Amundi DJIA UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. For the Amundi DJIA UCITS ETF, this means the total value of its holdings in the 30 companies of the Dow Jones Industrial Average, minus any liabilities (like management fees and expenses). The calculation is relatively straightforward: the total market value of all the ETF's assets is determined, and then its liabilities are subtracted. This results in the NAV per share.

The NAV differs from the market price of the ETF. The market price fluctuates throughout the trading day based on supply and demand, while the NAV is calculated at the end of the trading day. Differences between the NAV and market price can occur due to factors like trading volume and market sentiment. Essentially, the NAV reflects the intrinsic value of the ETF's holdings, while the market price reflects what investors are willing to pay or sell it for at a given moment.

- NAV reflects the intrinsic value of the ETF's holdings.

- NAV is calculated daily, typically at the close of the market.

- Understanding NAV helps assess the Amundi DJIA UCITS ETF's performance accurately.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several factors influence the Amundi DJIA UCITS ETF NAV. The most significant is the performance of the Dow Jones Industrial Average (DJIA) itself. If the DJIA rises, the value of the ETF's holdings increases, leading to a higher NAV. Conversely, a decline in the DJIA will result in a lower NAV.

Currency fluctuations can also impact the NAV, particularly because the DJIA is denominated in US Dollars. If the Euro (or the investor's local currency) weakens against the US Dollar, the NAV expressed in the investor's currency will decrease, even if the DJIA remains stable. Finally, management fees and other expenses deducted from the ETF's assets directly reduce the NAV.

- Market fluctuations in DJIA component stocks are the primary driver of NAV changes.

- Changes in currency exchange rates (USD/EUR, for example) affect the NAV for non-USD investors.

- Dividend payouts from the underlying DJIA companies can positively impact the NAV.

Where to Find the Amundi DJIA UCITS ETF NAV

Reliable information on the Amundi DJIA UCITS ETF NAV is crucial. You can find this data from several reputable sources:

- Amundi's official website: Amundi, the fund manager, typically publishes daily NAV figures on their investor relations section.

- Major financial data providers: Bloomberg, Refinitiv, and other financial data providers offer real-time and historical NAV data. Subscription may be required.

- Your brokerage account platform: Most brokerage accounts display the NAV of your holdings, offering convenient access to the information.

Always prioritize reliable sources to ensure you're working with accurate data when analyzing your investment.

Using NAV to Make Informed Investment Decisions

The Amundi DJIA UCITS ETF NAV is a critical tool for assessing investment performance and making informed decisions. By tracking NAV changes over time, you can monitor the ETF's performance against the DJIA and your investment goals. Comparing the current NAV to your purchase price helps determine your profit or loss. However, it's vital to consider NAV alongside other market indicators and your investment strategy.

- Tracking NAV changes helps monitor Amundi DJIA UCITS ETF performance.

- Comparing NAV to your purchase price determines profit or loss.

- Using NAV, in conjunction with market analysis and your risk tolerance, informs buy/sell decisions.

Conclusion

Understanding the Amundi DJIA UCITS ETF NAV is essential for successful investing. By grasping how it's calculated, the factors that influence it, and where to find reliable data, investors can make well-informed decisions. Regularly monitoring the Amundi DJIA UCITS ETF NAV, alongside other market indicators, allows for a more comprehensive investment strategy. Start monitoring your Amundi DJIA UCITS ETF NAV today to optimize your investment performance and make sound investment choices.

Featured Posts

-

Faiz Indirimi Sonrasi Avrupa Borsalarinin Performansi

May 24, 2025

Faiz Indirimi Sonrasi Avrupa Borsalarinin Performansi

May 24, 2025 -

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025 -

Dazi Stati Uniti Prezzi Moda 2024 Guida Completa

May 24, 2025

Dazi Stati Uniti Prezzi Moda 2024 Guida Completa

May 24, 2025 -

Chine Et France La Repression Des Voix Dissidentes

May 24, 2025

Chine Et France La Repression Des Voix Dissidentes

May 24, 2025 -

Guccis New Creative Director Demna Gvasalias Vision

May 24, 2025

Guccis New Creative Director Demna Gvasalias Vision

May 24, 2025

Latest Posts

-

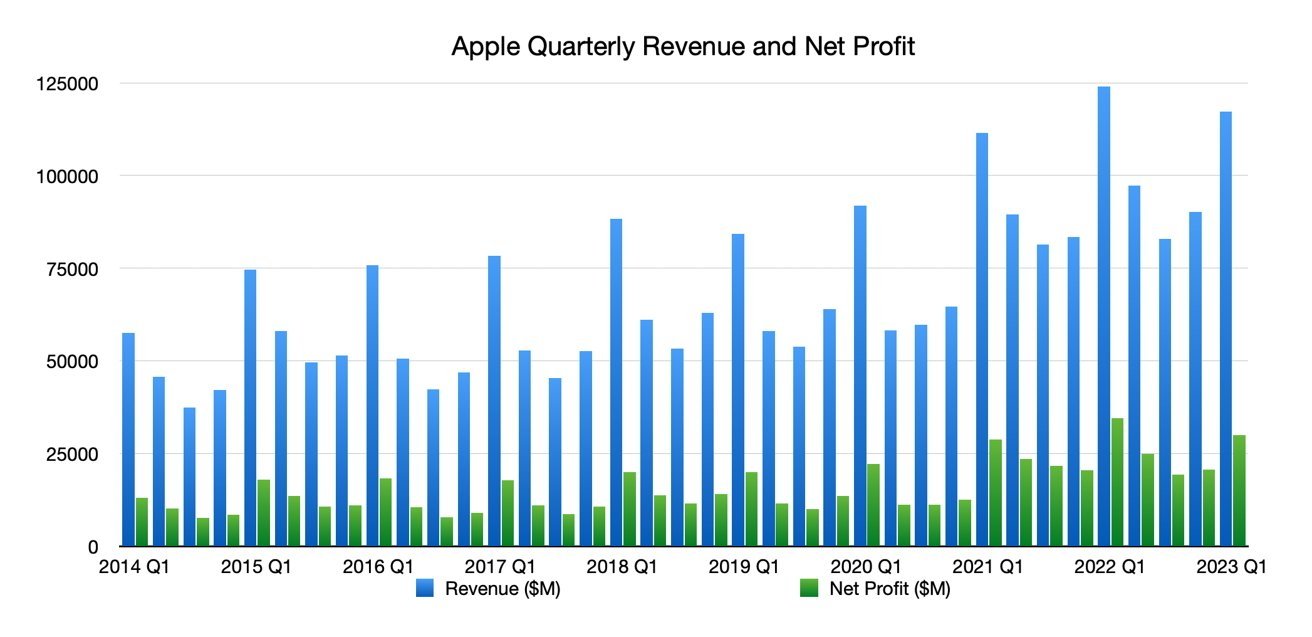

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025