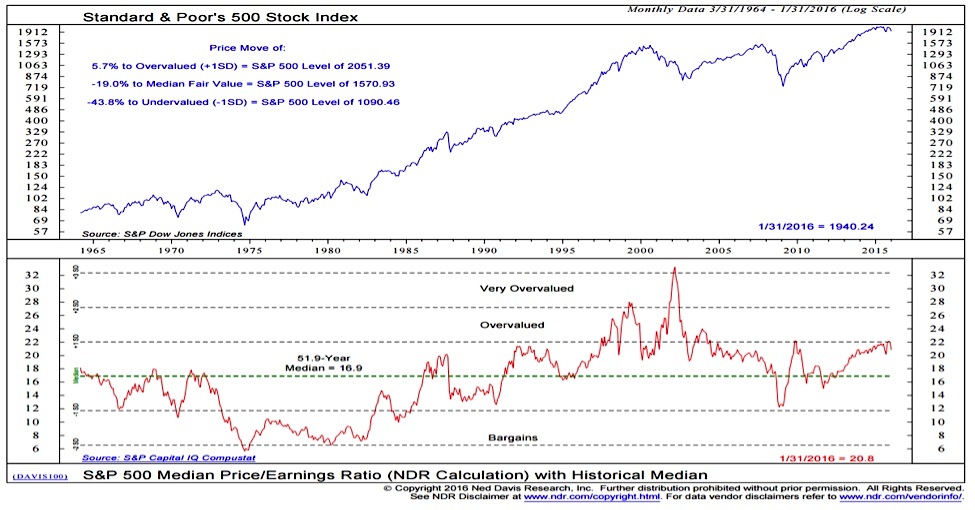

Price-to-Earnings ratio (P/E): This classic metric divides a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating high expectations for future growth or overvaluation. BofA's recent research likely shows the current average P/E ratio across the market, allowing comparison to historical averages.

-

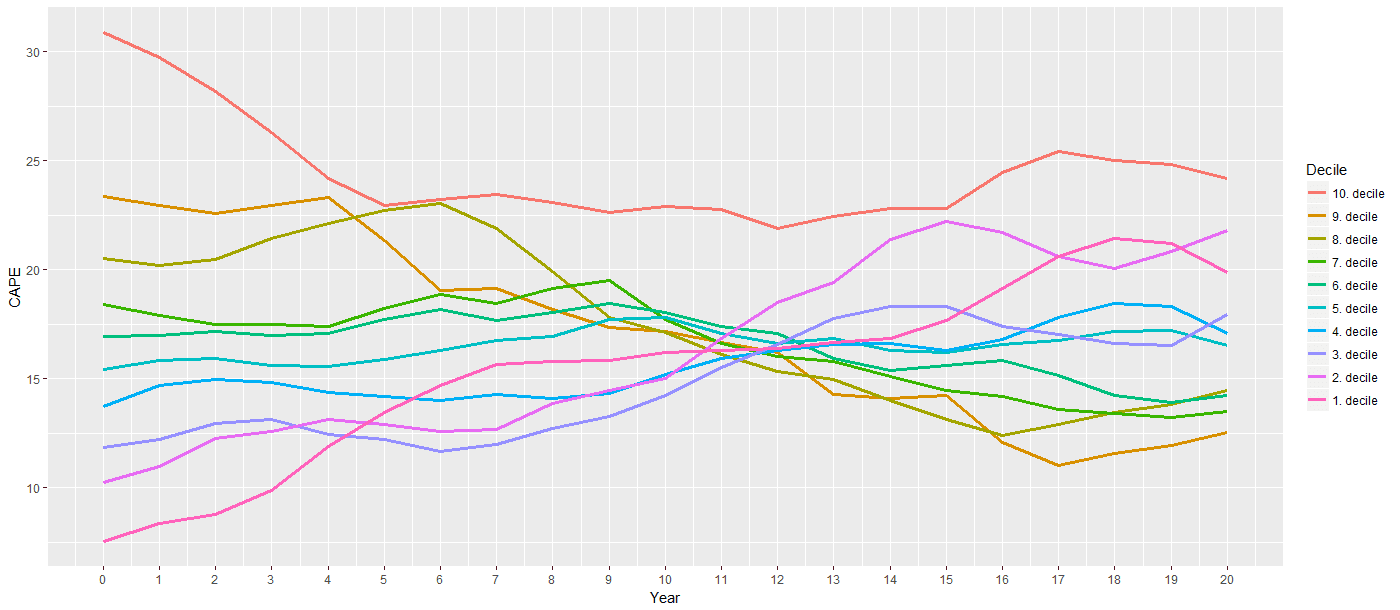

Cyclically Adjusted Price-to-Earnings ratio (CAPE or Shiller P/E): Developed by Nobel laureate Robert Shiller, the CAPE ratio adjusts the P/E ratio by using an average of earnings over the past ten years. This smooths out cyclical fluctuations in earnings, providing a more stable long-term valuation metric. BofA's analysis of the CAPE ratio offers a longer-term perspective on high stock market valuations.

-

Current Levels and Historical Context: BofA's research would provide specific numbers for these ratios. However, generally speaking, significantly elevated P/E and CAPE ratios compared to historical averages during bull markets might signal a higher risk of a market correction. Conversely, historically low ratios during bear markets might indicate undervalued opportunities. Analyzing these metrics within their historical context is key to understanding potential risks and rewards.

-

Interpretation: High valuation metrics, according to BofA's analysis, might suggest a higher probability of future market corrections. However, other factors, such as strong earnings growth or low interest rates (discussed below), must also be considered. The interpretation of these metrics requires a holistic view of the market environment.

Factors Contributing to High Stock Market Valuations (BofA's View)

BofA's analysis likely considers several macroeconomic factors contributing to the current high valuations. These factors interact in complex ways, and understanding their interplay is vital for investors:

-

Low Interest Rates: Extremely low interest rates, often a result of central bank monetary policies, make bonds less attractive relative to stocks. This pushes investors towards equities, increasing demand and driving up prices, potentially leading to higher valuations.

-

Strong Corporate Earnings Growth: Robust corporate earnings growth, either realized or projected, can justify higher stock prices. Strong earnings, combined with low interest rates, can lead to a powerful upward pressure on valuations.

-

Inflationary Pressures: While inflation can negatively impact valuations in the long run, moderate inflation can initially boost corporate earnings, pushing stock prices higher. However, runaway inflation poses a significant threat to valuations.

-

Geopolitical Uncertainties: Global events such as geopolitical tensions or trade disputes can influence investor sentiment. Fear and uncertainty might push investors towards safer assets, but depending on the nature of the uncertainty, it may lead to a "flight to safety" away from stocks, or conversely, into them.

-

Quantitative Easing (QE) and Monetary Policies: Central banks' use of QE and other monetary stimulus measures can significantly influence stock market valuations. Increased liquidity in the system can drive up asset prices, including stocks.

BofA's Investment Recommendations in a High-Valuation Environment

Given the current high valuations, BofA likely recommends a cautious, diversified approach. Their suggested strategies might include:

-

Diversification: Spread your investments across various asset classes (stocks, bonds, real estate, etc.), sectors, and geographies to reduce risk. This is crucial in a high-valuation environment, reducing the impact of any single sector or market downturn.

-

Defensive Investment Options: Consider value stocks (companies trading below their intrinsic value), dividend-paying stocks (providing a steady income stream), and high-quality bonds as more defensive options during periods of high valuations.

-

Active vs. Passive Investing: BofA's recommendation might depend on your risk tolerance and investment timeline. Active management involves trying to outperform the market, while passive management tracks a specific index.

-

Risk Management: Implement risk management strategies to protect your portfolio against potential market downturns. This could include stop-loss orders or hedging techniques.

-

Long-Term Investment Horizon: High valuations often accompany periods of market exuberance, followed by corrections. Maintaining a long-term investment horizon allows you to ride out short-term volatility.

Specific Sectors to Watch According to BofA

BofA's research likely highlights specific sectors that are particularly well-positioned or vulnerable in a high-valuation environment. For example, they might favor sectors with strong growth prospects and resilient business models, while suggesting caution with sectors highly sensitive to interest rate changes or economic slowdowns.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions. BofA's analysis provides valuable insights into the current market dynamics, highlighting key valuation metrics and contributing factors. By understanding these factors and employing a diversified, risk-managed strategy, investors can better navigate the complexities of this high-valuation environment. Remember to consult with a financial advisor before making any significant investment decisions based on analysis of high stock market valuations. Careful consideration of high stock market valuations is essential for long-term investment success.

Featured Posts

-

Dwindling Resources In Gaza Calls To End Israels Aid Ban Intensify

Apr 29, 2025

Dwindling Resources In Gaza Calls To End Israels Aid Ban Intensify

Apr 29, 2025 -

Minnesotas Snow Plow Naming Contest Winners Revealed

Apr 29, 2025

Minnesotas Snow Plow Naming Contest Winners Revealed

Apr 29, 2025 -

Regulatory Nod For Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025

Regulatory Nod For Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025 -

Investor Concerns About Stock Market Valuations Bof As Response

Apr 29, 2025

Investor Concerns About Stock Market Valuations Bof As Response

Apr 29, 2025 -

Indias Large Cap Stocks Surge Reliances Positive Earnings Report

Apr 29, 2025

Indias Large Cap Stocks Surge Reliances Positive Earnings Report

Apr 29, 2025

Latest Posts

-

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025 -

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025 -

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025 -

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025 -

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025