XRP Regulatory Uncertainty: Latest News And Analysis

Table of Contents

The SEC vs. Ripple Lawsuit: A Detailed Overview

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. The SEC argues that XRP's distribution and sales resembled an investment contract, offering investors the expectation of profits based on Ripple's efforts. This claim directly challenges Ripple's assertion that XRP is a decentralized digital asset, not subject to securities regulations.

Ripple's defense centers on the argument that XRP is a currency, not a security, and that its sales were not subject to registration requirements. They highlight XRP's decentralized nature, its widespread use in various payment systems, and its independent market function outside of Ripple's control.

- Key dates and events: December 2020 (lawsuit filed), several key motions and hearings throughout 2021-2023, July 2023 (Judge Torres' ruling on programmatic sales).

- Summary of major court rulings and decisions: Partial summary judgment for Ripple regarding institutional sales, unclear ruling on programmatic sales, ongoing legal battles.

- Analysis of legal arguments: The case hinges on the "Howey Test," which defines what constitutes an investment contract. Both sides present compelling arguments, making the outcome highly uncertain.

Impact of the Lawsuit on XRP Price and Market Sentiment

The SEC lawsuit has significantly impacted XRP's price and market sentiment. Periods of positive news, such as favorable court rulings or positive statements from Ripple's legal team, often result in price surges and increased trading volume. Conversely, negative news or setbacks in the legal proceedings typically lead to price drops and decreased investor confidence.

- Chart illustrating XRP price movements correlated with lawsuit developments: (Insert a chart here showing the correlation between XRP price and key events in the lawsuit)

- Statistics on trading volume and market cap changes: (Insert statistics showing the volatility of trading volume and market capitalization in relation to lawsuit developments)

- Quotes from market analysts on investor sentiment: "The uncertainty surrounding the outcome of the SEC vs. Ripple case continues to weigh heavily on investor sentiment." - [Source: reputable financial news outlet]

Global Regulatory Landscape for Cryptocurrencies and its Influence on XRP

The regulatory landscape for cryptocurrencies varies significantly across jurisdictions. The US approach, exemplified by the SEC's stance on XRP, is notably stricter than some other countries. The EU is developing its own comprehensive regulatory framework (MiCA), while Japan and Singapore have adopted more accommodative approaches. These differing regulatory environments impact XRP's adoption and usage in various regions.

- Comparison of regulatory frameworks in key jurisdictions: (Table comparing regulatory approaches to cryptocurrencies in the US, EU, Japan, Singapore, etc.)

- Examples of how differing regulations affect XRP trading and usage: Restrictions on XRP trading on certain exchanges in the US versus its widespread availability in other countries.

- Predictions and analysis of future global regulatory trends: Increased international cooperation on cryptocurrency regulation is likely, potentially leading to more harmonized frameworks in the future.

Potential Outcomes and Future Predictions for XRP

Several potential outcomes exist for the SEC vs. Ripple lawsuit. A settlement could see Ripple pay a fine and agree to certain conditions. A Ripple victory would likely result in a significant increase in XRP's price and market standing. An SEC victory could lead to further price drops and potentially even delisting from major exchanges.

- Scenarios outlining potential outcomes and their consequences: (Detailed description of each potential outcome and its likely impact on XRP)

- Expert opinions and predictions on XRP's future: (Include quotes and analysis from cryptocurrency experts and analysts)

- Potential risks and opportunities for XRP investors: High risk due to regulatory uncertainty, but potentially high rewards if Ripple wins the case.

Conclusion: Understanding and Managing XRP Regulatory Uncertainty

The XRP regulatory uncertainty continues to be a significant factor influencing the cryptocurrency market. Understanding the intricacies of the SEC vs. Ripple lawsuit and the global regulatory landscape is crucial for making informed investment decisions. Staying updated on the latest news and legal developments is paramount. Continue your research on XRP regulatory uncertainty and consult with financial professionals before making any investment choices. For further reading on the subject, explore reputable financial news sources and legal analyses of the case. Remember, responsible investment in cryptocurrencies requires thorough due diligence and understanding of inherent risks.

Featured Posts

-

Christopher Stevens Reviews Michael Sheens Million Pound Giveaway Pointless Or Purposeful

May 01, 2025

Christopher Stevens Reviews Michael Sheens Million Pound Giveaway Pointless Or Purposeful

May 01, 2025 -

Significant Oil Spill Leads To Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025

Significant Oil Spill Leads To Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025 -

Prva Ljubav I Gubitak Analiza Pesme Kad Sam Se Vratio Zdravka Colica

May 01, 2025

Prva Ljubav I Gubitak Analiza Pesme Kad Sam Se Vratio Zdravka Colica

May 01, 2025 -

Ziaire Williams Nba Redemption Hard Work And Improved Performance

May 01, 2025

Ziaire Williams Nba Redemption Hard Work And Improved Performance

May 01, 2025 -

Priscilla Pointer Celebrated Stage And Screen Actress Dead At 100

May 01, 2025

Priscilla Pointer Celebrated Stage And Screen Actress Dead At 100

May 01, 2025

Latest Posts

-

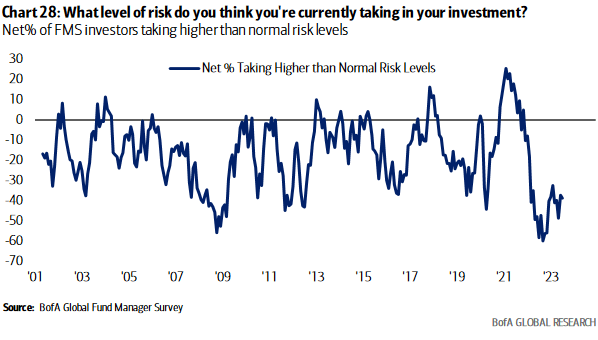

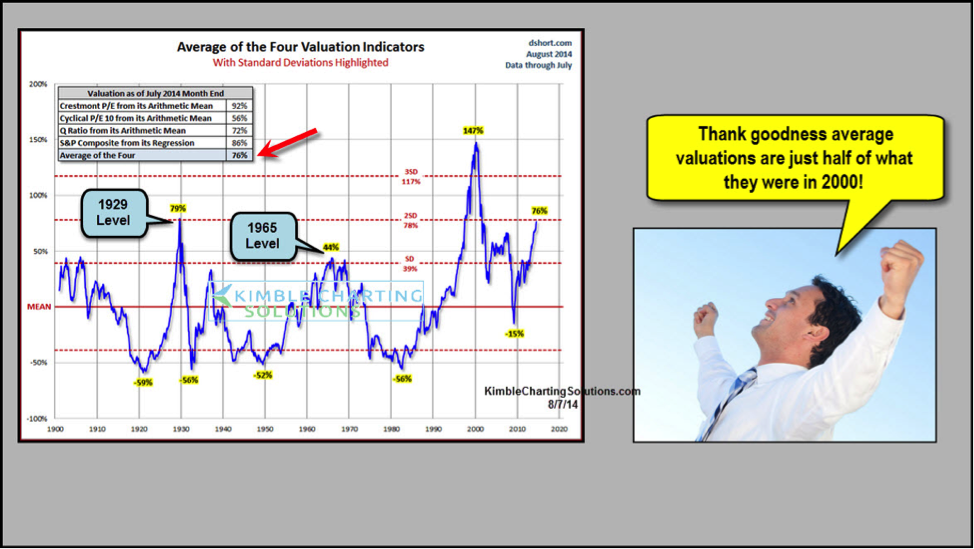

Are High Stock Market Valuations A Risk Bof As Analysis

May 01, 2025

Are High Stock Market Valuations A Risk Bof As Analysis

May 01, 2025 -

1 Billion Us Factory Merck Expands Domestic Production Of Blockbuster Drug

May 01, 2025

1 Billion Us Factory Merck Expands Domestic Production Of Blockbuster Drug

May 01, 2025 -

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025 -

Bof As Rationale Why Current Stock Market Valuations Are Not A Concern

May 01, 2025

Bof As Rationale Why Current Stock Market Valuations Are Not A Concern

May 01, 2025 -

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

May 01, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

May 01, 2025