ABN Amro: Dutch Central Bank Weighs Potential Fine Over Bonuses

Table of Contents

The DNB's Investigation into ABN Amro's Bonus Scheme

The DNB, as the Netherlands' central bank, plays a crucial role in regulating bank bonuses to ensure financial stability and ethical conduct. Their investigation into ABN Amro's bonus scheme stems from concerns about potential violations of banking regulations and ethical guidelines concerning executive compensation. The exact nature of these concerns hasn't been fully disclosed publicly, but it's likely related to the size, structure, and potential link between bonuses and excessive risk-taking. The investigation reflects a growing trend towards stricter regulatory oversight of bank bonuses across the European Union.

- Specific concerns of the DNB regarding ABN Amro's bonus system: While the specifics remain confidential, potential concerns could include the alignment of bonus structures with long-term bank performance, the potential for bonuses to incentivize excessive risk-taking, and the overall fairness and transparency of the system.

- Timeline of the investigation and any public statements released by ABN Amro or the DNB: The investigation is ongoing, with neither ABN Amro nor the DNB releasing detailed public statements. However, the mere initiation of the investigation signals a significant level of regulatory scrutiny.

- Potential legal ramifications for ABN Amro if found non-compliant: If found to have violated Dutch banking regulations, ABN Amro could face substantial financial penalties, reputational damage, and potential legal action from affected parties.

Potential Financial Penalties and Their Impact

The potential fine levied against ABN Amro could be significant, impacting its financial performance and shareholder confidence. The exact amount remains uncertain, but it could range from millions to potentially hundreds of millions of Euros depending on the severity of the alleged violations. This financial penalty would not only affect ABN Amro's short-term profitability but could also impact its long-term strategic plans and ability to compete effectively.

- Estimated range of the potential fine: While no official estimate has been released, analysts speculate a wide range depending on the findings of the investigation. The fine could be substantial enough to impact the bank's dividend payouts and investment capabilities.

- Impact on ABN Amro's stock price and profitability: The uncertainty surrounding the investigation and potential fine is already likely affecting ABN Amro's stock price. A large fine could further depress share prices and decrease overall profitability.

- Long-term implications for the bank's ability to attract and retain talent: A large fine and associated reputational damage could make it harder for ABN Amro to attract and retain top talent, potentially hindering its long-term growth.

- Increased compliance costs associated with future regulatory oversight: Regardless of the outcome, the investigation will likely lead to increased scrutiny and higher compliance costs for ABN Amro in the future.

The Broader Context of Banking Regulation and Bonus Culture

The DNB's investigation into ABN Amro's bonus scheme sits within the broader context of evolving banking regulations in the Netherlands and the EU aimed at curbing excessive risk-taking and promoting responsible banking practices. Post-2008 financial crisis, there's been a global shift towards stricter regulation of executive compensation and bonus culture within the financial sector. This is driven by concerns that excessive bonuses can incentivize short-term, high-risk strategies that undermine the long-term stability of financial institutions.

- Comparison of ABN Amro's bonus practices to those of other major Dutch and international banks: The investigation will likely lead to comparisons between ABN Amro's bonus practices and those of its competitors, both domestically and internationally. This comparison could reveal whether ABN Amro’s practices were significantly out of line with industry standards.

- Discussion of current regulatory trends regarding executive compensation globally: Globally, there’s a growing consensus that executive compensation needs to be more closely aligned with long-term sustainable performance, rather than solely focused on short-term gains.

- The role of responsible banking in promoting stability and ethical conduct within the financial industry: The DNB’s actions emphasize the importance of responsible banking practices and the crucial role of ethical considerations in maintaining the stability and integrity of the financial system.

ABN Amro's Response to the Investigation

ABN Amro has publicly stated its commitment to cooperating fully with the DNB's investigation. The bank has likely initiated its own internal review of its bonus scheme to identify areas for improvement and to demonstrate its commitment to regulatory compliance. The nature and extent of this internal review, however, remain undisclosed. Their response will be crucial in determining the ultimate outcome of the investigation and the severity of any potential penalties.

Conclusion

The DNB's investigation into ABN Amro's bonus scheme highlights the growing scrutiny of executive compensation within the Dutch banking sector and globally. The potential for substantial financial penalties underscores the importance of regulatory compliance and the need for responsible banking practices. The outcome of this investigation will have significant implications for ABN Amro, impacting its financial performance, reputation, and ability to attract and retain talent. It will also set a precedent for other financial institutions in the Netherlands and beyond.

Call to Action: Stay informed on the developments in the ABN Amro case and the evolving landscape of banking regulations concerning executive bonuses. Follow our updates for the latest news on the ABN Amro fine and other developments in Dutch banking regulation. Learn more about the intricacies of ABN Amro bonus structures and the implications of the DNB investigation by [linking to further resources].

Featured Posts

-

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable Y La Prevencion De Enfermedades Cronicas

May 22, 2025

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable Y La Prevencion De Enfermedades Cronicas

May 22, 2025 -

Googles Ai Smart Glasses Prototype First Impressions

May 22, 2025

Googles Ai Smart Glasses Prototype First Impressions

May 22, 2025 -

Bbc Antiques Roadshow Arrest Follows American Couples Episode

May 22, 2025

Bbc Antiques Roadshow Arrest Follows American Couples Episode

May 22, 2025 -

Images Exclusives Le Theatre Tivoli A Clisson Laureat Du Loto Du Patrimoine 2025

May 22, 2025

Images Exclusives Le Theatre Tivoli A Clisson Laureat Du Loto Du Patrimoine 2025

May 22, 2025 -

Gender Reveal Peppa Pigs Parents Announce The Sex Of Their Baby

May 22, 2025

Gender Reveal Peppa Pigs Parents Announce The Sex Of Their Baby

May 22, 2025

Latest Posts

-

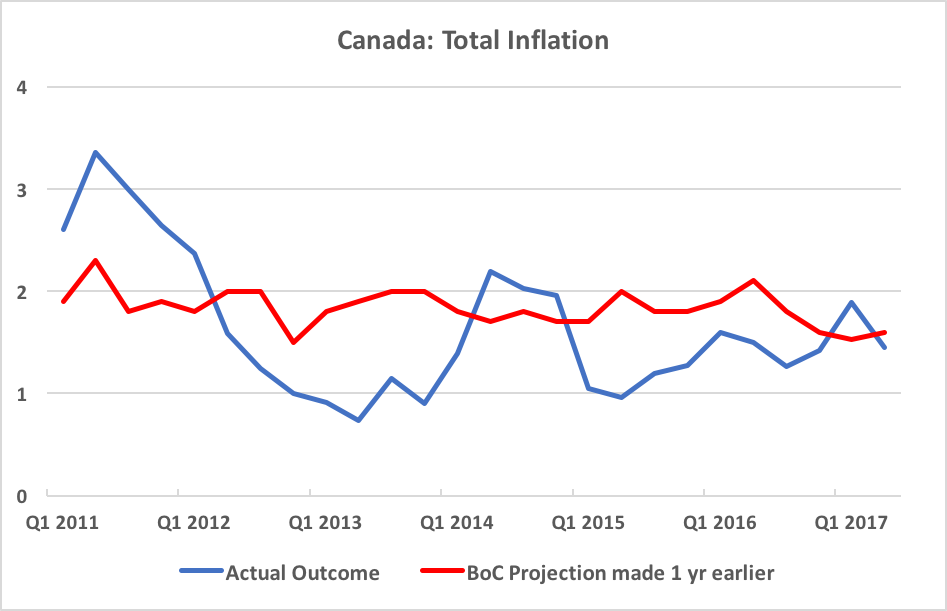

The Bank Of Canadas Inflation Challenge A Balancing Act

May 22, 2025

The Bank Of Canadas Inflation Challenge A Balancing Act

May 22, 2025 -

Home Depots Q Quarter Report Lower Than Expected Results Tariff Outlook Unchanged

May 22, 2025

Home Depots Q Quarter Report Lower Than Expected Results Tariff Outlook Unchanged

May 22, 2025 -

Bank Of Canada Navigating The Tightrope Of Inflation Control

May 22, 2025

Bank Of Canada Navigating The Tightrope Of Inflation Control

May 22, 2025 -

Home Depot Stock Impact Of Tariffs On Q Quarter Earnings

May 22, 2025

Home Depot Stock Impact Of Tariffs On Q Quarter Earnings

May 22, 2025 -

Can The Architect Of United Healths Success Lead Its Revival

May 22, 2025

Can The Architect Of United Healths Success Lead Its Revival

May 22, 2025