XRP (Ripple) Investment: Is It Wise To Buy Below $3?

Table of Contents

XRP's Current Market Position and Price Analysis

Understanding XRP's current market standing is crucial before considering an XRP investment. Several factors significantly influence its price, making it a volatile asset.

Factors Influencing XRP's Price:

-

Regulatory Uncertainty: The ongoing SEC lawsuit against Ripple casts a long shadow over XRP's price. A favorable outcome could send the price soaring, while an unfavorable ruling could severely impact its value. The uncertainty itself creates volatility.

-

Adoption Rate of RippleNet: RippleNet, Ripple's payment solution for financial institutions, is a key driver of XRP's long-term potential. Increased adoption by banks and payment providers could boost demand and price. However, widespread adoption remains a future prospect.

-

Overall Cryptocurrency Market Trends: The price of Bitcoin and the overall cryptocurrency market sentiment significantly impact XRP's price. A bull market generally benefits XRP, while a bear market can lead to substantial price drops.

-

Supply and Demand Dynamics: Like any asset, the supply and demand of XRP directly affect its price. Increased demand with limited supply pushes the price up, and vice versa.

-

Technical Analysis: Chart patterns, support and resistance levels, and technical indicators provide insights into potential price movements. However, technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

-

Specific Data Points (as of October 26, 2023 - Note: These figures are subject to constant change. Always refer to up-to-date data from reputable sources):

- Current XRP Price: (Insert current price from a reliable source like CoinMarketCap)

- Market Cap: (Insert current market cap from a reliable source)

- 24-Hour Trading Volume: (Insert current 24-hour trading volume from a reliable source)

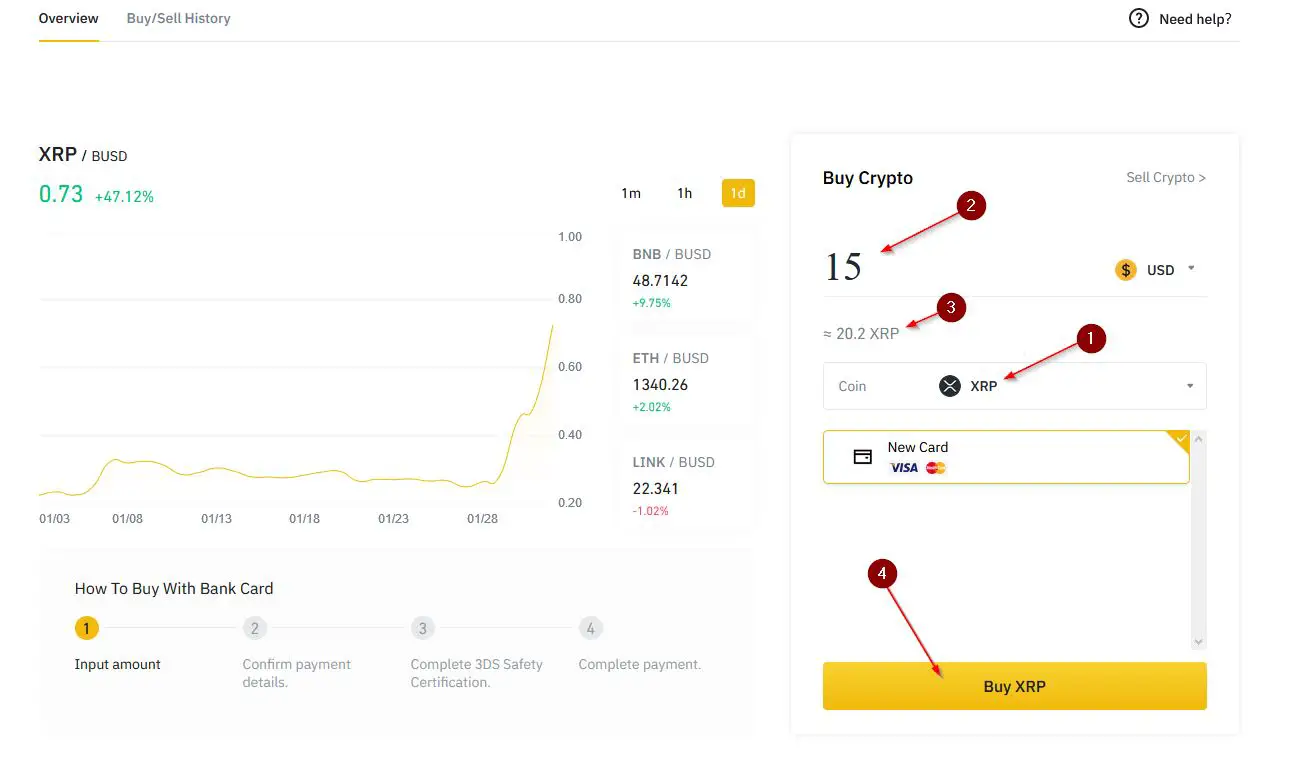

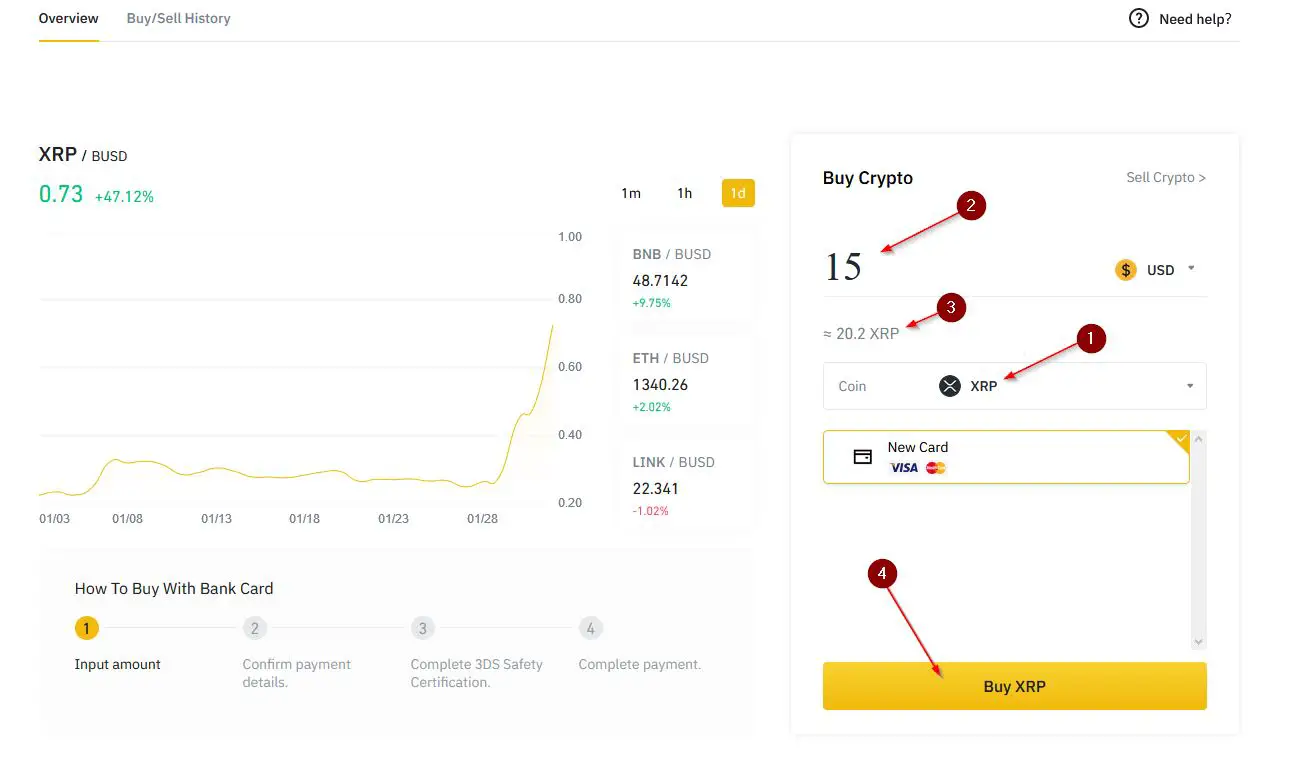

- (Include a relevant chart showing price movement over the past few months)

Potential Benefits of Investing in XRP Below $3

Despite the risks, buying XRP below $3 presents some potential advantages.

High Potential Returns:

- Favorable SEC Ruling: A positive resolution to the SEC lawsuit could trigger a substantial price increase, potentially leading to significant returns for early investors.

- Price Target Predictions: Various market analyses predict XRP reaching significantly higher price targets in the future, based on factors like increased adoption and technological advancements.

Relatively Low Entry Point:

-

Reduced Risk (relatively): Buying at a lower price point inherently reduces the potential downside compared to purchasing at higher price levels. While still risky, the potential for percentage gains is greater.

-

Greater Upside Potential: Even a modest price increase translates to larger percentage gains when the entry point is lower.

-

Examples of Past XRP Price Rallies: (Include specific examples of past price surges and the factors that contributed to them)

Risks Associated with Investing in XRP Below $3

Investing in XRP, even below $3, carries substantial risks.

Regulatory Risks:

- SEC Lawsuit Outcome: The SEC lawsuit's outcome is highly uncertain. An unfavorable judgment could significantly depress XRP's price or even lead to its delisting from major exchanges.

- Future Regulatory Actions: Even if the current lawsuit is resolved favorably, future regulatory actions could still impact XRP's price and trading.

Market Volatility:

- Cryptocurrency Market Swings: The cryptocurrency market is notoriously volatile, and XRP is no exception. Sharp price drops are common, and investors must be prepared for significant losses.

- Risk Management: Diversification and dollar-cost averaging are crucial risk management strategies to mitigate the impact of market volatility.

Technological Risks:

-

Technological Disruption: New technologies or competing payment solutions could potentially render XRP less relevant in the future.

-

Examples of Past Cryptocurrency Market Crashes: (Include specific examples of past market crashes and their impact on cryptocurrencies)

Alternative Investment Strategies

While an XRP investment below $3 might be tempting, it's crucial to consider alternative strategies.

Diversification:

- Spread Your Investments: Diversifying across different asset classes (stocks, bonds, real estate, other cryptocurrencies) reduces overall portfolio risk.

- Don't Put All Your Eggs in One Basket: Avoid concentrating your investments solely in XRP or any single cryptocurrency.

Dollar-Cost Averaging:

- Reduce Volatility Impact: Investing a fixed amount of money at regular intervals mitigates the risk of buying high and selling low.

Staking and Other Passive Income Opportunities with XRP:

- (If applicable, discuss opportunities to earn passive income through staking or other XRP-related activities. Clearly state any associated risks.)

Conclusion: XRP (Ripple) Investment – The Verdict Below $3

Investing in XRP below $3 presents a compelling opportunity for high potential returns, particularly if the SEC lawsuit is resolved favorably and RippleNet adoption increases. However, the regulatory uncertainty, inherent market volatility, and potential technological disruptions pose significant risks. A low entry point reduces the potential downside, but losses are still possible.

The decision to invest in XRP below $3 is highly personal and depends on your risk tolerance, investment goals, and overall financial situation. It is crucial to conduct thorough research, understand the risks involved, and consider alternative investment strategies before committing your capital. Is investing in XRP below $3 right for you? Do your research and make an informed decision.

Featured Posts

-

Dragons Den A Comprehensive Guide For Aspiring Entrepreneurs

May 01, 2025

Dragons Den A Comprehensive Guide For Aspiring Entrepreneurs

May 01, 2025 -

The Target Dei Story A Case Study In Corporate Social Responsibility Evolution

May 01, 2025

The Target Dei Story A Case Study In Corporate Social Responsibility Evolution

May 01, 2025 -

Michael Sheens 1 Million Debt Write Off A Look At His Net Worth

May 01, 2025

Michael Sheens 1 Million Debt Write Off A Look At His Net Worth

May 01, 2025 -

Is Xrp A Commodity The Secs Stance And Ongoing Debate

May 01, 2025

Is Xrp A Commodity The Secs Stance And Ongoing Debate

May 01, 2025 -

Kort Geding Kampen Eist Snelle Stroomnetaansluiting Van Enexis

May 01, 2025

Kort Geding Kampen Eist Snelle Stroomnetaansluiting Van Enexis

May 01, 2025

Latest Posts

-

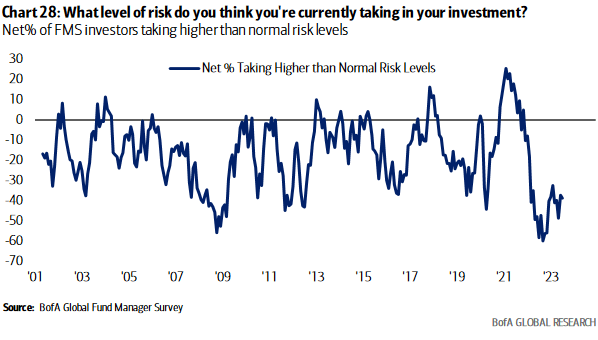

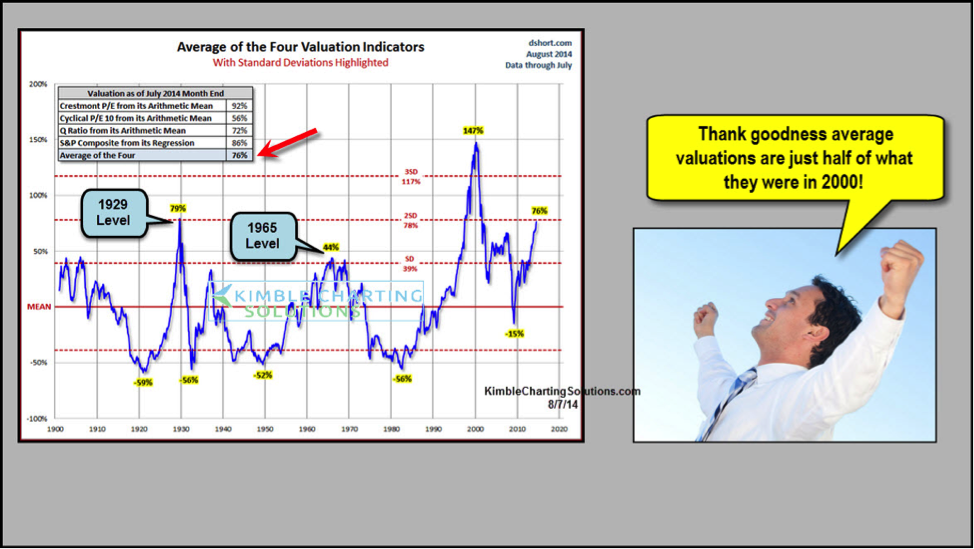

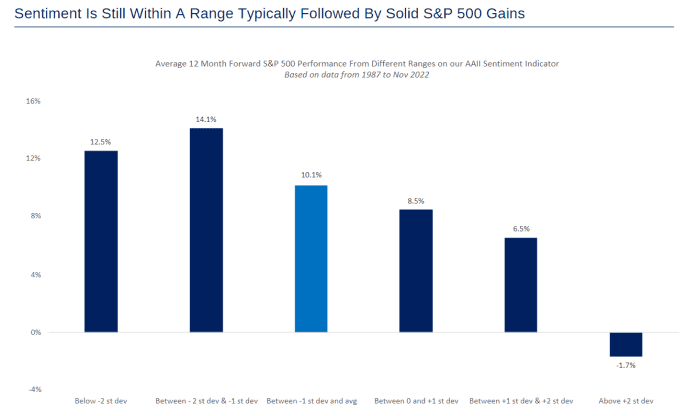

Are High Stock Market Valuations A Risk Bof As Analysis

May 01, 2025

Are High Stock Market Valuations A Risk Bof As Analysis

May 01, 2025 -

1 Billion Us Factory Merck Expands Domestic Production Of Blockbuster Drug

May 01, 2025

1 Billion Us Factory Merck Expands Domestic Production Of Blockbuster Drug

May 01, 2025 -

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025 -

Bof As Rationale Why Current Stock Market Valuations Are Not A Concern

May 01, 2025

Bof As Rationale Why Current Stock Market Valuations Are Not A Concern

May 01, 2025 -

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

May 01, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

May 01, 2025