European Stock Market Update: Trump's Tariff Comments And LVMH's Drop

Table of Contents

Trump's Tariff Comments and Their Impact on European Markets

President Trump's latest pronouncements regarding tariffs have sent shockwaves through European markets. While specifics often remain fluid, his comments generally centered on increasing tariffs on various imported goods, potentially impacting numerous sectors. This uncertainty fuels stock market volatility, creating anxiety among investors.

The immediate market reaction was a downturn across major European indices. The DAX (Germany), CAC 40 (France), and FTSE 100 (UK) all experienced declines following the announcements. While the precise percentage drops varied, the overall trend indicated a negative investor sentiment.

- Affected Sectors: Automobiles, luxury goods (like those produced by LVMH), and agricultural products were among the sectors most significantly impacted by the tariff threat.

- Investor Sentiment: The overall investor sentiment shifted from cautious optimism to pronounced concern, leading to a sell-off in many stocks.

- Long-Term Implications: The long-term implications depend heavily on the extent and duration of these tariffs. Prolonged uncertainty could hinder economic growth and investment across Europe. A trade war could severely impact European businesses reliant on international trade.

LVMH's Stock Drop: A Deeper Dive

LVMH, a global leader in luxury goods, experienced a particularly sharp decline in its stock price following Trump's comments. This sensitivity stems from its reliance on international sales and exposure to luxury goods markets, which are often considered discretionary spending and therefore vulnerable to economic downturns.

The drop wasn't solely attributable to tariffs. Several factors contributed to the decline:

- Percentage Drop: LVMH's stock price experienced a [Insert Percentage]% drop [Insert timeframe, e.g., in a single trading day/week]. (Please insert actual data here).

- Other Influencing Factors: Concerns about a slowing Chinese economy, a key market for LVMH, also played a significant role. Furthermore, potential supply chain disruptions due to tariff-related complexities added to investor anxieties.

- Analyst Opinions: Analyst opinions on LVMH's future performance are varied, with some expressing short-term pessimism but maintaining a long-term positive outlook, contingent on the resolution of trade tensions.

Analyzing the Broader European Economic Landscape

The health of the European economy is a crucial factor in understanding the impact of these events. While Europe has shown resilience in the face of past economic challenges, the current situation presents new difficulties.

The recent events need to be analyzed within the context of broader economic indicators:

- Key Economic Indicators: Current GDP growth rates, inflation levels, and unemployment figures need to be considered to accurately assess the overall economic health.

- Potential for Further Volatility: The potential for further market volatility remains high as long as tariff uncertainty persists. This unpredictability makes accurate forecasting challenging.

- Role of the European Central Bank (ECB): The ECB’s response to these challenges will play a significant role in shaping the European stock market's trajectory. Their monetary policy decisions will greatly influence investor confidence.

Strategies for Investors Navigating Market Uncertainty

Navigating this period of uncertainty requires a considered approach to investment strategies. Investors should focus on mitigating risks and seeking out potential opportunities.

Here are some strategies:

- Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate) and geographic regions reduces exposure to any single market's volatility.

- Risk Management: Employing risk management techniques, such as stop-loss orders, helps limit potential losses.

- Investment Time Horizon: A long-term investment strategy generally performs better than short-term trading during periods of market uncertainty.

Conclusion: European Stock Market Outlook and Next Steps

Trump's tariff comments and the subsequent LVMH stock drop highlight the significant impact of global events on the European stock market. The outlook for the European stock market remains somewhat uncertain, with the potential for both further volatility and eventual recovery. The resolution of trade disputes and the performance of key economic indicators will heavily influence the market's direction.

To navigate this evolving landscape, stay informed about the latest European market trends, conduct thorough stock market analysis, and consider a well-diversified investment strategy. Before making any investment decisions, consult with a qualified financial advisor to discuss your personal circumstances and risk tolerance. Understanding the complexities of the European stock market is crucial for making sound investment choices in this dynamic environment.

Featured Posts

-

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

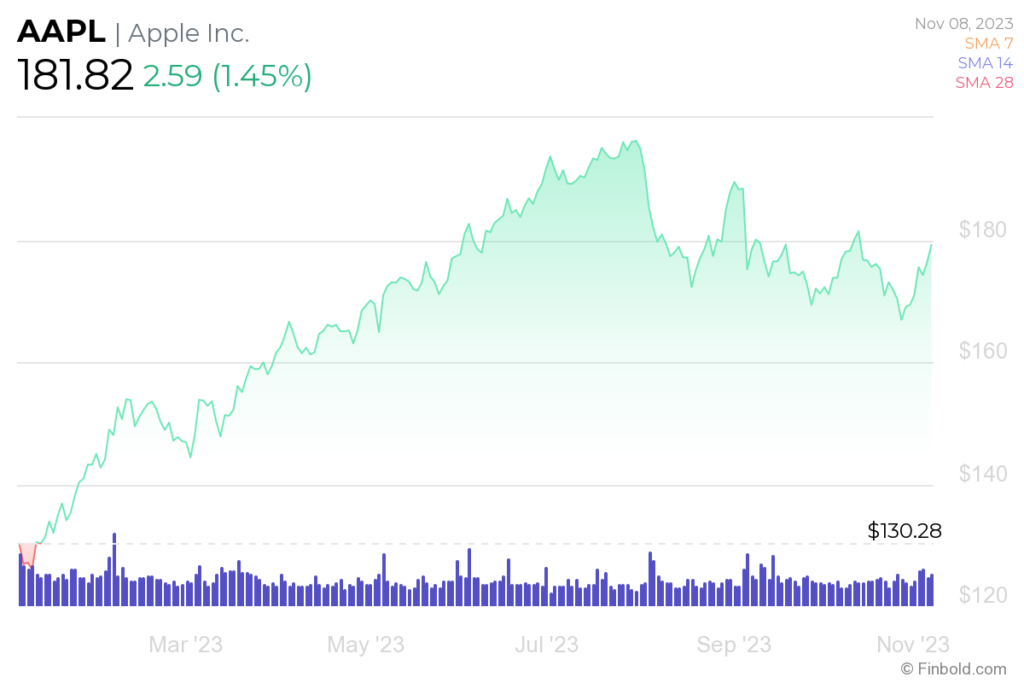

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Securing Bbc Radio 1s Big Weekend 2025 Tickets In Sefton Park

May 24, 2025

Securing Bbc Radio 1s Big Weekend 2025 Tickets In Sefton Park

May 24, 2025 -

Artfae Daks Alalmany Atfaq Jmrky Amryky Syny Jdyd

May 24, 2025

Artfae Daks Alalmany Atfaq Jmrky Amryky Syny Jdyd

May 24, 2025 -

Juvenile Justice Reform France Explores Stricter Sentencing

May 24, 2025

Juvenile Justice Reform France Explores Stricter Sentencing

May 24, 2025

Latest Posts

-

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025 -

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025

Is Apple Stock A Buy At 200 Analyst Sees Potential For 254

May 24, 2025 -

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025 -

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025 -

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025