Amundi DJIA UCITS ETF: Net Asset Value Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of an ETF's underlying assets. For the Amundi DJIA UCITS ETF, the NAV reflects the total value of its holdings in the 30 companies comprising the DJIA. It's a crucial metric because it represents the actual worth of the investment, independent of market fluctuations.

The NAV is calculated daily by the fund manager. Essentially, it's determined by summing the current market value of each holding within the ETF's portfolio and then dividing this total by the number of outstanding ETF shares. This gives you a per-share valuation of the ETF's assets.

- NAV reflects the intrinsic value of the ETF's holdings, representing the true worth of the underlying assets.

- It's calculated daily by summing the market value of all assets (shares of the 30 DJIA companies) and dividing by the number of outstanding shares.

- NAV differs from the market price of the ETF, though they generally track each other closely. The market price can fluctuate throughout the trading day.

Factors Affecting the Amundi DJIA UCITS ETF's NAV

Several factors influence the daily fluctuations in the Amundi DJIA UCITS ETF's NAV. Understanding these factors allows investors to better anticipate and interpret NAV changes.

- Performance of the Dow Jones Industrial Average (DJIA) components: The most significant factor influencing the ETF's NAV is the overall performance of the 30 companies within the DJIA. Positive performance in these companies directly increases the NAV, and vice versa. A rise in the DJIA index generally leads to a rise in the ETF's NAV.

- Currency fluctuations (if applicable): If the ETF holds assets denominated in currencies other than the base currency of the ETF, exchange rate fluctuations can affect the NAV.

- Dividend distributions from underlying companies: When the companies in the DJIA pay dividends, the ETF receives these distributions, which are then either reinvested or distributed to ETF shareholders. These dividend payments indirectly influence the NAV.

- Management fees and expenses: The fund's management fees and other operating expenses reduce the overall assets under management, impacting the NAV.

Understanding the Difference Between NAV and Market Price

While the NAV and market price of the Amundi DJIA UCITS ETF are closely related, they aren't always identical. The market price reflects the price at which the ETF is currently trading on the exchange, influenced by supply and demand.

Arbitrage – the simultaneous buying and selling of an asset to profit from price differences – plays a vital role in keeping the NAV and market price aligned. If the market price deviates significantly from the NAV, arbitrage opportunities arise, driving the market price back towards the NAV.

- Supply and demand significantly impact the market price of the ETF, causing short-term deviations from the NAV.

- Small discrepancies between NAV and market price are typically short-lived and corrected through market forces.

- Significant divergence might indicate market inefficiency or unusual trading activity.

Using NAV to Evaluate Investment Performance

Tracking the Amundi DJIA UCITS ETF's NAV is essential for evaluating your investment performance. By monitoring changes in the NAV over time, you can assess the growth of your investment.

- Monitor NAV growth to assess investment returns. Consistent increases indicate positive performance.

- Compare NAV performance against benchmarks, such as the DJIA itself, to gauge the ETF's effectiveness in tracking the index.

- Understand the impact of dividends on overall NAV growth; reinvested dividends contribute to the growth.

Where to Find the Amundi DJIA UCITS ETF's NAV

Finding the daily NAV for the Amundi DJIA UCITS ETF is straightforward. Reliable sources include:

- Amundi's official website: The fund provider's website is the most reliable source for the latest NAV.

- Major financial data providers (e.g., Bloomberg, Refinitiv): These providers offer real-time and historical NAV data for various ETFs.

- Your brokerage account statement: Your brokerage platform will typically display the NAV of your holdings.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is crucial for making informed investment decisions. By monitoring the NAV regularly and understanding the factors that influence it, you can effectively track your investment performance and assess the ETF's alignment with the underlying Dow Jones Industrial Average. Remember to compare the NAV to the market price to identify any significant discrepancies, and utilize reliable sources to stay up-to-date on the Amundi DJIA UCITS ETF NAV. Regularly monitoring your Amundi DJIA UCITS ETF NAV, understanding its relationship to the market price, and researching its suitability for your investment goals will allow you to manage your Amundi DJIA UCITS ETF investment effectively. Further research into the Amundi DJIA UCITS ETF and other ETFs is recommended to diversify your portfolio and reach your financial goals.

Featured Posts

-

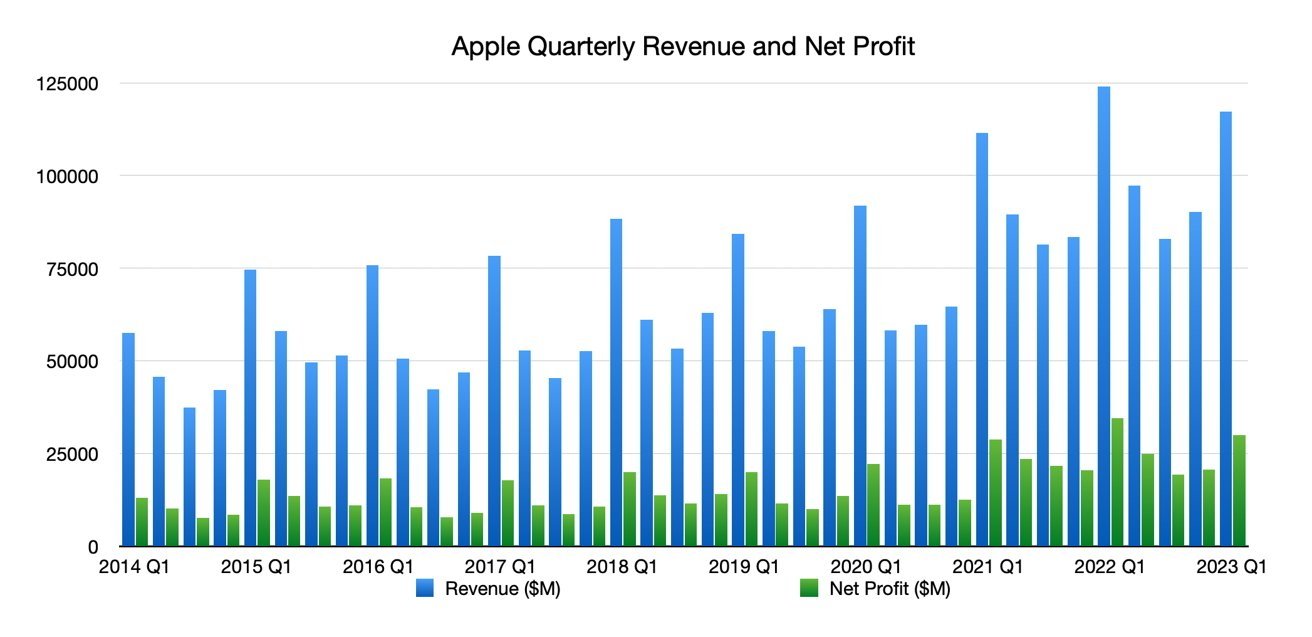

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Matt Malteses Sixth Album Her In Deep Exploring Intimacy And Personal Growth

May 24, 2025

Matt Malteses Sixth Album Her In Deep Exploring Intimacy And Personal Growth

May 24, 2025 -

Konchita Vurst Ot Evrovideniya 2014 K Roli Devushki Bonda

May 24, 2025

Konchita Vurst Ot Evrovideniya 2014 K Roli Devushki Bonda

May 24, 2025 -

Analysis Of Demna Gvasalias Impact On Guccis Design

May 24, 2025

Analysis Of Demna Gvasalias Impact On Guccis Design

May 24, 2025 -

Kerings Q1 Earnings Miss Targets Shares Fall 6

May 24, 2025

Kerings Q1 Earnings Miss Targets Shares Fall 6

May 24, 2025

Latest Posts

-

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025