Analysis Of Westpac (WBC) Profit Decline Due To Margin Pressure

Table of Contents

Net Interest Margin (NIM) Compression: The Core Issue

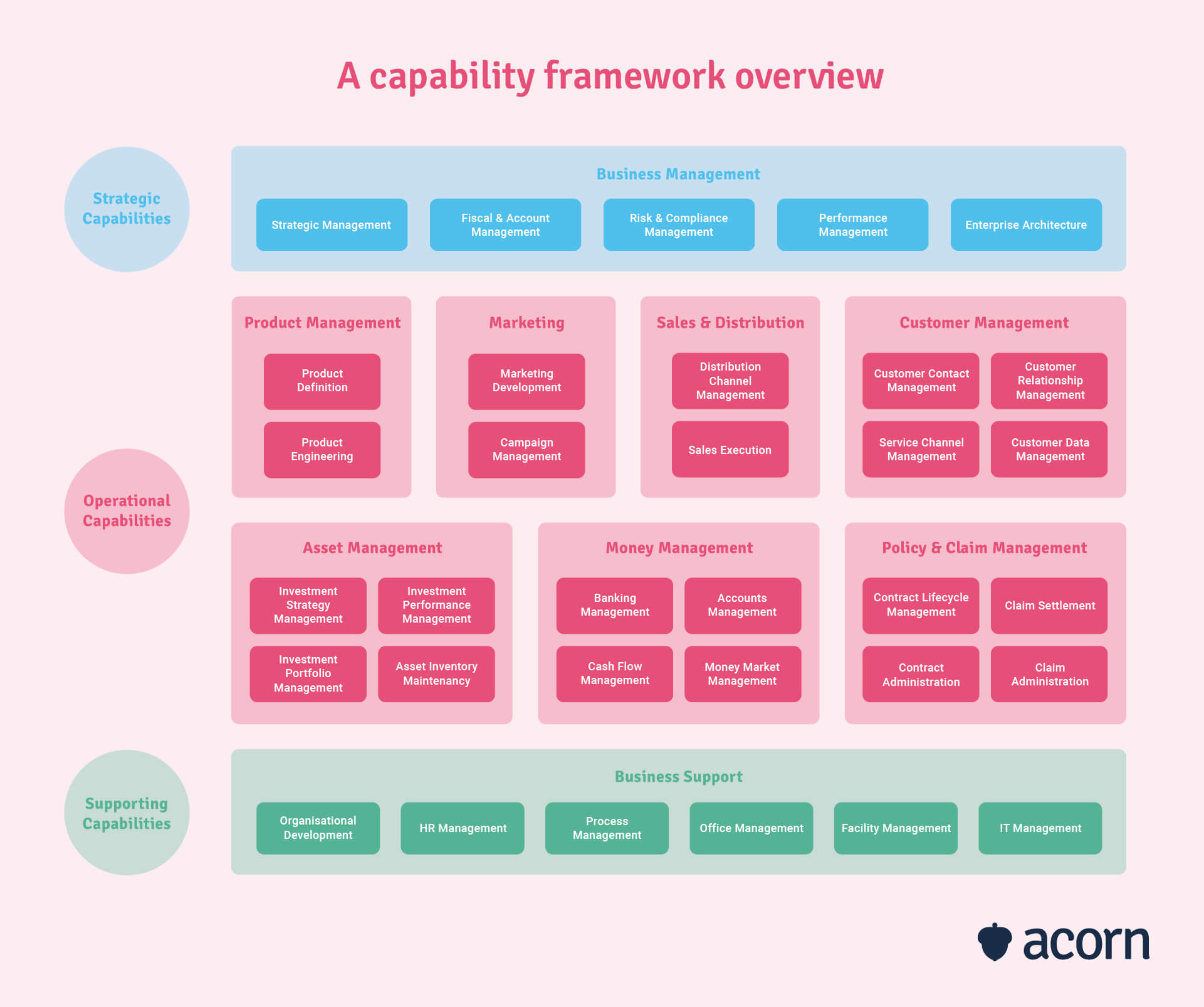

Understanding Net Interest Margin (NIM) is crucial to understanding Westpac's current challenges. Simply put, NIM represents the difference between the interest a bank earns on its loans and the interest it pays on its deposits and borrowed funds, expressed as a percentage. For everyday investors, it's a key indicator of a bank's profitability. Higher NIM generally means higher profits.

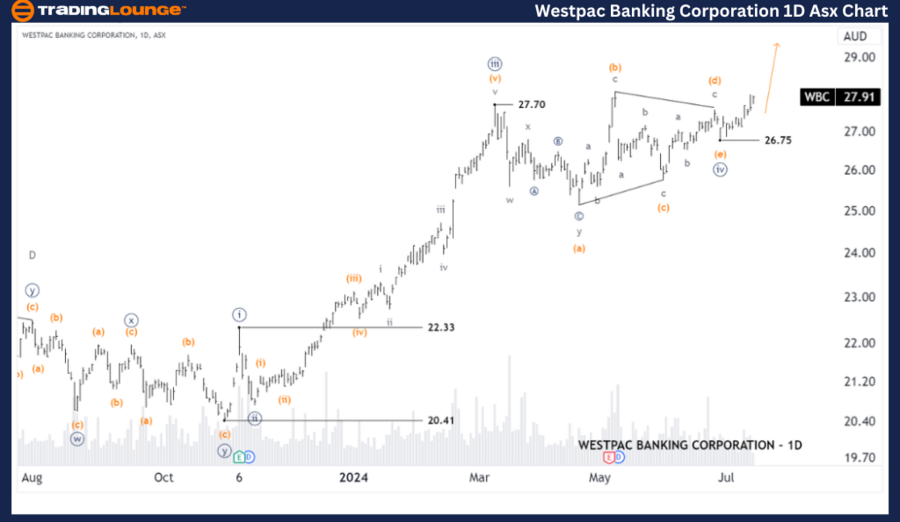

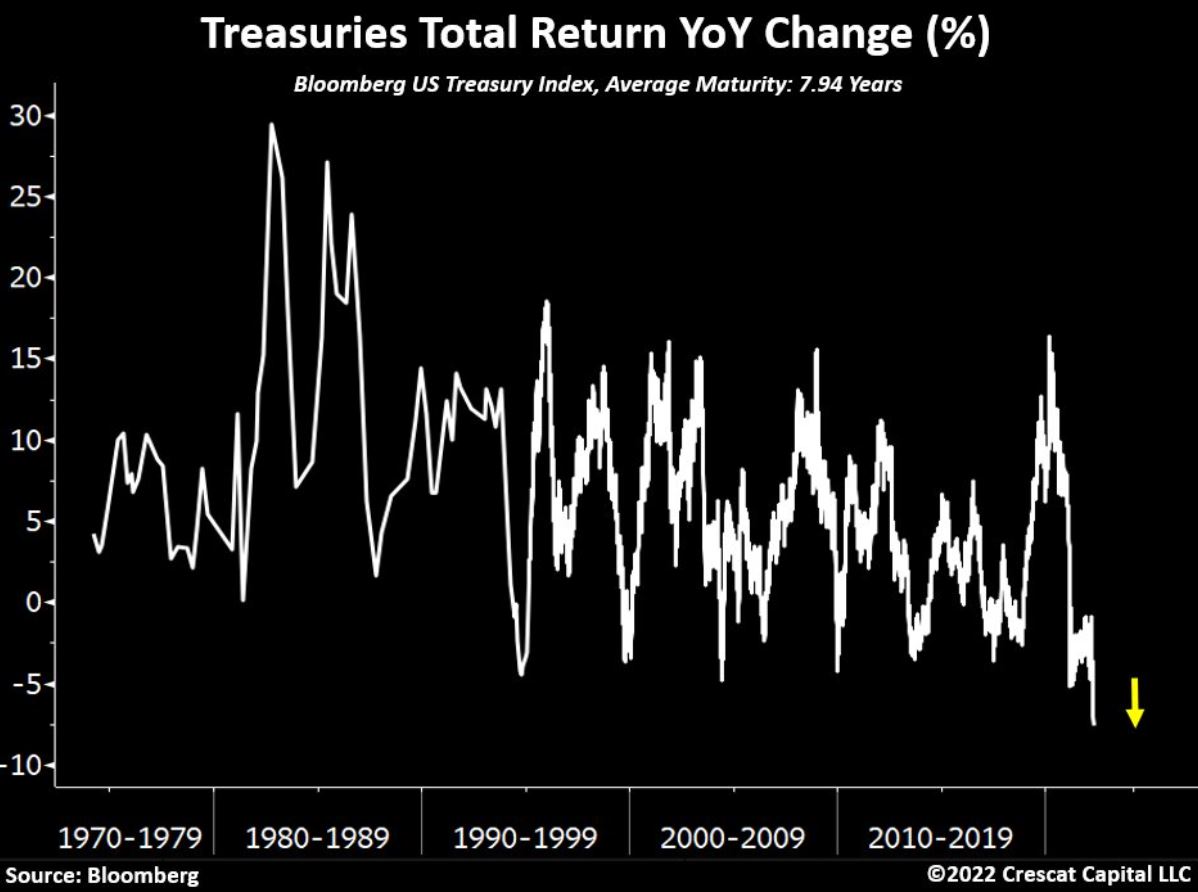

Initially, rising interest rates seem beneficial to banks; they can charge borrowers more. However, there's a lag effect. Banks don't instantly increase the interest they pay on deposits to match rising loan rates. This lag, coupled with increased competition and the cost of funds, leads to NIM compression. Westpac's NIM has demonstrably declined in recent quarters (insert chart or graph showing Westpac's NIM decline here, referencing the source). This compression is a primary driver of the Westpac (WBC) profit decline due to margin pressure.

- Increased competition: Fierce competition from other major banks like ANZ, NAB, and Commonwealth Bank, as well as the rise of fintech companies, forces Westpac to offer more competitive loan rates, squeezing its margin.

- Increased cost of funds: Global economic uncertainty has increased the cost of funds for banks, forcing them to pay more for deposits and borrowed capital, further reducing NIM.

- Regulatory changes: Stringent regulatory changes impacting lending practices, such as stricter capital requirements, can limit a bank's ability to lend aggressively and maximize profits.

Rising Operational Costs and Expenses

Running a large financial institution like Westpac involves substantial operational costs. These costs have been escalating, adding pressure to profitability. Significant increases are seen in several key areas:

- Investments in digital transformation and technology: Westpac, like other banks, is investing heavily in upgrading its technology infrastructure to enhance customer experience and improve operational efficiency. These investments represent substantial upfront costs.

- Compliance and regulatory costs: The Australian financial services industry faces stringent regulatory scrutiny, particularly after the Royal Commission. Compliance costs, including those related to AUSTRAC (Australian Transaction Reports and Analysis Centre), are significant and continuously rising.

- Increased salaries and employee benefits: Attracting and retaining skilled employees in a competitive job market necessitates higher salaries and benefits, adding to operational expenditure. Data on Westpac's employee costs (sourced from financial reports) would further illustrate this point.

Impact of Economic Slowdown and Loan Defaults

A slowing economy directly impacts bank profitability. Rising interest rates, intended to combat inflation, can dampen consumer spending and business investment, leading to increased loan defaults. Westpac's loan loss provisions – the money set aside to cover potential loan defaults – have likely increased (include data on Westpac's loan loss provisions and non-performing loans here, referencing the source).

- Increased loan defaults in specific sectors: Sectors like housing and small businesses may be particularly vulnerable to economic downturns, leading to a rise in loan defaults within those portfolios.

- Impact of inflation on consumer borrowing and repayment capabilities: High inflation erodes purchasing power, making it harder for consumers to repay loans, increasing the risk of defaults.

- Geopolitical factors influencing economic uncertainty: Global events and geopolitical instability contribute to economic uncertainty, negatively impacting consumer and business confidence and increasing the likelihood of loan defaults.

Strategic Responses by Westpac to Address Margin Pressure

Westpac is implementing various strategies to mitigate the effects of margin pressure and protect its profitability. These include:

- Cost optimization initiatives: Westpac is actively seeking to streamline operations and reduce costs across various departments. This might involve restructuring, workforce optimization, or renegotiating contracts with suppliers.

- Focus on higher-margin products and services: The bank is likely shifting its focus towards higher-margin products and services to offset the impact of NIM compression. This may involve promoting wealth management services or other fee-based offerings.

- Investments in new technologies to improve efficiency: Continuing investment in technology aims to automate processes, reduce operational costs, and enhance the efficiency of various banking operations.

Conclusion: Understanding and Navigating Westpac's (WBC) Profit Decline

The Westpac (WBC) profit decline is a complex issue stemming from a confluence of factors. NIM compression, driven by increased competition, rising cost of funds, and regulatory changes, is a key driver. Simultaneously, rising operational costs and the impact of an economic slowdown, including increased loan defaults, further contribute to the reduced profitability. Westpac's strategic responses to these challenges are crucial for its future performance. The ongoing challenges highlight the dynamic nature of the banking sector and the importance of understanding the complexities of margin pressure. To stay informed about Westpac (WBC) and the ongoing impact of margin pressure on its profitability, and the broader banking sector, continue your research by visiting Westpac's investor relations website and following reputable financial news sources. Understanding the factors impacting Westpac's profit and the broader banking sector affected by margin pressure is key to informed investment decisions.

Featured Posts

-

Following In Giant Footsteps Evaluating The Sequel Website

May 06, 2025

Following In Giant Footsteps Evaluating The Sequel Website

May 06, 2025 -

Wildfire Speculation A Grim Reflection Of Our Times Los Angeles

May 06, 2025

Wildfire Speculation A Grim Reflection Of Our Times Los Angeles

May 06, 2025 -

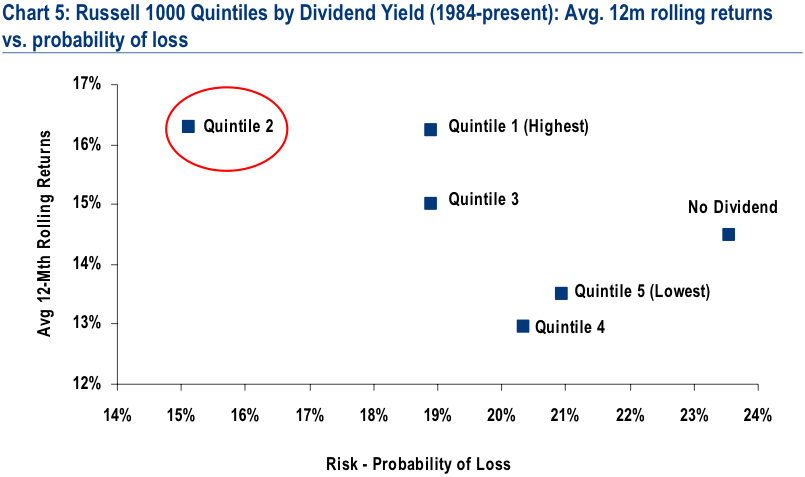

Addressing High Stock Market Valuations Insights From Bof A For Investors

May 06, 2025

Addressing High Stock Market Valuations Insights From Bof A For Investors

May 06, 2025 -

Investment Opportunities Mapping The Countrys Best Business Locations

May 06, 2025

Investment Opportunities Mapping The Countrys Best Business Locations

May 06, 2025 -

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

May 06, 2025

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

May 06, 2025

Latest Posts

-

Shopify Developers Lifetime Revenue Share Model Explained

May 06, 2025

Shopify Developers Lifetime Revenue Share Model Explained

May 06, 2025 -

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025 -

Gold Market Update Two Straight Weeks Of Losses In 2025

May 06, 2025

Gold Market Update Two Straight Weeks Of Losses In 2025

May 06, 2025 -

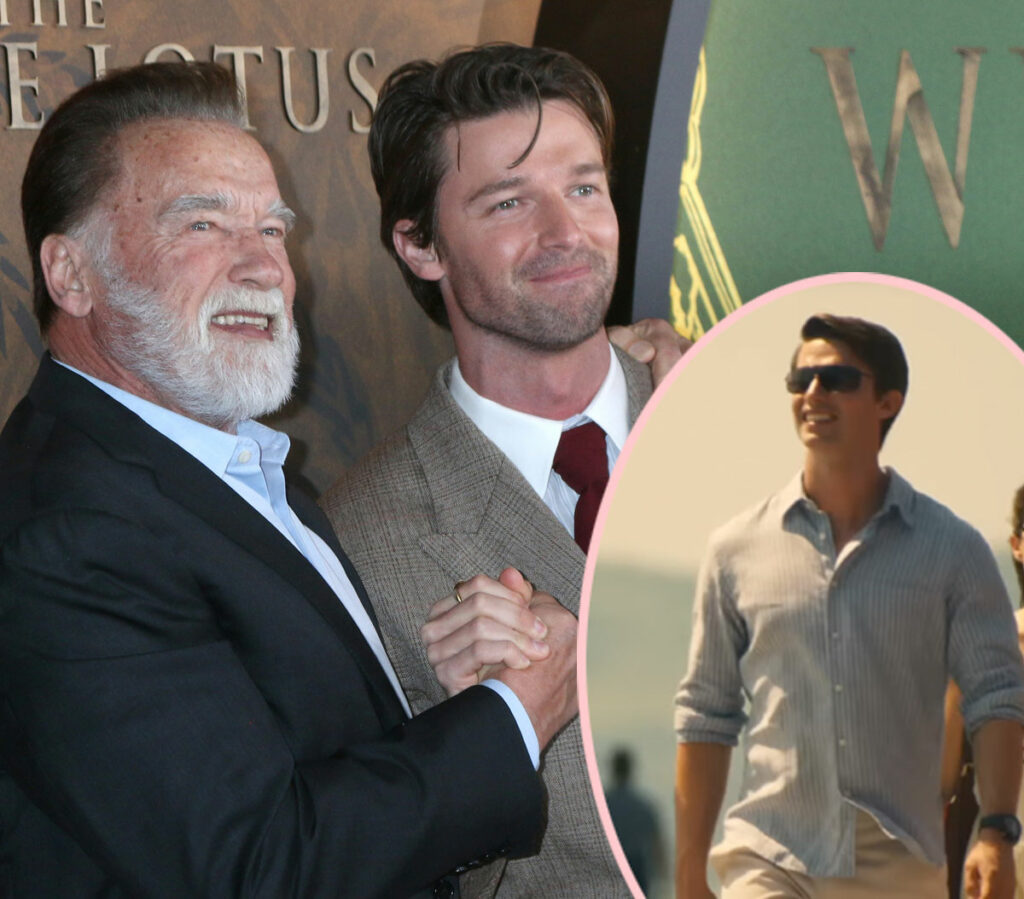

White Lotus Casting Patrick Schwarzeneggers Response To Nepotism Criticism

May 06, 2025

White Lotus Casting Patrick Schwarzeneggers Response To Nepotism Criticism

May 06, 2025 -

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025